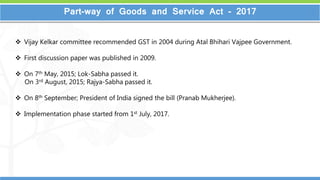

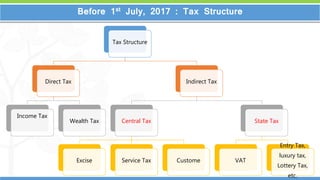

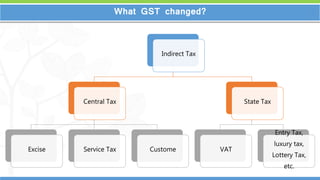

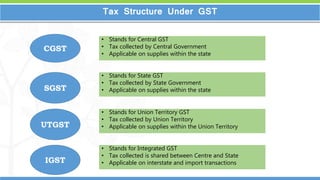

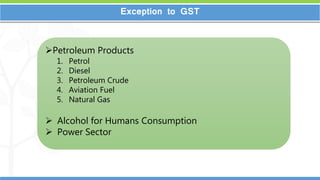

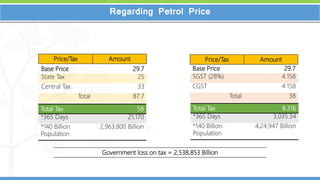

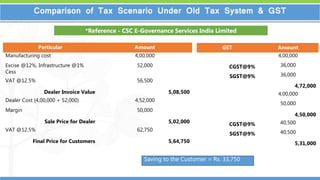

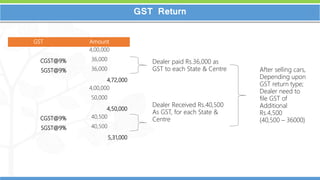

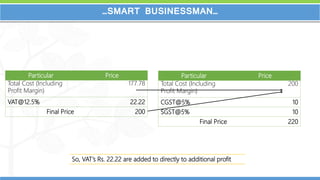

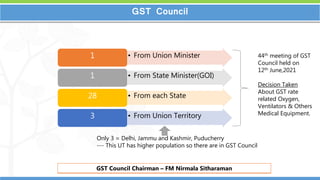

The document outlines the history and implementation of the Goods and Services Tax (GST) in India, highlighting key dates and legislative milestones from 2004 to 2017. It details the significant changes in the tax structure, the types of GST (CGST, SGST, IGST, UTGST), and provides information on tax slabs and exceptions. Additionally, it includes expert opinions, examples of tax scenarios, and the composition and decisions of the GST Council.