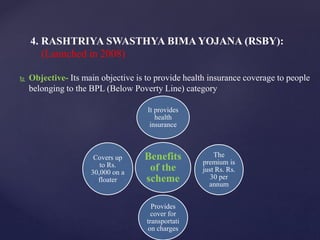

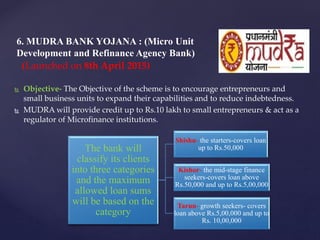

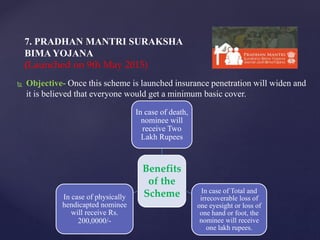

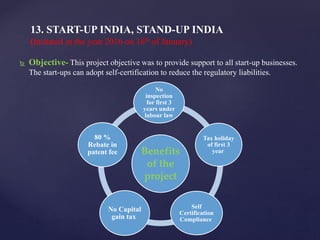

The document discusses various socio-economic development schemes introduced by the Indian government. It provides details of 15 key schemes, including their objectives and benefits. Some of the major schemes discussed are Pradhan Mantri Jan Dhan Yojana, which provides bank accounts and insurance to citizens, and Pradhan Mantri Fasal Bima Yojana, which provides crop insurance for farmers. The document outlines how these schemes aim to improve people's livelihoods through financial inclusion, education, healthcare, agriculture support and more.