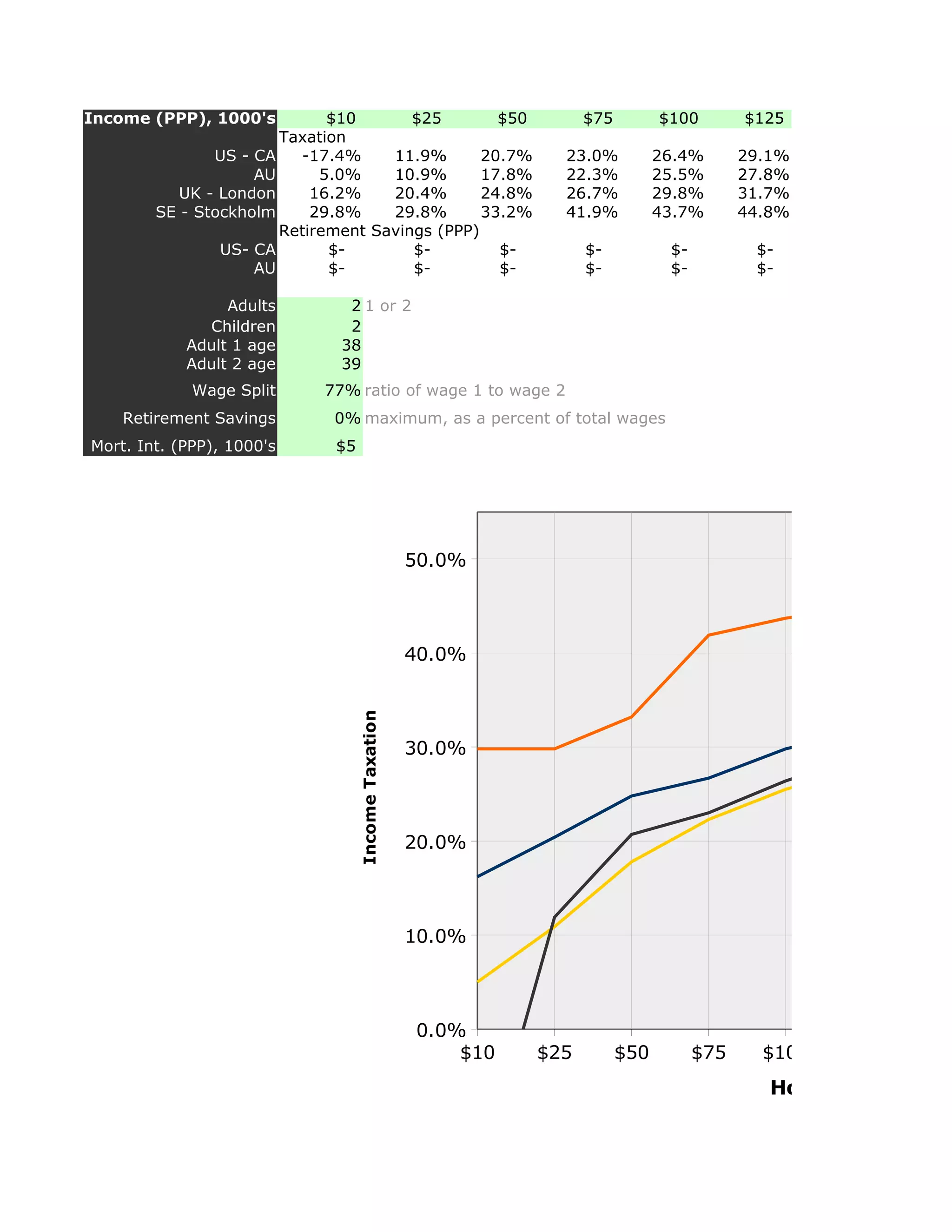

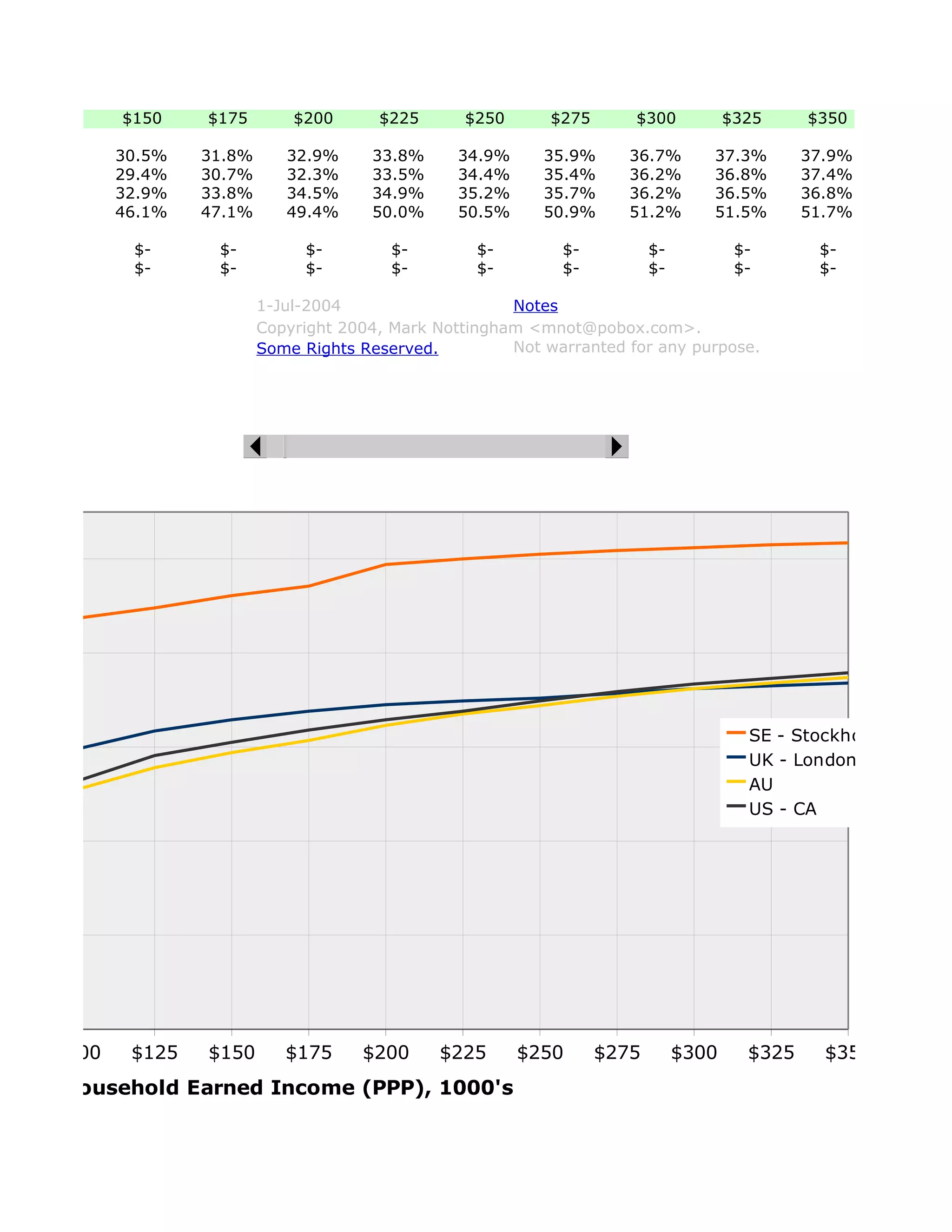

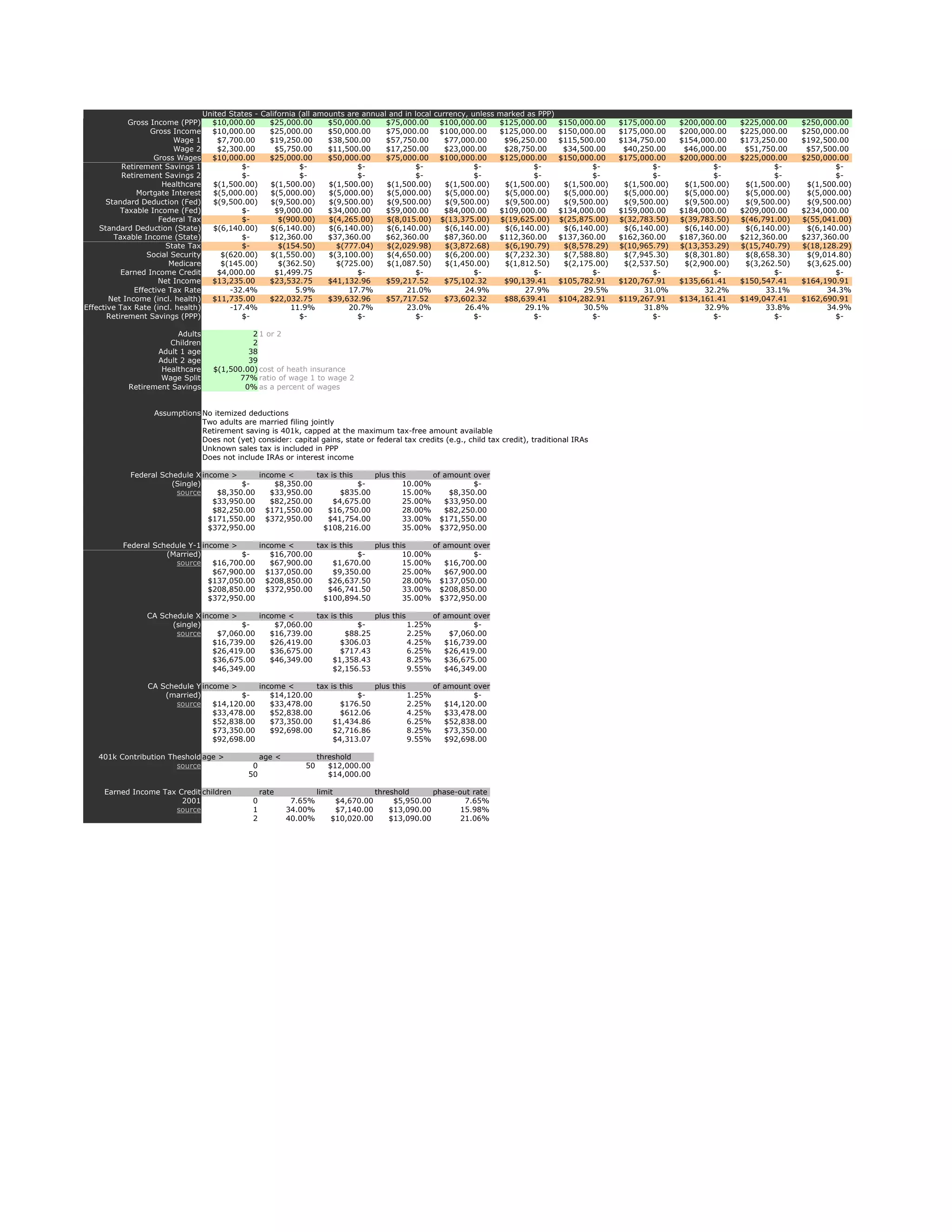

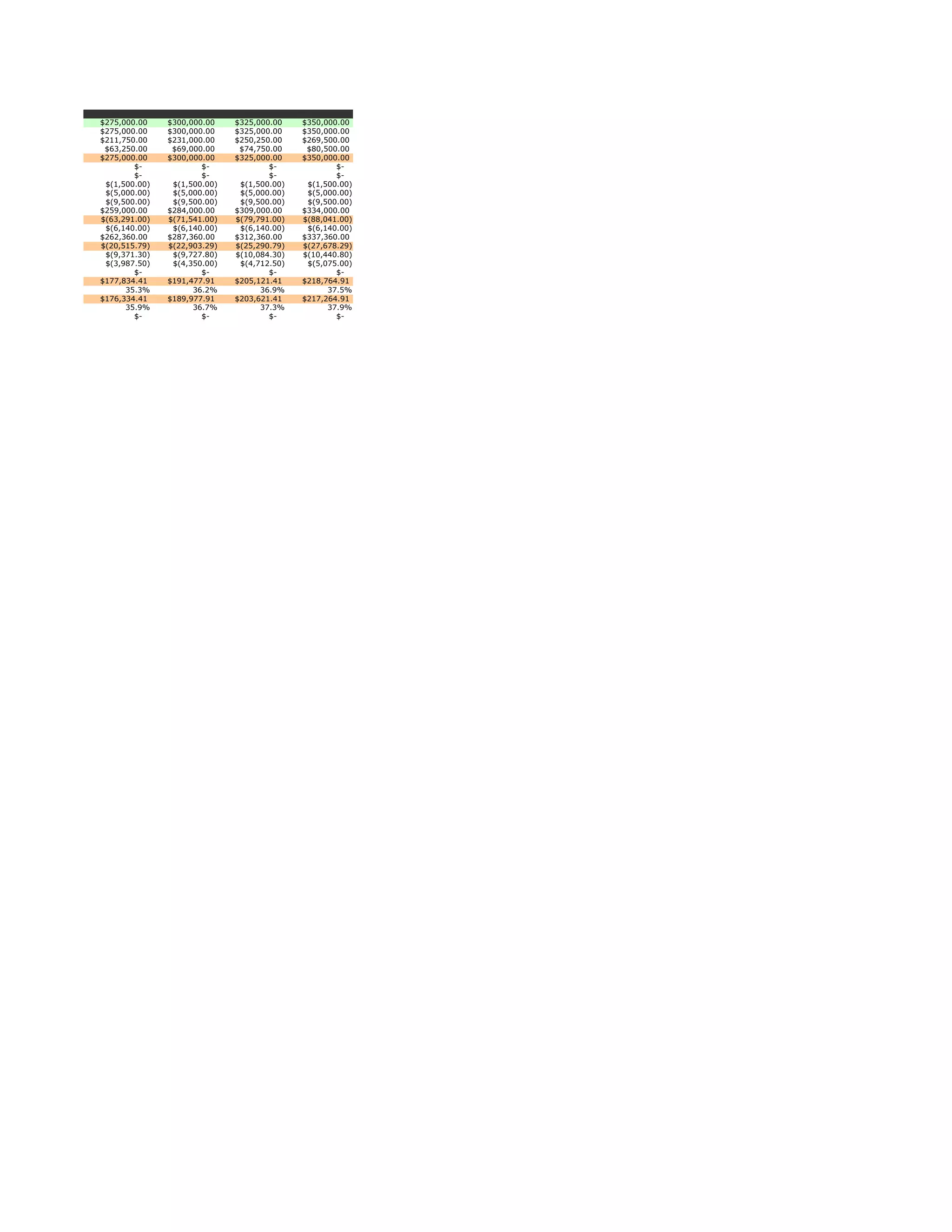

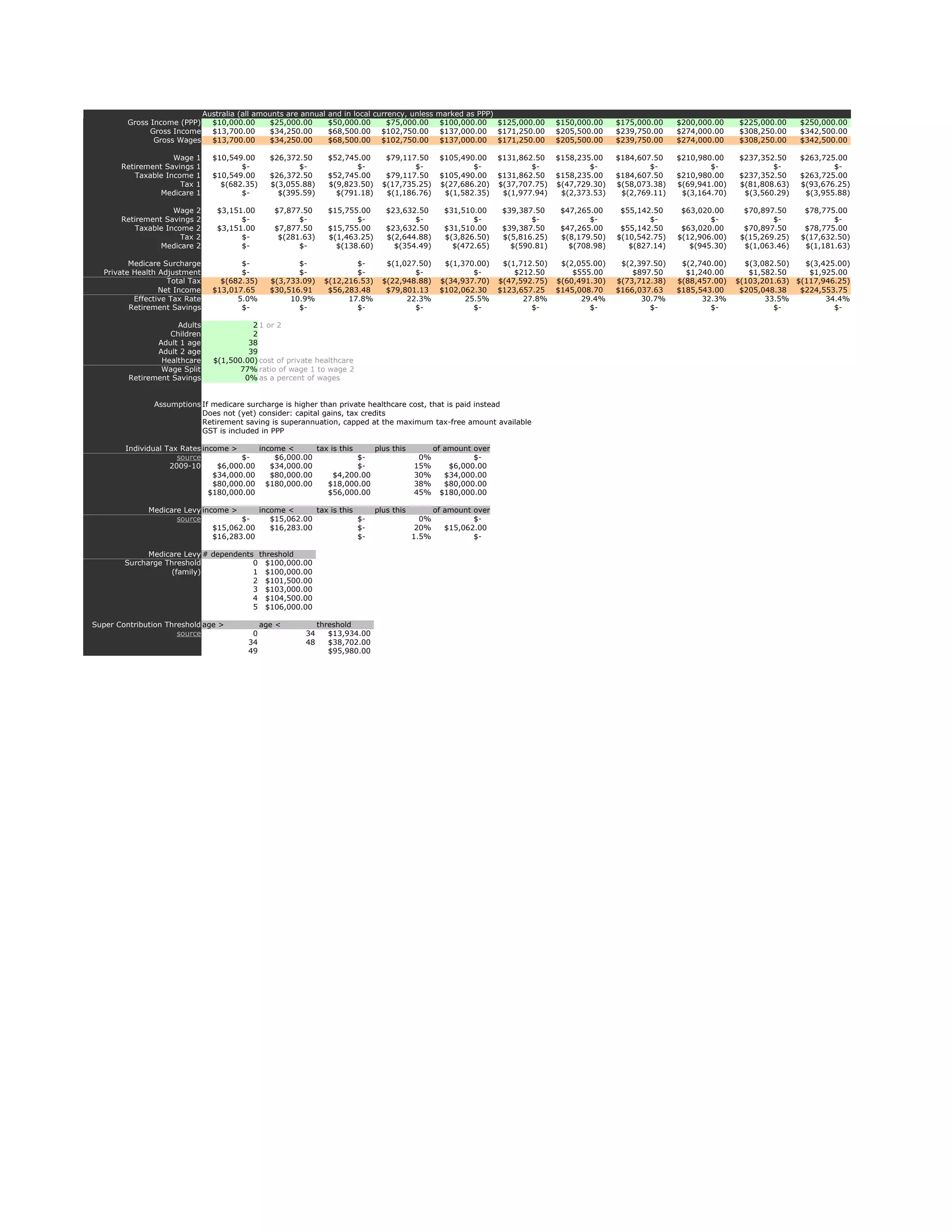

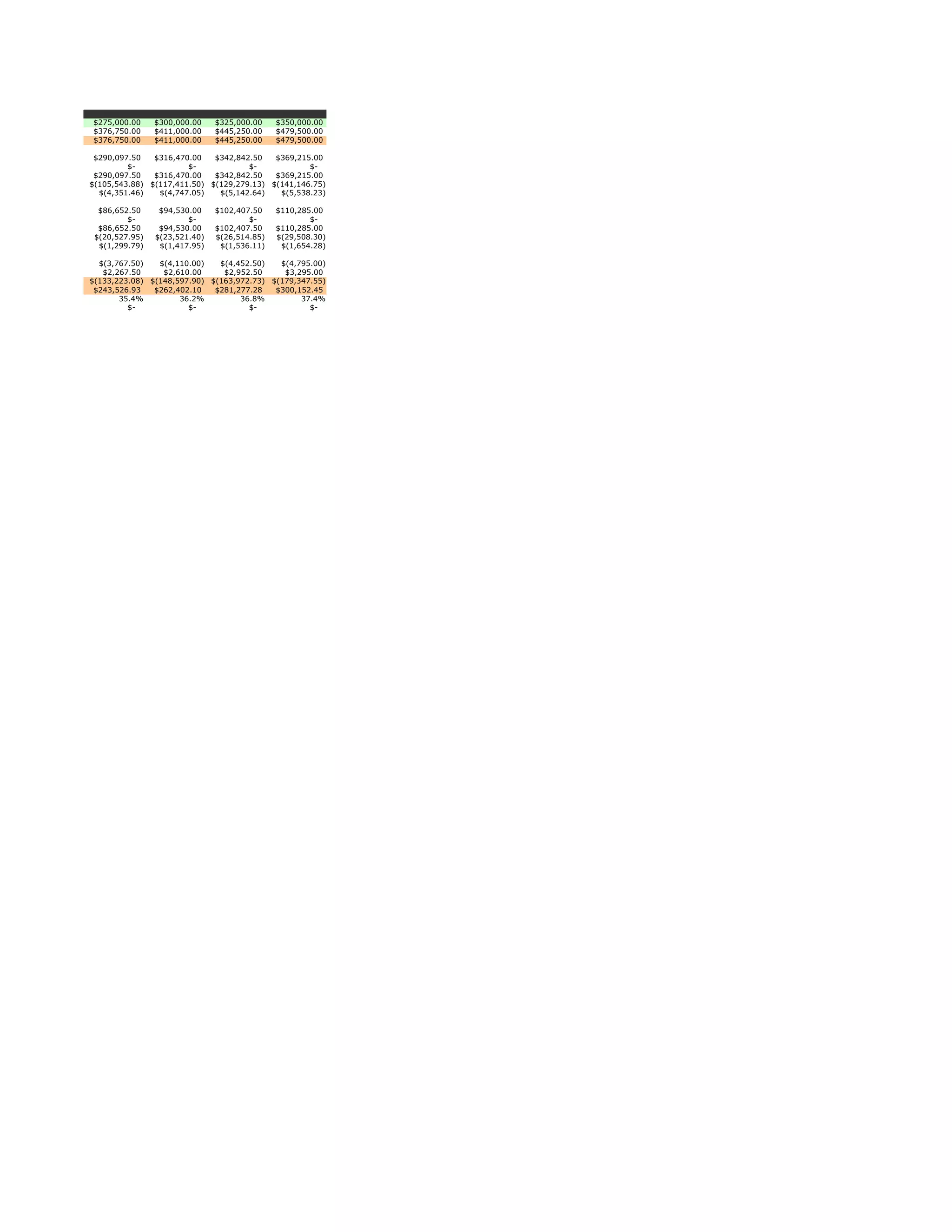

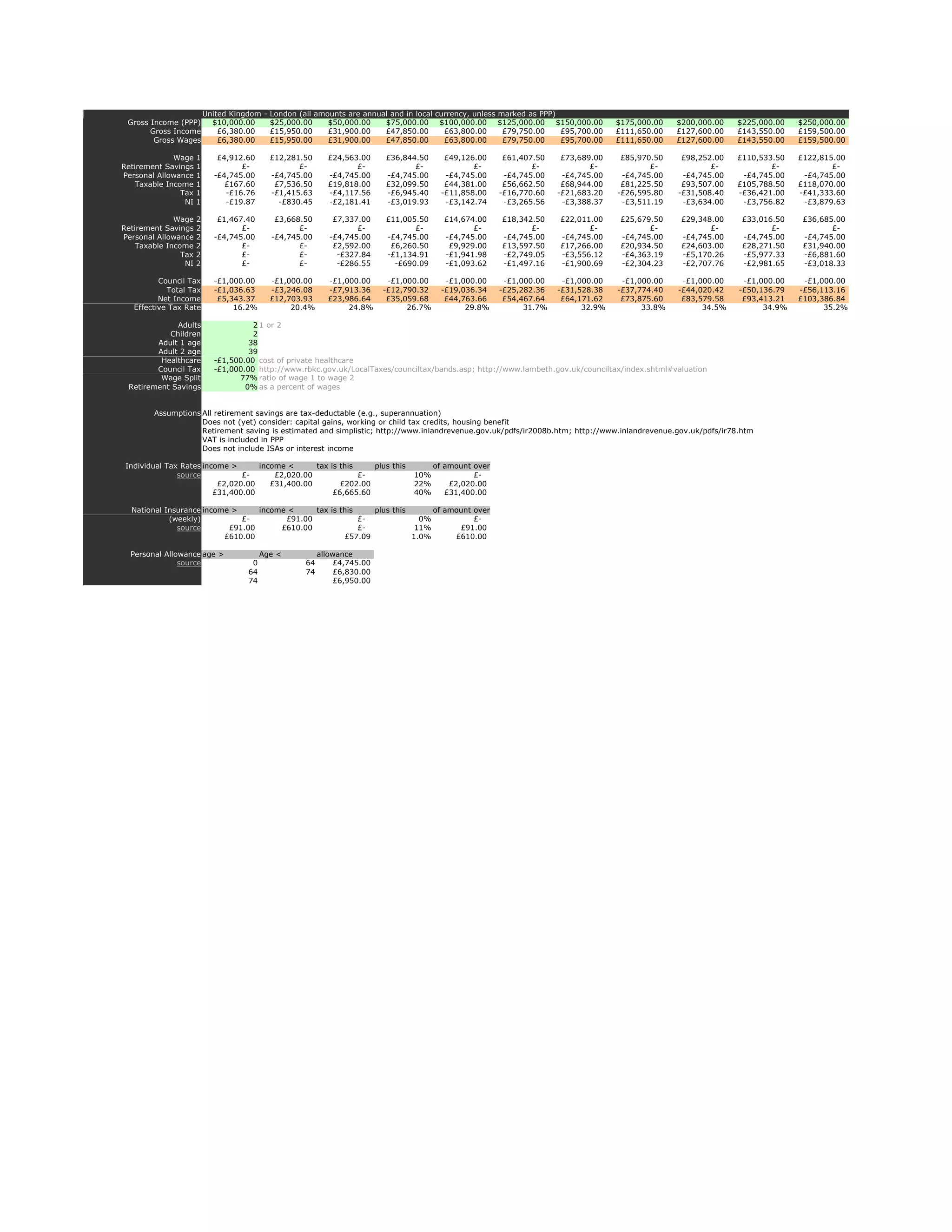

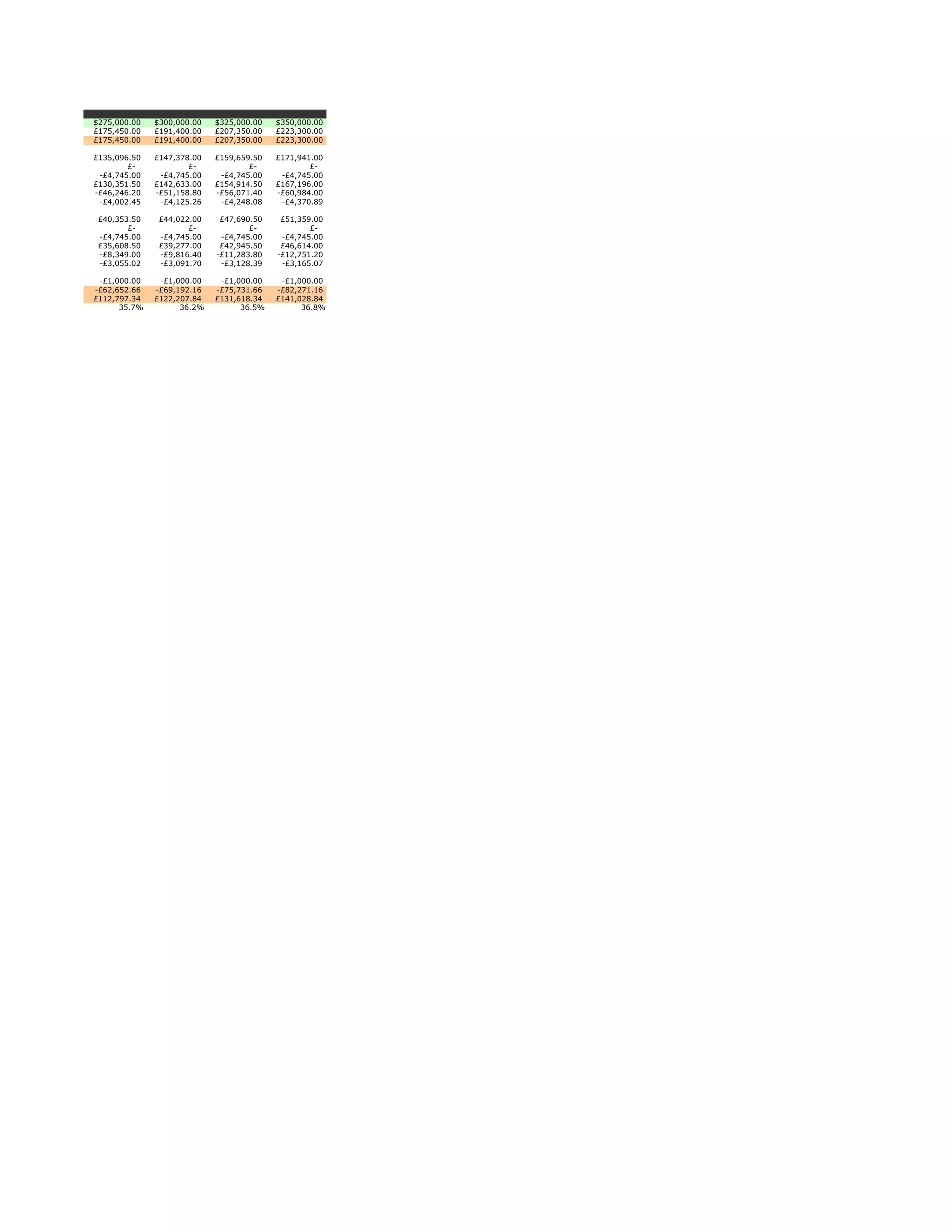

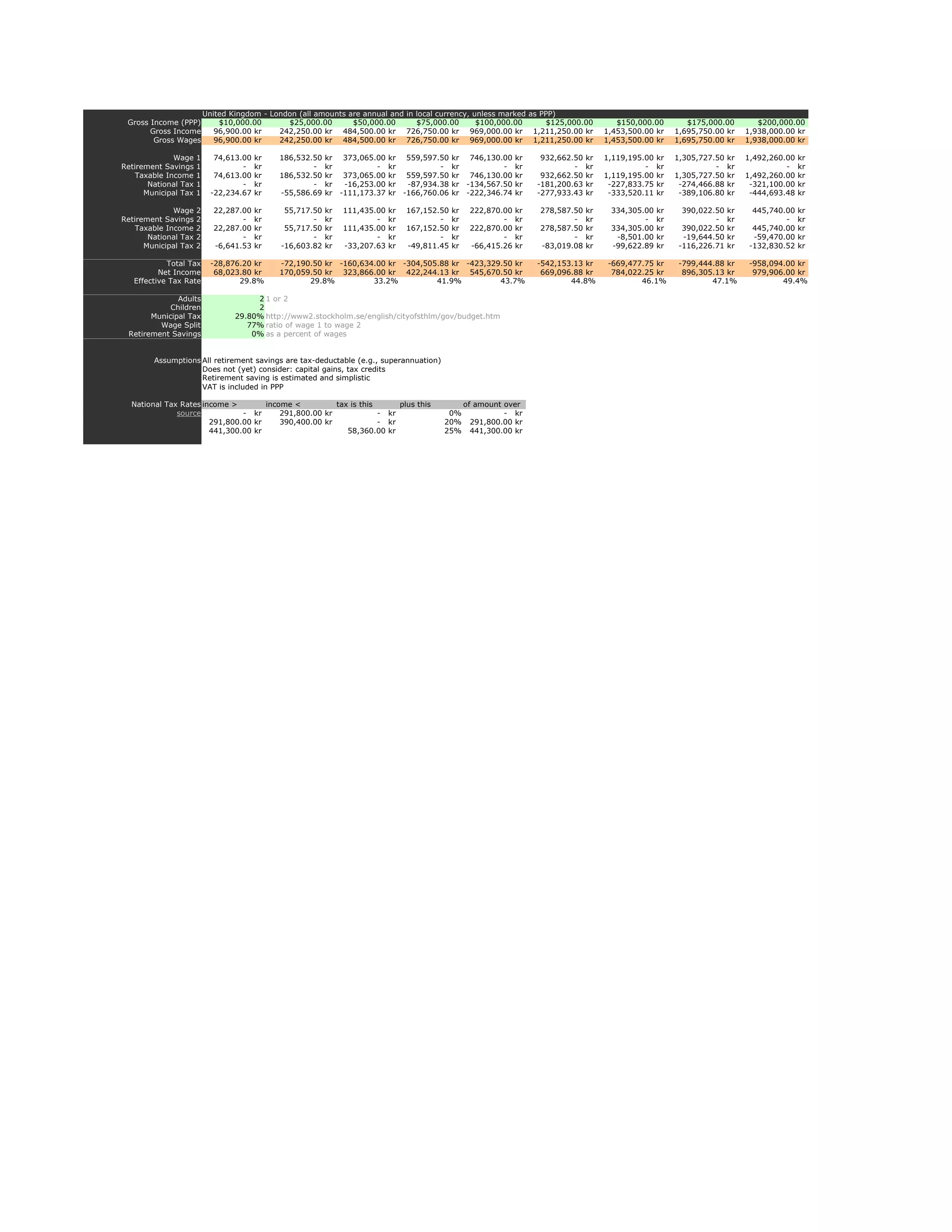

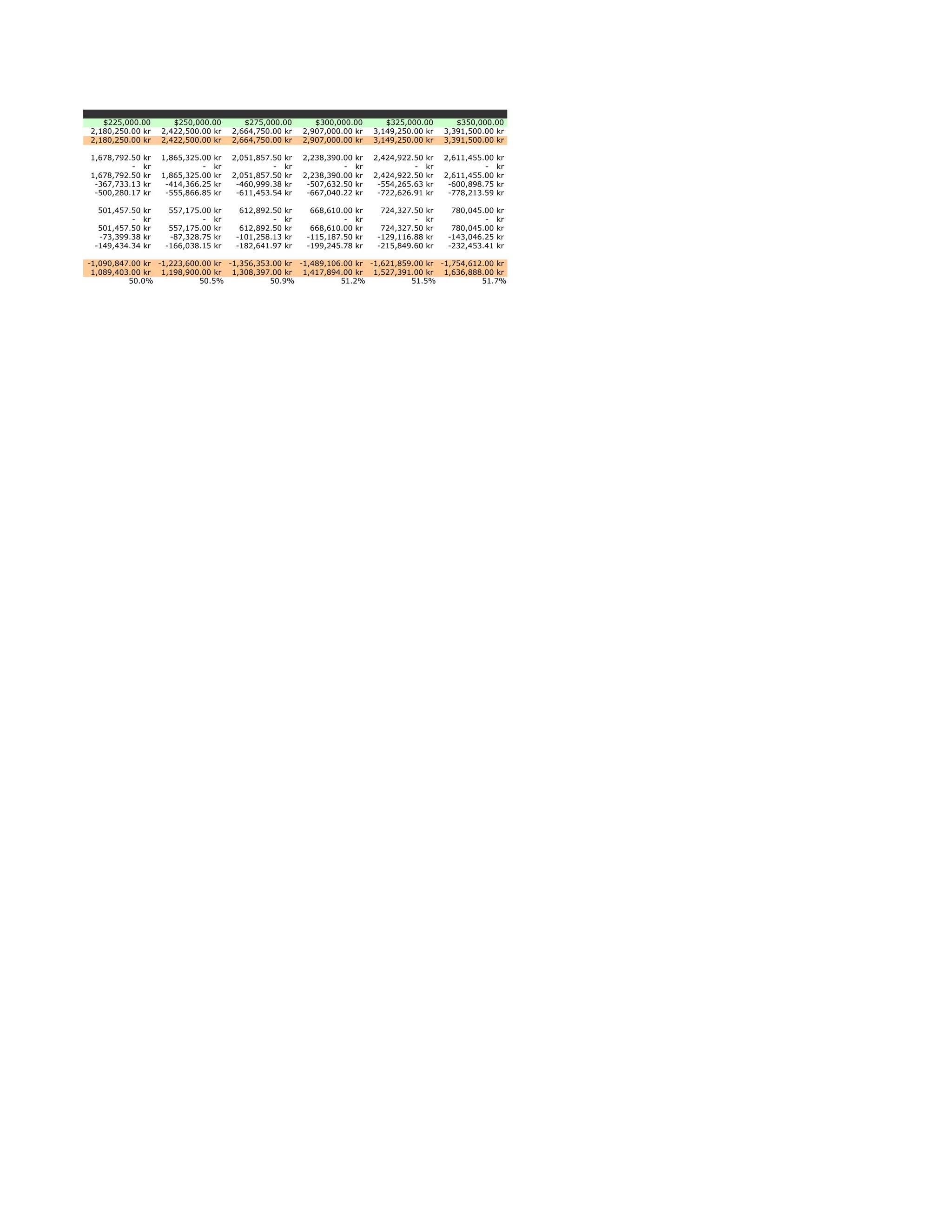

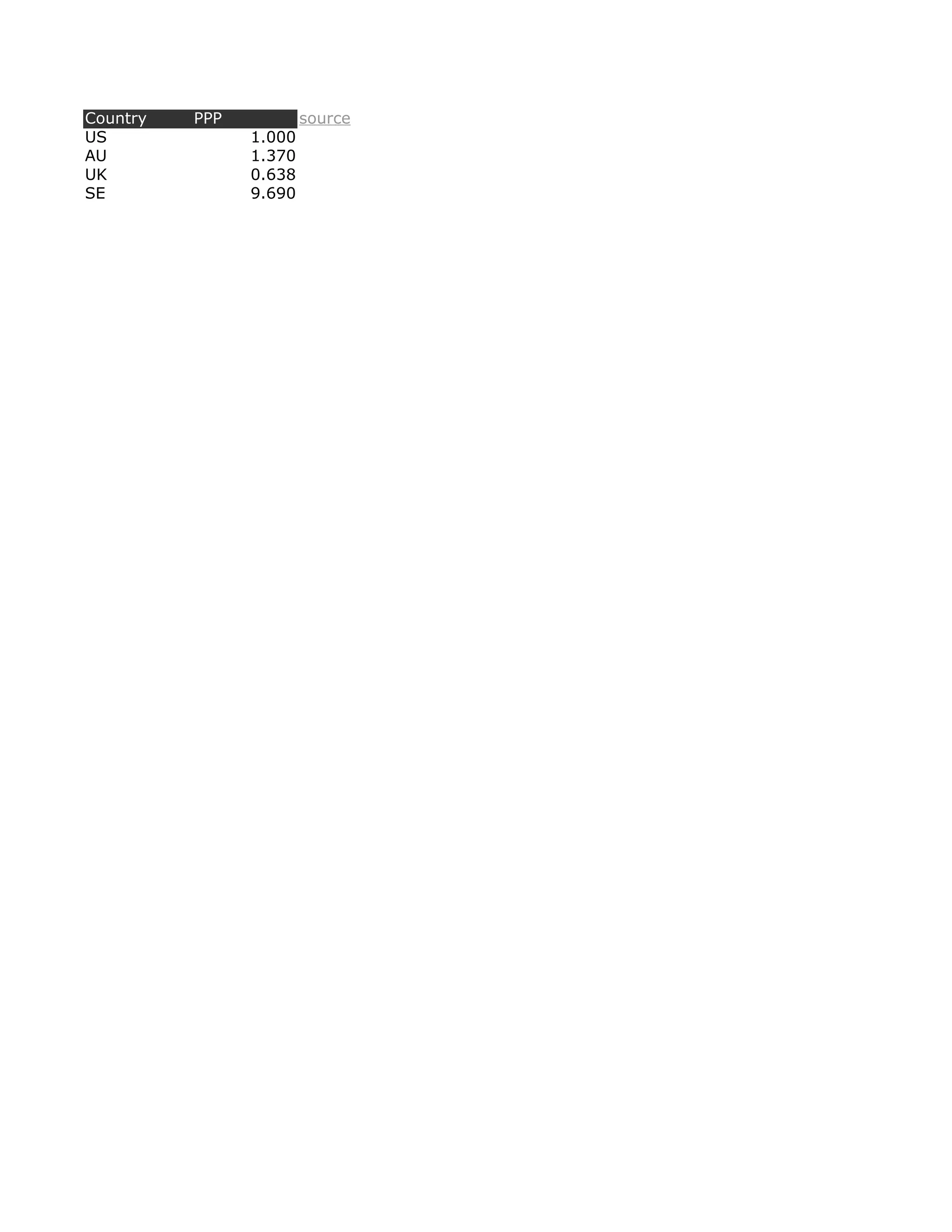

The document provides a detailed analysis of income and taxation for various countries including the US, Australia, the UK, and Sweden, using purchasing power parity (PPP) metrics. It includes information on retirement savings, household income, effective tax rates, and various deductions applicable in California. Additionally, it outlines assumptions and calculations related to federal and state taxes, healthcare costs, and earned income tax credits.