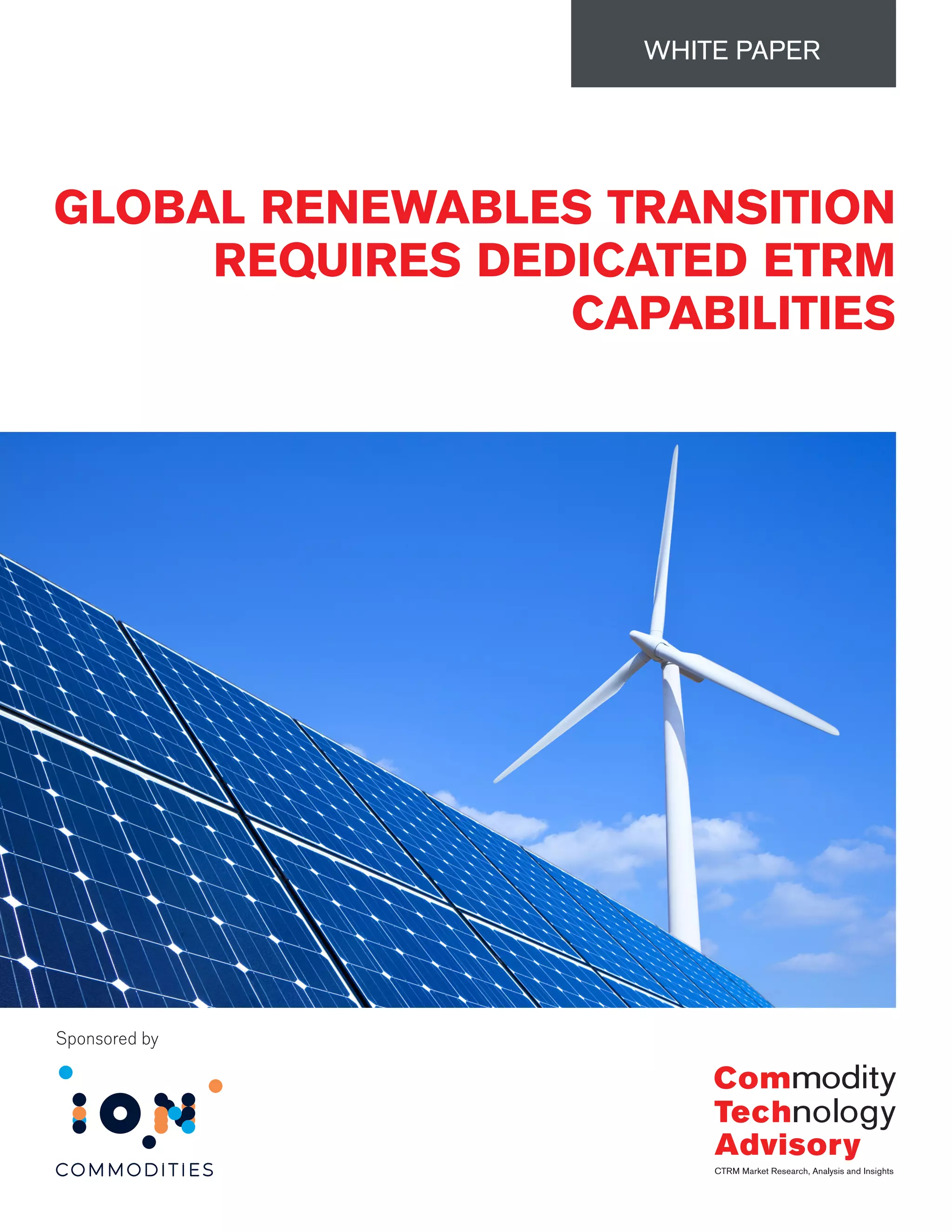

The white paper discusses the accelerating global transition to renewable energy and the need for dedicated energy trading and risk management (ETRM) capabilities. With significant growth in wind and solar power, traditional energy companies are diversifying into green projects and adopting carbon-neutral strategies, while innovative pricing agreements like power purchase agreements (PPAs) are becoming crucial for financing. The increasing complexity of power markets necessitates sophisticated software solutions to manage the profitability, risks, and operational challenges associated with renewable energy assets.