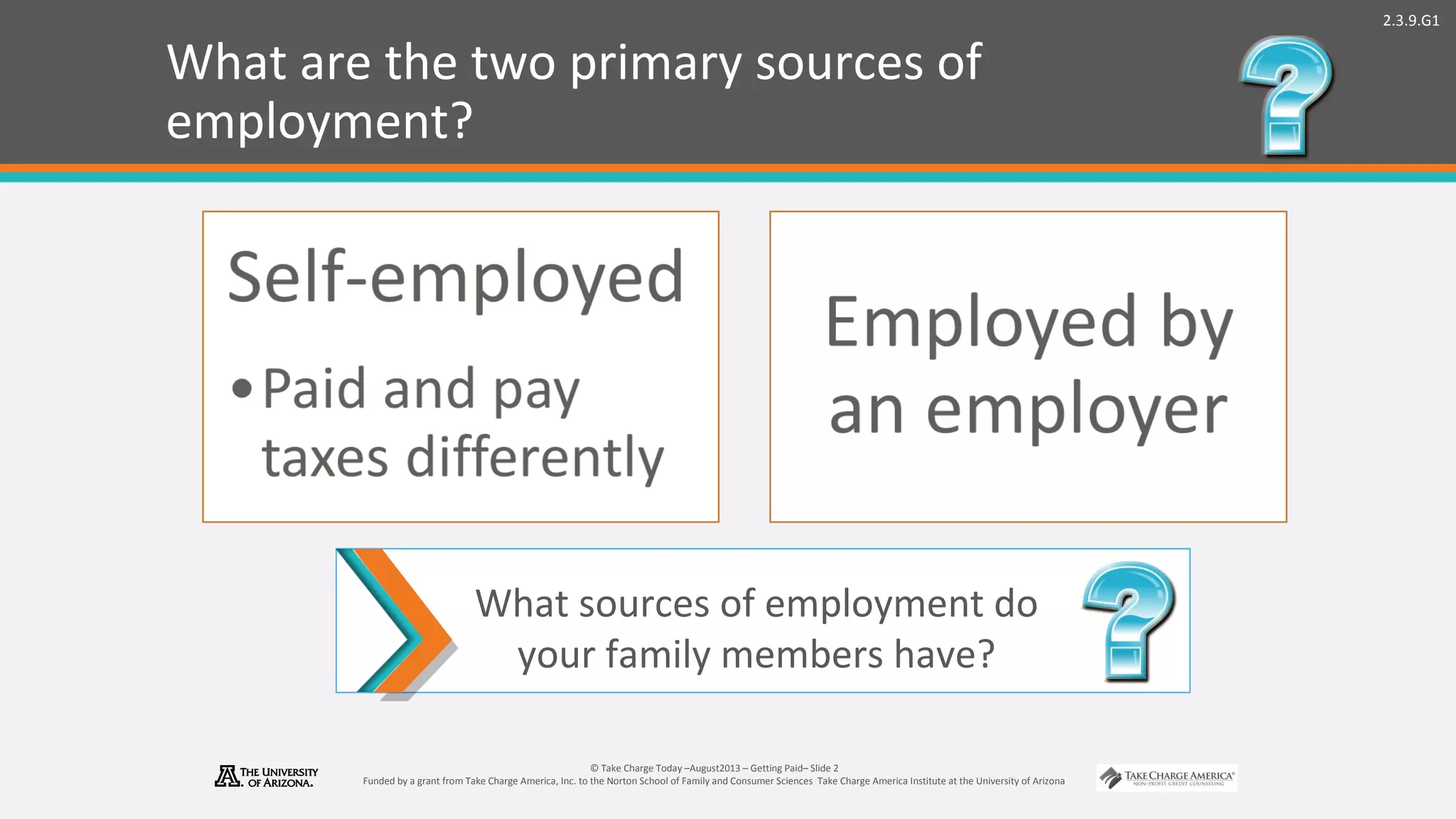

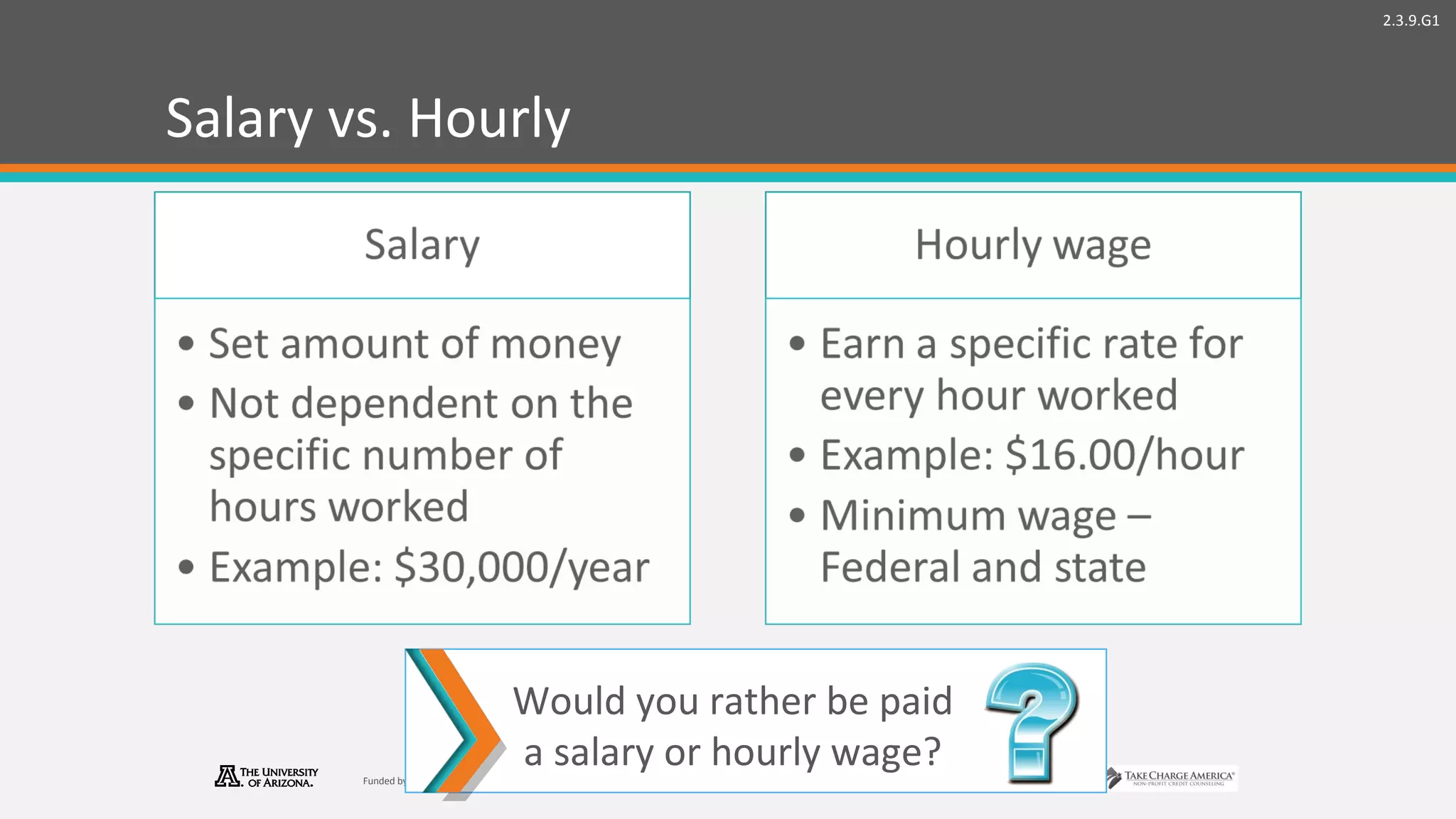

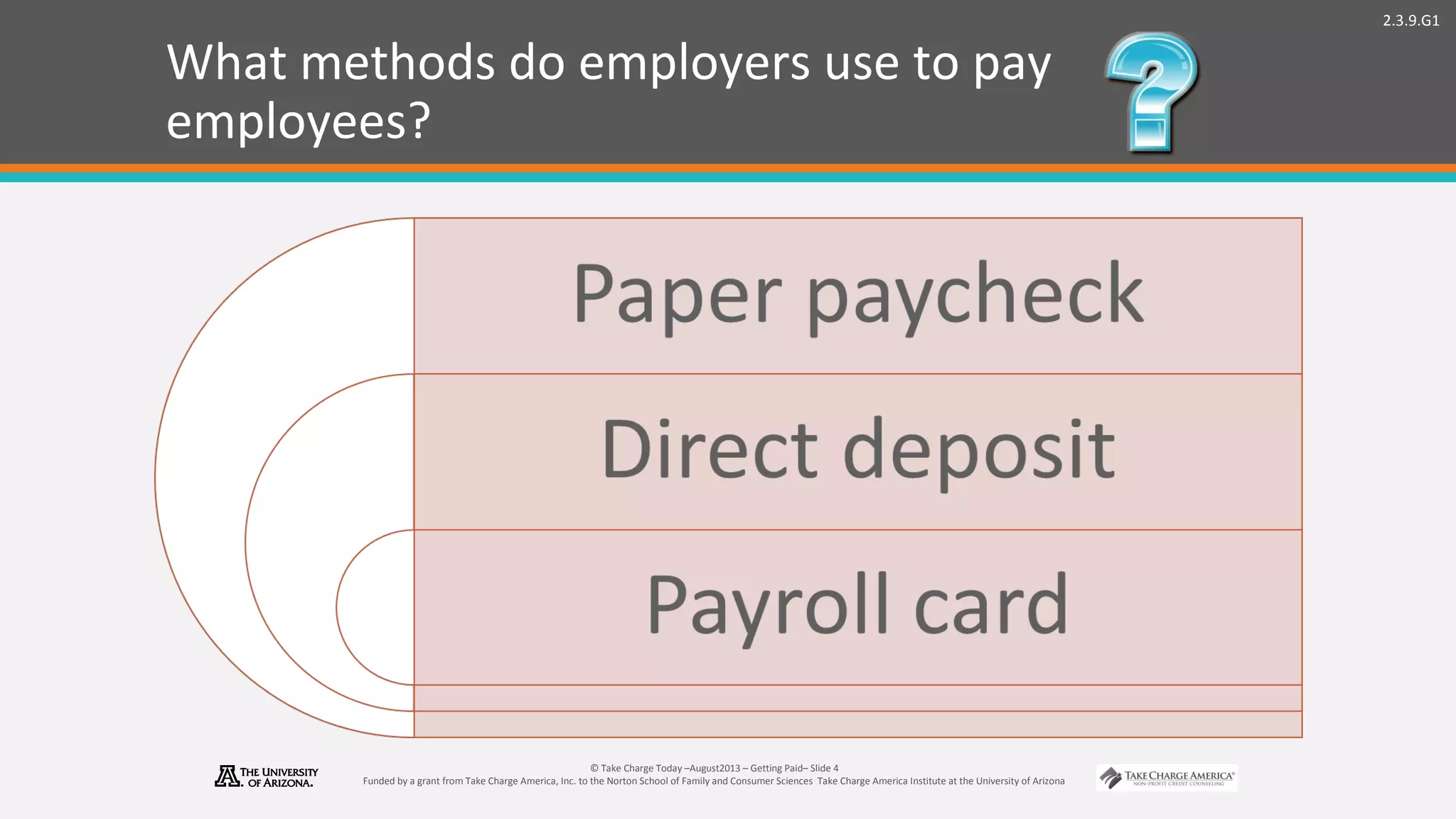

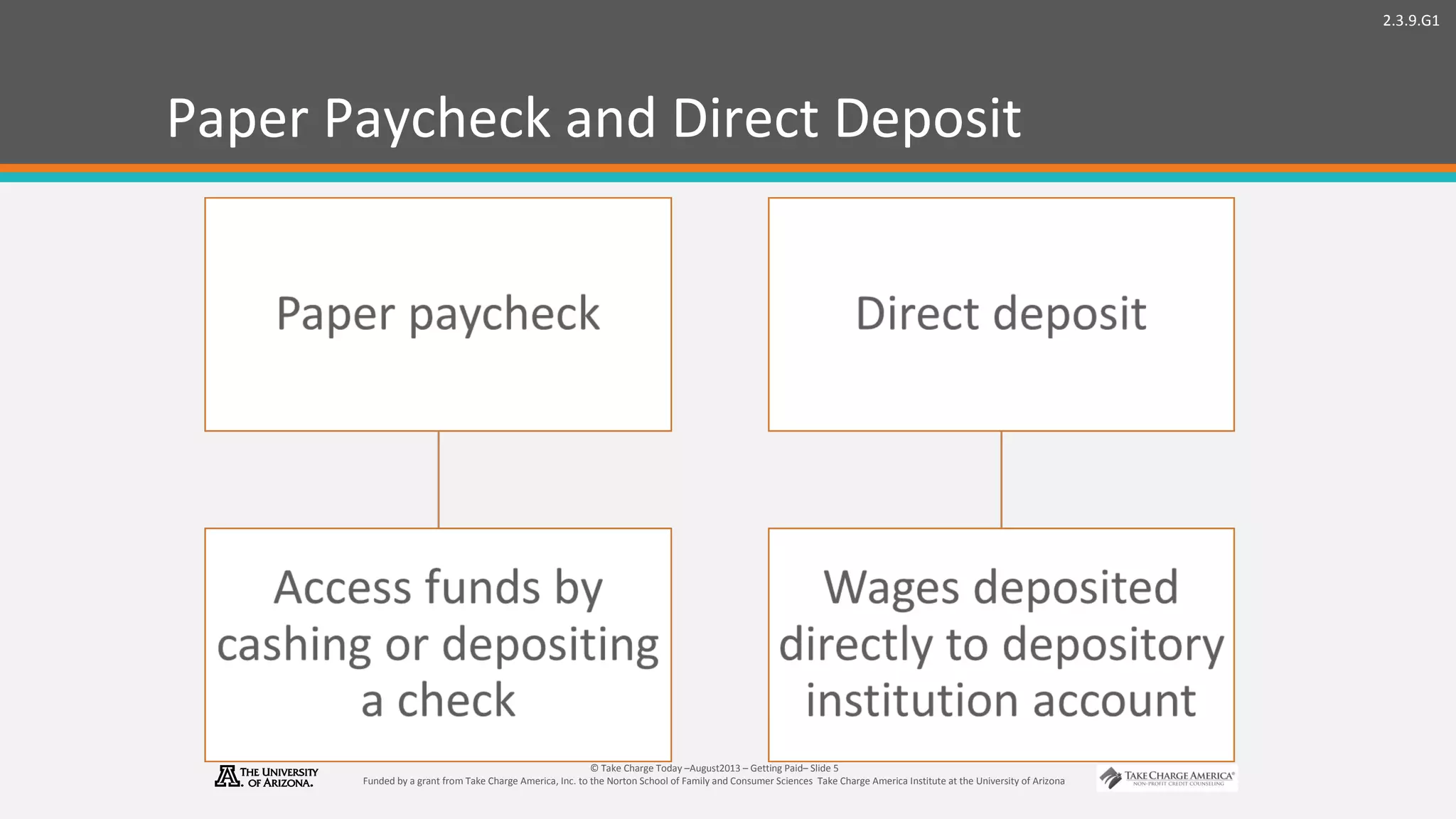

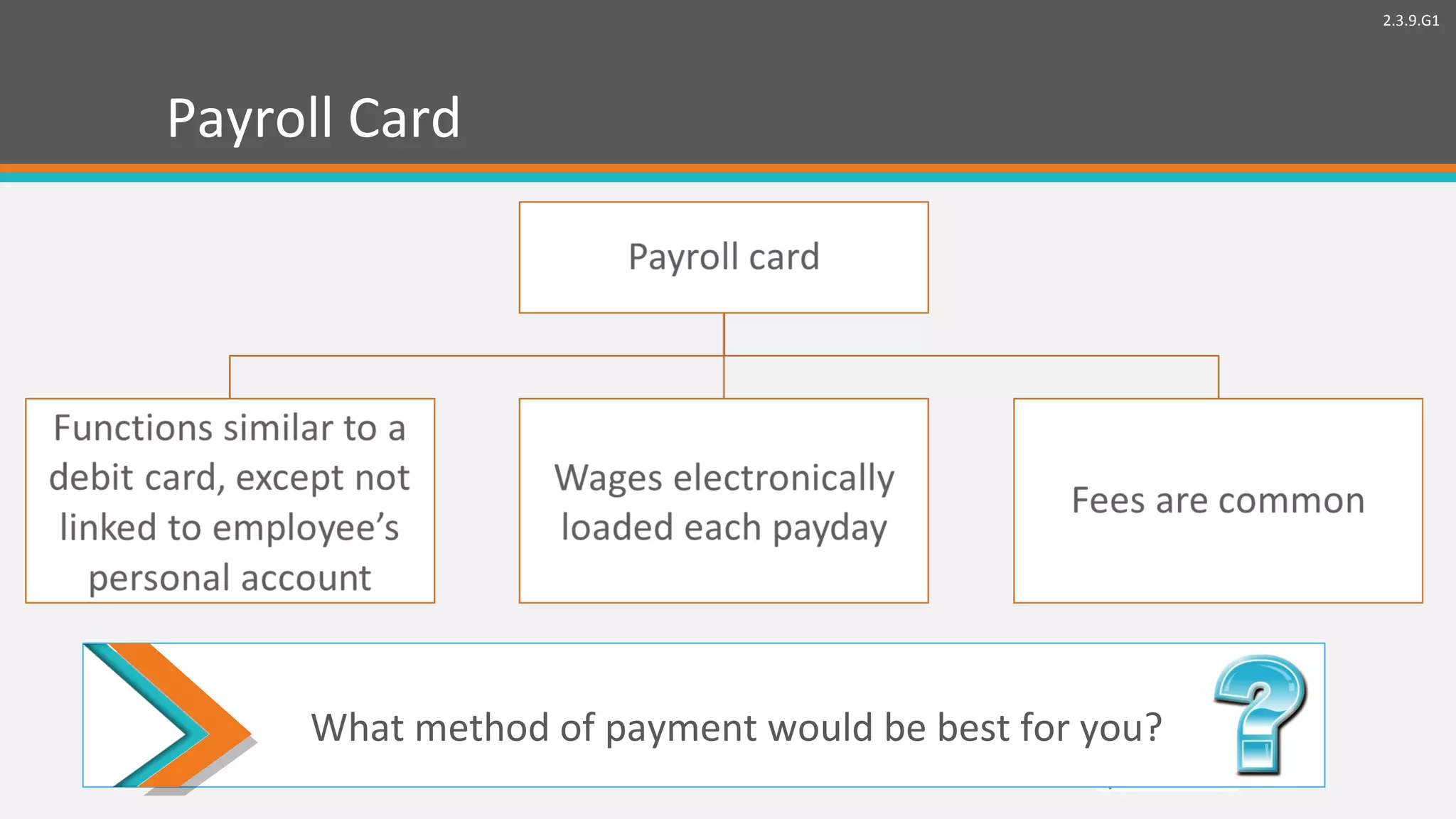

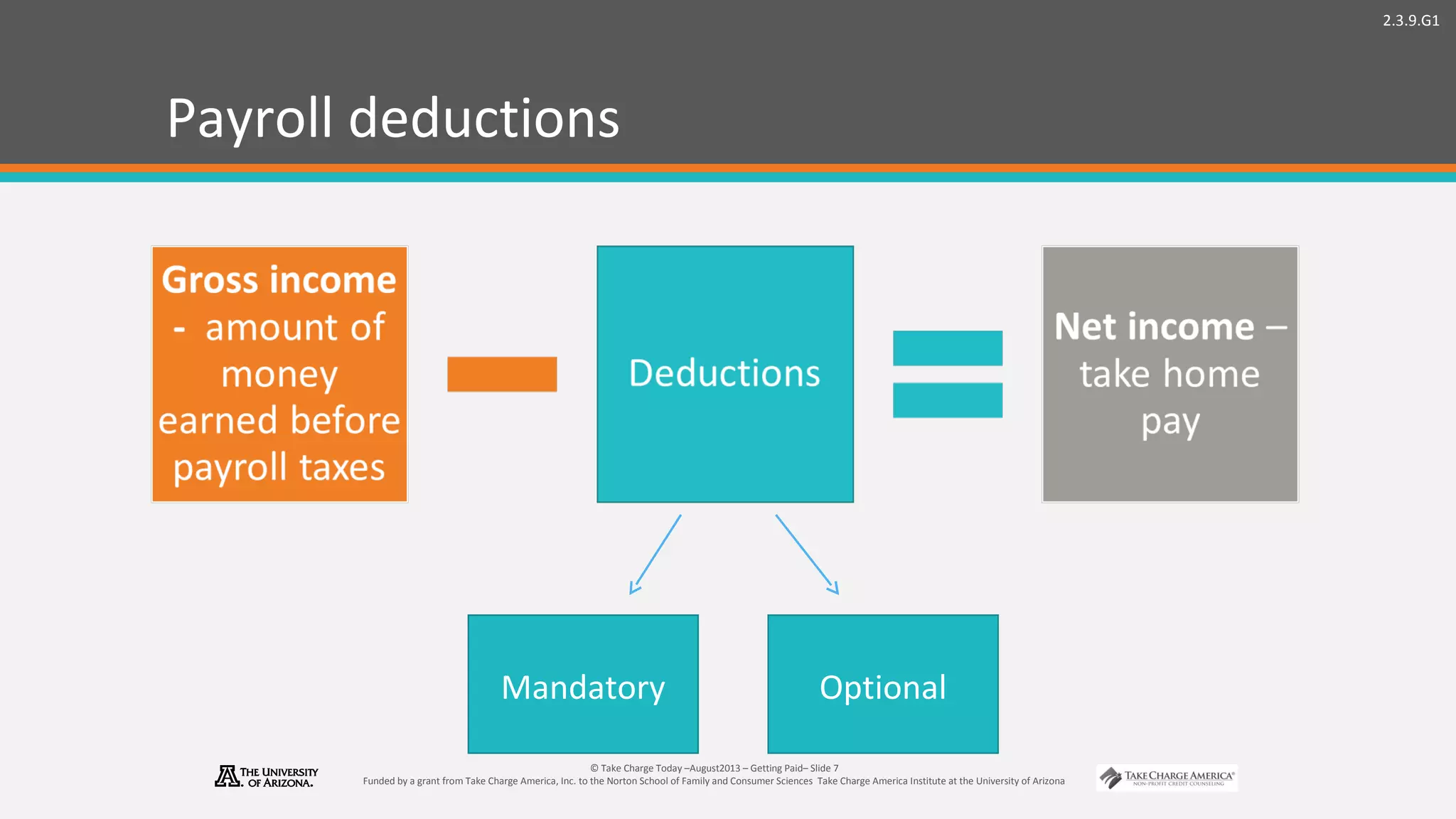

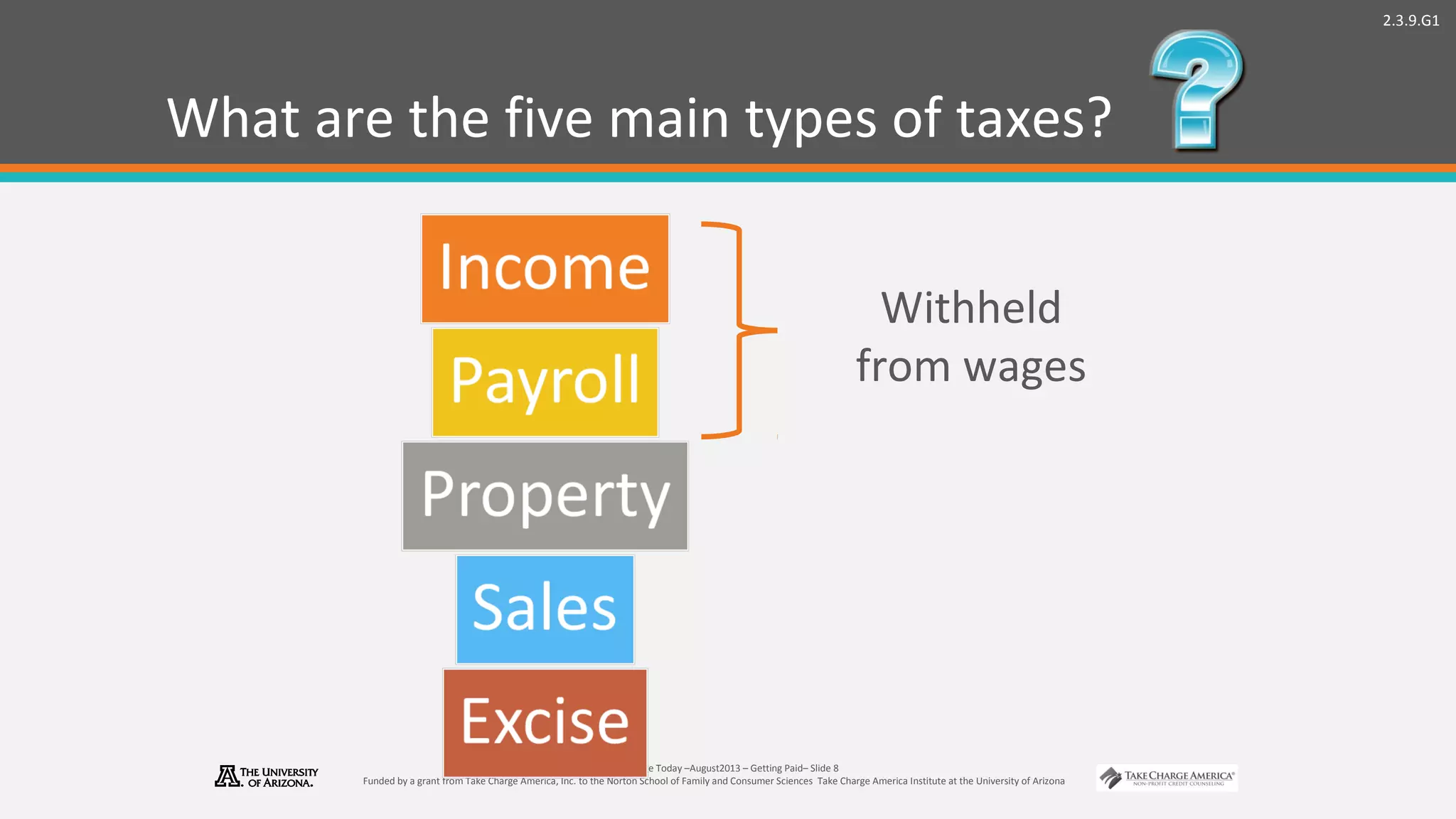

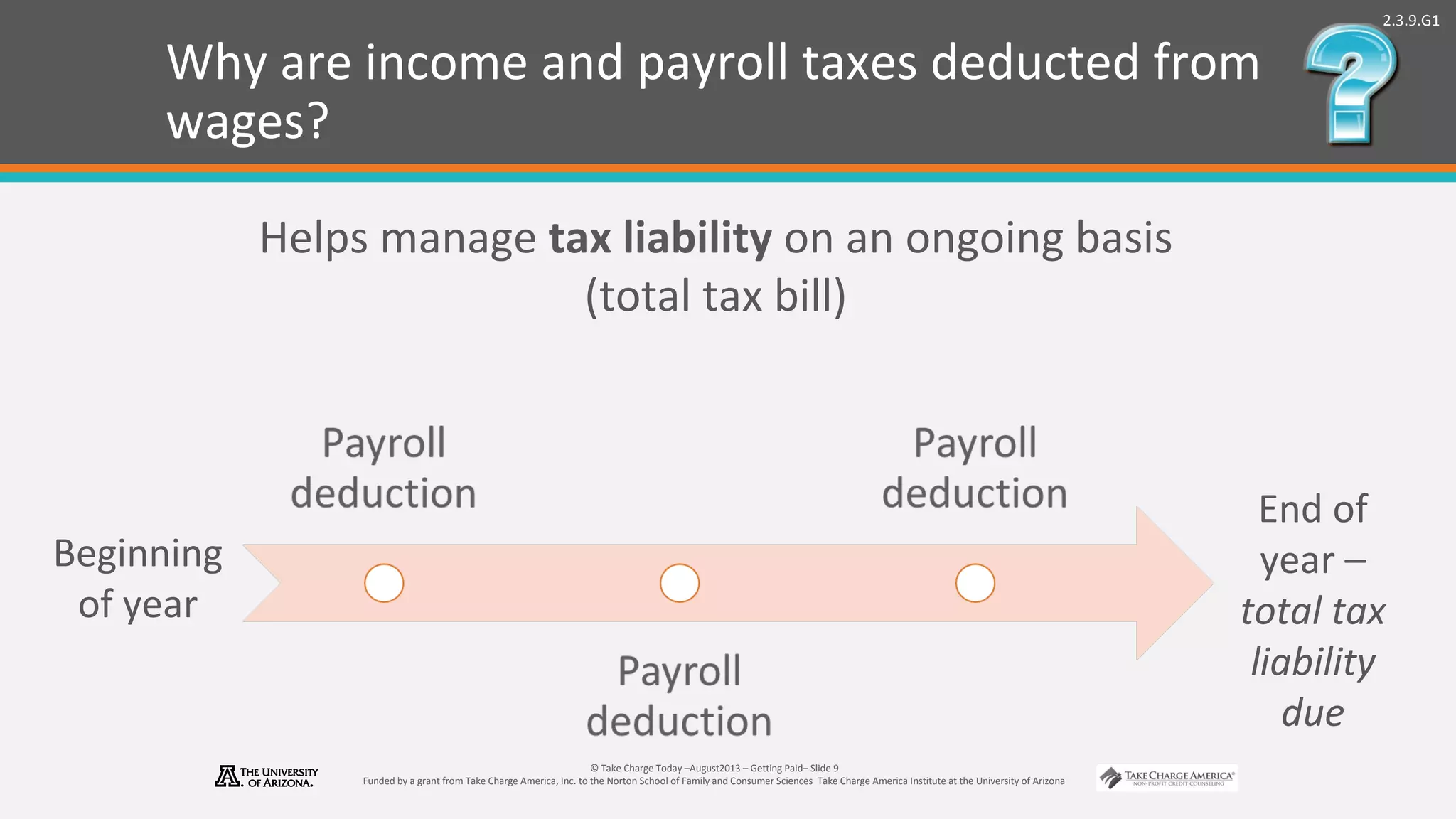

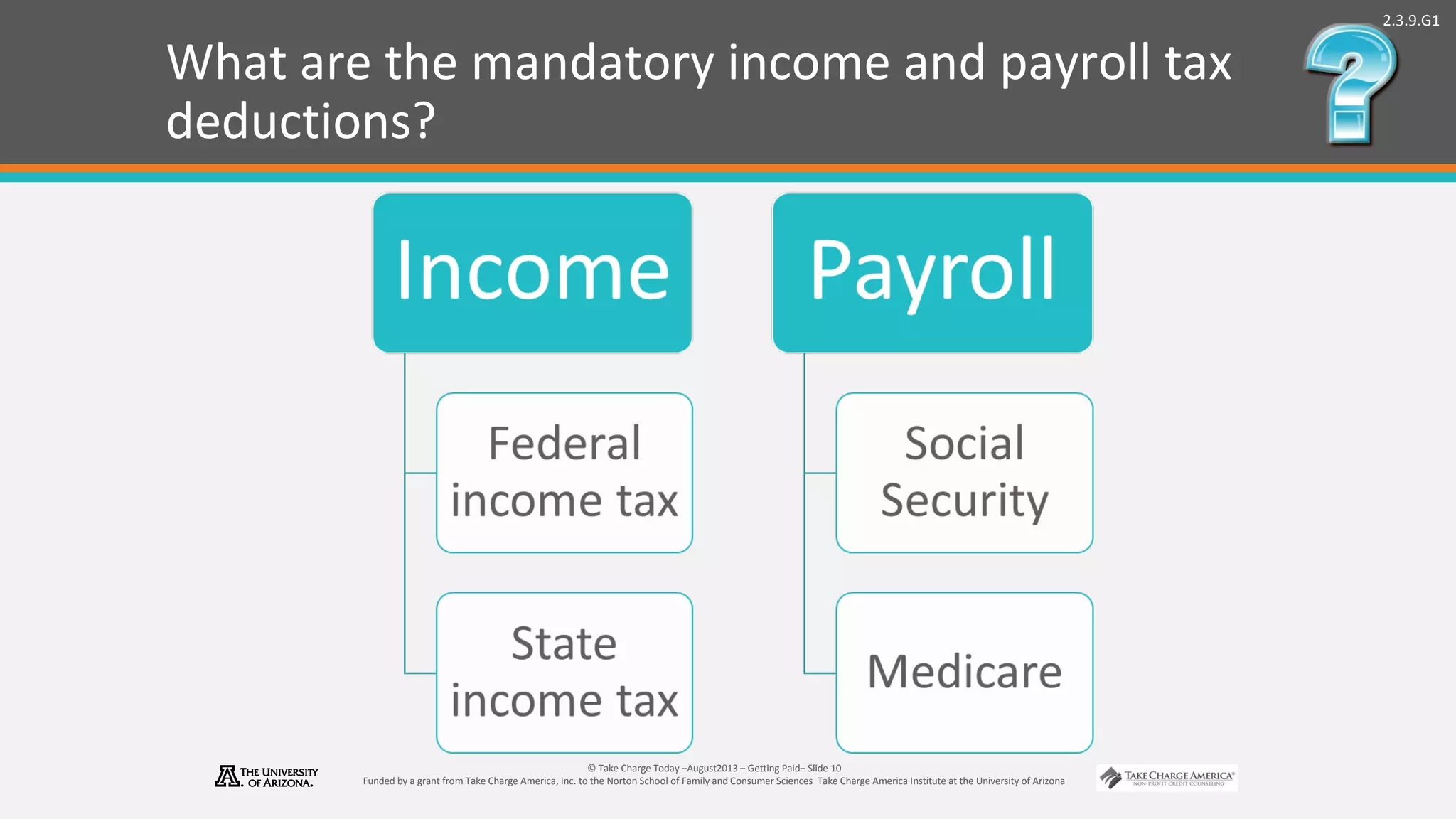

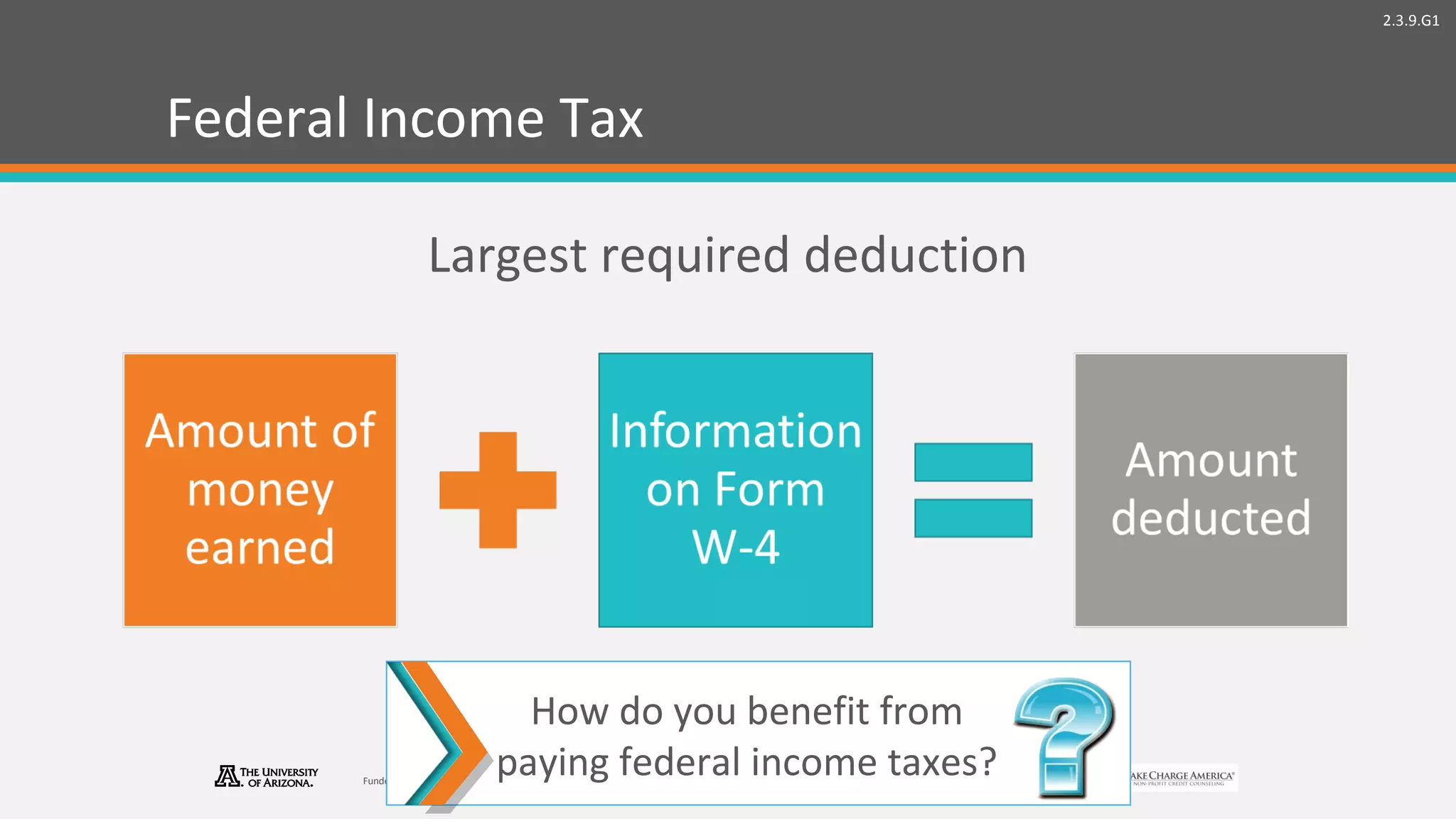

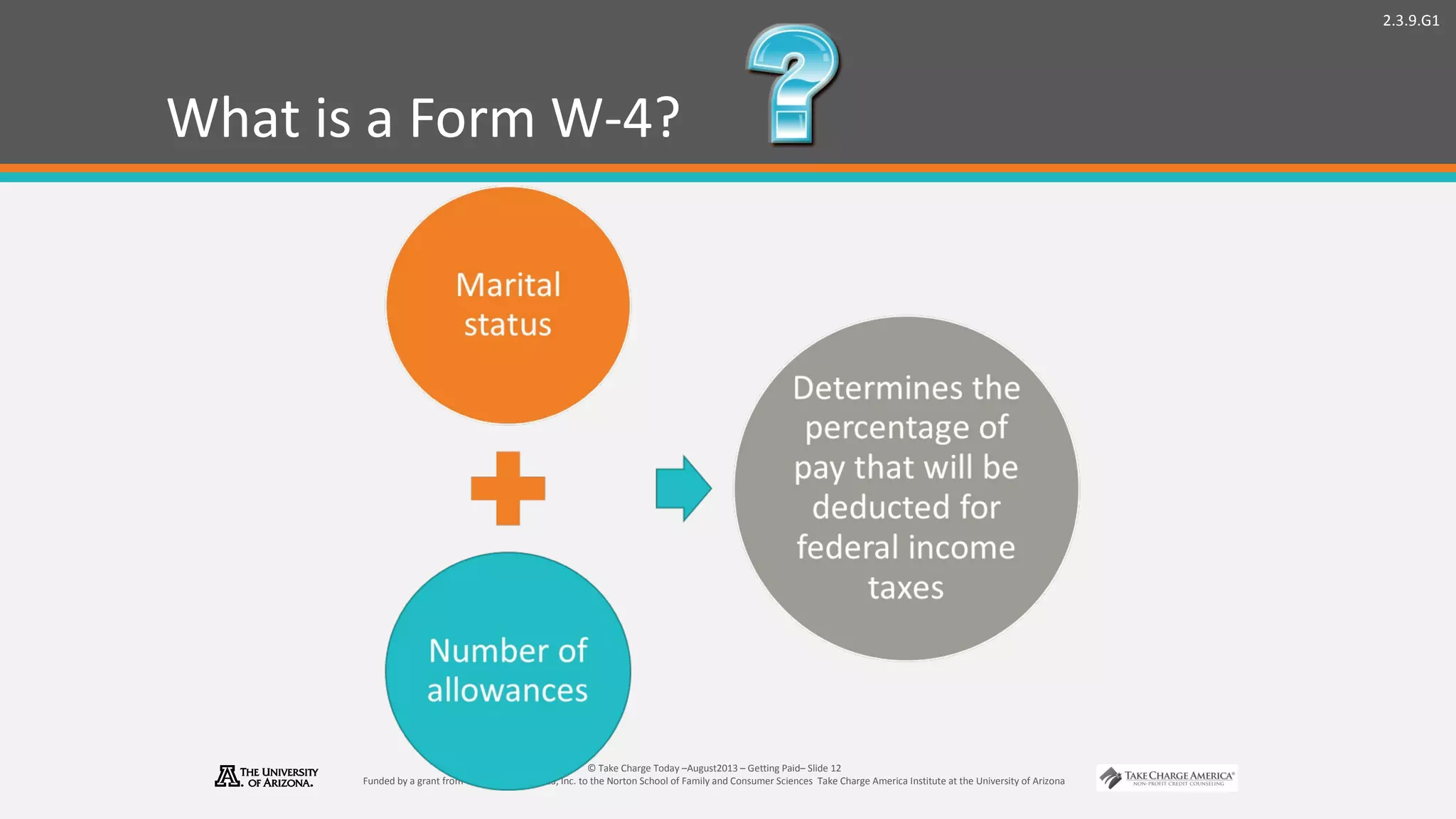

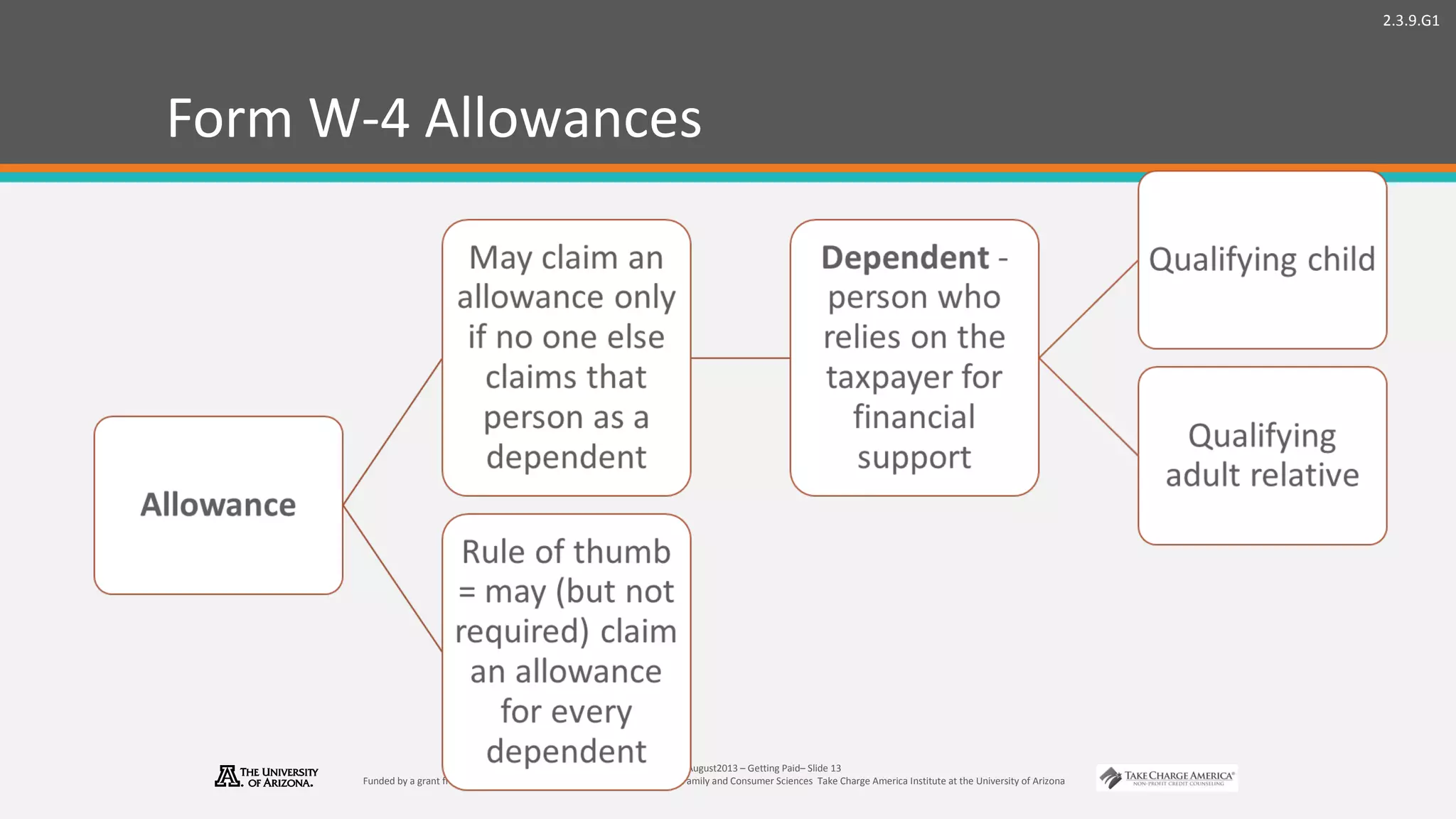

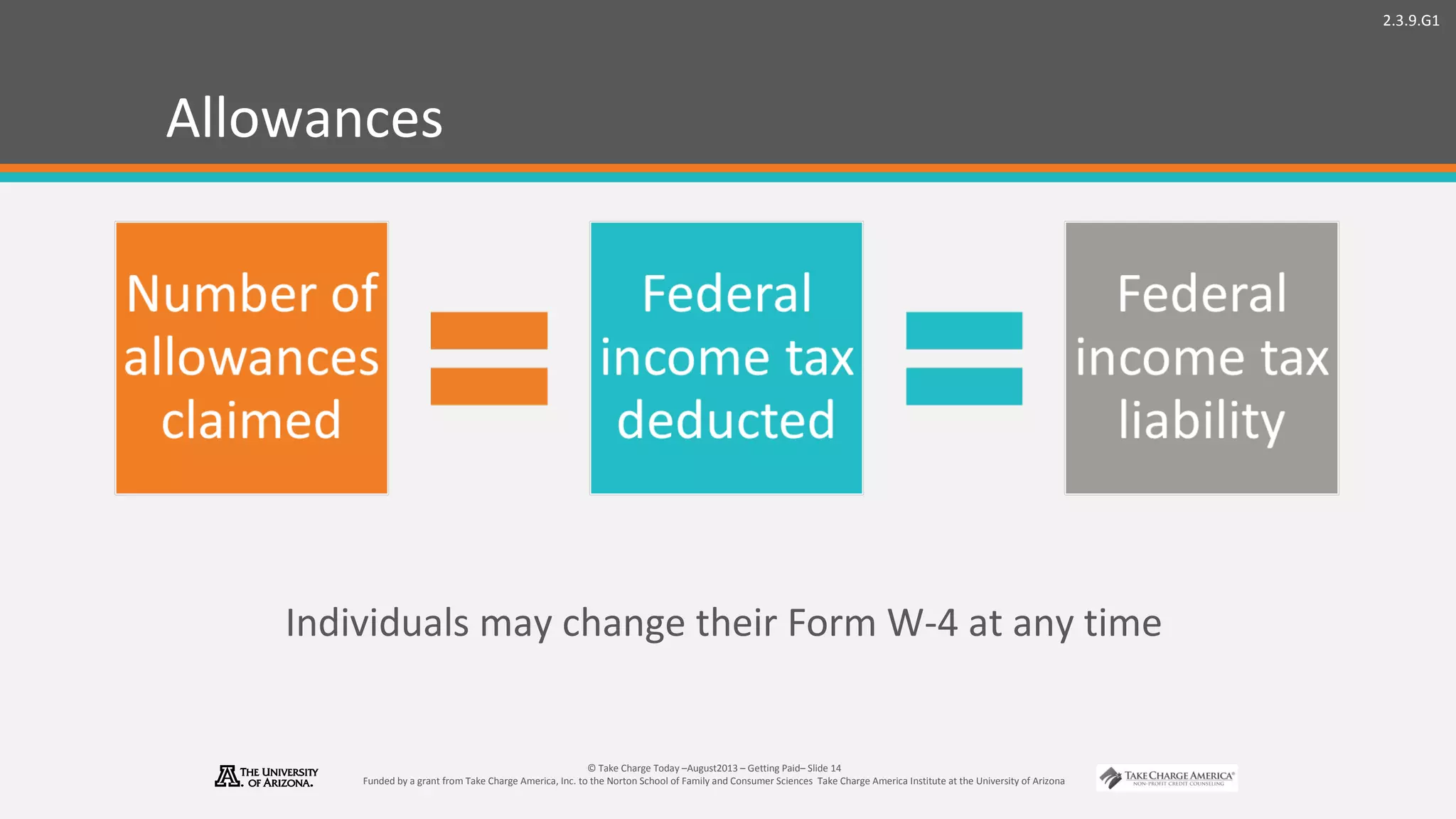

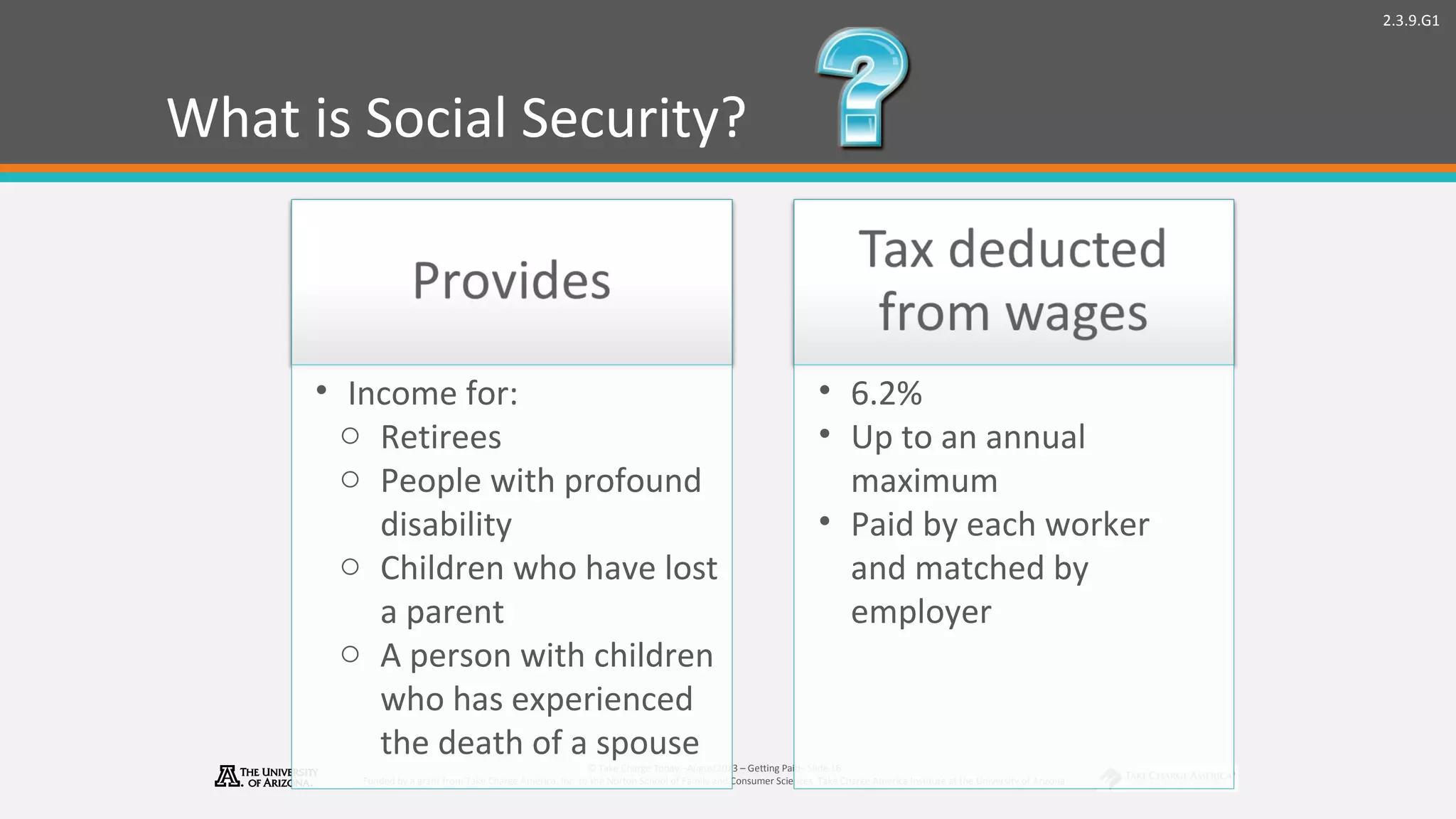

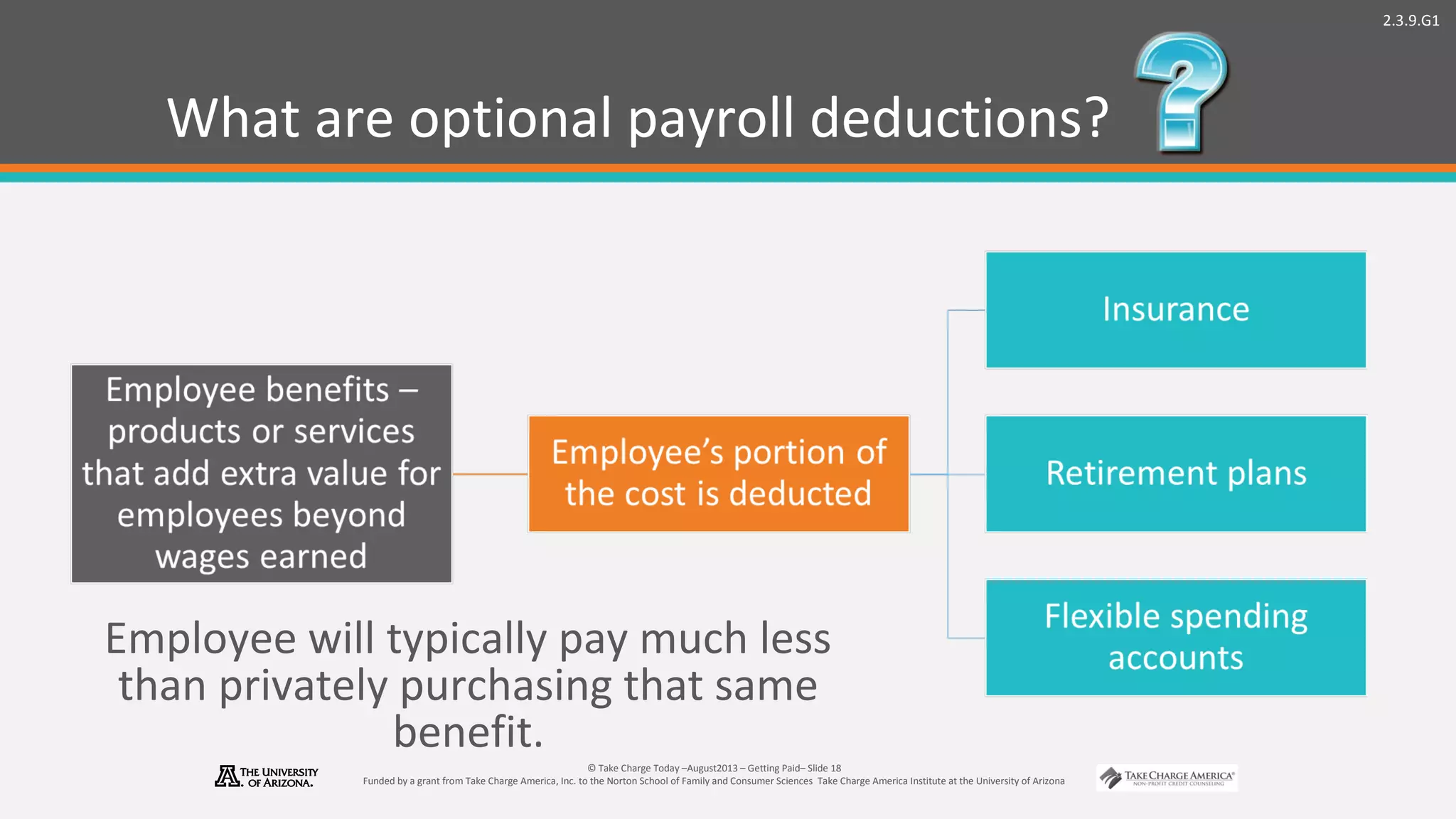

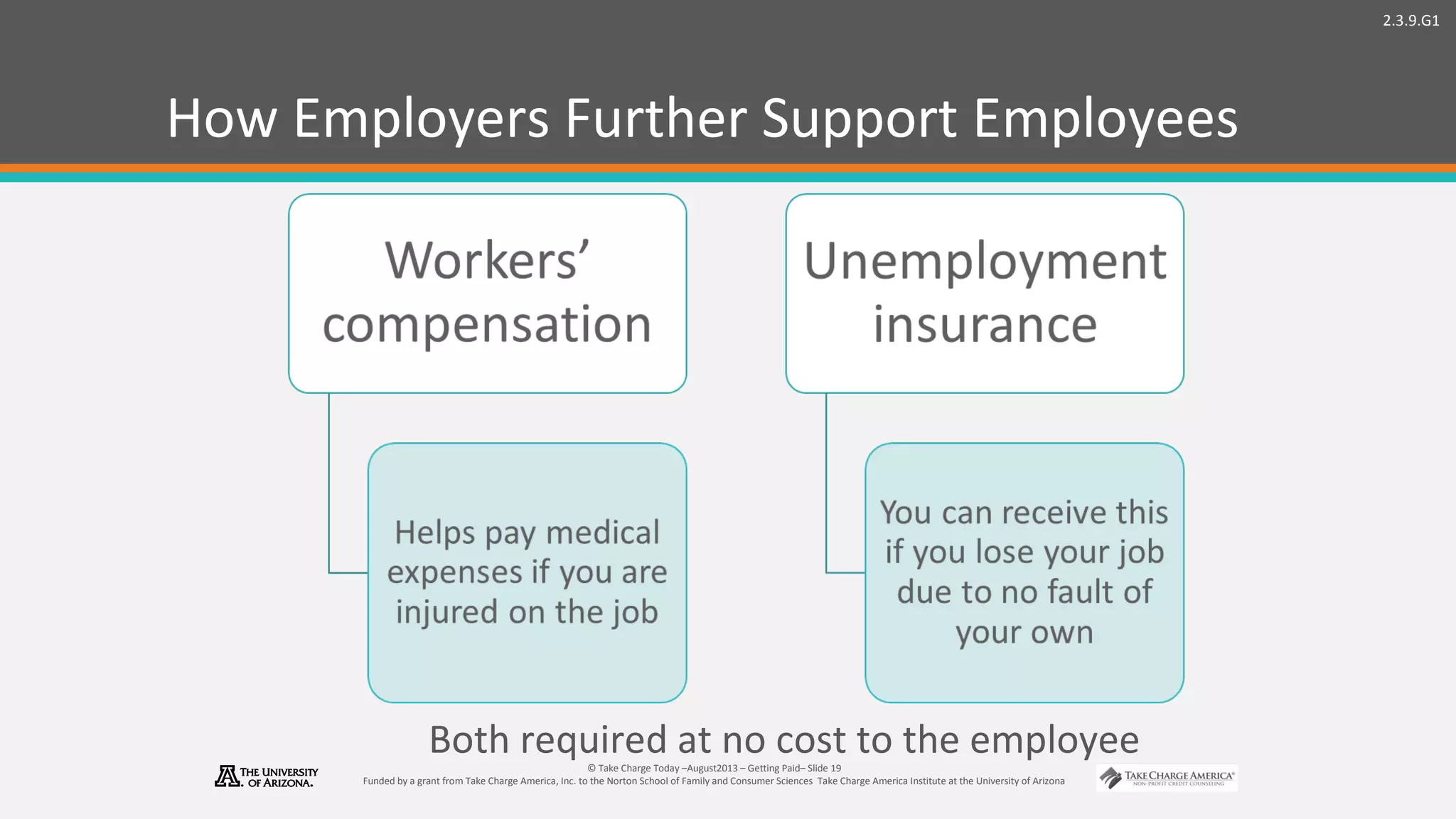

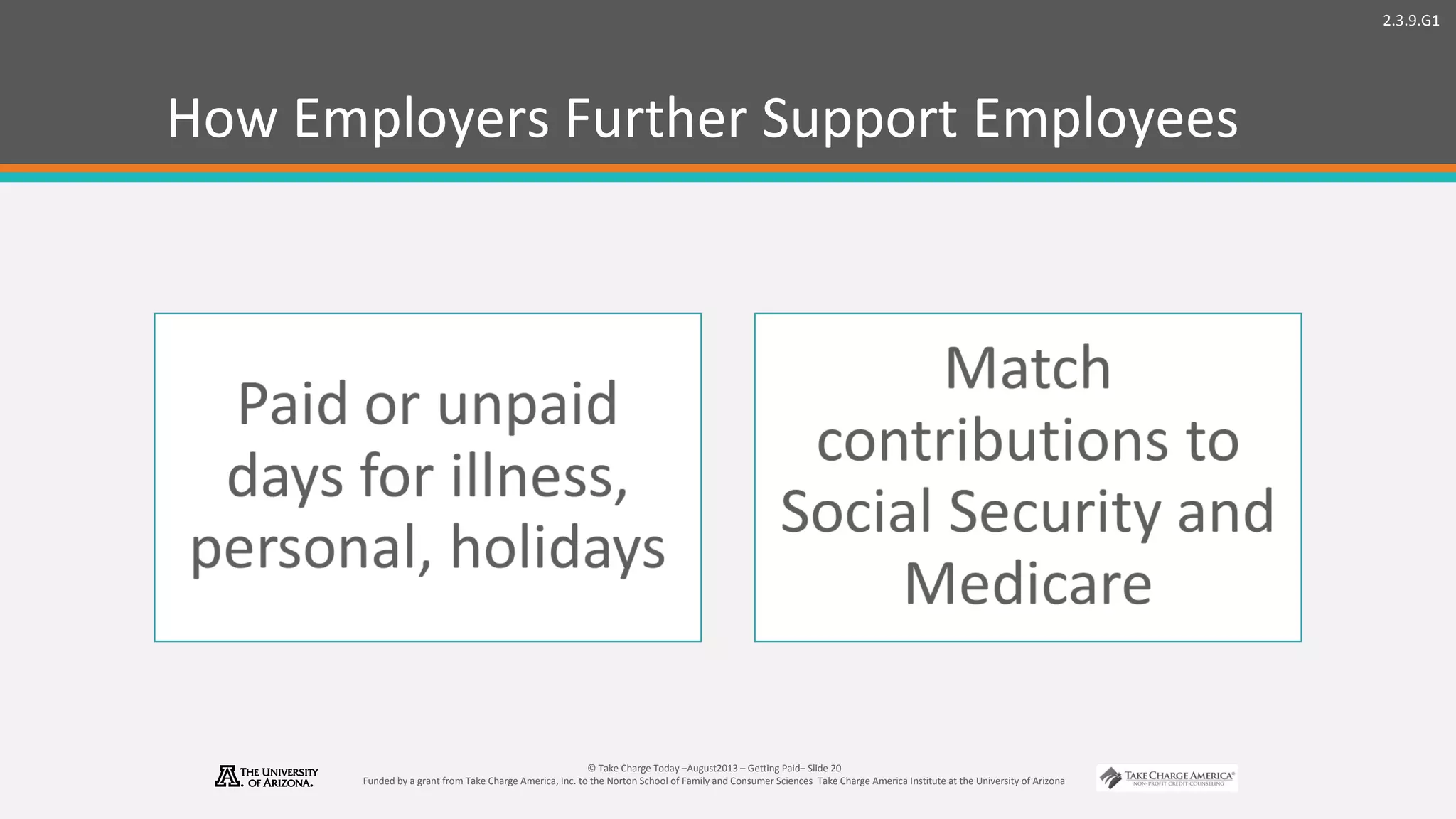

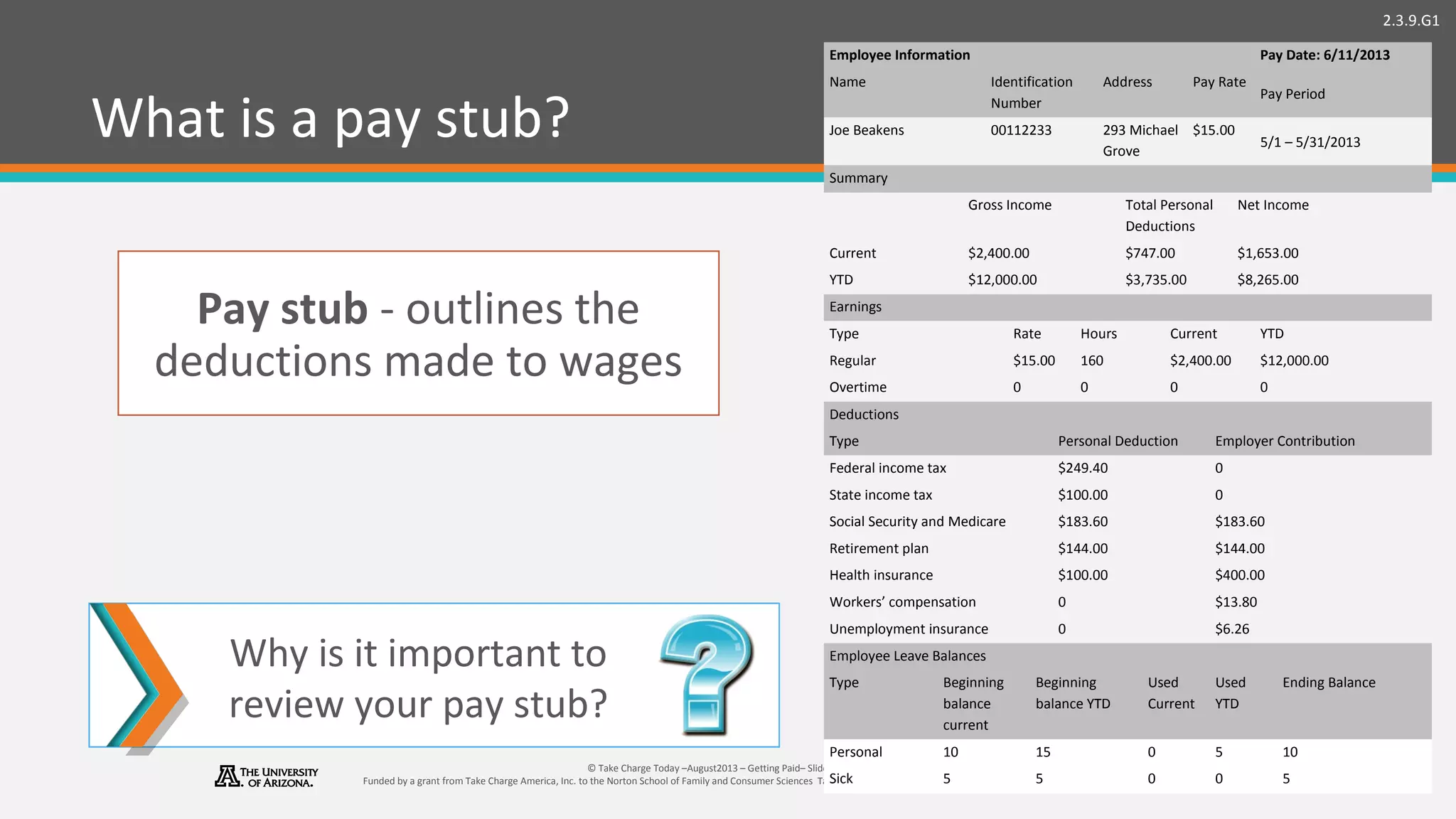

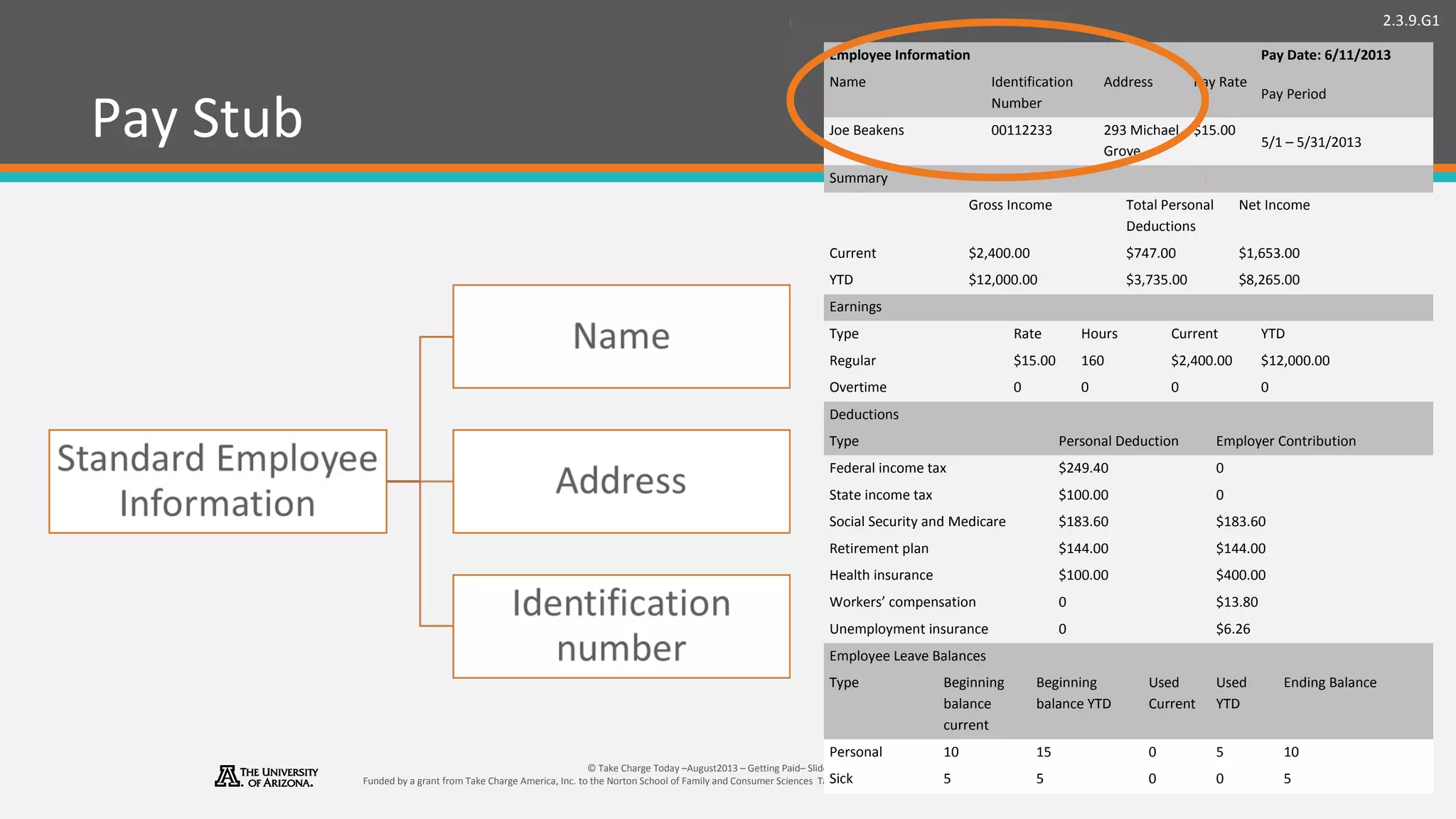

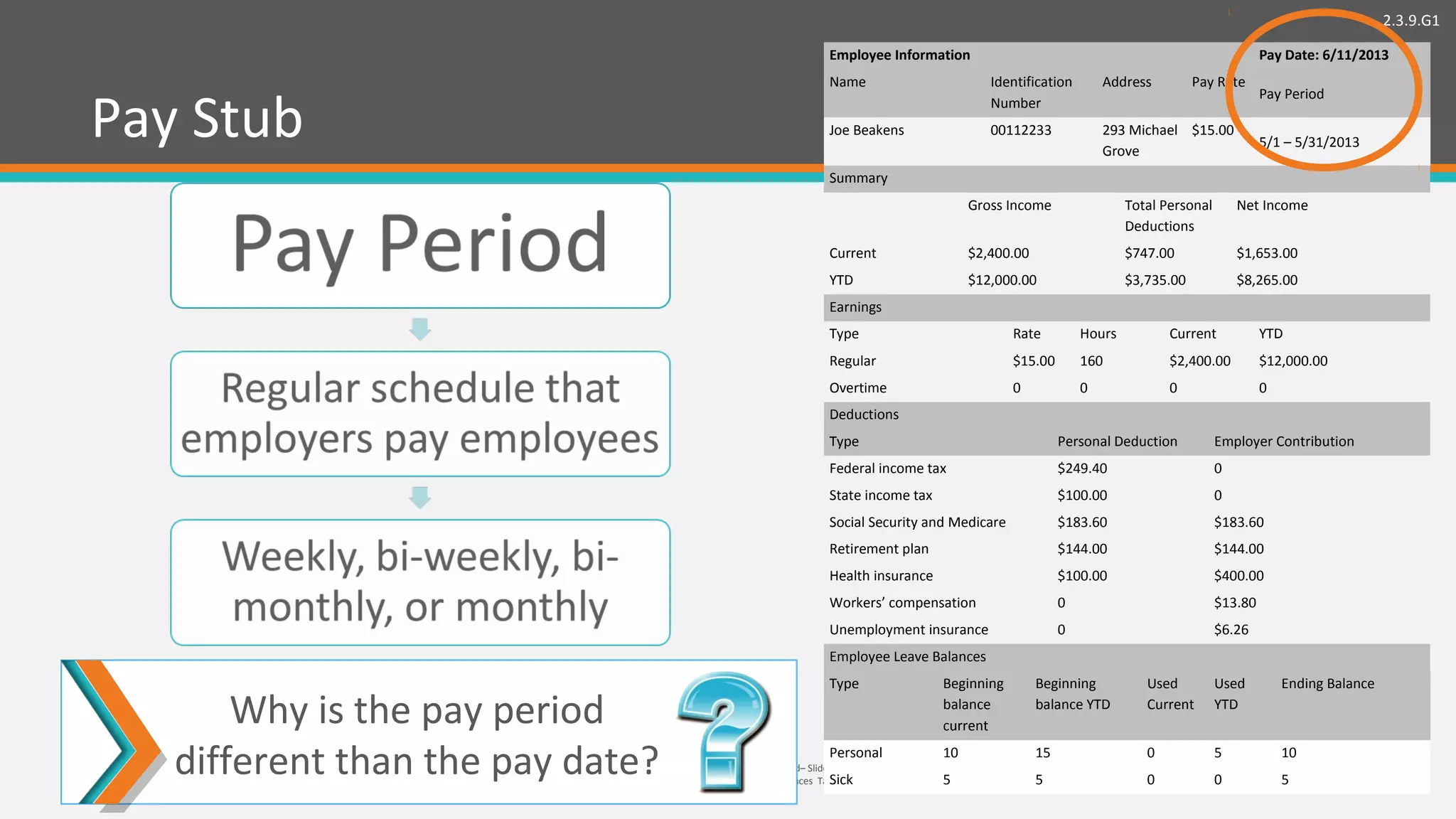

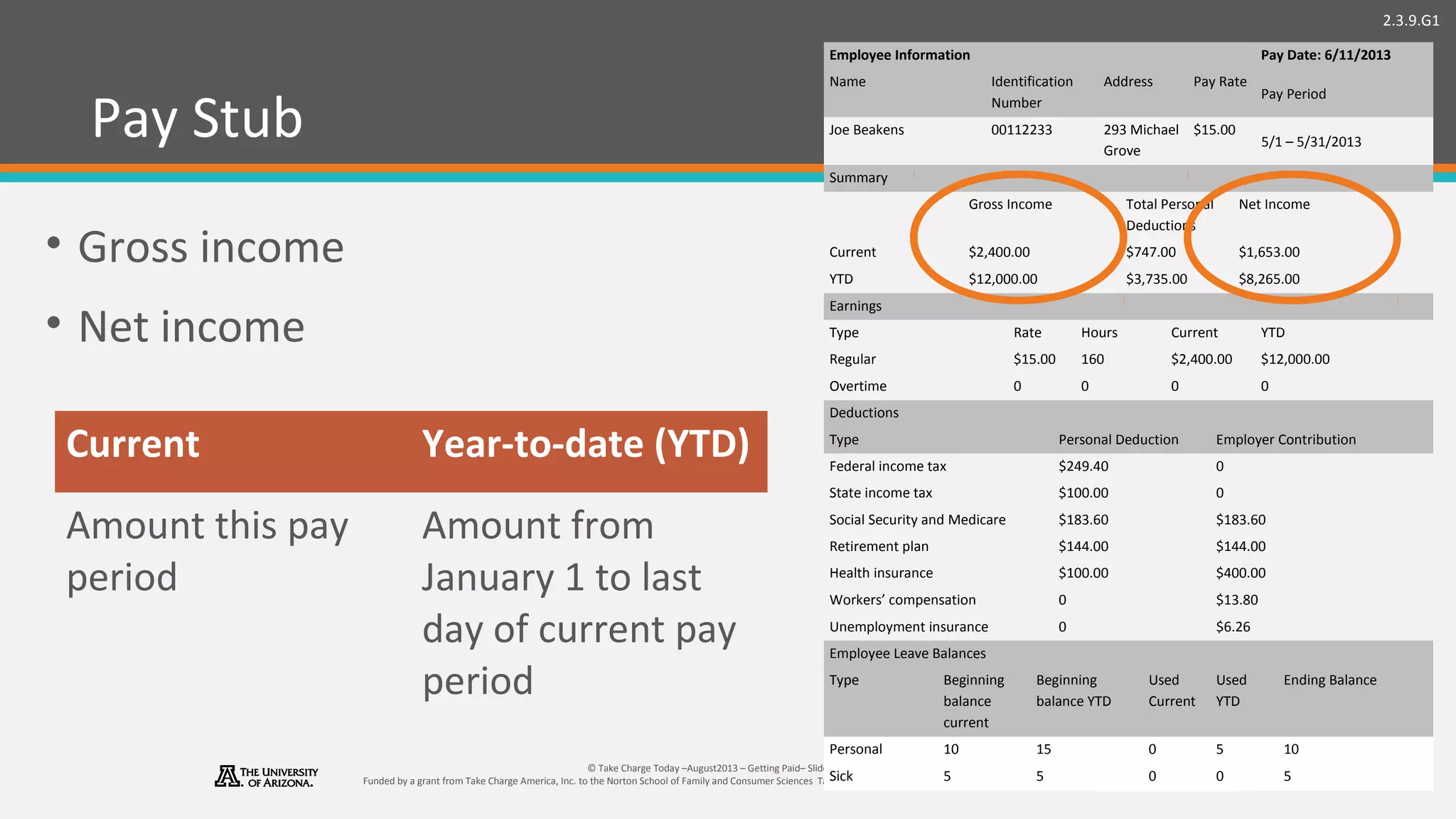

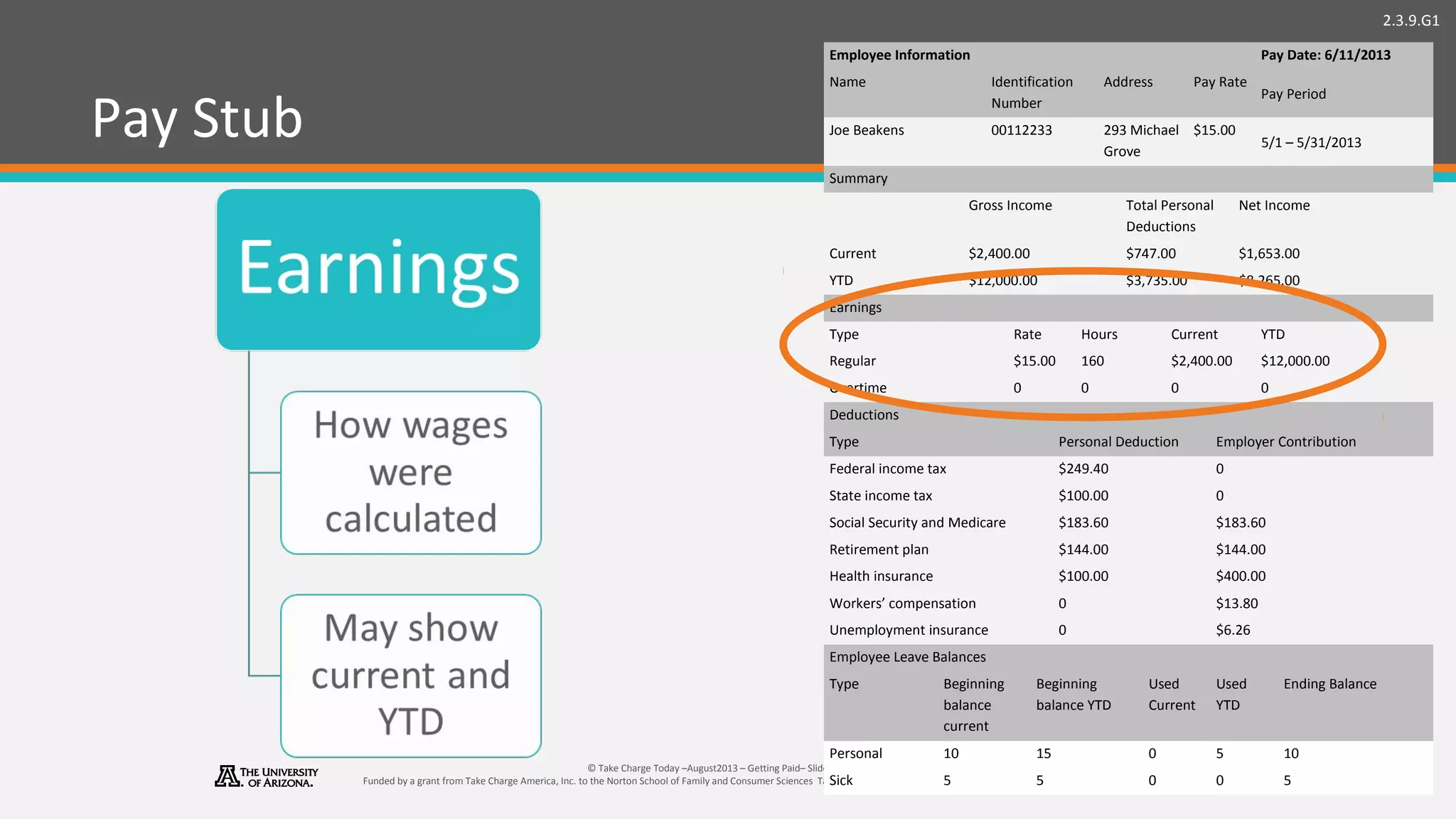

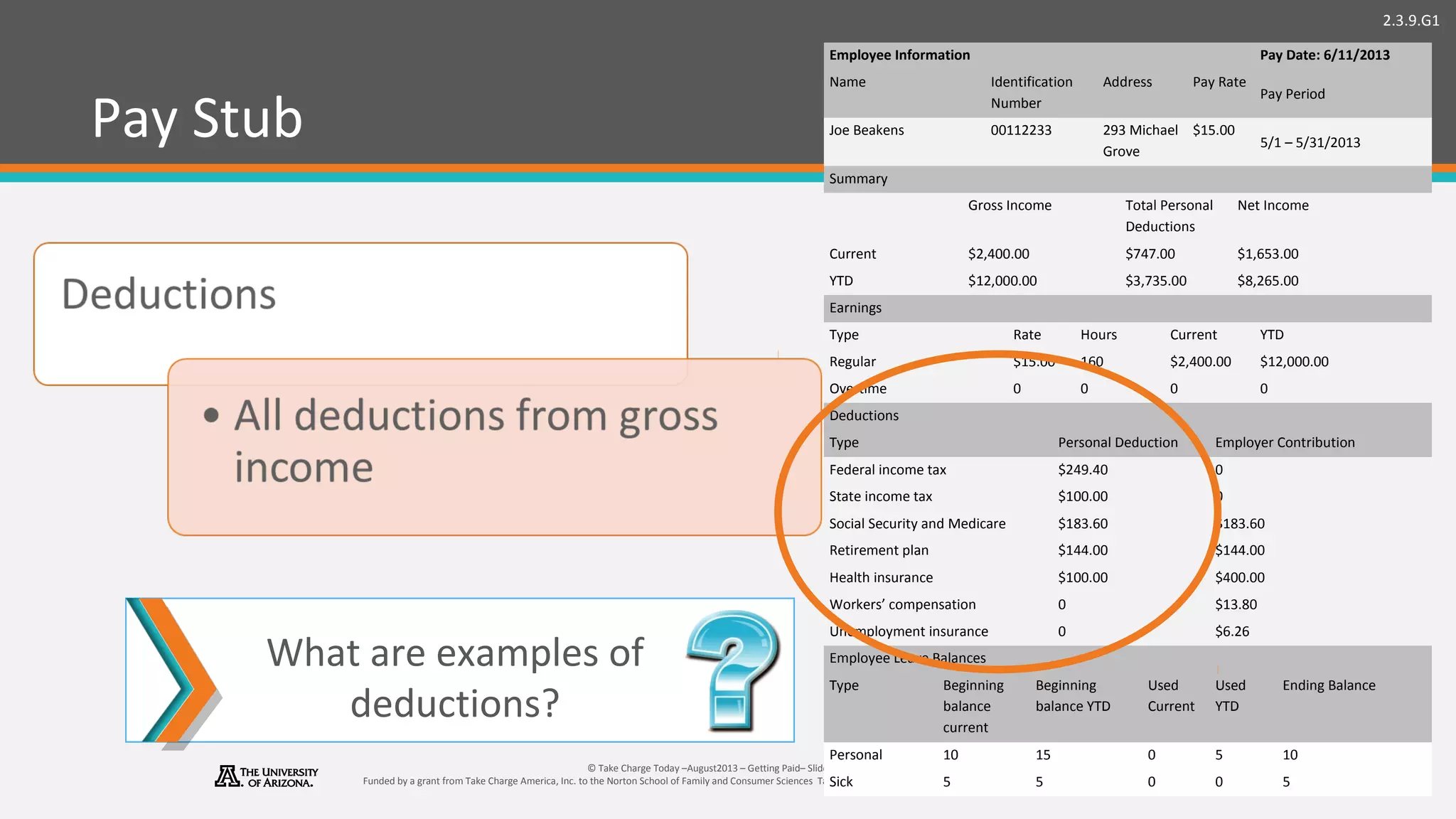

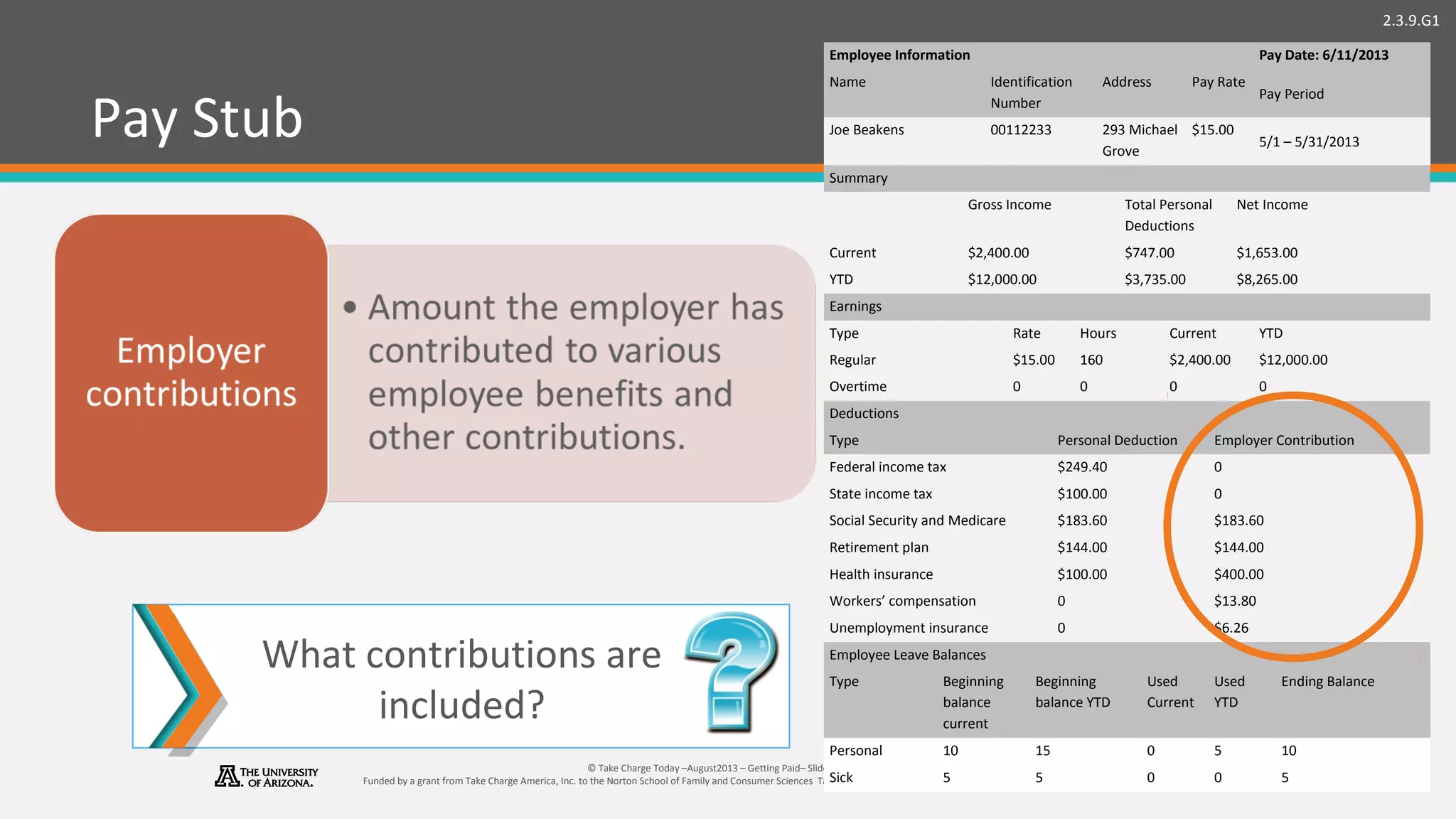

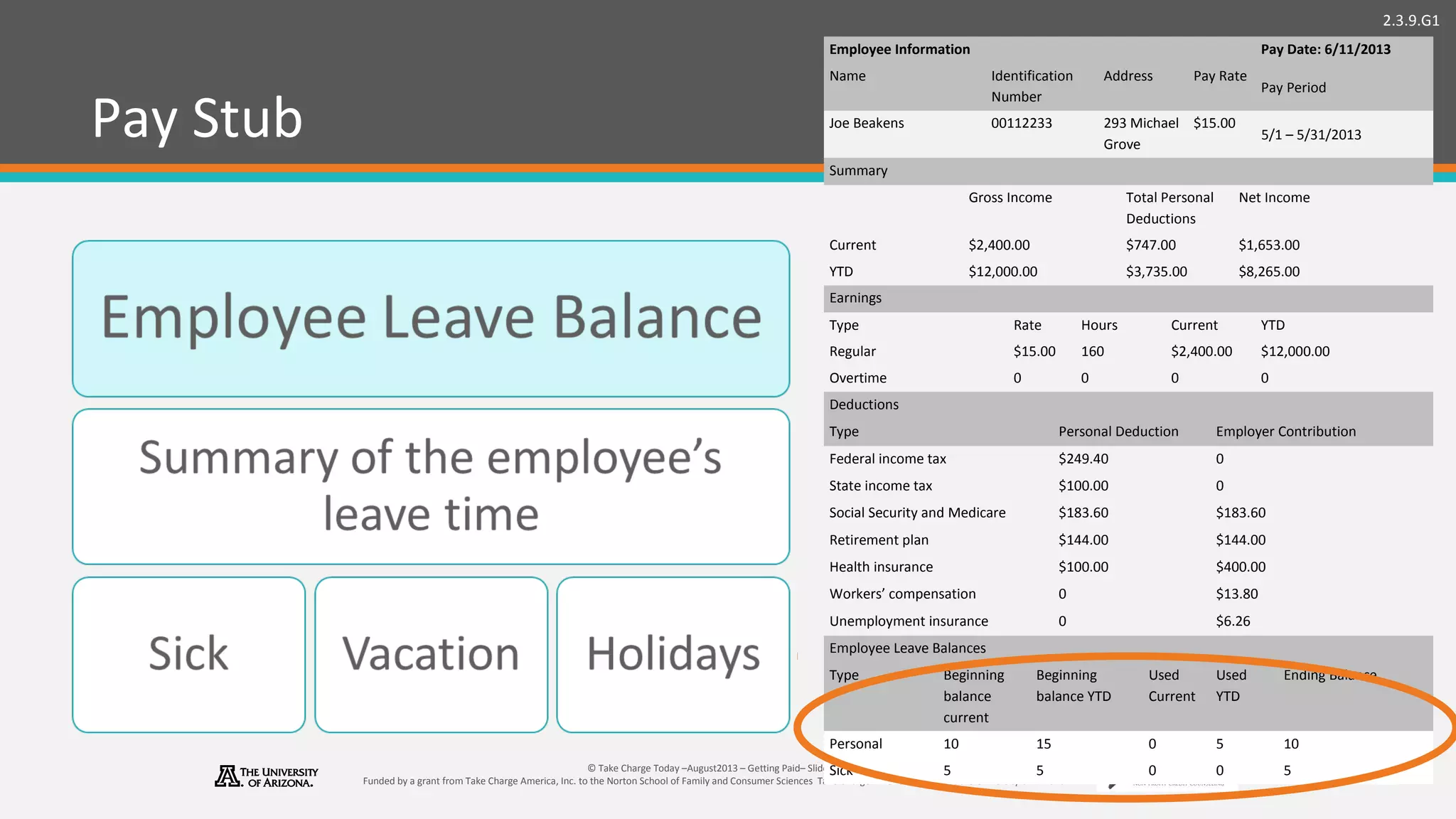

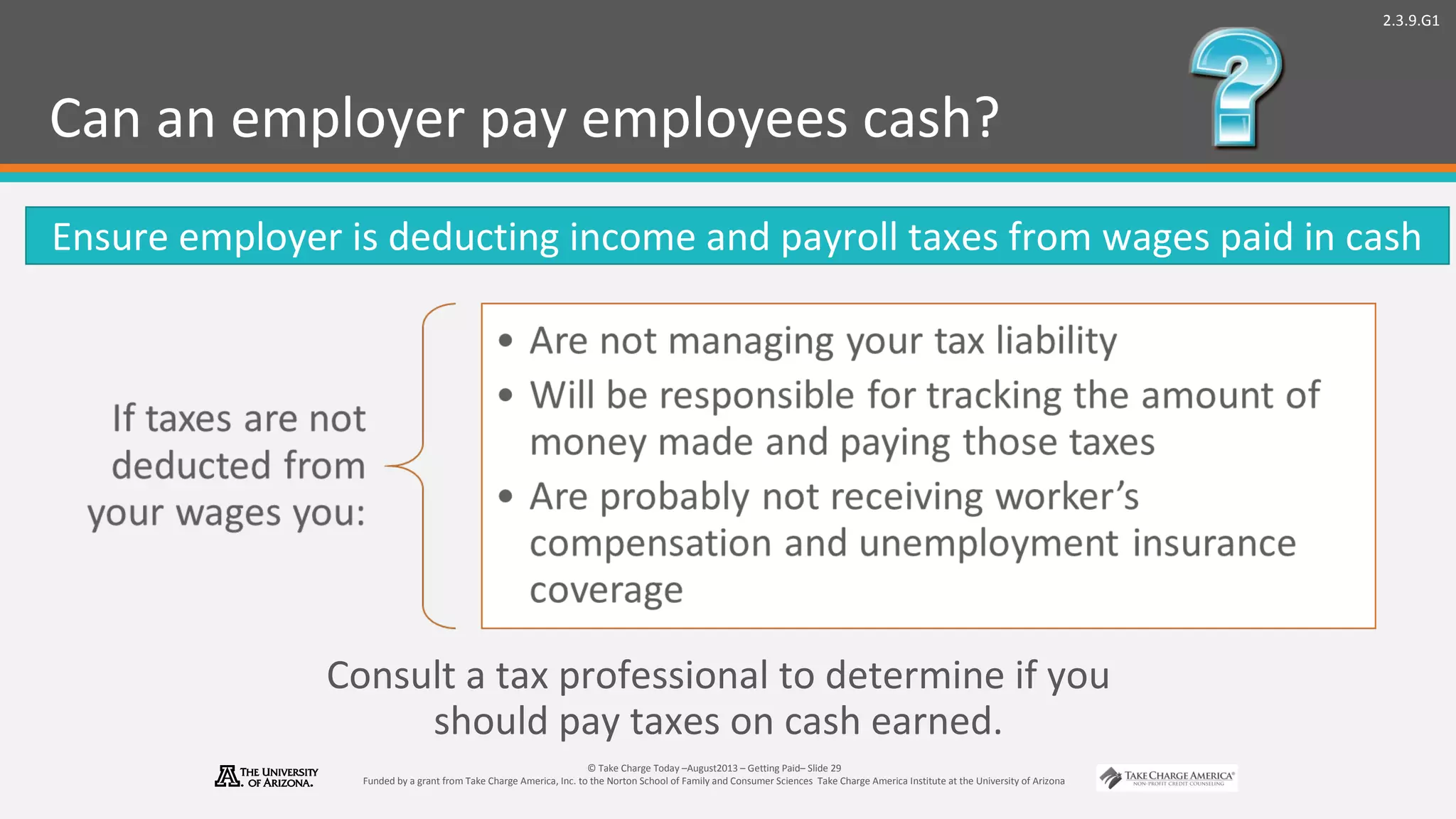

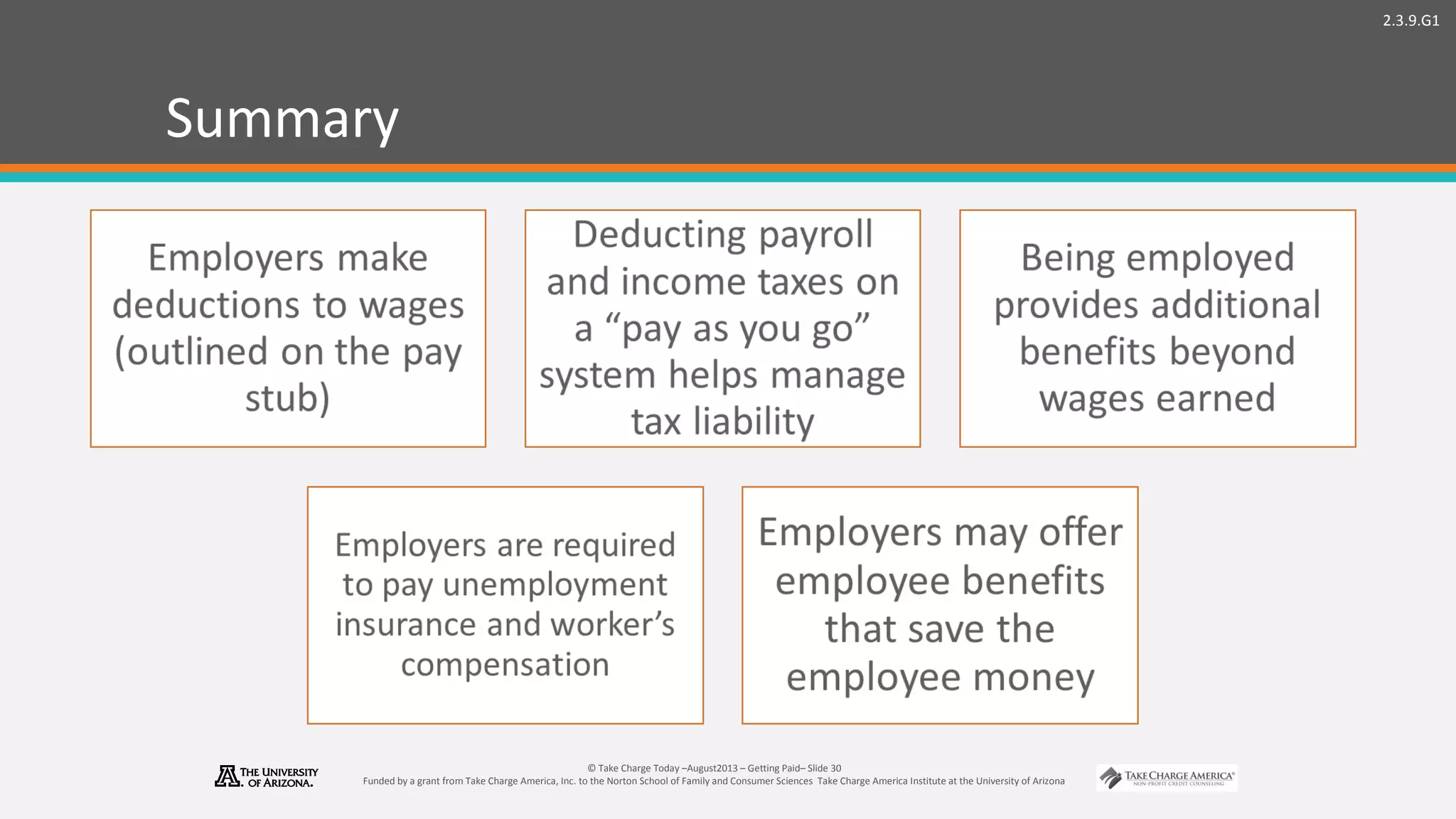

The document is a presentation on getting paid and understanding pay stubs. It discusses key topics like salary vs hourly pay, methods of payment including direct deposit and pay cards, mandatory and optional payroll deductions including taxes, and components of a pay stub such as earnings, deductions, and leave balances. The purpose is to help individuals understand the pay process and how to read a pay stub which outlines deductions from wages.