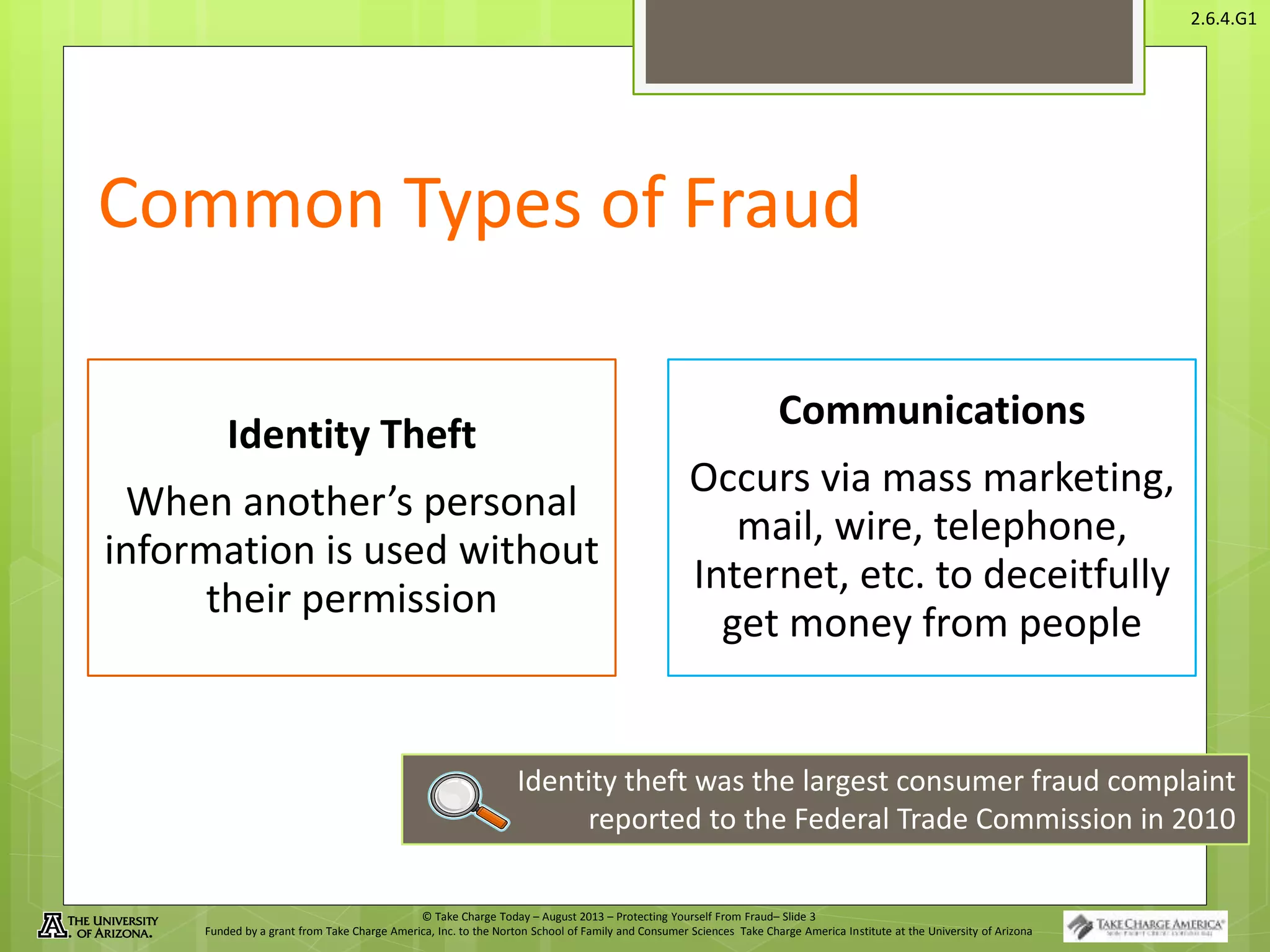

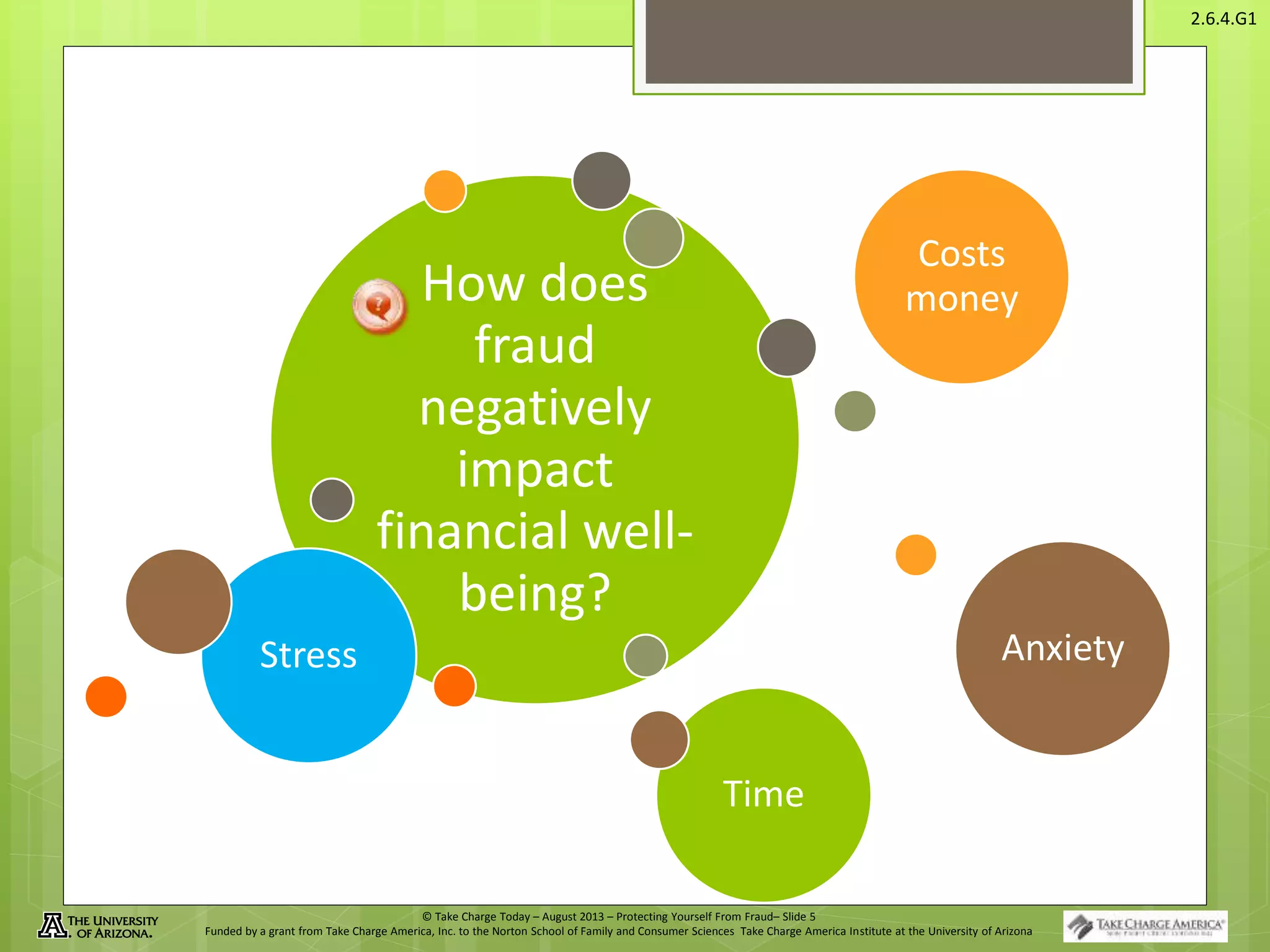

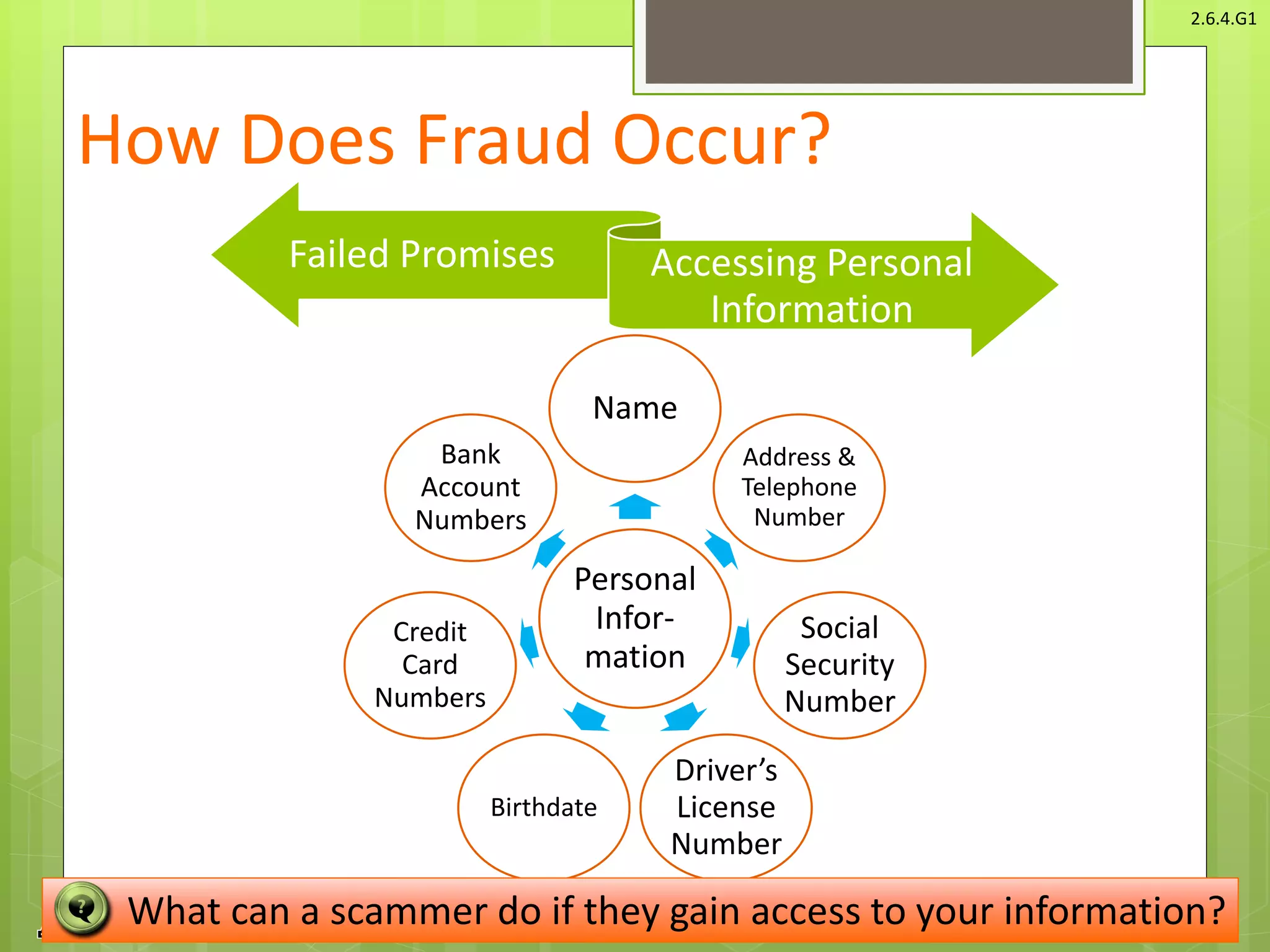

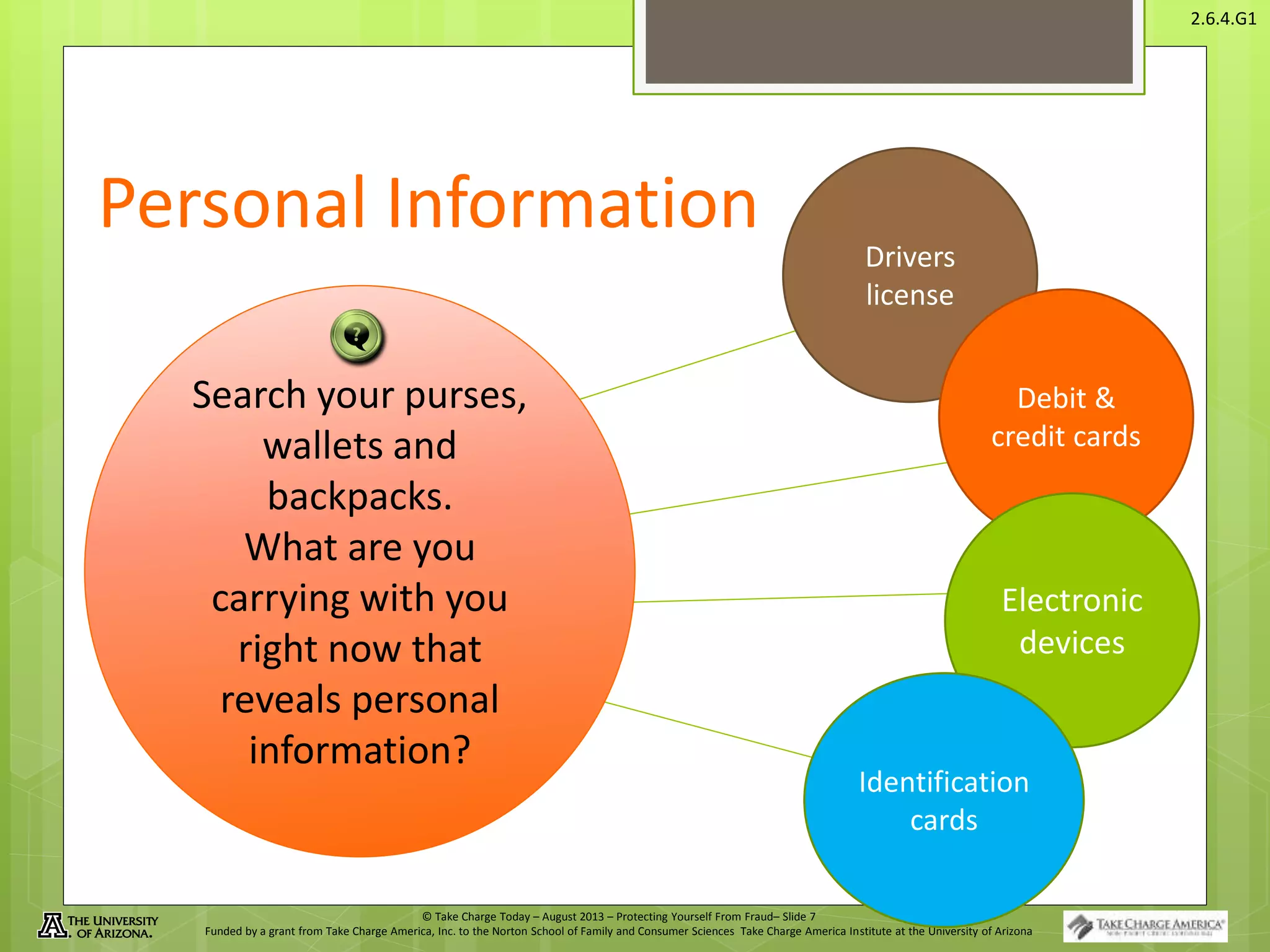

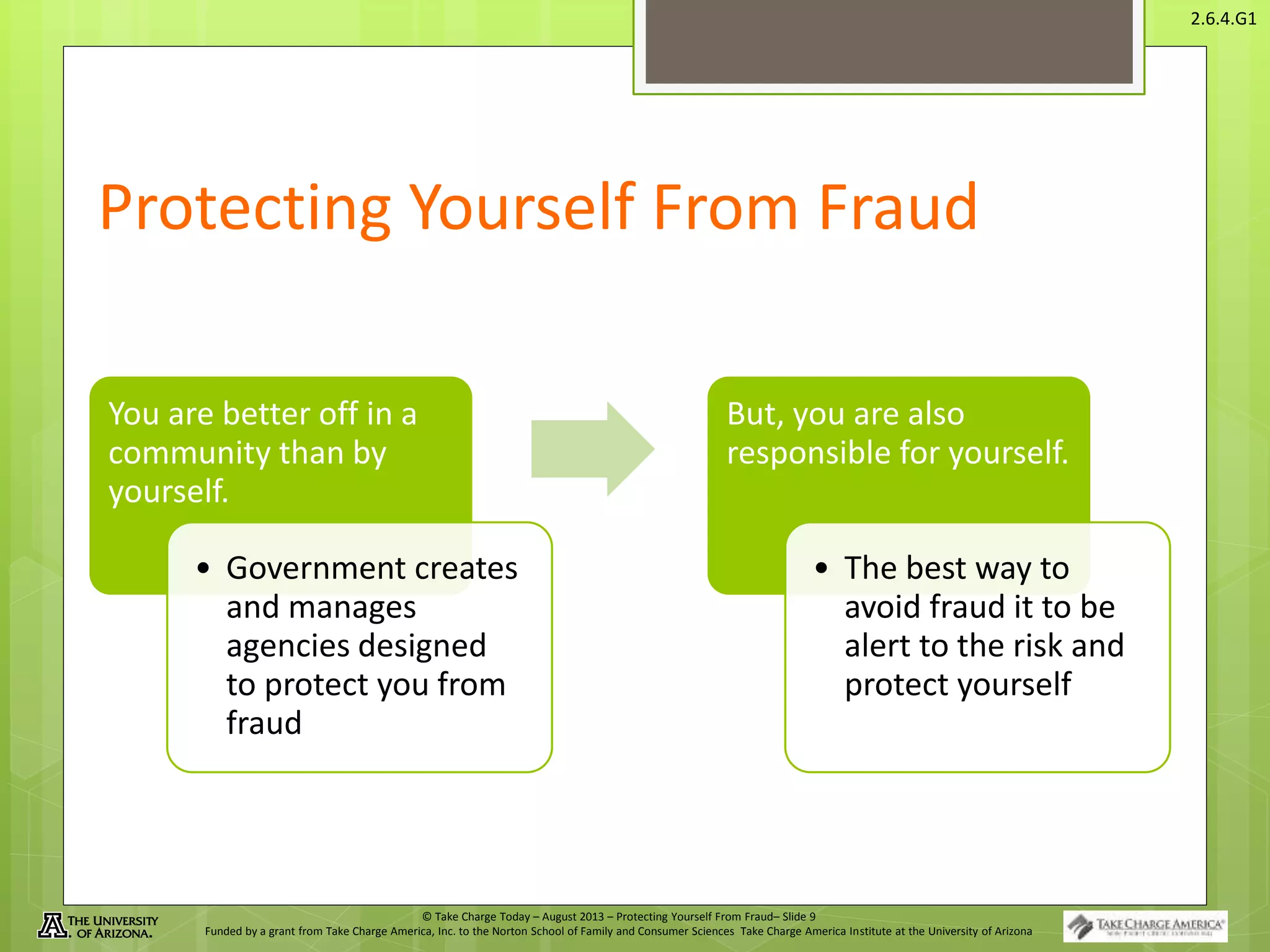

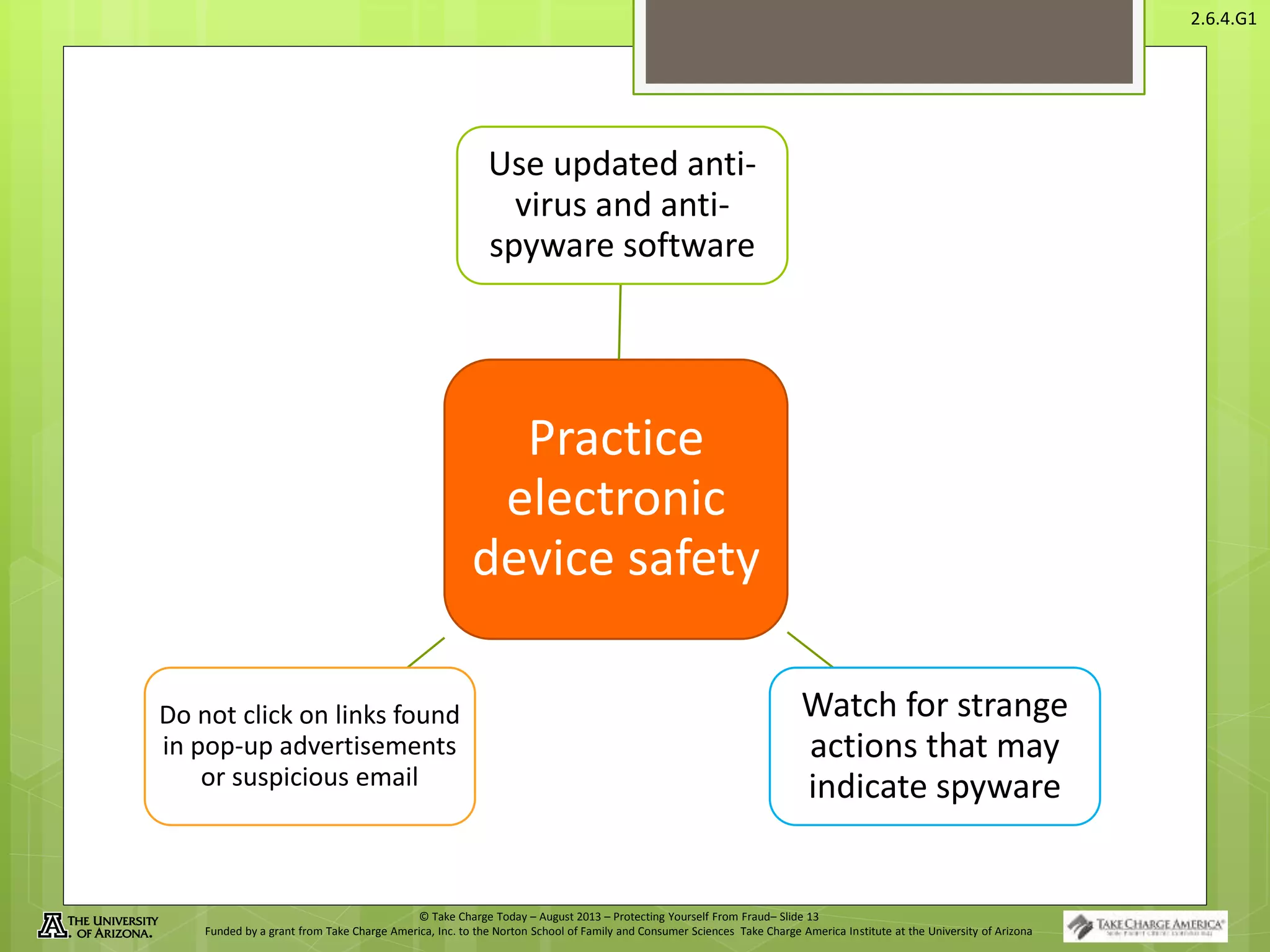

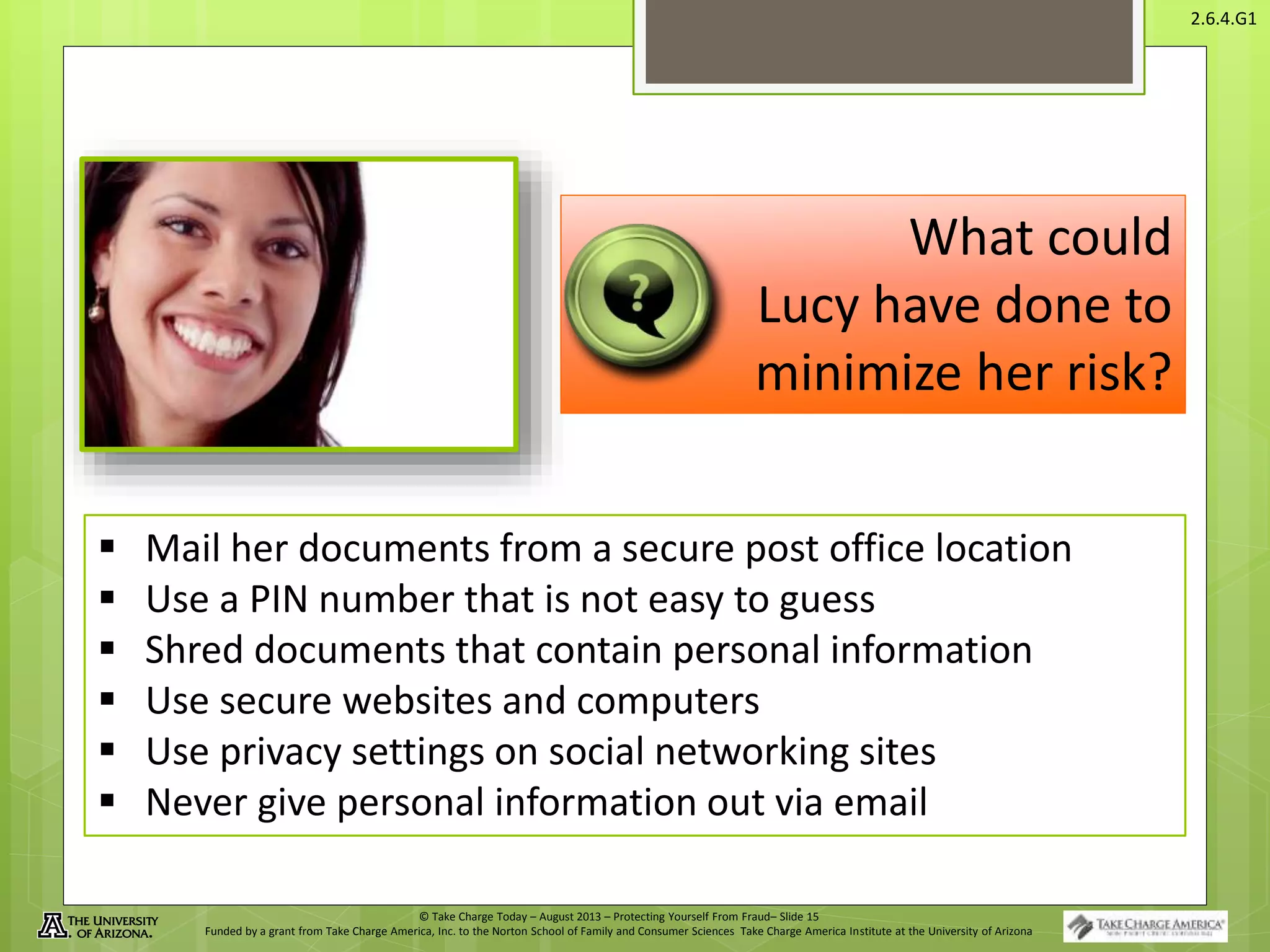

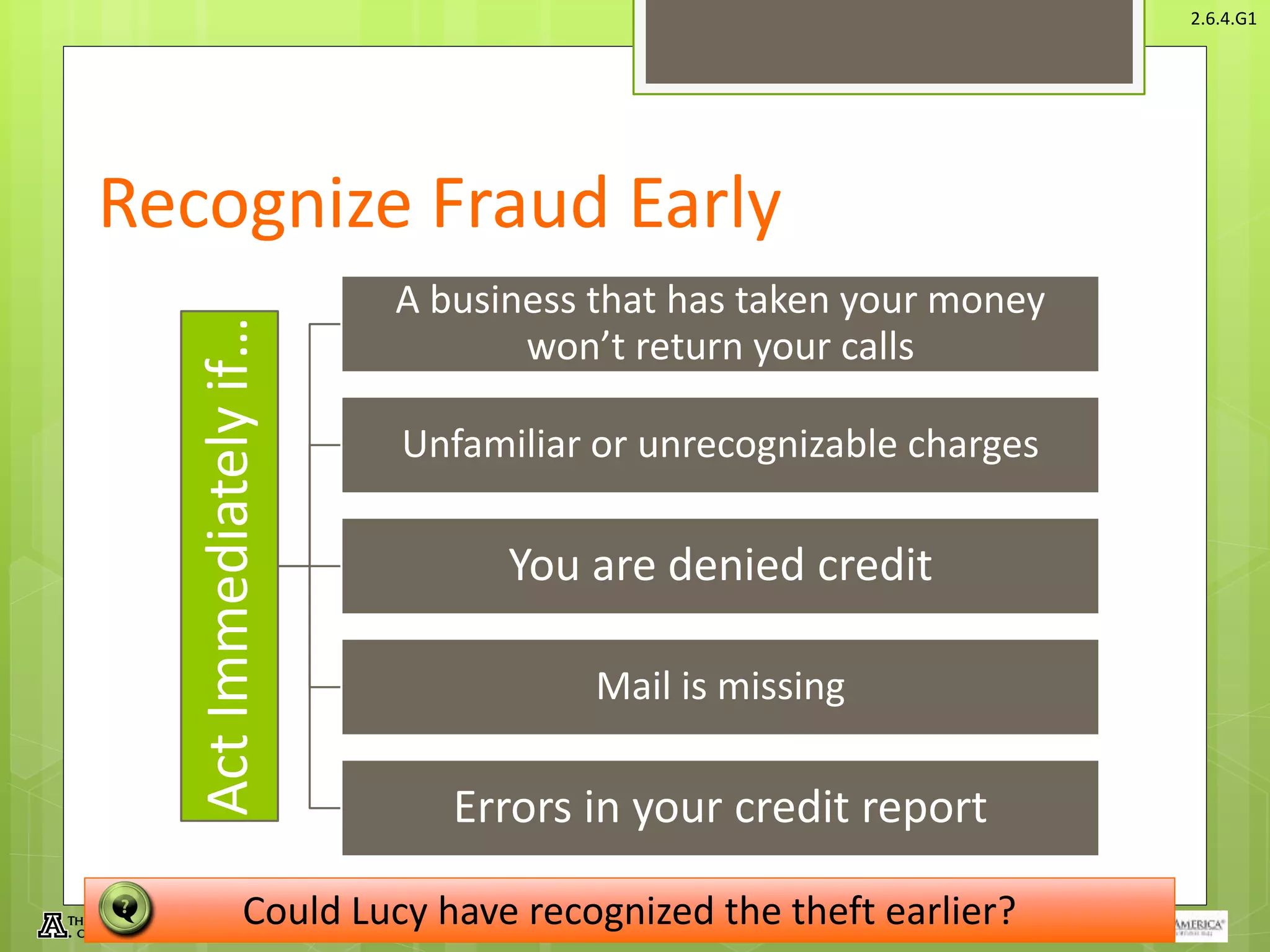

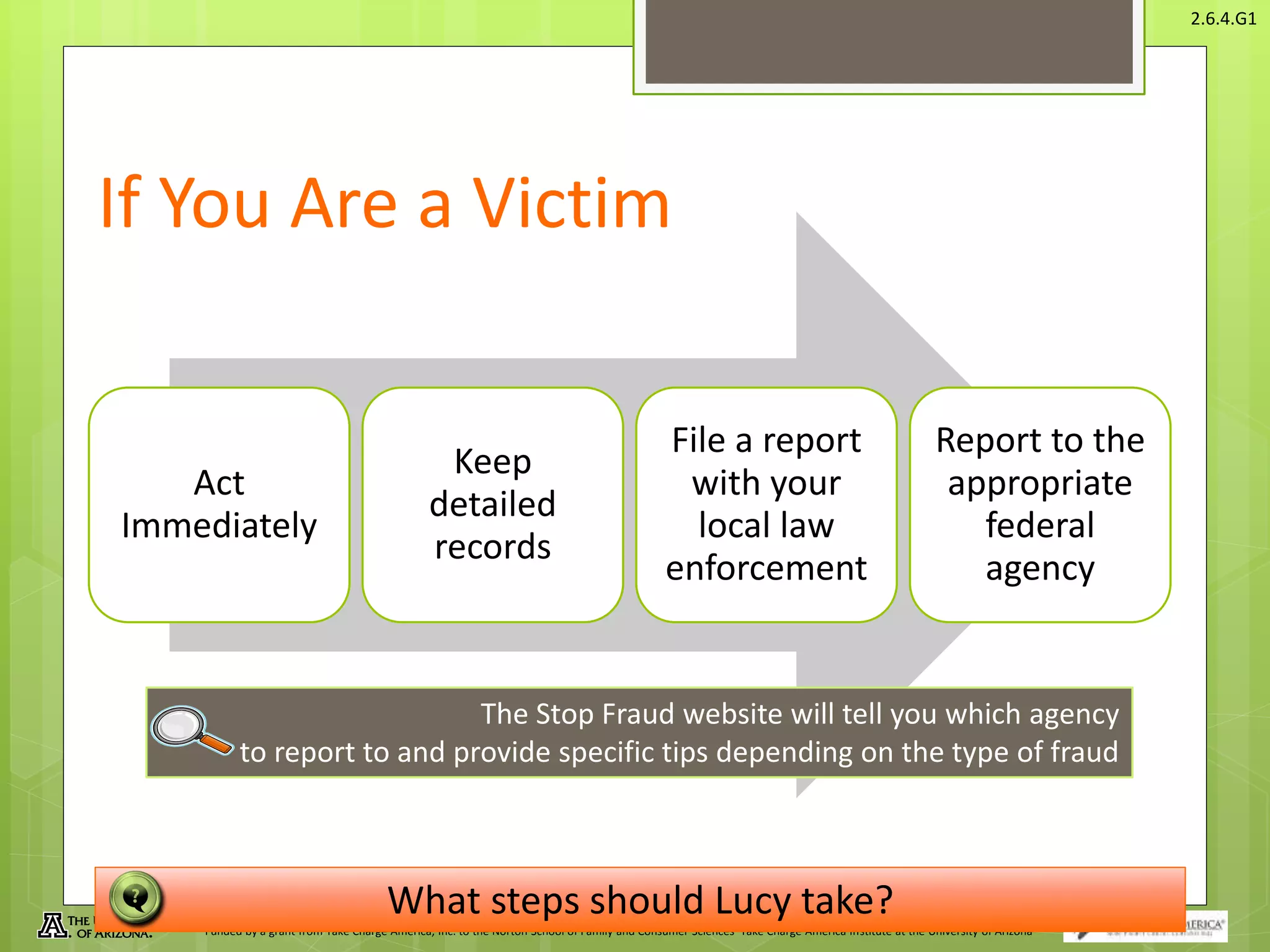

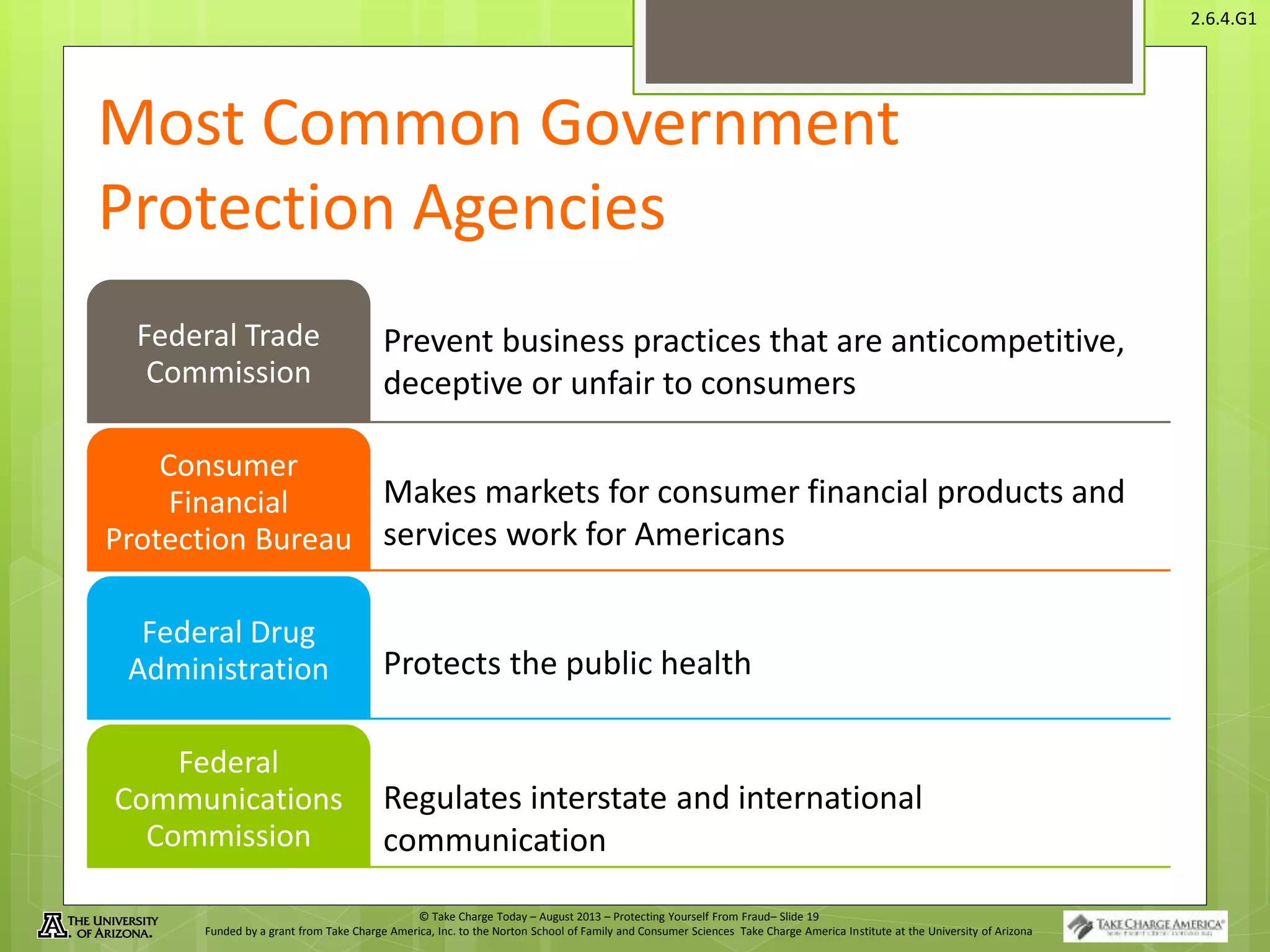

The document discusses fraud and identity theft. It defines fraud as intentional deception for personal gain. Identity theft is when someone uses another person's personal information without permission. Common types of fraud include identity theft, communications fraud, credit fraud, investment fraud, and tax fraud. If a person becomes a victim of fraud, they should act immediately by filing a police report, reporting it to the relevant government agency, and keeping detailed records. The document provides tips for protecting personal information and recognizing fraud.