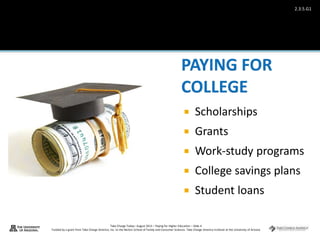

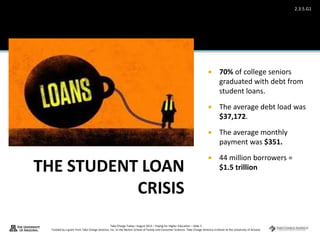

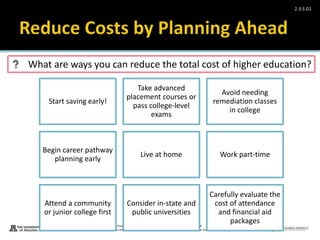

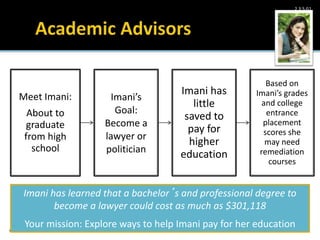

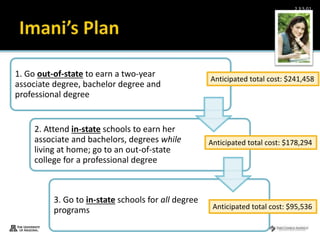

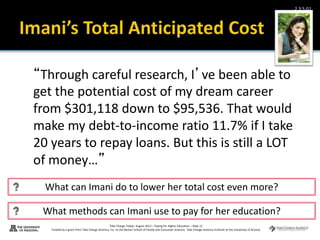

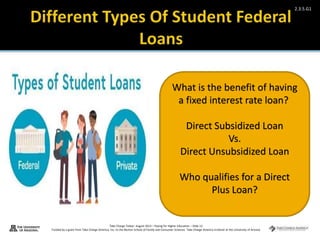

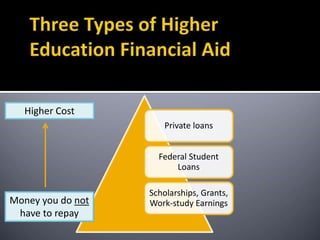

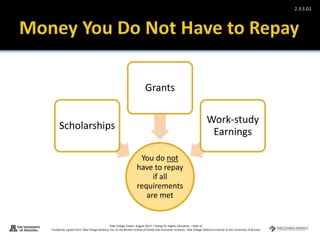

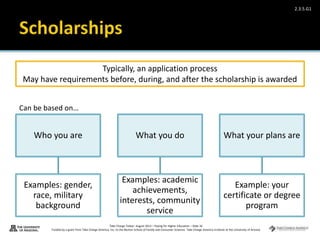

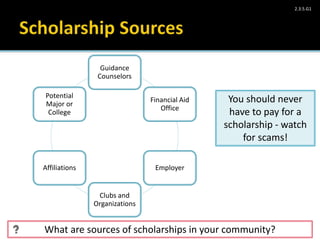

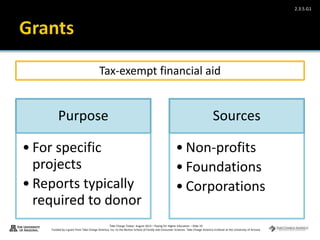

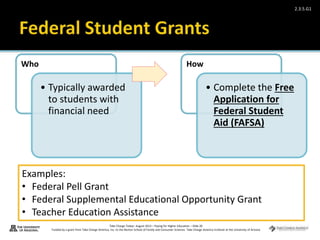

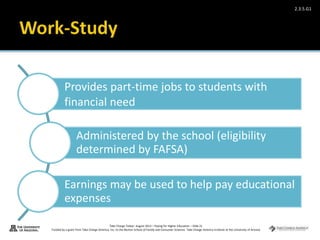

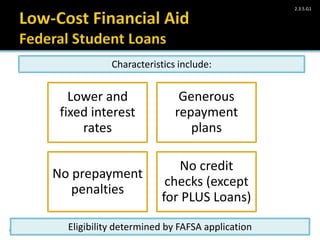

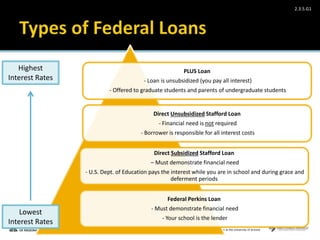

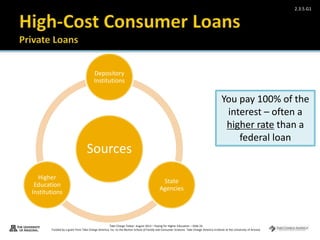

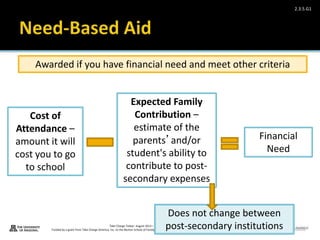

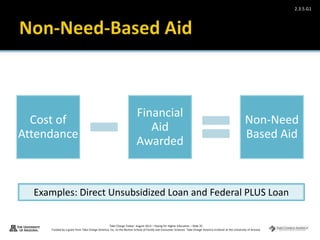

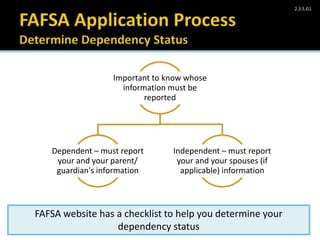

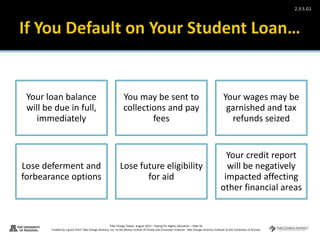

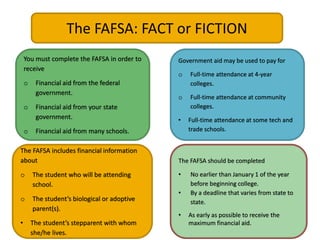

The document discusses various options for paying for higher education, including scholarships, grants, work-study programs, and student loans. It notes that 70% of college seniors graduate with debt averaging $37,172. It also provides tips for reducing costs such as starting at a community college, living at home, and considering in-state public schools. The document uses a case study of a student named Imani to illustrate ways to minimize costs such as pursuing in-state programs and applying for scholarships.