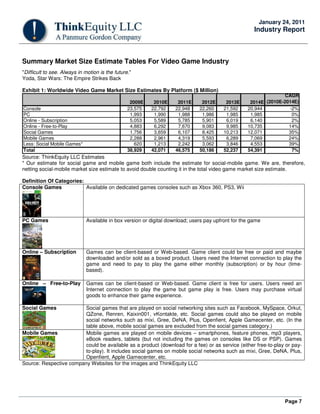

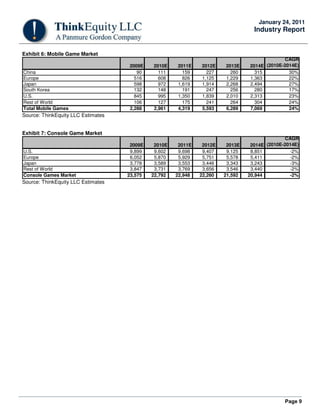

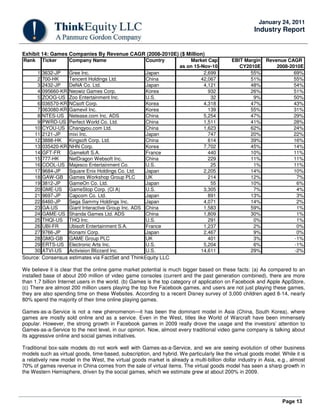

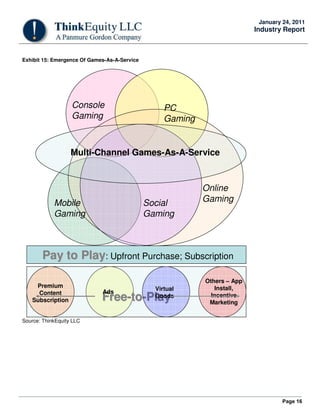

This report summarizes the analyst's thesis on the emergence of multi-channel games-as-a-service and ubiquitous games accessed through cloud computing. Some key points:

- The report estimates the worldwide video game market will grow at a 7% CAGR to $54 billion by 2014, with shifting platform shares away from consoles towards online and mobile games.

- Emerging business models like free-to-play, virtual goods, subscriptions, and hybrid models are expected to complement the shift from games as products to games as services. Virtual goods revenues are projected to reach $20 billion by 2014.

- Social and mobile games are forecasted to be the fastest growing segments, at 35% and

![Page 35

January 24, 2011

Industry Report

Why Are We Excited About Social Games

“With over 50 foreign cars already on sale here, the Japanese auto industry isn't likely to carve out a big slice of the U.S.

market.”

Business Week, August 2, 1968.

“For the first time ever, we're letting them [users] engage in games with their real friends in their real social networks.

Gaming is a fundamentally social experience, not a single-player experience, and not a technology experience. We are

bringing gaming back to its roots.”

Mark Pincus, Founder & CEO, Zynga

“Today, audiences want to be connected. They expect games to have a strong social component and they want the ability

to customize and express themselves through their entertainment experiences.”

Bobby Kotick, CEO, Activision-Blizzard

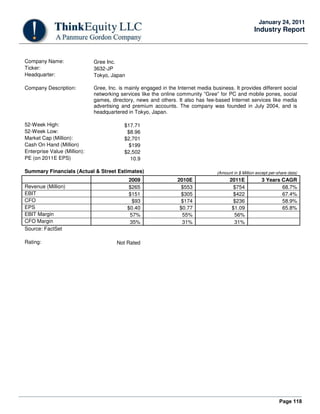

Broadening Market To Include Non-Gamers

“Target customer is anybody who lives inside the social networks….Facebook has users from 13 to 80 years old and it

has equal distribution between men and women…In our markets we have 300-plus million people on Facebook

alone….While hardcore gamers, like a World of Warcraft have limited reach, games like a Maple Story or a Mobsters 2 or

a Sorority Life game reach much broader demographics.”

John Pleasants, CEO, Playdom

We believe that similar to the Nintendo Wii, which broadened the console game audience to families from mostly males,

social games further broaden the game market to include non-gamers. Today’s generation is connected on social

networks. According to comScore, more than two-thirds of Internet users are also on social networks, and the number is

still growing. The popularity of social networking sites is not just limited to the Y generation, more and more people 35

years of age and older are joining these social networks. The latest statistics regarding Facebook users show that the

number of users in the 35-54 years of age population has increased 10x versus 88% growth for the 18-34 years of age

group since October 2007. Not only are more people joining these social networks, but they are also spending more time

on these social networks. According to Hitwise, the average user is now spending approximately 27 minutes/day, up 71%

Y/Y. We believe the reach and the demographic of users on these sites make social networks fertile ground for game

vendors to acquire users, build awareness, and create buzz through viral marketing.

Viral Marketing

“Over 95% of our growth is viral. In fact, when we launched our first title a year ago, we started by inviting 100 of our own

friends and we've grown from there to over 60 million registered players across our games organically.”

Kristian Segerstrale, CEO, Playfish

For online game vendors, social networks offer an inexpensive way of marketing their games to new users and improve

stickiness through viral distribution. We believe that social networking sites level the playing field for small developers to

compete with large companies like Electronic Arts (recall the success of Scrabulous, developed by two brothers in remote

corners in India, which became a rage on Facebook through viral marketing).

For social networking sites, games provide an easier way to monetize their users, in our view.

Despite significant size, strong community, and solid ecommerce platforms, most social networks have struggled with

monetizing their users. With ARPU hovering in the $0.10-0.25/month range for most social networks versus as high as

$150/month for some online games, social networks do look under-monetized. Most social networks rely largely on

banner and text ads for user monetization, but, given low conversion rates (less than one-tenth of a percent), display ad

rates for most social networks hover at about $0.10-0.25 cost per thousand (CPM) versus as high as $35 for video ads

and $8 for display ads for in-game advertising. We believe that online games provide a natural way for social networks to

monetize users through in-game advertising and, more importantly, through virtual goods sales.](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-35-320.jpg)

![Page 52

January 24, 2011

Industry Report

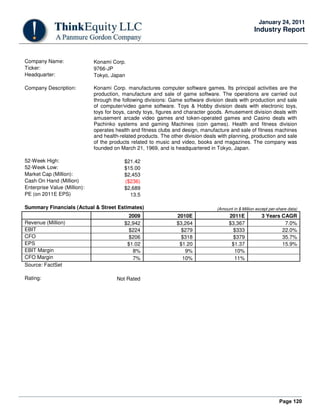

Exhibit 50: Sample Of The Immersive 3D Experience With Online Games

Source: Company Websites (clockwise from top left): World of Warcraft by Blizzard, Star Wars: The Old Republic by

Electronic Arts, League of Legends by Riot Games, and Uberstrike by Cmune

Reduced Cost Of Ownership For Consumers

If you are like most gamers, you will want to play at least 20-30 different games per year, you will want to own all the

major consoles, and you will need to buy a new generation console every three to four years to play these games in their

full glories. That works out to an annual spend of about $2,000-2,500 per user on games, which might be out of budget for

many gamers. Even more importantly, although the marginal entertainment value of every next game for a user is

arguably lower than that of the previous game that he/she owned, the marginal cost remains the same. And, as a result,

most gamers end up buying about four to five titles (about $250-300) per year. Since Games-as–a-Service enables

players to pay as they go, a player doesn’t have to buy all 30 games (that she wants to play) at $60 apiece. Rather, the

user can play all the games only as much as he/she wants to play and pays only for as much as he/she plays. Game

companies should benefit as many players, for whom a marginal $60 investment for the 10

th

game didn’t make sense, will

now be willing to open their wallets for not only the 10

th

best game but also for 11

th

, 12

th

, and all the games that they would

not have bought.

Avoid Buyer’s Remorse

“For the premium [subscription] offer, they [subscribers] play ten different games a month; for the basic offer, they try or

play four to five games a month. … They try them, and concentrate on those they really like, which is the interest of this

service. Our customers don't have the stress to choose one game among the others in the shelves, which is a bet,

because every gamer has made several times the wrong choice. A game is very personal; the packaging does not tell you

what is really inside the box, and the game reviews, and friends' recommendations, only limit the risk to make the wrong

choice.”

Thibaut de Robien, Cofounder of Metaboli

And then there is always the case of buyer’s remorse, players getting stuck after buying a game because the game was

not really their type. The problem is exacerbated for kids’ games, as these players arguably have a lower attention span.

With Games-as-a-Service, players are paying only for their playtime and, therefore, avoid buyer’s remorse. Not only that,](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-52-320.jpg)

![Page 53

January 24, 2011

Industry Report

Games-as-a-Service enables the vendors to offer “Try and Buy”—the idea is to offer a free trial for a limited time, and if

the player likes the game, he or she can either buy unlimited play or enroll in some other form of game subscription. By

offering a free trial, the vendor can cast a wider net and players who otherwise may not have bought the game, may now

try the game and eventually convert to become paying customers. Furthermore, since the players have already tried the

game before making a monetary commitment, the buyer’s remorse is limited, resulting in fewer returns and fewer

customer service calls.

Improved Efficiency With Digital Distribution

“There's a shift and a disruption going on in the games industry that had for so long relied on producing very expensive,

high budget games, and when these big budget games fail, developers go out of business. The times are changing. Now

solo game developer and hobbyists can develop a game in their spare time and find an audience through sites like

Miniclip and they don't have to get involved in this very complex, hierarchy of distributors and publishers.”

Robert Small, Founder & CEO, Miniclip.com

In the traditional packaged game distribution channel, since the shelf space is limited, retailers are willing to assign the

premium shelf space only to the super-hyped, highly anticipated, AAA games. As a result, most of the smaller or second-

tier titles are either left out for non-premium shelf space where they have limited visibility from walk-in customers or, even

worse, these titles may not get any distribution deals. This creates a Catch-22 situation for smaller titles—since they don’t

have the fire power of a AAA title, they cannot get the premium shelf to get the players’ attention, and since they don’t

have the players’ attention, they have even less chance to succeed. Not only that, larger video game companies mostly

focus on AAA titles that may appeal to broader mass markets, ignoring the needs for smaller niche markets, which creates

inefficiency in the market.

Digital distribution by definition breaks the barrier of limited shelf space, which makes the distribution to niche markets

financially viable. With digital distribution, vendors can publish titles focused on the smallest of the niche and use guerrilla

marketing or viral marketing to reach the desired segment efficiently. Digital distribution may also help expand margin for

vendors—as vendors save on the cost of medium, packaging, and slotting expenses.

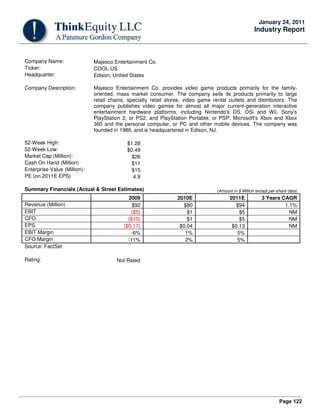

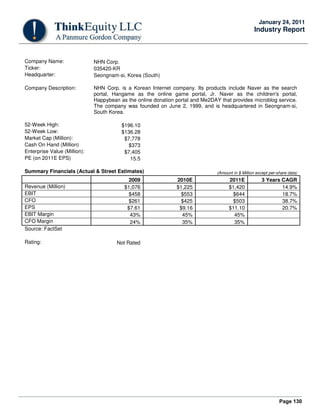

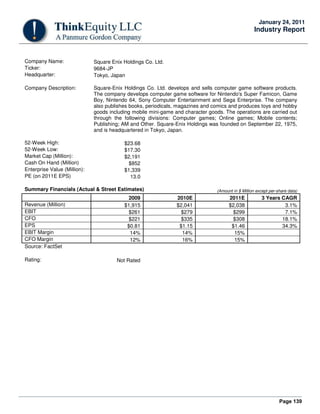

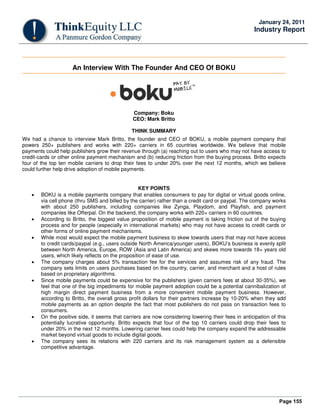

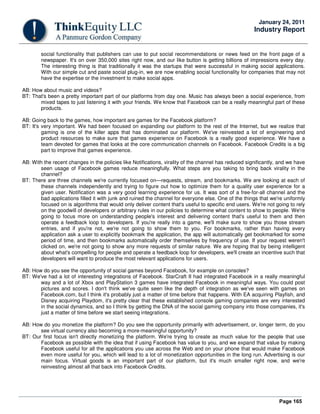

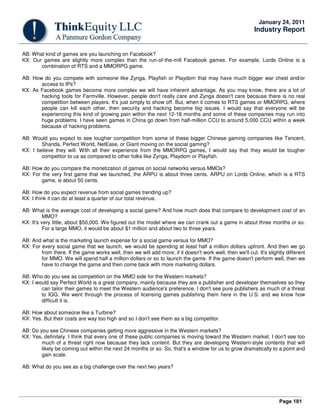

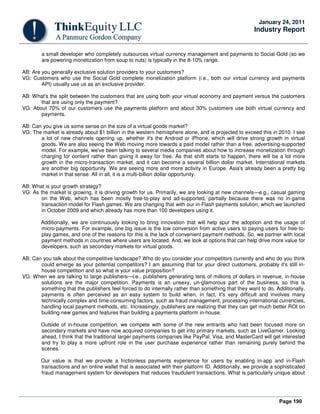

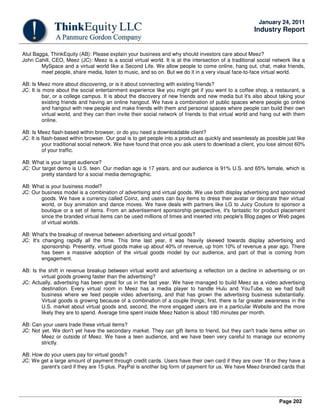

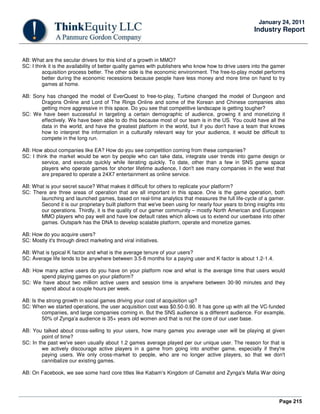

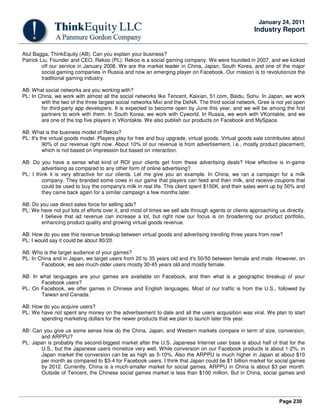

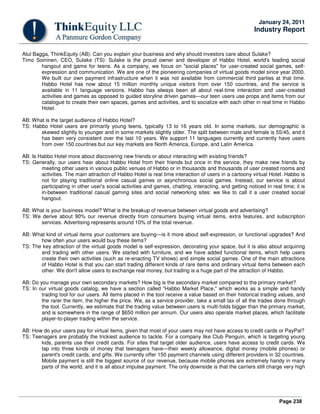

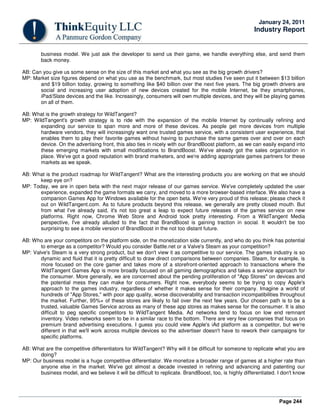

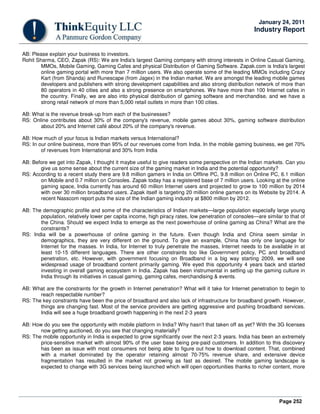

Exhibit 51: Digital Distribution Enables Reaching Out Long Tail

Rhapsody

Wal-Mart

Amazon.com

Barnes & Noble

Netflix

Blockbuster

Source: The Long Tail by Chris Anderson

Ability To Respond To Changing Consumer Demands

“It [online game] is more similar to a Web 2.0 business model than a pure video gaming business. The traditional video

gaming business companies are in a retail business where you ship games and then it's a one-off sale until there is a next

expansion or sequel. … We have a large number of experienced, dedicated, full-time employees whose job is to interact

with our gamers and generate revenues. We get gamers' feedback, their needs and wants and desires, and we funnel that

information directly toward our developer and then we update the game on a regular basis.”

Joshua Hong, CEO, K2 Networks

Video game is largely a hit-driven business, and predicting a hit or miss before a game launch is not an accurate

science—it is more of a guessing game. In the traditional video game business model, after a game is launched, there is

little that the video game vendors can do to fix issues with the game or make changes based on the users’ response.

735,000 Songs

2.3 mil Books

25,000 DVDs

39,000 Songs

130,000 Books

3000 DVDs](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-53-320.jpg)

![Page 60

January 24, 2011

Industry Report

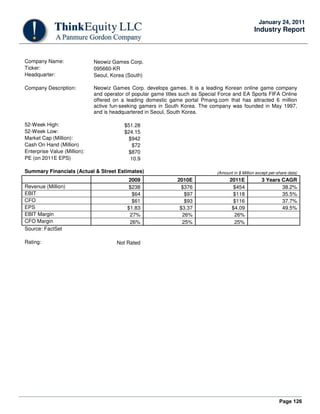

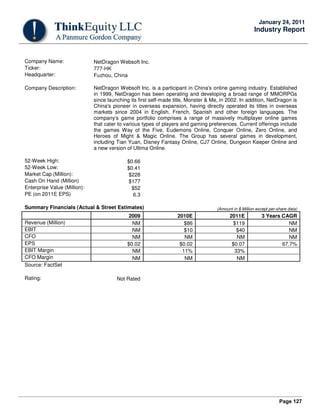

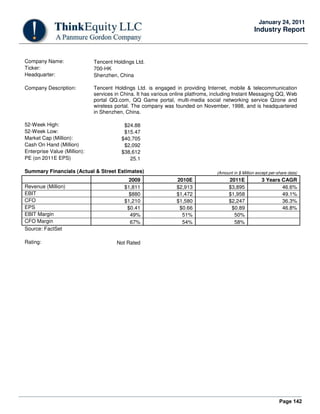

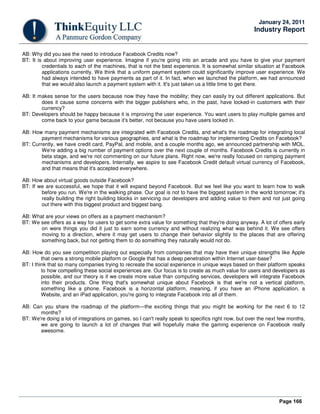

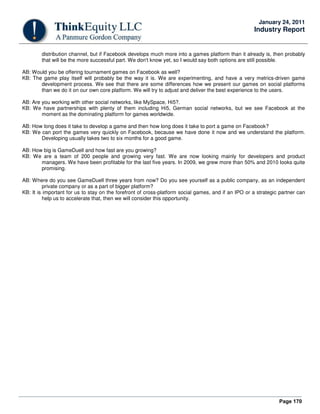

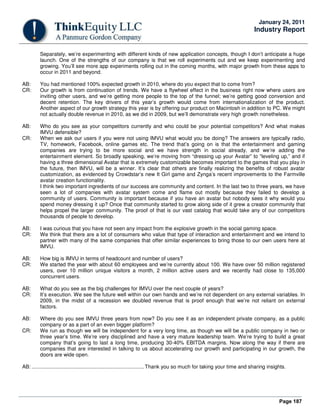

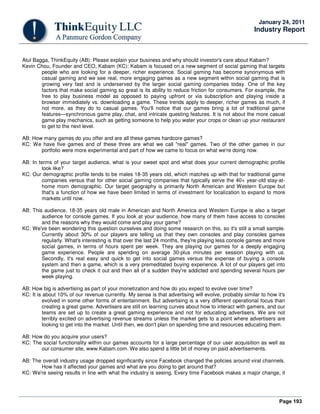

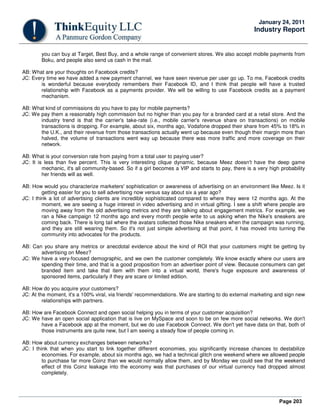

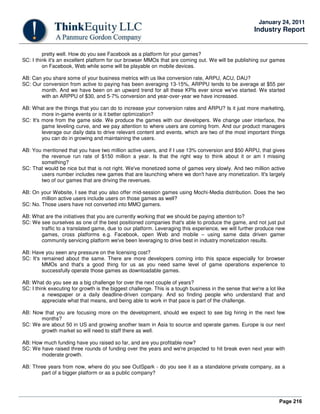

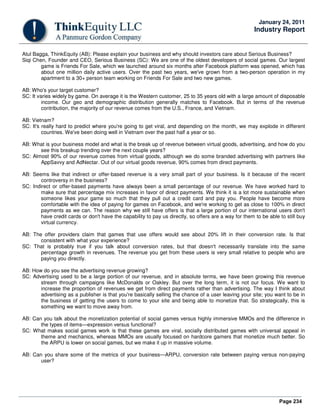

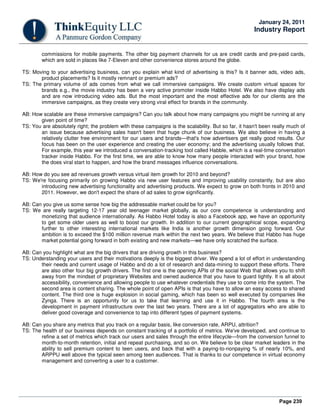

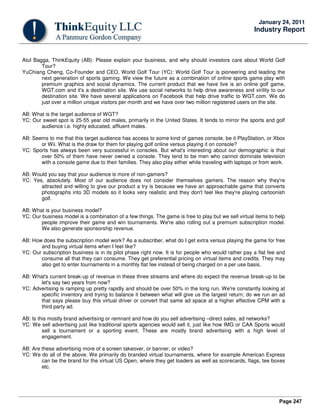

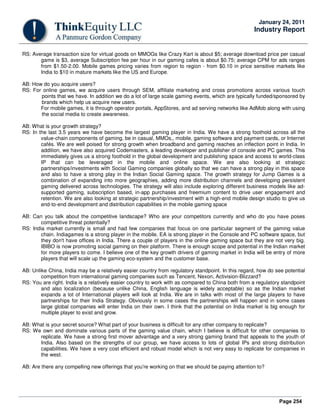

Exhibit 60: Broadband Speedometer

Broadband Speedometer – Maximum Download Speeds

Wireline 2.5 G Wireless 3G Wireless 4G Wireless

Cable

Modem

768kbps

30Mbps

56kbps

144kbps

144kbps

384kbps

2Mbps

3Mbps

3.6Mbps

2Mbps

Dial-Up

ADSL

IXRTT

GPRS

EDGE

EVDO UMTS /

WCDMA

HSDPAEVDO

Rev. A

WiMAX

20Mbps

FiOS

30Mbps

3Mbps

1.5Mbps

ADSL

ADSL

15Mbps

5Mbps

FiOS

FiOS

NottoScale

Source: CTIA Website

Easy To Use And Consumer-Friendly eStores For Games

We believe that improving the user experience of buying and installing mobile games will drive the adoption of mobile

games. Historically, most people played only those games that came pre-installed with the mobile phone, given that the

process of installing games on the phone has been pretty complex. Apple changed that with the launch of AppStore,

which made the process of browsing, searching, downloading, and installing games very easy and user-friendly. The

popularity of the AppStore can be gauged by the fact that since it opened in July 2008, there have already been almost 10

billion applications downloaded (according to Apple) on 120 million iPhone and iPod Touch, i.e., about 83 apps/iPhone.

Lucrative Business Model For Wireless Operators And Platform Vendors

In our view, video game provides an attractive revenue stream for mobile operators in the form of accompanying sale of

data plans and also revenue share with game developers. Although the revenue from video game remains pretty small

compared to the overall mobile business, it could start to look as an attractive way to grow a company’s ARPU as it

struggles with falling prices and slowing growth. We believe that, not only is the opportunity lucrative for carriers, but that it

makes a lot of sense for video game vendors, as the incremental cost of porting existing games on a new platform is

minimal and, therefore, incremental profit margins substantial. According to an article in The Wall Street Journal, Simon

Jeffery, the U.S. president of Sega said he believes that [despite 30% revenue share with Apple] "games sold via the

AppStore are the most profitable in terms of any of the formats.”

Emerging Standardized Platforms For Games

Historically, non-standardized phones, varied carriers specifications, and multiple operating systems meant that the

mobile game companies had to port their games on a number of platforms and support hundreds, if not thousands, of

SKUs, which involved significant upfront costs and maintenance costs and stifled innovation. With the emergence of the

iPhone (although a proprietary platform, given the high reach of iPhone, it eliminates the need to support multiple

platforms to achieve similar penetration), Google Android, and Nokia Ngage, the mobile game market, in our opinion, will

concentrate on a few standardized platforms, which should make the job of maintaining and supporting versions of mobile

games easier for developers and encourage innovation.](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-60-320.jpg)

![Page 73

January 24, 2011

Industry Report

Emerging Themes In Console Game Market

"Decide you must how to serve them best. If you leave now, help them you could. But you would destroy all for which they

have fought and suffered."

Yoda, Starwars: The Empire Strikes Back

Expect Market To Continue To Shrink

We estimate that the console game market could shrink moderately over the next few years. We believe that consumers

who grew up on console games may remain loyal to console games. We would expect to see a tectonic shift in games

purchasing habits over the next 5-10 years as the next generation of gamers (users who are growing up in connected

environments like Facebook and Twitter and who have already been trained in the free-to-play environment) becomes the

core consumer of games software in the next 5-10 years. Over the next five years, we estimate that the console game

market will shrink at a 2% CAGR for three reasons:

1) Publishers Trying To Monetize Online Gameplay On Consoles

As the market continues to evolve and favor larger titles, and as consumers continue to extend their value from the

purchases, we believe that companies will seek to increase their value through alternative revenues from console games

to improve return and investment to justify the enhanced risk profile of the top titles. We expect companies to add

subscription and micro-transaction models on top of the box purchase model for ancillary revenue streams.

2) Next-Generation Consoles From New Players

While we expect a very small likelihood of a next-generation console from either Microsoft and/or Sony (we wouldn’t be

surprised to see an HD version of Nintendo Wii sometime in 2011/12), we believe that companies like Apple and Google

may want to stake claims in this space. With the advances in the set-up boxes and with GPU pricing going down and with

the Internet pipeline getting broader (i.e., average download speed going up), we believe that the next-generation set-top

box could also double up as a game console. We believe that publishers may be excited about a next-generation open

source game console given our view of broader distribution and lower royalty.

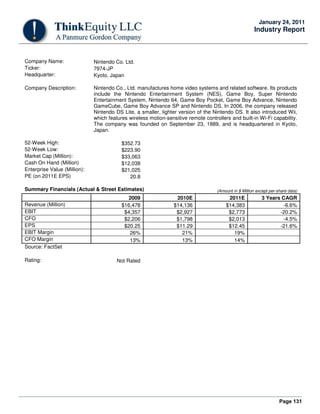

Exhibit 77: New Games Consoles?

Google.com/TV, Apple TV, Logitech Revue, OnLive

3) Traditional Video Game Companies Extending Brands From GaaP To GaaS

“We have transferred many elements of Blizzard's expertise to our approach to Call of Duty, which now joins the very

short list of entertainment properties that have successfully bridged traditional and emerging models.”

Bobby Kotick, CEO, Activision-Blizzard

“What we've been doing is bringing our titles down in terms of the number, and broadening it…short and fat is the new tall

and thin. Meaning a shorter list but more broadly exploited across properties [platforms]”.

John Riccitiello, CEO, Electronic Arts

Given significantly higher growth, higher margins, better predictability, and lower risks associated with it, coupled with

declining sales of the Games-as-a-Product business, the Games-as-a-Service segment has become much more lucrative

to traditional packaged software publishers. We believe there could be a meaningful opportunity for traditional video game

companies to monetize their strong licenses and/or owned IPs on these new platforms. On the other hand, we believe that

GaaS requires a completely different mindset—as a service, games have to be operational 24x7 and be able to withstand](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-73-320.jpg)

![Page 156

January 24, 2011

Industry Report

Atul Bagga, ThinkEquity (AB): Please explain your business and why should investors care about BOKU?

Mark Britto, Founder and CEO, BOKU (MB): BOKU is the leading mobile payments company. We enable consumers in

more than 60 countries around the world to make a purchase, typically of digital or virtual goods. Instead of using

a credit card, the consumer gives us his or her cell phone number and at the end of the month, the purchase of

that item shows up on his or her cell phone bill. We incorporated the business in January of 2009. Since then

we've acquired a couple businesses that pre-date our January 2009 company formation. We have some of the

best VCs in the world invested in BOKU, including Andreessen Horowitz, Benchmark Capital, DAG Ventures,

Index Capital and Khosla Ventures. What PayPal did for the email address, BOKU wants to do for the mobile

phone number.

AB: What is the value proposition for payment by mobile? Is it mostly for the users who do not have access to credit

cards such as minors or international?

MB: The biggest value proposition is that we take friction out of the buying process. Everyone knows their cell phone

number but not everyone knows their credit card number. When you're completing a credit card purchase you've

got to get up from your computer, get your wallet, find your credit card, type in 16 digits, give the security code,

the expiration date, your billing address. On the other hand, since you know your cell phone number, a

transaction can be completed much quicker and with fewer keystrokes. That is one piece of it. The other is that a

consumer can complete a transaction without giving personal financial information over the Web, which is a very

compelling feature for people who are security conscious. Finally, in many of our international markets, many

consumers either don't have a credit card or if they have a credit card, the publisher doesn't accept credit cards.

So the only way that the consumer can transact with that publisher is using a payment system like ours.

AB: How do you define your target audience?

MB: Our target audience is typically consumers who are buying virtual or digital goods in online games. Last year, the

virtual currency was roughly an $8 billion market, growing at 50-75% annually. We work on games from

companies like Zynga, Playdom and Playfish and payment companies like Offerpal. We're currently working with

about 250 publishers and processing millions of transactions a month.

AB: What about Facebook? Are you doing anything with them?

MB: Many discussions are taking place, but there’s nothing to announce at this time.

AB: What is the break-up of revenue geographically?

MB: U.S. and North America represents roughly one-third of our volume, roughly one-third from Europe, and then one-

third from Asia and Latin America.

AB: What is age distribution of your users in the U.S.?

MB: It's across the board and it skews significantly to over 18. Our user demographic is relatively consistent with the

age demographic of games like Farmville, Mafia Wars.

AB: Can you explain how do you work with telecom carriers, publishing partner, and ultimately consumers?

MB: We connect into 200+ carriers in 60+ countries. When a consumer from that country wants to make a purchase,

he gives us his cell phone number, we send a SMS message to the consumer asking him to authorize the

transaction. When we receive authorization, we fund the transaction and send a message to the carrier telling the

carrier to bill the consumer for transaction amount at the end of the month.

AB: Who takes the risk of any fraud? Is this BOKU or the telecom carrier?

MB: It is BOKU. We are very focused on risk management, fraud management, on behalf of our publishing partners.

We look at the history of a consumer across games. We look at how much they spend, where they spend it, when

they spend it. We’ve created a risk service that at the time of transaction executes a host of rules based on our

algorithms and limits we’ve set at the country, carrier, and merchant.

AB: Typically, what kind of transaction service fee [would] a mobile carrier charge, what kind of fees [would] you

charge, and how does that compare with that for a credit card or PayPal transaction fee?](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-156-320.jpg)

![Page 158

January 24, 2011

Industry Report

AB: Who do you see [as] your competitors currently and potentially?

MB: We don’t worry about our competitors. We worry about building a world-class product and a great customer

experience, always knowing that if we do that, the competitive landscape would take care of itself.

AB: What is your secret sauce or what will make it difficult for someone to replicate what BOKU is doing?

MB: There are a couple of things. One is that we've got great experience and data that is specific to this environment

and replicating that is not possible without operating in this environment. Two, we have built connections into 200

carriers throughout the world. And that's difficult to do and complicated to architect, and I think replicating that will

be will be expensive. Finally, I think that the risk management systems that we build as a result of our domain

expertise give us a competitive advantage relative to someone that is trying to get into this business.

AB: When you look out next three years from now, what do you see as the big challenges for BOKU?

MB: I think our challenge is the same as our opportunity. And that is to convince the carriers that it's in their best

interest to work more closely with us to promote the service and make it a more mainstream option. We spend a

lot of time focusing on that and to the extent that we're successful that will represent the opportunity for the

company as well.

AB: Can you give us some sense of how big BOKU is right now and how fast you might be growing?

MB: We're processing millions of transactions a month. On average we process about one transaction every second.

We're 60 people, based in San Francisco, an office in London and a small sales presence in Asia.

AB: Where do you see BOKU three years from now? Do you see yourself as an independent company, or as a part of

a bigger platform?

MB: It is unclear to me and definitely not something that we spend time thinking about. Our view on this is that if we

build a great product, build a great customer experience, that the rest will take care of itself.

AB: Thank you for speaking with us, Mark.](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-158-320.jpg)

![Page 164

January 24, 2011

Industry Report

Atul Bagga, ThinkEquity (AB): Over the last couple years, while Facebook has grown from 150 million to 500 million users,

during the same time, a few other social networks have seen a big decline. What do you attribute Facebook's success to?

What have you done different that your competitors missed?

Bret Taylor, CTO, Facebook (BT): I think the primary thing is that we were exclusively focused [on the] user experience.

We want to create a product that's not just trendy or fun but also just extremely useful for people. And that

manifests itself in a number of attributes that makes Facebook different from other social networks; the most

important is that we're focused on real identity and because of that, Facebook has become a valuable utility for

people. I think that a combination of making it an extremely useful service that people use every day in addition to

fun social destination where people can play games, shares photos and videos, has been the main distinguishing

factor of Facebook.

AB: Facebook population is now almost 30% of the total Internet population. Where do you expect the growth to come

from over the next couple years?

BT: We're very focused on growing our user base. Internally, we say that the most important feature that we can add is

the one that gets your friend on Facebook because when you put people who are meaningful to you in your real

life on Facebook, it makes Facebook even more valuable service for you. Having said that, our product strategy is

focused on our platform. We view social graph as the core of our service and communications channels as

features on top of that platform. We are focused on expanding our platform from Facebook.com to the entire Web

and launch social functionality in the form of social plug-ins. We think that any given service has the potential to

be disrupted by the presence of deeply integrated social functionality.

AB: In terms of your expectations from growth, is it more about growing the user base or more about expanding your

reach through the social plug-in?

BT: We would like to do both. To some degree, Facebook.com is the killer app for the social graph that makes people

want to sign up for the service and makes them actively use Facebook every day. The core value of

Facebook.com is our platform, which is also valuable to third-party developers. I think, over time, the third-party

applications would become a very meaningful part of people's Facebook experience but you really can't have one

without the other. They're closely connected.

AB: How do you see Places expanding the reach of Facebook.com?

BT: It's very early. Right now, we're focused on creating a great user experience around people checking in, finding out

where their friends are, and we have integrated it into our platform really deeply on day one. I think location is a

really meaningful part of our platform and will continue to grow particularly as mobile devices continue to grow as

a predominant platform for people to interact with social networks.

AB: What is your expectation around penetration of Facebook within the Internet users?

BT: I think it's useful to everybody. Facebook is an efficient way for connecting and sharing with others; and those are

fundamental human needs. Likewise, our platform helps cater to particular interests whether it's a game or

charities through applications. A good example is the disruption in video games space.

AB: Facebook has already gained a lot of ground with mobile apps. How meaningful is the mobile for Facebook currently

and, over a longer term, how do you see mobile opportunity evolve as compared to the PC opportunity?

BT: The phone is already a very social device, and I'm very excited about integrating the Facebook platform on the

phones. I think that there is a huge value in integrating the social channels, serendipity, and discovery with the

Facebook platform, and the value is even more for mobile applications than that for Web applications. We're

focused not only in making the Facebook experience really good on the phones but enabling phone developers to

integrate Facebook into their own applications.

AB: Outside of games, what other verticals do you see where Facebook has potential to create a similar disruption that we

saw in games?

BT: That's something we talk a lot about internally. One of the areas that we are focusing on right now is media and news.

Currently, the front page of a newspaper represents the editorial voice of the newspaper, but there are a lot more

articles than can fit on that front page, and everyone's interest are very diverse and people will like to see the

story of their interest promoted to the front page. In April, we launched social plug-ins, which is cut-and-paste](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-164-320.jpg)

![Page 184

January 24, 2011

Industry Report

Atul Bagga, ThinkEquity (AB): ...............Please explain your business and why should investors care about IMVU?

Cary Rosenzweig, CEO, IMVU (CR):IMVU is a social entertainment network where members use three-dimensional

avatars to dress up, chat, create and play games with their friends. Investors should keep an eye on IMVU,

because we’re one of the fastest growing businesses in the social entertainment space.

AB: Is IMVU more about discovery or is it more about meeting with existing friends in an online environment?

CR: Currently people come to IMVU for multiple reasons, but primarily they come to make new friends. Although

increasingly we’re finding that people are bringing their existing friends, and we believe over time that will become

a more important aspect.

AB: What are the things that people can do at IMVU?

CR: IMVU is a virtual world where people can create an avatar, dress up the avatar, and chat with their friends. They

often create their own games by role playing, by sharing their interests with each other. Music is also a very

important aspect to our users of IMVU. In fact, we’re the only social entertainment network that sells music to our

own users. Shopping for all kinds of virtual goods, in general, is very popular and it drives a significant part of user

engagement for IMVU members.

AB: How do you position IMVU between a virtual world such as Second Life and an instant messenger such as QQ?

CR: We’re no longer a virtual world; rather, we’re a social entertainment network, focusing on casual games and the

social network, enhanced by 3D avatars. At the very beginning we positioned it essentially as instant messaging.

However, we quickly learned that users wanted IMVU to be more than that. For everyday instant messaging there

is no need for an avatar, because people want [a] very rapid way to communicate. The presence of the avatar

creates a completely new and even emotional aspect to communicating between people. The avatar becomes

your alter ego online and becomes a wonderful way for to present yourself in the way that you like to present

yourself to other people, which make it ideal for making new friends, for meeting new people who share your

interests.

AB: What is the target audience of IMVU?

CR: About 40% of our users currently are between 13-17 years and 60% over the age of 18 years. The average age is

22 years. About 70% of the users are female.

AB: What about geographic break-up of users?

CR: About 60% of the active and paying customers are in the United States. 40% users come from English-speaking

countries, U.K., Canada, Australia, and also Western Europe. We have a lot of users from Spain, Germany,

France, and they communicate with each other in their native language. At the moment, we offer IMVU only in the

English language, and one of our initiatives in the fourth quarter of 2010 is to offer IMVU in many languages and

we expect the majority of active and paying customers to be non-U.S.

AB: What is your business model?

CR: Our business model is free-to-play. A vast majority of our users use IMVU for free and a small percentage pay

money. About 85% of our revenue comes directly from consumers buying IMVU credits that they can use to buy

virtual goods. Key to our business model is that the virtual goods that users buy are created by other users. We

have an extremely effective user generate content (UGC), system that has resulted in IMVU offering our users the

world’s largest catalog of virtual goods; well over three million items. The remaining 15% revenue comes from

advertising, which is comprised of two elements. One is the offers category i.e. people taking surveys, advertisers’

offers; that is about 10% of revenue. 5% of the revenue comes from traditional form of advertising, including

banner ads and video ads.

AB: I saw that some of your deals with marketers like Charlotte Russe, Nike. Can you talk about your vision on

sponsored virtual goods?

CR: We’ve been experimenting with presenting real world brands to our users. So far, we have structured the deal

where our users pay for these branded goods and we split revenue with advertisers. We believe that there is

probably a larger benefit for the brand if this is structured as advertising so that we could reach to almost all of our](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-184-320.jpg)

![Page 191

January 24, 2011

Industry Report

Social Gold, is that it was natively designed for gaming platforms, ensuring a lightweight API that is easy and fast

to integrate into online applications. In the end, developers can easily and quickly launch their own white-labeled

virtual currency and a direct payments solution for their online applications that is secure and scalable.

AB: How do you compete with someone like PayPal, or even PlaySpan that has a big network of retail credit card

distribution?

VG: We partner with PayPal rather than compete with them. We present payment method options to a developer that

includes PayPal. Publishers typically pay us a little bit higher fees by working directly with us versus working

directly with those payment methods. Additionally, they look at the convenience and benefits of a single payments

platform and the potential lift that they can generate by working with us. We consistently see that our platform

results in 30-40% lift versus if the publisher had been working directly with each and every local payment method.

In terms of competition with PlaySpan, we're not focused on having a retail card presence because we believe

that gamers want to buy a cash card that belongs to the game itself and have a direct experience with the brand,

rather than buying a third party card. So, we're focused on helping game developers to bring their game card

within the game through our platform, solidify the branding experience, and make it more seamless for users.

AB: What drives this 30-40% lift that you highlighted—is it the improved experience or analytics?

VG: Usually, it's a combination of using all the tools in the Social Gold suite, but people who use only our payments

solution also see that kind of a lift. We focus heavily on creating a user experience that keeps users engaged

within a game that in turn creates an extremely seamless and frictionless repeat user purchase experience, which

results in a higher ARPU than the publishers would be seeing otherwise.

AB: Do you offer solutions for mobile channels?

VG: Currently, we don't offer solutions for mobile channels, but we're looking at notable platforms that are now opening

up, such as Android. We're not looking into development for the iPhone at this time because Apple has

implemented tight controls around it—it's basically a closed system, where payments are processed only through

iTunes. For open platforms, such as Android, Social Gold would be an ideal solution for micro-payments because

we could bring the same kind of repeat user purchase experience as we would do on the Web.

AB: When you look out [a] few years from now, what do you think are the big challenges for Jambool?

VG: I think the big challenge for us is continuing to innovate in [the] online payments and virtual goods space and grow

market share because I don't believe it's a sprint, I think it's a marathon. In the short term, we have to continue to

differentiate ourselves from others in a relatively crowded space. Another challenge is to tap into international

markets, whether it is through reaching publishers or end-users.

AB: Can you give us some sense as to how big Jambool is and how fast you might be growing?

VG: I expect the market to grow to a multi-billion dollar market in a few years, and we expect Social Gold to grab 30-40%

market share. Currently, we process several million dollars in payments every month and, as we expand our

business to new channels and continents, we project these payments to increase rapidly. Additionally, we have

about 25 employees across offices in San Francisco, Seattle, and Singapore, and we're continuing to grow.

AB: Where do you see Social Gold/Jambool three years from now? Do you see yourself as a standalone company, as a

part of a bigger platform, or a public company?

VG: Neither of those options—standalone or public company—are out of the question. It depends on how the market

shapes up, how well we are able to capitalize on the growth in the market. I believe we are on target to build a

very successful independent company in this space.

AB: Thank you so much for speaking with us.](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-191-320.jpg)

![Page 198

January 24, 2011

Industry Report

AB: Payments versus the e-commerce solution - what is the bigger part of your business?

MD: The ecommerce solution certainly drives the primary value for our publishers and majority of our revenue.

Payment gateways are an essential part of the business, but of limited value to publishers. It is kind of a two-

percent business. But providing the Elements Commerce solution that enables a digital economy is a significantly

larger set of services and solutions and clearly more valuable.

Our Clients are generally focused on three goals—increasing users, usage, and ARPPU. Our technology helps

drive all three, with an emphasis on increasing ARPPU. Live Gamer’s tech stack and services focus on features

that deliver the highest free-to-paying conversion rates, highest revenue per user and those that help to boost

user retention. Those features are typically centered on effective item management, sophisticated analytics,

marketing and merchandising of virtual content to end users.

AB: Can you give us some sense what is a size of addressable market?

MD: The addressable online gaming market is in the order of $15 billion today—hardcore games at about $4 billion,

casual and social at about $7 billion, and secondary market of virtual goods at about $3-4 billion. The derivative

market for our transaction solution business, assuming a 7% take-rate, is over a billion dollars. Our addressable

market is benefitting from two growth factors—one is at 40% CAGR in the micro-transaction based gaming

market, which itself can expand Live Gamer’s addressable market to greater than two billion dollars in three to

five years; and then the opportunity in the related categories of digital entertainment could be at least 50 percent

of the Game market or $7.5B over the next 3-5 years.

AB: Can you talk about a few secular drivers that are driving growth in this market?

MD: There [are] four major drivers. Firstly, increased broadband penetration and social activity on the Web are very

significant drivers. When you’ve got 500 million users on Facebook and 450,000 apps, it drives a lot of

transactions. Of course, globally there are many social networks like Oak Pacific that have greater than 100

million users. My sense is that the micro-transaction value of social networks is probably worth well north of a

billion dollars today and heading to five plus billion dollars by 2012.

Secondly, advances in game development technology have lowered the cost and increased the speed of

development. Publishers are delivering a portfolio of quality entertainment experiences on the Web. The current

generation MMOs are great games; they're fun to play, there's a ton of social interactivity in there and it's a

rewarding entertainment experience. Similarly, innovations in social gaming have created compelling game

experiences with low budgets and short development cycles. Both game forms are structured around item-based

game leveling—a significant driver for micro-transactions.

The third driver is the global recession. Since the disposable income available for entertainment has reduced over

the last two years, it has brought a lot of people into free to play games from expensive box games and

subscriptions and accelerated the sector’s growth.

Finally, mass distribution of free to play games has changed the demography of gaming. That has bought a mass

market to micro-transaction driven entertainment. People from 6 to 60 play social games like Zynga’s. That

demographic is now entrenched in micro-transactions, consuming all sorts of entertainment forms from music to

film to sports.

AB: How easy or difficult it is to sell your solutions now versus it was about a year ago?

MD: A year ago, the market was growing so fast and consumer demand was so strong that publishers were just

focused on creating virtual goods for distribution inside the games. Now they've moved to another level of

sophistication and they need to analyze their demographics, their ARPUs, their SKUs performance, payment

method effectiveness and so on. In many respects, it resembles the kind of sophistication that Amazon or Wal-

Mart have around managing their businesses. Yes you're running a game-as-a-service, but you have to be able

to merchandise virtual goods and manage your digital economy at optimal levels. We see a lot of publishers that](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-198-320.jpg)

![Page 219

January 24, 2011

Industry Report

Atul Bagga, ThinkEquity, (AB): Please explain your business and why investors should care about Playdom?

John Pleasants, CEO, Playdom (JP): We are in the social gaming space, which is defined as online games that live

primarily inside existing social networks. Our products are a combination of games and social interactivity and it's

the hybrid of the two that makes them differentiated from traditional games that tend to be more immersive and

generally more focused on production qualities, graphic capabilities. Social gaming is a free-to-play model, so it

attracts a broad demographic of people. There are now hundreds of millions [of] people playing social games, and

as a category, social gaming is still in infancy. So it's a disruptive model. Relative to traditional gaming, this model

has lower cost of production and higher returns, because you can very quickly capitalize on your user base, and

it's a live service, so you change and evolve your product over time. You don't have the risk of spending a lot of

money and time building a product then shipping it and hoping people come. You're mitigating all of that risk in

the traditional entertainment model, and hence, we have a superior model for entertainment, production, and

distribution.

AB: Can you explain how do you make money—virtual goods, advertising, what could be the mix between these different

revenue streams and how do you see it trending over a longer term?

JP: We are primarily a virtual goods model. People acquire items in order to accelerate in a game or to unlock new parts

of the game and limited edition items. That represents 90 percent of our revenue. Between five and 10 percent of

our revenue comes from advertising. I think that the revenue mix will always be dominated by direct consumer

payments.

AB: How much of the virtual goods revenue comes from direct payment versus indirect payment and maybe if you can

share your thoughts on indirect payment that lead generation offers, et cetera?

JP: A vast majority of our revenue comes from the direct payment. We want to have direct billing relationships with all of

our customers. Offers can be a good thing for people who can't or don't want to pay but are willing to invest time

or some personal information. Only about 15% of our revenue comes from the indirect payments. As long as the

offers are clean, legitimate and transparent, they can be acceptable. But if they are less than transparent and

manipulative, they don't create a good user experience and they are not good for us.

AB: You mentioned that about five or 10 percent of revenue coming from advertising. What kind of advertisements are

these—are these video ads, in-game ads, banner ads?

JP: These are primarily adjacency ads to our existing products. We've done a few things, sort of in-game experiences, but

it's rather limited. And advertising has not, to date, been a focus for us. We do not even have one person in our

company dedicated to advertising at this time.

AB: If we look at the Chinese online gaming space, it seems like highly immersive massive multiplayer online games are

better monetized than the casual games. And given that your games are shorter duration, more casual; what

gives you the confidence about the ability to monetize these games?

JP: Well, it really all comes down to reach in different behaviors. You've got game room phenomena over in China and

Korea, so people go in games rooms and play these online games. We don't have that phenomenon here

because we have a lot of personal computers in the home and people can buy downloadable games. In our

markets we have 300-plus million people on Facebook alone, so that's the equivalent of our game room. That's

where everybody has congregated and we're simply going there and offering them a free model. While hardcore

gamers, like a World of Warcraft have limited reach, games like a Maple Story or a Mobsters 2 or a Sorority Life

game reach much broader demographics.

AB: Can you talk a little bit about who is your target customer.

JP: Target customer is anybody who lives inside the social networks, which these days feels like anybody. Facebook has

users from 13 to 80 years old and it has equal distribution between men and women. Each of our game has a

different demographic. Sorority Life appeals more to women; Mobsters 2 appeals more to men; Poker application

appeals to a gaming or casino demographic. So if you took the aggregate of it, it's broad-based and follows the

populations of the social networks, with a primary target of 18 to 35.

AB: Can you give us some sense on how big this market could be and maybe if you could share some of your

assumptions around market-sizing estimates?](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-219-320.jpg)

![Page 220

January 24, 2011

Industry Report

JP: I think the western market is somewhere between $0.5-1.0 billion today and it can be $3-5 billion over the next three

years. It's growing more than 100 percent a year and all the metrics are moving in the right way. That starts with

Internet penetration worldwide, followed by social networking penetration, followed by percent of users of social

networks that play games, followed by percent of people who pay inside of these games, followed by how many

games they play per month, followed by ARPU per paying user. Add it all up; they're all growing and if each of

those things goes up you know 20 or 30 percent or whatever the respective numbers are, it adds to 5-10x of the

category over a three to four-year period of time.

AB: Can you share some of the metrics with us—typical conversion rate between playing users versus paying users;

typical ARPU?

JP: It's all over the map, but we see conversion in the range of 1-4%. Our ARPU per paying user tends to be about $20;

but when you average it all in with all the non-paying people, it is about $0.20-0.25 cents per month.

AB: What is your growth strategy? Is it more about getting in more social network, clocking-up ARPU, or adding more

games to get a bigger audience?

JP: Yes, the latter; more games, bigger audience. We have 15 games now and we hope to well more than double our size

over the course of the next year. We have also acquired (Lil) Fram Life through our acquisition of Green Patch.

AB: Can you talk about your mobile strategy? Now that Apple has opened up its platform for in-game transaction, how

does that change the landscape?

JP: We have our Mobsters product both online, as well as on the iPhone. We have booster packs that come off of that and

that product is doing well for us. We have recently acquired Trippert Labs, which gives us dozens of applications

on iPhone. Micro-transactions are an important part of this economy; it's how it works, so I'm very excited that

Apple is opening up their platform and enabling more Flash over time to live and exist inside the iPhone

environment. Our games are live services and a consumer should be able to access them from any device they

have, whether that's a mobile device or a Notebook or a PC.

AB: Who do you think represents the biggest competitive threat for Playdom?

JP: Surely, Zynga and Playfish both are very similar companies as ours. Some of the independent developers can come

up quickly and do nice jobs. Some of the big media companies are trying to get into this, foreign companies

especially from China are aggressively moving into this space as well.

AB: What is the key source of differentiation for Playdom that is difficult for others to replicate?

JP: You have to make the products, and you have to know how to run a live service, and you have to have the

infrastructure to manage the scale, which I think is one of our strengths. The other thing is that we've a very good

combination of Internet people, gaming people, creative people, and live services people. You have to get the

right blend of talent that can keep these things.

AB: Can you talk about the Facebook Credit? How does that change the payment landscape and what does that mean for

a social gaming company like yours?

JP: I think that if Facebook were to create a universal payment system for a platform as large as theirs, I can imagine it

would grow the ecosystem and drive conversion rates. Look at what happened to Amazon when they did 1-Click

Ordering. I think it could have [a] material impact on our business.

AB: When you look out a couple of years, what do you see as the biggest challenges for Playdom?

JP: Our company has tripled in size in the last three months and when you're growing like that, just staying high quality

and high efficiency while driving absolute volume and throughput is a challenge. We are on a path to increase the

size of our company by 5-10x in one year from a not-so-insignificant base. And in doing that you can create chaos

or you can create a beautiful piece of art, that is the challenge.

AB: Can you give us some sense of how big Playdom is and how fast you might be growing?

JP: We have about 28 million users a month right now. We have about 220 full-time people, rapidly growing. We have

north of $50 million in revenue this year. We are profitable.](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-220-320.jpg)

![Page 221

January 24, 2011

Industry Report

AB: Of 25 million people that you mentioned, what's the breakup between Facebook and MySpace?

JP: I'm guessing 60/40 on MySpace because we [have] 13 applications on MySpace and six on Facebook; but our

revenue distribution tilts a little bit more toward Facebook.

AB: If you look out three years from now, where do you see Playdom? Do you see yourself as a public company, as an

independent private company, or as a part of any bigger platform?

JP: We're still a very young company with very big dreams and we're trying to build a great self-sustaining enterprise.

There are all kinds of things that could happen along the way. We're not building the company to be sold rapidly.

We're trying to create IP. We're trying to create a strong and lasting infrastructure. We can be a company that is

worth billions of dollars by having hundreds of millions of revenue and having high profit margins. And mostly

we're trying to build great products that people love to play and enjoy playing and hopefully make their lives

happier and meet more people and all the things that come from social gaming.

AB: Thank you so much for speaking with me.](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-221-320.jpg)

![Page 417

Effective October 7, 2009, ThinkEquity LLC moved from a four-tier Buy/Accumulate/Source of Funds/Sell rating system to a three-tier

Buy/Hold/Sell system. The new ratings appear in our Distribution of Ratings, Firmwide chart. To request historical information, including

previously published reports or statistical information, please call: 866-288-8206, or write to: Director of Research, ThinkEquity LLC, 600

Montgomery Street, San Francisco, California, 94111.

Buy: ThinkEquity expects the stock to generate positive risk-adjusted returns of more than 10% over the next 12 months. ThinkEquity

recommends initiating or increasing exposure to the stock.

Hold: ThinkEquity expects the stock to generate risk-adjusted returns of +/-10% over the next 12 months. ThinkEquity believes the stock

is fairly valued.

Sell: ThinkEquity expects the stock to generate negative risk-adjusted returns of more than 10% during the next 12 months. ThinkEquity

recommends decreasing exposure to the stock.

Distribution of Ratings, Firmwide

ThinkEquity LLC

IB Serv./Past 12 Mos.

Rating Count Percent Count Percent

BUY [B] 154 68.40 20 12.99

HOLD [H] 70 31.10 0 0.00

SELL [S] 1 0.40 0 0.00

This report does not purport to be a complete statement of all material facts related to any company, industry, or security mentioned. The

information provided, while not guaranteed as to accuracy or completeness, has been obtained from sources believed to be reliable. The

opinions expressed reflect our judgment at this time and are subject to change without notice and may or may not be updated. Past

performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or

implied, is made regarding future performance. This notice shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall

there be any sale of these securities in any state in which said offer, solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state. This research report was originally prepared and distributed to institutional clients

of ThinkEquity LLC. Recipients who are not market professionals or institutional clients of ThinkEquity LLC should seek the advice of their

personal financial advisors before making any investment decisions based on this report. Additional information on the securities

referenced is available upon request. In the event that this is a compendium report (covers more than six ThinkEquity LLC-covered

subject companies), ThinkEquity LLC may choose to provide specific disclosures for the subject companies by reference. To request

more information regarding these disclosures, please call: 866-288-8206, or write to: Director of Research, ThinkEquity LLC, 600

Montgomery Street, San Francisco, California, 94111. Stocks mentioned in this report are not covered by ThinkEquity LLC unless

otherwise mentioned. Member of FINRA and SIPC. Copyright 2011 ThinkEquity LLC, A Panmure Gordon Company

January 24, 2011

Industry Report](https://image.slidesharecdn.com/9f3e0384-5c68-4280-87ab-c09a5a0212d7-150425212220-conversion-gate01/85/GaaS-Whitepaper-2011-417-320.jpg)