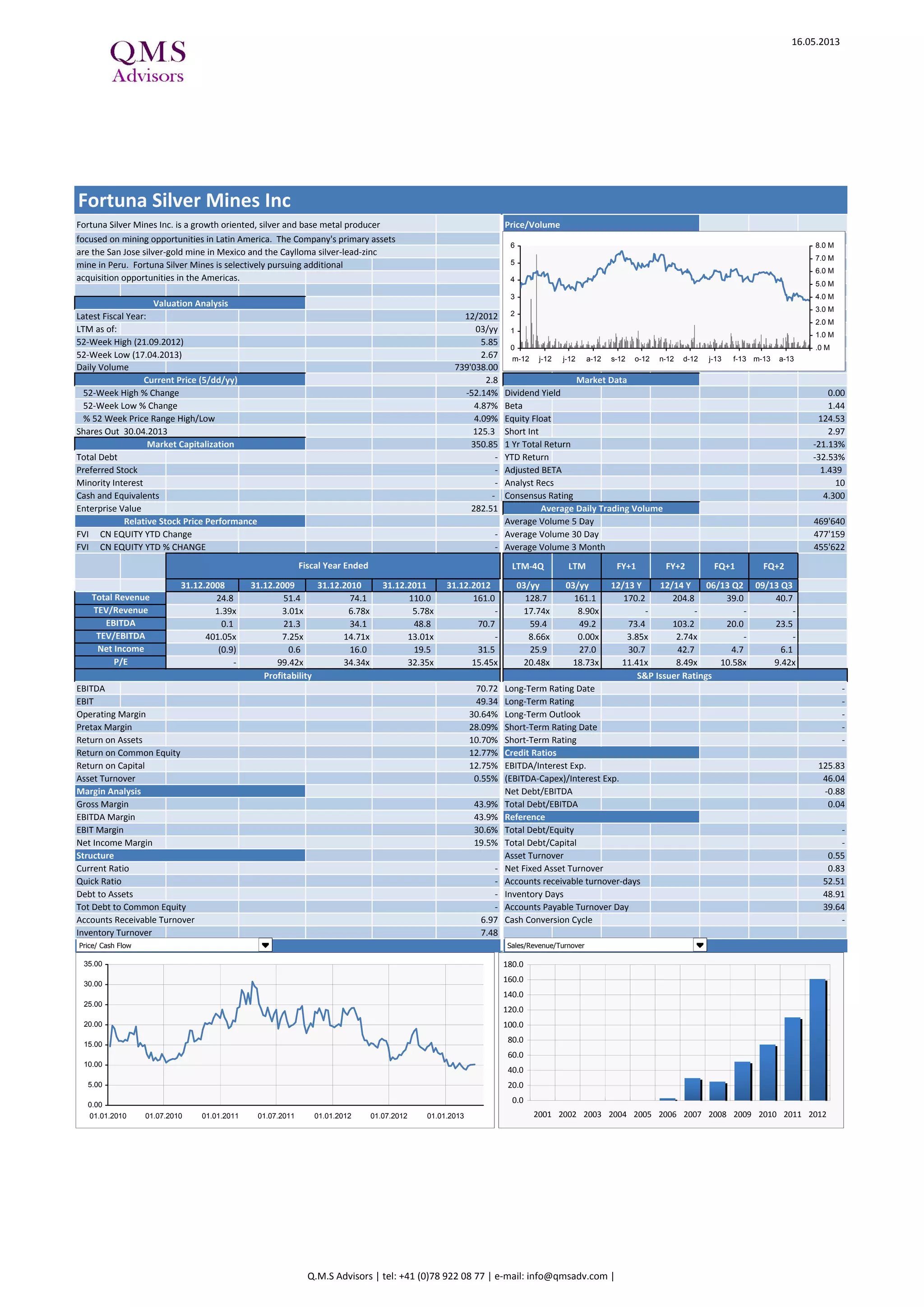

The document provides an overview of the QMS Advisors' Gold Miners Flexible Index, which tracks companies in the gold mining industry, along with various financial metrics of these companies. It includes data such as market capitalization, revenue estimates, EBITDA, credit ratings, and other relevant financial statistics for specific gold mining firms. The information serves as a comparative analysis without constituting investment advice.