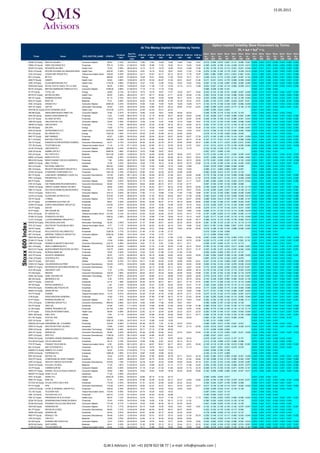

STOXX 600 Index - Dividends and Implied Volatility Surfaces Parameters

- 1. 15.05.2013 Ticker Name GICS_SECTOR_NAME ATM Ref Dividend Yield Next Ex- Dividend Date ATM Vol - 30D ATM Vol - 60D ATM Vol - 90D ATM Vol - 6M ATM Vol - 12M ATM Vol - 18M ATM Vol - 24M Skew (a) - 30D Skew (a) - 60D Skew (a) - 90D Skew (a) - 6M Skew (a) - 12M Skew (a) - 18M Skew (a) - 24M Skew (b) - 30D Skew (b) - 60D Skew (b) - 90D Skew (b) - 6M Skew (b) - 12M Skew (b) - 18M Skew (b) - 24M NESN VX Equity NESTLE SA-REG Consumer Staples 68.00 3.16% 16.04.2014 13.86 13.64 13.69 13.85 14.29 14.85 15.07 -0.412 -0.309 -0.270 -0.207 -0.131 -0.085 -0.047 0.056 0.023 0.017 0.008 0.003 0.002 0.002 HSBA LN Equity HSBC HOLDINGS PLC Financials 755.10 5.23% 21.08.2013 18.59 16.88 17.32 18.52 19.14 19.45 19.93 -0.208 -0.220 -0.196 -0.144 -0.048 -0.018 -0.015 0.010 0.010 0.008 0.004 0.002 0.002 0.002 NOVN VX Equity NOVARTIS AG-REG Health Care 73.20 3.28% 28.02.2014 14.73 14.73 14.79 14.95 15.03 14.98 15.06 -0.183 -0.139 -0.132 -0.115 -0.051 -0.041 -0.028 0.047 0.017 0.011 0.005 0.002 0.002 0.001 ROG VX Equity ROCHE HOLDING AG-GENUSSCHEIN Health Care 248.30 3.30% 10.03.2014 16.81 16.19 16.33 16.87 16.63 17.40 17.48 -0.274 -0.165 -0.146 -0.118 -0.051 -0.039 -0.018 0.040 0.012 0.008 0.004 0.003 0.003 0.004 VOD LN Equity VODAFONE GROUP PLC Telecommunication Services195.85 5.25% 05.06.2013 23.71 23.67 23.17 22.10 20.70 17.78 16.87 0.095 0.086 0.065 0.012 0.003 0.020 0.025 0.014 0.006 0.003 0.002 0.001 0.001 0.000 BP/ LN Equity BP PLC Energy 468.80 5.26% 07.08.2013 16.28 16.01 16.62 17.55 18.93 19.17 18.71 -0.249 -0.212 -0.173 -0.126 -0.067 -0.097 -0.122 0.039 0.007 0.004 0.003 0.001 0.003 0.003 SAN FP Equity SANOFI Health Care 84.80 3.66% 12.05.2014 20.70 20.32 20.57 21.00 20.91 22.47 21.64 -0.311 -0.231 -0.212 -0.175 -0.095 -0.059 -0.055 0.041 0.010 0.006 0.004 0.002 0.001 0.001 GSK LN Equity GLAXOSMITHKLINE PLC Health Care 1718.50 4.66% 07.08.2013 14.47 13.97 14.46 15.02 15.63 16.24 15.52 -0.097 -0.120 -0.109 -0.087 -0.050 -0.085 -0.069 0.002 0.005 0.005 0.003 0.002 0.005 0.004 RDSA NA Equity ROYAL DUTCH SHELL PLC-A SHS Energy 26.35 5.36% 14.08.2013 10.23 11.36 11.57 12.35 13.10 13.10 12.98 -0.422 -0.227 -0.194 -0.119 -0.082 -0.048 -0.012 0.045 0.015 0.010 0.009 0.005 0.003 0.003 BATS LN Equity BRITISH AMERICAN TOBACCO PLC Consumer Staples 3759.00 3.88% 21.08.2013 17.15 17.10 17.16 17.62 -0.556 -0.236 -0.168 -0.101 0.025 0.011 0.008 0.004 FP FP Equity TOTAL SA Energy 38.80 6.13% 16.12.2013 16.73 16.74 16.91 17.47 18.05 18.71 18.24 -0.233 -0.123 -0.136 -0.131 -0.066 -0.047 -0.040 0.045 0.015 0.010 0.005 0.002 0.001 0.001 BAYN GY Equity BAYER AG-REG Health Care 85.00 2.35% 28.04.2014 19.77 20.17 20.65 21.71 22.26 22.06 21.63 -0.303 -0.216 -0.182 -0.130 -0.088 -0.063 -0.058 0.040 0.010 0.007 0.003 0.002 0.002 0.002 SIE GY Equity SIEMENS AG-REG Industrials 81.19 3.70% 24.01.2014 14.83 15.00 15.55 16.86 18.13 18.76 19.24 -0.233 -0.206 -0.203 -0.185 -0.132 -0.106 -0.094 0.043 0.012 0.008 0.004 0.002 0.001 0.001 BAS GY Equity BASF SE Materials 73.41 3.68% 02.05.2014 20.50 20.16 20.66 21.46 23.38 23.24 23.61 -0.293 -0.193 -0.151 -0.091 -0.034 -0.007 0.021 0.039 0.009 0.005 0.002 0.000 -0.001 -0.002 DGE LN Equity DIAGEO PLC Consumer Staples 2060.00 2.33% 04.09.2013 14.94 14.82 14.94 15.94 16.26 15.88 15.77 -0.142 -0.170 -0.158 -0.129 -0.091 -0.060 -0.049 0.019 0.015 0.009 0.004 0.003 0.003 0.002 SAP GY Equity SAP AG Information Technology 64.00 1.33% 26.05.2014 20.82 19.89 20.07 20.23 20.60 21.83 22.07 -0.300 -0.296 -0.275 -0.216 -0.177 -0.150 -0.135 0.043 0.011 0.007 0.004 0.002 0.001 0.001 NOVOB DC Equity NOVO NORDISK A/S-B Health Care 1015.00 2.07% 20.03.2014 23.05 22.24 23.41 22.03 -0.066 -0.055 -0.033 -0.003 0.001 0.000 0.000 0.000 ABI BB Equity ANHEUSER-BUSCH INBEV NV Consumer Staples 75.82 2.37% 16.10.2013 18.90 19.35 19.61 19.90 20.29 20.29 -0.246 -0.109 -0.118 -0.129 -0.103 -0.103 0.033 0.005 0.003 0.003 0.002 0.002 SAN SQ Equity BANCO SANTANDER SA Financials 5.44 11.03% 08.07.2013 31.24 31.19 30.49 30.01 28.28 25.83 24.08 -0.152 -0.229 -0.217 -0.165 -0.069 0.039 0.289 0.001 0.003 0.002 0.000 -0.001 0.000 0.000 ALV GY Equity ALLIANZ SE-REG Financials 118.25 4.06% 08.05.2014 22.42 20.97 21.21 21.84 22.79 22.64 20.46 -0.248 -0.190 -0.166 -0.133 -0.096 -0.061 -0.043 0.038 0.010 0.006 0.003 0.001 0.000 0.000 UNA NA Equity UNILEVER NV-CVA Consumer Staples 32.90 3.30% 07.08.2013 13.35 13.42 13.97 14.88 15.72 15.85 15.57 -0.176 -0.127 -0.134 -0.144 -0.093 -0.068 -0.045 0.047 0.013 0.009 0.005 0.004 0.003 0.003 UBSN VX Equity UBS AG-REG Financials 17.64 1.30% 06.05.2014 24.40 23.35 23.48 24.33 25.10 25.58 24.70 -0.253 -0.157 -0.157 -0.173 -0.150 -0.136 -0.130 0.051 0.014 0.009 0.004 0.002 0.001 0.001 ENI IM Equity ENI SPA Energy 18.90 5.77% 23.09.2013 18.71 18.39 18.99 19.96 19.81 19.39 18.36 -0.139 -0.201 -0.192 -0.152 -0.117 -0.098 -0.081 0.039 0.013 0.009 0.005 0.002 0.002 0.002 AZN LN Equity ASTRAZENECA PLC Health Care 3379.00 5.64% 07.08.2013 13.17 13.22 13.97 14.84 15.53 15.39 15.37 -0.212 -0.169 -0.135 -0.118 -0.059 -0.063 -0.065 0.013 0.009 0.007 0.004 0.002 0.002 0.003 BG/ LN Equity BG GROUP PLC Energy 1222.50 1.55% 31.07.2013 25.25 23.55 23.98 24.74 24.88 24.88 -0.018 -0.115 -0.106 -0.052 -0.040 -0.040 0.005 0.004 0.003 0.001 0.000 0.000 BNP FP Equity BNP PARIBAS Financials 45.67 3.28% 30.05.2014 29.65 29.04 29.24 29.97 28.46 28.37 27.24 -0.272 -0.190 -0.169 -0.150 -0.124 -0.081 -0.084 0.034 0.006 0.005 0.003 0.002 0.002 0.003 BLT LN Equity BHP BILLITON PLC Materials 1905.50 4.18% 04.09.2013 25.76 24.85 24.85 25.75 25.91 26.19 27.44 -0.167 -0.177 -0.161 -0.137 -0.081 -0.068 -0.088 0.011 0.006 0.002 0.001 0.000 0.002 0.001 DAI GY Equity DAIMLER AG-REGISTERED SHARES Consumer Discretionary 46.47 4.73% 10.04.2014 26.46 24.50 24.78 25.37 25.95 25.56 26.27 -0.263 -0.159 -0.117 -0.072 -0.029 0.014 0.029 0.038 0.006 0.003 0.001 0.000 0.000 0.000 TEF SQ Equity TELEFONICA SA Telecommunication Services 11.18 3.13% 07.11.2013 22.49 22.90 23.12 23.59 22.32 21.87 19.91 -0.141 -0.212 -0.210 -0.176 -0.159 -0.059 0.084 0.003 0.002 0.000 0.000 0.002 0.001 -0.002 ULVR LN Equity UNILEVER PLC Consumer Staples 2855.00 3.24% 07.08.2013 14.15 13.80 14.27 15.05 15.18 15.18 -0.123 -0.150 -0.156 -0.131 -0.102 -0.102 0.005 0.006 0.006 0.004 0.003 0.003 SAB LN Equity SABMILLER PLC Consumer Staples 3665.50 1.88% 07.08.2013 19.23 18.88 18.67 18.22 -0.057 -0.071 -0.090 -0.102 0.002 0.002 0.003 0.004 RIO LN Equity RIO TINTO PLC Materials 2914.50 4.06% 14.08.2013 30.70 29.59 29.56 30.26 30.66 31.51 31.51 -0.170 -0.163 -0.148 -0.111 -0.083 -0.055 -0.047 0.008 0.004 0.002 0.001 0.000 -0.001 -0.001 BARC LN Equity BARCLAYS PLC Financials 319.80 2.35% 07.08.2013 27.03 26.69 27.24 28.26 30.12 29.47 29.33 -0.331 -0.260 -0.224 -0.167 -0.114 -0.066 -0.067 0.011 0.007 0.005 0.002 0.001 0.001 0.002 BBVA SQ Equity BANCO BILBAO VIZCAYA ARGENTA Financials 7.46 5.63% 08.07.2013 30.02 30.66 30.46 30.28 29.43 29.10 29.09 -0.179 -0.281 -0.290 -0.253 -0.154 -0.120 -0.028 0.002 0.001 0.001 0.000 -0.003 -0.003 -0.006 ABBN VX Equity ABB LTD-REG Industrials 21.64 3.23% 30.04.2014 18.26 17.55 18.12 19.38 20.40 20.78 20.88 -0.116 -0.160 -0.166 -0.154 -0.104 -0.093 -0.091 0.044 0.013 0.009 0.004 0.002 0.001 0.001 NG/ LN Equity NATIONAL GRID PLC Utilities 845.00 4.83% 05.06.2013 17.00 14.59 14.68 14.72 14.88 14.88 -0.030 -0.078 -0.097 -0.080 -0.058 -0.058 0.006 0.005 0.004 0.004 0.003 0.003 RB/ LN Equity RECKITT BENCKISER GROUP PLC Consumer Staples 4791.00 2.84% 07.08.2013 17.32 17.28 17.77 18.62 19.00 19.00 -0.088 -0.101 -0.084 -0.059 -0.057 -0.057 0.011 0.008 0.005 0.002 0.001 0.001 STAN LN Equity STANDARD CHARTERED PLC Financials 1581.00 3.79% 07.08.2013 25.80 23.91 24.29 24.76 24.98 24.98 -0.283 -0.259 -0.212 -0.137 -0.124 -0.124 0.009 0.004 0.002 0.002 0.001 0.001 MC FP Equity LVMH MOET HENNESSY LOUIS VUI Consumer Discretionary 137.95 2.32% 29.11.2013 21.06 20.49 20.78 21.58 22.41 22.08 22.60 -0.179 -0.159 -0.159 -0.133 -0.099 -0.098 -0.082 0.030 0.006 0.005 0.003 0.001 0.001 0.000 PRU LN Equity PRUDENTIAL PLC Financials 1184.00 2.50% 21.08.2013 32.96 28.27 27.71 27.48 26.34 23.14 21.83 -0.319 -0.250 -0.211 -0.144 -0.131 -0.026 -0.009 0.016 0.008 0.006 0.003 0.002 0.003 0.003 BN FP Equity DANONE Consumer Staples 58.90 2.63% 06.05.2014 21.16 20.02 20.12 20.64 20.87 21.17 19.27 -0.395 -0.262 -0.206 -0.142 -0.052 -0.015 -0.044 0.042 0.012 0.008 0.004 0.002 0.002 0.002 CFR VX Equity CIE FINANCIERE RICHEMON-BR A Consumer Discretionary 82.80 0.74% 18.09.2013 28.54 26.64 26.72 27.31 27.30 27.77 -0.407 -0.184 -0.167 -0.135 -0.090 -0.080 0.020 0.005 0.004 0.002 0.001 0.001 CSGN VX Equity CREDIT SUISSE GROUP AG-REG Financials 28.84 2.60% 30.04.2014 27.16 25.53 25.71 26.34 27.02 26.75 26.55 -0.189 -0.205 -0.199 -0.178 -0.145 -0.124 -0.118 0.042 0.009 0.006 0.003 0.001 0.001 0.002 DBK GY Equity DEUTSCHE BANK AG-REGISTERED Financials 36.73 2.04% 23.05.2014 32.94 29.97 29.74 29.70 29.70 30.07 30.25 -0.316 -0.264 -0.245 -0.201 -0.144 -0.128 -0.112 0.037 0.006 0.004 0.002 0.001 0.002 0.001 TSCO LN Equity TESCO PLC Consumer Staples 375.15 3.93% 09.10.2013 17.65 17.13 16.98 17.29 17.84 17.08 16.68 -0.197 -0.123 -0.100 -0.081 -0.048 -0.036 -0.049 0.011 0.005 0.004 0.003 0.001 0.001 0.002 GLEN LN Equity GLENCORE XSTRATA PLC Materials 333.95 5.33% 28.08.2013 32.58 31.03 30.43 29.65 28.47 27.28 25.99 -0.400 -0.222 -0.169 -0.133 -0.059 -0.009 -0.018 0.025 0.004 0.005 0.002 0.003 0.008 0.006 OR FP Equity L'OREAL Consumer Staples 135.70 1.77% 28.04.2014 21.56 21.00 21.06 21.15 21.44 20.57 20.60 -0.286 -0.234 -0.212 -0.165 -0.117 -0.080 -0.107 0.035 0.009 0.006 0.003 0.001 0.001 0.000 SU FP Equity SCHNEIDER ELECTRIC SA Industrials 58.81 3.32% 02.05.2014 25.29 25.59 26.27 27.72 29.18 28.49 28.50 -0.259 -0.184 -0.166 -0.137 -0.099 -0.053 0.007 0.036 0.007 0.005 0.002 0.001 0.000 0.001 ZURN VX Equity ZURICH INSURANCE GROUP AG Financials 270.60 6.47% 02.04.2014 20.55 16.33 16.06 15.98 16.25 16.18 16.02 -0.310 -0.240 -0.207 -0.172 -0.129 -0.080 -0.057 0.037 0.015 0.011 0.006 0.003 0.002 0.002 CS FP Equity AXA SA Financials 14.97 5.35% 05.05.2014 26.00 25.04 25.30 26.21 27.60 26.76 24.96 -0.278 -0.151 -0.137 -0.130 -0.073 -0.031 -0.087 0.045 0.008 0.006 0.003 0.002 0.002 0.003 AI FP Equity AIR LIQUIDE SA Materials 97.69 5.32% 12.05.2014 16.36 16.75 16.92 17.78 18.22 18.90 19.38 -0.008 -0.131 -0.133 -0.113 -0.115 -0.095 -0.076 0.042 0.012 0.008 0.004 0.002 0.003 0.001 BT/A LN Equity BT GROUP PLC Telecommunication Services312.40 3.14% 23.12.2013 23.53 22.28 22.95 23.43 23.52 19.13 17.35 -0.187 -0.265 -0.205 -0.114 -0.083 -0.085 -0.114 0.008 0.003 0.002 0.003 0.002 0.000 -0.001 SYNN VX Equity SYNGENTA AG-REG Materials 399.20 2.58% 28.04.2014 17.78 16.99 17.44 18.48 19.16 19.10 18.97 -0.225 -0.117 -0.124 -0.167 -0.116 -0.103 -0.090 0.040 0.009 0.005 0.003 0.002 0.001 0.002 LLOY LN Equity LLOYDS BANKING GROUP PLC Financials 59.43 07.08.2013 27.88 25.40 26.59 28.75 28.22 33.46 35.17 -0.398 -0.210 -0.174 -0.154 -0.178 -0.062 -0.016 0.015 0.014 0.009 0.003 0.003 0.001 -0.001 ERICB SS Equity ERICSSON LM-B SHS Information Technology 82.85 3.50% 10.04.2014 21.37 24.60 25.01 24.43 26.34 26.34 26.34 -0.281 -0.156 -0.133 -0.120 -0.116 -0.116 -0.116 0.067 0.014 0.005 0.003 0.003 0.003 0.003 DTE GY Equity DEUTSCHE TELEKOM AG-REG Telecommunication Services 9.77 7.17% 19.05.2014 30.76 24.22 23.25 22.19 19.91 19.86 19.32 0.613 0.190 0.149 0.069 0.007 0.015 0.038 0.041 0.014 0.010 0.004 0.003 0.002 0.000 LIN GY Equity LINDE AG Materials 151.10 3.77% 07.05.2014 16.53 16.31 16.85 18.09 19.50 20.36 20.26 -0.216 -0.168 -0.155 -0.122 -0.088 -0.069 -0.054 0.042 0.010 0.006 0.003 0.001 0.001 0.000 RR/ LN Equity ROLLS-ROYCE HOLDINGS PLC Industrials 1226.00 1.77% 23.10.2013 21.48 21.53 21.60 21.72 -0.315 -0.264 -0.194 -0.094 0.012 0.009 0.006 0.001 IMT LN Equity IMPERIAL TOBACCO GROUP PLC Consumer Staples 2292.00 5.06% 15.01.2014 16.93 17.03 17.47 17.81 -0.113 -0.085 -0.048 0.001 0.009 0.008 0.006 0.004 INGA NA Equity ING GROEP NV-CVA Financials 6.88 2.91% 08.08.2013 31.44 30.40 30.73 31.66 31.62 30.66 32.38 -0.497 -0.245 -0.209 -0.134 -0.063 0.073 0.167 0.038 0.009 0.006 0.003 0.002 0.001 -0.002 EOAN GY Equity E.ON SE Utilities 12.94 5.80% 09.05.2014 21.99 21.82 22.21 22.82 22.45 20.79 22.08 -0.238 -0.173 -0.165 -0.127 -0.037 0.029 0.135 0.051 0.013 0.008 0.003 0.002 0.002 0.000 HMB SS Equity HENNES & MAURITZ AB-B SHS Consumer Discretionary 233.70 4.28% 24.04.2014 18.81 17.15 5.50 17.88 19.11 19.11 -0.226 -0.167 -0.090 -0.137 -0.113 -0.113 0.058 0.019 0.019 0.005 0.001 0.001 AAL LN Equity ANGLO AMERICAN PLC Materials 1543.50 3.83% 14.08.2013 34.69 31.70 31.62 32.20 31.58 32.14 32.03 -0.180 -0.133 -0.109 -0.073 -0.011 -0.055 -0.051 0.005 0.003 0.001 -0.001 -0.001 -0.001 -0.001 MUV2 GY Equity MUENCHENER RUECKVER AG-REG Financials 150.75 4.64% 24.04.2014 20.80 20.59 20.53 20.51 20.75 20.37 21.37 -0.323 -0.195 -0.167 -0.129 -0.076 -0.042 -0.062 0.039 0.010 0.007 0.004 0.002 0.001 0.001 NDA SS Equity NORDEA BANK AB Financials 78.95 4.35% 14.03.2014 15.42 18.97 21.88 21.45 21.95 21.95 -0.204 -0.253 -0.290 -0.185 -0.137 -0.137 0.052 0.020 0.013 0.005 0.003 0.003 GLE FP Equity SOCIETE GENERALE Financials 30.57 1.47% 02.06.2014 36.72 35.15 34.88 34.83 33.03 34.93 32.93 -0.304 -0.254 -0.229 -0.186 -0.125 -0.059 -0.020 0.032 0.006 0.005 0.003 0.001 0.000 0.001 CNA LN Equity CENTRICA PLC Utilities 385.70 4.60% 25.09.2013 15.36 14.56 14.99 15.87 15.88 15.88 0.066 -0.074 -0.154 -0.148 -0.070 -0.070 0.008 0.010 0.010 0.006 0.002 0.002 GSZ FP Equity GDF SUEZ Utilities 16.49 9.10% 15.11.2013 22.71 21.64 22.02 21.82 22.89 23.09 22.21 -0.221 -0.144 -0.142 -0.099 -0.067 -0.006 -0.010 0.045 0.010 0.007 0.003 0.002 0.002 0.003 VOW3 GY Equity VOLKSWAGEN AG-PREF Consumer Discretionary 163.00 2.67% 22.04.2014 24.83 23.62 23.80 24.55 25.36 25.36 25.09 -0.205 -0.154 -0.143 -0.120 -0.078 -0.049 -0.032 0.029 0.005 0.004 0.002 0.002 0.002 0.003 BMW GY Equity BAYERISCHE MOTOREN WERKE AG Consumer Discretionary 71.90 19.05.2014 22.34 22.13 22.36 23.14 22.61 23.97 23.44 0.119 -0.016 -0.030 -0.035 -0.029 -0.018 0.007 0.031 0.005 0.004 0.002 0.001 0.001 0.000 UCG IM Equity UNICREDIT SPA Financials 4.19 2.15% 19.05.2014 36.71 35.73 36.19 37.14 36.20 36.85 38.18 -0.176 -0.143 -0.150 -0.135 -0.110 -0.053 -0.235 0.034 0.006 0.004 0.001 0.001 0.000 -0.001 ITX SQ Equity INDITEX Consumer Discretionary 105.25 1.95% 02.05.2014 26.24 25.47 25.44 25.65 25.29 25.20 25.08 0.135 -0.155 -0.154 -0.138 -0.166 -0.116 -0.076 0.007 0.002 0.002 0.002 0.001 0.002 0.002 ASML NA Equity ASML HOLDING NV Information Technology 60.77 0.95% 25.04.2014 25.07 26.83 27.21 26.98 27.83 28.09 28.39 -0.379 -0.218 -0.201 -0.167 -0.124 -0.103 -0.091 0.030 0.006 0.004 0.002 0.001 0.000 0.000 IBE SQ Equity IBERDROLA SA Utilities 4.25 4.07% 03.01.2014 28.90 35.07 35.84 33.32 30.10 28.79 26.52 -0.153 -0.339 -0.394 -0.380 -0.295 -0.234 -0.136 0.005 0.003 0.002 0.001 0.002 0.001 -0.001 EAD FP Equity EADS NV Industrials 43.14 1.39% 04.06.2014 26.35 25.75 26.01 26.71 26.21 27.18 27.07 -0.364 -0.177 -0.166 -0.145 -0.114 -0.115 -0.069 0.032 0.006 0.003 0.001 0.000 0.001 0.002 ISP IM Equity INTESA SANPAOLO Financials 1.46 3.42% 19.05.2014 32.83 33.27 33.95 33.60 32.65 32.47 31.47 -0.326 -0.203 -0.200 -0.178 -0.110 -0.114 -0.042 0.045 0.005 0.003 0.003 0.001 0.001 0.002 PHIA NA Equity KONINKLIJKE PHILIPS NV Industrials 22.40 3.57% 02.05.2014 23.22 21.69 22.14 23.35 23.95 23.59 24.02 -0.177 -0.226 -0.209 -0.170 -0.120 -0.092 -0.086 0.036 0.010 0.006 0.004 0.002 0.001 0.001 SREN VX Equity SWISS RE AG Financials 74.20 5.12% 14.04.2014 21.22 19.16 19.06 19.33 19.72 19.82 19.99 -0.171 -0.181 -0.180 -0.152 -0.099 -0.067 -0.054 0.044 0.013 0.009 0.004 0.003 0.002 0.002 VIV FP Equity VIVENDI Telecommunication Services 15.70 6.37% 05.05.2014 32.26 27.26 27.35 27.86 29.75 27.71 27.45 -0.277 -0.133 -0.122 -0.110 -0.045 -0.007 -0.015 0.033 0.006 0.005 0.002 -0.001 0.001 0.002 G IM Equity ASSICURAZIONI GENERALI Financials 14.62 1.37% 19.05.2014 28.34 27.68 27.96 28.73 27.74 27.83 26.44 0.198 -0.250 -0.228 -0.184 -0.110 -0.063 -0.046 0.047 0.005 0.003 0.001 0.001 0.001 0.001 RI FP Equity PERNOD-RICARD SA Consumer Staples 94.17 1.85% 02.07.2013 18.61 18.27 18.71 19.62 20.37 19.63 19.45 -0.252 -0.194 -0.156 -0.134 -0.073 -0.098 -0.111 0.038 0.008 0.004 0.003 0.002 0.001 0.001 CPG LN Equity COMPASS GROUP PLC Consumer Discretionary 880.50 2.68% 22.01.2014 19.92 18.06 17.98 18.46 18.61 18.61 -0.389 -0.258 -0.187 -0.128 -0.109 -0.109 0.012 0.008 0.006 0.004 0.003 0.003 DG FP Equity VINCI SA Industrials 37.86 1.45% 11.11.2013 20.00 19.96 20.66 21.99 22.65 21.88 21.96 -0.289 -0.218 -0.211 -0.150 -0.100 -0.110 -0.082 0.038 0.009 0.006 0.003 0.001 0.002 0.003 UL NA Equity UNIBAIL-RODAMCO SE Financials 201.85 4.36% 07.05.2014 21.03 19.53 19.38 19.61 19.55 19.55 19.55 -0.260 -0.175 -0.156 -0.136 -0.116 -0.116 -0.116 0.037 0.012 0.009 0.005 0.003 0.003 0.003 EI FP Equity ESSILOR INTERNATIONAL Health Care 88.84 0.99% 26.05.2014 22.62 22.10 22.40 22.86 22.32 22.37 22.33 -0.293 -0.156 -0.148 -0.127 -0.093 -0.093 -0.094 0.027 0.005 0.004 0.003 0.001 0.001 0.001 ENEL IM Equity ENEL SPA Utilities 2.94 5.11% 23.06.2014 25.67 24.88 24.39 24.56 24.65 23.11 24.17 -0.294 -0.176 -0.145 -0.146 -0.152 -0.149 -0.085 0.068 0.006 0.004 0.001 0.001 0.001 0.001 STL NO Equity STATOIL ASA Energy 130.80 15.05.2014 25.23 17.76 18.49 19.53 18.49 20.28 0.488 0.120 0.051 -0.010 -0.064 -0.045 0.058 0.013 0.007 0.007 0.000 -0.001 SSE LN Equity SSE PLC Utilities 1592.00 5.36% 24.07.2013 14.15 13.89 14.05 13.59 -0.165 -0.131 -0.089 -0.037 0.005 0.005 0.004 0.003 SWEDA SS Equity SWEDBANK AB - A SHARES Financials 165.50 6.28% 21.03.2014 20.46 20.78 7.28 21.94 23.03 23.03 -0.489 -0.297 -0.213 -0.183 -0.051 -0.051 0.068 0.021 0.025 0.006 0.002 0.002 DPW GY Equity DEUTSCHE POST AG-REG Industrials 19.86 3.53% 30.05.2014 21.26 19.29 19.64 20.68 19.97 21.12 20.62 -0.034 -0.019 -0.037 -0.038 -0.035 -0.020 0.015 0.045 0.010 0.006 0.003 0.001 0.000 0.000 ARM LN Equity ARM HOLDINGS PLC Information Technology 1098.00 0.46% 04.09.2013 26.71 27.19 27.86 28.95 -0.101 -0.099 -0.096 -0.090 0.004 0.003 0.002 0.001 ADS GY Equity ADIDAS AG Consumer Discretionary 84.88 2.02% 09.05.2014 24.28 22.90 22.84 23.07 23.70 24.63 24.45 -0.150 -0.125 -0.116 -0.093 -0.067 -0.031 -0.009 0.039 0.009 0.005 0.002 0.000 0.000 -0.001 WPP LN Equity WPP PLC Consumer Discretionary 1156.00 2.57% 09.10.2013 24.94 24.66 24.29 23.81 -0.059 -0.047 -0.031 -0.017 0.000 0.000 0.001 0.001 SHBA SS Equity SVENSKA HANDELSBANKEN-A SHS Financials 296.80 3.77% 26.03.2014 17.78 18.71 5.16 18.55 20.30 20.30 -0.476 -0.303 -0.311 -0.216 -0.157 -0.157 0.071 0.025 0.030 0.008 0.003 0.003 VOLVB SS Equity VOLVO AB-B SHS Industrials 94.15 3.19% 03.04.2014 19.36 18.96 6.90 23.33 25.15 25.15 -0.213 -0.126 -0.096 -0.107 -0.086 -0.086 0.065 0.022 0.021 0.006 0.000 0.000 FTE FP Equity FRANCE TELECOM SA Telecommunication Services 8.30 6.03% 09.12.2013 26.13 26.07 26.61 26.17 25.01 22.61 20.49 -0.129 -0.116 -0.125 -0.100 -0.015 0.358 0.326 0.049 0.008 0.005 0.003 0.002 0.003 0.002 BA/ LN Equity BAE SYSTEMS PLC Industrials 401.70 5.05% 16.10.2013 20.44 18.75 19.17 20.84 21.10 21.10 -0.011 -0.047 -0.051 -0.073 -0.075 -0.075 0.005 0.004 0.003 0.002 0.002 0.002 SAMAS FH Equity SAMPO OYJ-A SHS Financials 32.02 4.37% 21.04.2014 17.13 15.95 16.30 17.33 -0.404 -0.209 -0.180 -0.156 0.033 0.007 0.005 0.003 EXPN LN Equity EXPERIAN PLC Industrials 1268.00 1.85% 01.01.2014 18.87 19.29 19.86 20.52 -0.150 -0.132 -0.107 -0.068 0.008 0.007 0.005 0.002 REP SQ Equity REPSOL SA Energy 18.42 3.07% 26.12.2013 28.44 27.60 26.64 25.78 23.71 24.23 24.16 -0.222 -0.384 -0.415 -0.385 -0.228 -0.291 -0.208 -0.005 0.002 0.003 0.003 0.000 0.001 -0.001 SGO FP Equity COMPAGNIE DE SAINT-GOBAIN Industrials 32.43 3.82% 09.06.2014 25.87 24.75 25.49 27.05 27.03 27.30 26.62 -0.149 -0.098 -0.122 -0.133 -0.099 -0.054 -0.067 0.040 0.009 0.005 0.002 0.001 0.002 0.002 UHR VX Equity SWATCH GROUP AG/THE-BR Consumer Discretionary 579.50 1.16% 21.05.2014 24.78 22.81 23.03 23.68 23.85 24.48 24.18 -0.331 -0.152 -0.123 -0.105 -0.087 -0.076 -0.067 0.019 0.005 0.004 0.002 0.002 0.002 0.002 HOLN VX Equity HOLCIM LTD-REG Materials 77.45 1.87% 21.04.2014 20.03 19.89 20.32 21.14 21.73 21.69 22.03 -0.354 -0.160 -0.163 -0.142 -0.089 -0.070 -0.073 0.025 0.006 0.005 0.003 0.002 0.002 0.002 CA FP Equity CARREFOUR SA Consumer Staples 23.60 2.54% 02.05.2014 31.18 31.24 31.45 31.66 32.08 31.16 30.10 -0.258 -0.175 -0.154 -0.120 -0.071 -0.079 -0.141 0.040 0.007 0.004 0.002 0.001 0.001 0.001 HEN3 GY Equity HENKEL AG & CO KGAA VORZUG Consumer Staples 76.90 1.38% 15.04.2014 18.93 18.52 18.85 19.58 20.29 20.38 20.50 -0.162 -0.099 -0.096 -0.080 -0.052 -0.027 -0.017 0.035 0.006 0.004 0.003 0.002 0.002 0.002 KNEBV FH Equity KONE OYJ-B Industrials 71.40 2.59% 25.02.2014 SHP LN Equity SHIRE PLC Health Care 2043.00 0.64% 04.09.2013 20.86 20.15 21.03 22.72 -0.069 -0.063 -0.040 -0.017 0.004 0.004 0.003 0.001 RWE GY Equity RWE AG Utilities 27.41 7.30% 22.04.2014 27.86 22.49 22.25 22.14 24.07 23.80 23.82 -0.239 -0.194 -0.186 -0.155 -0.078 -0.024 0.031 0.033 0.010 0.007 0.003 0.000 -0.001 -0.002 ATCOA SS Equity ATLAS COPCO AB-A SHS Industrials 172.90 3.33% 30.04.2014 21.51 22.53 22.60 22.80 25.22 25.22 -0.354 -0.244 -0.207 -0.164 -0.099 -0.099 0.059 0.013 0.007 0.004 0.001 0.001 PP FP Equity PPR Consumer Discretionary 172.55 3.97% 02.05.2014 24.05 23.27 23.51 24.41 24.72 22.57 22.77 -0.217 -0.139 -0.128 -0.119 -0.071 -0.052 -0.053 0.026 0.005 0.005 0.002 0.001 0.002 0.002 LGEN LN Equity LEGAL & GENERAL GROUP PLC Financials 186.40 4.35% 28.08.2013 19.47 18.62 18.83 19.64 19.84 19.84 -0.209 -0.255 -0.234 -0.151 -0.139 -0.139 0.004 0.004 0.004 0.005 0.004 0.004 TEL NO Equity TELENOR ASA Telecommunication Services133.40 4.50% 16.05.2014 24.74 18.28 19.62 19.33 -0.097 0.043 -0.027 -0.110 0.047 0.008 0.002 0.002 OML LN Equity OLD MUTUAL PLC Financials 220.70 3.31% 23.10.2013 22.02 22.20 22.45 22.88 -0.340 -0.292 -0.227 -0.127 0.012 0.010 0.008 0.004 FRE GY Equity FRESENIUS SE & CO KGAA Health Care 98.35 1.12% 20.05.2014 16.78 16.21 16.47 17.38 17.74 17.44 17.12 0.004 -0.035 -0.040 -0.076 -0.068 -0.066 -0.053 0.034 0.007 0.004 0.002 0.002 0.001 0.001 SEBA SS Equity SKANDINAVISKA ENSKILDA BAN-A Financials 70.40 4.05% 24.03.2014 18.99 19.26 6.39 20.13 21.32 21.32 -0.390 -0.302 -0.093 -0.218 -0.136 -0.136 0.075 0.028 0.021 0.009 0.004 0.004 SCAB SS Equity SVENSKA CELLULOSA AB-B SHS Consumer Staples 177.40 2.71% 11.04.2014 19.24 19.87 20.42 20.10 20.30 20.30 -0.531 -0.328 -0.245 -0.144 -0.102 -0.102 0.076 0.022 0.011 0.005 0.004 0.004 HEIA NA Equity HEINEKEN NV Consumer Staples 57.72 1.77% 26.08.2013 20.13 19.38 19.55 19.92 19.81 19.87 19.81 -0.132 -0.182 -0.158 -0.139 -0.102 -0.070 -0.047 0.033 0.007 0.005 0.003 0.002 0.001 0.001 ML FP Equity MICHELIN (CGDE) Consumer Discretionary 68.05 7.27% 13.05.2014 26.90 26.04 26.05 26.41 26.07 26.00 -0.233 -0.183 -0.179 -0.165 -0.117 -0.092 0.033 0.006 0.005 0.003 0.002 0.002 SAND SS Equity SANDVIK AB Industrials 94.55 3.97% 28.04.2014 20.57 20.65 22.77 23.00 24.20 24.20 -0.178 -0.086 -0.039 -0.116 -0.137 -0.137 0.095 0.025 0.015 0.006 0.003 0.003 RNO FP Equity RENAULT SA Consumer Discretionary 58.48 3.25% 12.05.2014 36.30 33.31 33.37 33.74 32.62 31.36 29.75 -0.225 -0.149 -0.137 -0.117 -0.063 -0.033 -0.044 0.028 0.004 0.003 0.001 0.001 0.002 0.002 CRH ID Equity CRH PLC Materials 16.65 3.76% 28.08.2013 33.94 31.10 30.40 30.49 29.68 30.06 -0.299 -0.243 -0.226 -0.179 -0.145 -0.136 0.022 0.003 0.003 0.001 0.001 0.001 AH NA Equity KONINKLIJKE AHOLD NV Consumer Staples 12.41 3.87% 22.04.2014 16.36 16.79 16.76 16.77 16.49 16.39 16.82 -0.424 -0.263 -0.233 -0.164 -0.068 -0.023 -0.010 0.054 0.021 0.014 0.007 0.004 0.004 0.004 AKZA NA Equity AKZO NOBEL Materials 49.41 3.02% 24.10.2013 21.92 22.85 23.13 23.13 23.44 23.11 23.10 -0.341 -0.229 -0.194 -0.132 -0.092 -0.074 -0.061 0.040 0.009 0.006 0.003 0.002 0.001 0.001 TLSN SS Equity TELIASONERA AB Telecommunication Services 45.54 7.14% 04.04.2014 14.11 15.98 16.22 16.65 19.46 19.46 19.46 -0.365 -0.218 -0.274 -0.229 -0.160 -0.160 -0.160 0.088 0.040 0.048 0.020 0.010 0.010 0.010 Stoxx600Index Option Implied Volatility Skew Parameters by Terms: IVt = atx + btx 2 + ct At The Money Implied Volatilities by Terms Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. 15.05.2013 Ticker Name GICS_SECTOR_NAME ATM Ref Dividend Yield Next Ex- Dividend Date ATM Vol - 30D ATM Vol - 60D ATM Vol - 90D ATM Vol - 6M ATM Vol - 12M ATM Vol - 18M ATM Vol - 24M Skew (a) - 30D Skew (a) - 60D Skew (a) - 90D Skew (a) - 6M Skew (a) - 12M Skew (a) - 18M Skew (a) - 24M Skew (b) - 30D Skew (b) - 60D Skew (b) - 90D Skew (b) - 6M Skew (b) - 12M Skew (b) - 18M Skew (b) - 24M PSON LN Equity PEARSON PLC Consumer Discretionary 1204.00 3.93% 14.08.2013 18.37 18.59 18.89 19.70 -0.120 -0.103 -0.079 -0.060 0.004 0.004 0.003 0.002 SAF FP Equity SAFRAN SA Industrials 39.65 2.52% 16.12.2013 25.18 25.17 25.16 24.40 23.81 23.81 -0.056 -0.053 -0.049 -0.051 -0.061 -0.061 0.005 0.005 0.004 0.003 0.003 0.003 DNB NO Equity DNB ASA Financials 94.95 2.63% 25.04.2014 29.41 28.09 27.07 25.01 -0.494 -0.326 -0.120 -0.116 0.082 0.019 0.002 0.004 SL/ LN Equity STANDARD LIFE PLC Financials 411.90 3.73% 11.09.2013 26.92 26.36 25.59 24.75 -0.231 -0.182 -0.117 -0.043 0.007 0.005 0.004 0.002 AV/ LN Equity AVIVA PLC Financials 322.70 6.20% 18.09.2013 21.66 21.88 21.71 22.23 21.25 23.35 22.87 -0.309 -0.253 -0.193 -0.119 -0.075 -0.028 -0.010 0.022 0.010 0.006 0.005 0.004 0.003 0.003 TLW LN Equity TULLOW OIL PLC Energy 1047.00 1.29% 04.09.2013 29.81 30.13 30.56 31.04 -0.121 -0.107 -0.087 -0.071 0.008 0.006 0.003 0.000 FME GY Equity FRESENIUS MEDICAL CARE AG & Health Care 53.05 1.41% 19.05.2014 20.70 17.66 17.77 18.27 18.30 18.81 18.66 -0.114 -0.078 -0.087 -0.094 -0.067 -0.053 -0.048 0.042 0.009 0.005 0.002 0.001 0.001 0.001 NOK1V FH Equity NOKIA OYJ Information Technology 2.92 09.05.2014 46.13 47.08 46.69 44.20 43.66 41.65 39.60 -0.268 -0.200 -0.199 -0.230 -0.219 -0.207 -0.176 0.044 0.009 0.007 0.005 0.005 0.007 0.006 WOS LN Equity WOLSELEY PLC Industrials 3380.00 2.19% 09.10.2013 19.89 19.90 19.91 20.14 0.076 0.095 0.121 0.084 0.002 0.004 0.005 0.005 REL LN Equity REED ELSEVIER PLC Consumer Discretionary 766.00 3.16% 07.08.2013 18.27 18.56 19.11 19.70 -0.185 -0.172 -0.155 -0.114 0.004 0.004 0.003 0.002 SDRL NO Equity SEADRILL LTD Energy 230.10 8.91% 10.06.2013 23.91 24.15 24.47 0.055 0.093 0.143 0.022 0.016 0.008 INVEB SS Equity INVESTOR AB-B SHS Financials 200.40 3.87% 16.04.2014 15.46 15.34 15.84 16.59 17.42 17.42 -0.256 -0.164 -0.089 -0.150 -0.164 -0.164 0.065 0.024 0.020 0.009 0.004 0.004 ASSAB SS Equity ASSA ABLOY AB-B Industrials 272.80 2.13% 28.04.2014 20.78 20.64 21.12 21.77 22.77 22.77 -0.296 -0.212 -0.224 -0.187 -0.144 -0.144 0.055 0.014 0.007 0.003 0.000 0.000 SGSN VX Equity SGS SA-REG Industrials 2346.00 1.41% 21.03.2014 21.84 21.04 21.08 21.07 20.53 20.39 -0.516 -0.145 -0.124 -0.141 -0.062 -0.079 0.026 0.004 0.002 0.003 0.001 0.001 AMS SQ Equity AMADEUS IT HOLDING SA-A SHS Information Technology 23.69 2.20% 30.01.2014 16.43 16.66 16.86 17.10 17.65 17.63 17.70 -0.103 -0.086 -0.098 -0.117 -0.081 -0.088 -0.072 0.001 0.001 0.001 0.001 0.000 0.001 0.000 CON GY Equity CONTINENTAL AG Consumer Discretionary 99.15 16.05.2014 27.62 25.44 25.49 26.07 26.35 27.15 26.72 -0.115 -0.128 -0.123 -0.101 -0.057 -0.029 -0.009 0.030 0.005 0.004 0.002 0.001 0.000 0.000 MT NA Equity ARCELORMITTAL Materials 9.77 1.59% 09.05.2014 35.14 33.83 33.80 33.98 35.00 35.75 35.93 -0.287 -0.149 -0.130 -0.124 -0.079 -0.049 -0.047 0.039 0.004 0.003 0.001 0.000 -0.001 -0.001 PUB FP Equity PUBLICIS GROUPE Consumer Discretionary 55.27 1.63% 27.06.2014 21.04 21.58 21.72 21.53 21.50 20.94 20.77 -0.141 -0.125 -0.151 -0.139 -0.104 -0.073 -0.069 0.041 0.011 0.007 0.003 0.001 0.002 0.002 LG FP Equity LAFARGE SA Materials 53.80 1.86% 03.07.2014 26.19 25.67 26.33 27.93 28.94 28.11 27.78 -0.318 -0.217 -0.179 -0.150 -0.118 -0.073 -0.056 0.035 0.009 0.007 0.003 0.001 0.002 0.001 DB1 GY Equity DEUTSCHE BOERSE AG Financials 49.27 4.26% 15.05.2014 33.75 23.50 21.84 20.26 20.23 20.97 20.21 0.013 -0.182 -0.204 -0.183 -0.147 -0.112 -0.084 0.035 0.005 0.003 0.003 0.002 0.002 0.002 PAH3 GY Equity PORSCHE AUTOMOBIL HLDG-PRF Consumer Discretionary 62.07 23.06.2014 33.37 31.70 30.12 28.26 29.42 28.88 29.23 0.038 0.023 0.004 -0.019 -0.059 -0.018 -0.029 0.028 0.000 0.000 0.000 0.000 0.001 0.001 BSY LN Equity BRITISH SKY BROADCASTING GRO Consumer Discretionary 825.50 3.53% 23.10.2013 18.41 17.09 17.53 18.58 18.51 18.51 -0.284 -0.137 -0.086 -0.057 -0.038 -0.038 0.012 0.004 0.002 0.001 -0.001 -0.001 LR FP Equity LEGRAND SA Industrials 37.98 2.63% 02.06.2014 24.55 24.60 24.68 26.23 24.22 24.22 -0.102 -0.112 -0.124 -0.130 -0.114 -0.114 0.006 0.005 0.003 0.001 0.003 0.003 RYA ID Equity RYANAIR HOLDINGS PLC Industrials 6.37 28.66 27.86 27.23 26.07 25.40 25.27 -0.350 -0.117 -0.091 -0.071 -0.042 -0.028 0.036 0.004 0.002 0.001 0.000 0.000 LAND LN Equity LAND SECURITIES GROUP PLC Financials 989.00 3.07% 11.09.2013 15.95 14.62 14.60 14.86 -0.344 -0.240 -0.182 -0.130 0.011 0.008 0.006 0.004 KGF LN Equity KINGFISHER PLC Consumer Discretionary 327.20 3.22% 09.10.2013 22.60 21.99 21.60 21.31 -0.294 -0.172 -0.108 -0.055 0.023 0.004 -0.001 0.001 TEC FP Equity TECHNIP SA Energy 84.70 2.36% 08.05.2014 23.82 24.38 25.16 26.73 28.14 27.25 -0.064 -0.063 -0.061 -0.058 -0.026 -0.009 0.004 0.003 0.002 0.000 0.000 0.001 AGN NA Equity AEGON NV Financials 5.01 4.39% 15.08.2013 27.68 27.99 27.71 28.50 27.48 25.73 24.07 -0.075 -0.181 -0.174 -0.114 -0.069 -0.047 -0.021 0.053 0.010 0.007 0.004 0.002 0.005 0.006 NXT LN Equity NEXT PLC Consumer Discretionary 4618.00 2.34% 20.11.2013 14.25 15.01 15.69 16.78 -0.090 -0.092 -0.092 -0.070 0.005 0.004 0.003 0.002 REN NA Equity REED ELSEVIER NV Consumer Discretionary 12.97 3.71% 08.08.2013 17.27 17.74 18.18 18.63 18.73 18.40 18.47 -0.228 -0.223 -0.218 -0.142 -0.090 -0.062 -0.041 0.058 0.015 0.009 0.004 0.002 0.002 0.002 ABF LN Equity ASSOCIATED BRITISH FOODS PLC Consumer Staples 2033.00 1.53% 04.12.2013 12.57 12.62 12.69 12.73 -0.051 -0.049 -0.048 -0.046 0.001 0.001 0.001 0.001 DANSKE DC EquityDANSKE BANK A/S Financials 102.30 1.96% 19.03.2014 26.39 23.64 26.51 26.10 -0.302 -0.224 -0.076 -0.052 0.067 0.016 0.001 0.000 HEI GY Equity HEIDELBERGCEMENT AG Materials 59.47 1.43% 05.05.2014 30.23 27.78 27.81 28.39 29.38 30.02 30.26 -0.425 -0.204 -0.171 -0.120 -0.085 -0.063 -0.040 0.025 0.007 0.004 0.002 0.001 0.000 -0.001 MKS LN Equity MARKS & SPENCER GROUP PLC Consumer Discretionary 437.70 3.93% 29.05.2013 25.23 25.15 24.45 23.00 22.35 21.08 20.27 0.083 0.018 0.004 -0.006 -0.011 -0.041 -0.060 0.003 0.002 0.002 0.002 0.001 0.001 0.001 SN/ LN Equity SMITH & NEPHEW PLC Health Care 778.50 2.28% 09.10.2013 14.59 15.14 15.90 17.36 -0.376 -0.325 -0.255 -0.132 0.014 0.012 0.009 0.004 DSM NA Equity KONINKLIJKE DSM NV Materials 49.02 3.16% 07.08.2013 17.82 17.11 17.78 18.96 19.52 19.44 19.09 -0.433 -0.169 -0.147 -0.143 -0.110 -0.087 -0.063 0.030 0.005 0.004 0.004 0.002 0.002 0.002 CARLB DC Equity CARLSBERG AS-B Consumer Staples 576.50 1.13% 24.03.2014 28.66 25.61 24.79 25.47 -0.062 0.012 0.002 0.033 0.006 0.000 0.000 -0.001 ACA FP Equity CREDIT AGRICOLE SA Financials 7.19 26.05.2014 35.29 34.49 35.29 37.03 35.30 36.90 35.40 -0.184 -0.116 -0.145 -0.129 -0.046 0.066 0.087 0.047 0.010 0.007 0.002 0.001 -0.001 -0.002 TEN IM Equity TENARIS SA Energy 16.86 1.98% 18.11.2013 22.86 22.91 23.27 24.22 -0.156 -0.170 -0.147 -0.125 0.031 0.007 0.006 0.004 MRW LN Equity WM MORRISON SUPERMARKETS Consumer Staples 282.00 4.63% 25.09.2013 14.22 14.15 15.11 16.36 0.042 0.143 0.091 -0.043 0.002 0.008 0.007 0.001 SCMN VX Equity SWISSCOM AG-REG Telecommunication Services433.60 5.07% 11.04.2014 12.68 11.25 11.61 12.30 12.98 13.28 13.44 -0.276 -0.163 -0.168 -0.193 -0.130 -0.086 -0.071 0.042 0.013 0.009 0.006 0.003 0.003 0.003 MRK GY Equity MERCK KGAA Health Care 119.10 1.51% 22.04.2014 23.04 21.25 21.50 21.79 21.42 20.94 20.80 -0.299 -0.183 -0.156 -0.116 -0.104 -0.098 -0.101 0.034 0.006 0.004 0.002 0.000 0.000 0.001 RBS LN Equity ROYAL BANK OF SCOTLAND GROUP Financials 308.00 07.08.2013 32.53 31.33 31.56 32.28 32.16 32.04 32.57 -0.273 -0.200 -0.173 -0.134 -0.093 -0.065 0.000 0.029 0.006 0.005 0.002 0.001 0.000 -0.002 GIVN VX Equity GIVAUDAN-REG Materials 1270.00 3.15% 26.03.2014 17.41 16.27 16.49 17.12 17.60 17.53 -0.462 -0.179 -0.151 -0.122 -0.079 -0.058 0.018 0.005 0.005 0.004 0.002 0.002 CPI LN Equity CAPITA PLC Industrials 948.00 2.69% 11.09.2013 CDI FP Equity CHRISTIAN DIOR Consumer Discretionary 139.00 2.16% 29.11.2013 23.75 23.92 24.14 24.52 25.09 25.09 -0.136 -0.144 -0.156 -0.154 -0.122 -0.122 0.004 0.004 0.004 0.003 0.002 0.002 GEBN VX Equity GEBERIT AG-REG Industrials 239.00 3.01% 08.04.2014 16.69 16.71 17.13 18.09 19.72 19.69 -0.288 -0.246 -0.214 -0.163 -0.106 -0.093 0.034 0.008 0.006 0.004 0.002 0.002 MAERSKB DC EquityAP MOELLER-MAERSK A/S-B Industrials 40600.00 2.96% 14.04.2014 29.32 21.91 22.13 22.16 -0.107 -0.119 -0.097 -0.060 0.011 0.002 0.001 0.000 BRBY LN Equity BURBERRY GROUP PLC Consumer Discretionary 1421.00 2.04% 03.07.2013 32.38 31.92 31.18 30.22 30.75 31.11 -0.158 0.017 0.002 -0.005 0.003 0.008 0.026 0.001 0.000 -0.001 -0.001 -0.002 SESG FP Equity SES Consumer Discretionary 22.75 4.70% 18.04.2014 FI IM Equity FIAT INDUSTRIAL Industrials 8.80 3.13% 21.04.2014 27.26 27.27 27.79 28.70 29.62 29.62 -0.035 -0.278 -0.252 -0.182 -0.122 -0.122 0.043 0.008 0.006 0.002 0.000 0.000 IFX GY Equity INFINEON TECHNOLOGIES AG Information Technology 6.54 1.99% 07.03.2014 34.38 31.51 31.81 32.79 32.78 33.20 32.62 -0.348 -0.204 -0.196 -0.126 -0.075 -0.055 0.009 0.034 0.005 0.004 0.002 0.001 0.001 0.001 BAER VX Equity JULIUS BAER GROUP LTD Financials 39.32 1.65% 11.04.2014 23.94 20.39 20.78 21.87 24.12 25.11 25.27 -0.401 -0.181 -0.161 -0.143 -0.091 -0.083 -0.076 0.029 0.006 0.004 0.002 0.001 0.001 0.001 SKFB SS Equity SKF AB-B SHARES Industrials 160.40 3.58% 29.04.2014 18.95 20.38 20.91 21.36 22.94 22.94 -0.315 -0.206 -0.220 -0.134 -0.108 -0.108 0.059 0.016 0.011 0.004 0.002 0.002 EBS AV Equity ERSTE GROUP BANK AG Financials 25.49 1.57% 22.05.2014 33.62 30.46 31.28 32.74 36.64 36.87 -0.246 -0.131 -0.114 -0.072 0.500 0.634 0.079 0.012 0.004 0.003 -0.002 -0.003 BEI GY Equity BEIERSDORF AG Consumer Staples 69.90 1.29% 22.04.2014 18.21 18.12 18.36 19.10 19.00 18.45 18.25 -0.220 -0.109 -0.111 -0.113 -0.065 -0.057 -0.044 0.031 0.005 0.003 0.003 0.001 0.001 0.002 SOLB BB Equity SOLVAY SA Materials 114.45 2.84% 16.01.2014 26.66 24.85 25.29 26.36 26.08 26.08 -0.157 -0.157 -0.141 -0.110 -0.096 -0.096 0.029 0.006 0.004 0.001 0.002 0.002 BLND LN Equity BRITISH LAND CO PLC Financials 635.00 4.25% 02.10.2013 13.62 13.97 14.24 14.97 -0.457 -0.362 -0.228 -0.089 0.020 0.016 0.010 0.001 ADN LN Equity ABERDEEN ASSET MGMT PLC Financials 475.90 3.07% 04.12.2013 LUX IM Equity LUXOTTICA GROUP SPA Consumer Discretionary 42.19 1.37% 19.05.2014 22.94 22.57 22.38 22.85 23.22 23.22 -0.049 -0.162 -0.147 -0.108 -0.071 -0.071 0.028 0.005 0.005 0.003 0.002 0.002 KBC BB Equity KBC GROEP NV Financials 31.43 13.05.2015 41.74 35.89 35.27 34.33 33.10 33.10 -0.243 -0.190 -0.177 -0.142 -0.110 -0.110 0.024 0.003 0.003 0.003 0.002 0.002 CBK GY Equity COMMERZBANK AG Financials 7.79 23.05.2014 53.93 45.27 44.35 42.78 39.65 37.68 37.10 -0.743 -0.498 -0.411 -0.287 -0.206 -0.162 0.051 0.034 0.011 0.007 0.003 0.003 0.002 -0.001 TIT IM Equity TELECOM ITALIA SPA Telecommunication Services 0.64 3.13% 21.04.2014 44.92 44.28 42.32 39.08 37.74 37.57 36.46 -0.639 -0.065 -0.078 -0.081 -0.047 -0.016 -0.046 0.060 0.005 0.003 0.001 0.000 -0.001 0.000 AGS BB Equity AGEAS Financials 28.73 4.18% 28.04.2014 31.29 25.66 25.07 25.11 24.97 24.53 25.25 -0.304 -0.111 -0.106 -0.087 -0.066 -0.029 -0.022 0.022 0.003 0.002 0.001 0.001 0.000 0.000 JMAT LN Equity JOHNSON MATTHEY PLC Materials 2644.00 2.34% 12.06.2013 KYG ID Equity KERRY GROUP PLC-A Consumer Staples 45.33 0.87% 16.10.2013 19.73 19.20 19.26 19.72 20.30 20.35 -0.084 -0.104 -0.106 -0.117 -0.091 -0.085 0.034 0.003 0.000 0.001 0.001 0.001 ITRK LN Equity INTERTEK GROUP PLC Industrials 3452.00 1.24% 30.10.2013 FUM1V FH Equity FORTUM OYJ Utilities 14.72 6.79% 10.04.2014 21.87 22.82 23.15 23.05 -0.309 -0.127 -0.099 -0.079 0.034 0.005 0.002 0.001 CAP FP Equity CAP GEMINI Information Technology 39.45 2.53% 04.06.2014 25.74 25.81 27.00 29.00 28.74 29.11 29.16 -0.278 -0.183 -0.169 -0.130 -0.092 -0.072 -0.071 0.040 0.010 0.006 0.002 0.001 0.001 0.001 SW FP Equity SODEXO Consumer Discretionary 64.98 2.74% 30.01.2014 20.99 20.86 20.68 20.34 19.74 19.03 18.75 -0.193 -0.185 -0.176 -0.144 -0.082 -0.089 -0.079 0.011 0.009 0.006 0.002 0.002 0.003 0.003 SRG IM Equity SNAM SPA Utilities 3.80 6.59% 21.10.2013 17.10 15.82 15.65 15.69 15.54 15.54 0.241 -0.013 -0.083 -0.047 -0.031 -0.031 0.058 0.008 0.002 0.002 0.001 0.001 ALO FP Equity ALSTOM Industrials 29.15 2.88% 03.07.2014 29.73 29.37 29.45 29.65 29.75 28.93 28.41 -0.240 -0.149 -0.131 -0.109 -0.089 -0.094 -0.091 0.034 0.005 0.004 0.002 0.001 0.002 0.003 KD8 GY Equity KABEL DEUTSCHLAND HOLDING AG Consumer Discretionary 75.41 3.32% 13.10.2014 20.25 20.49 21.41 22.71 22.60 22.66 22.74 -0.232 -0.101 -0.095 -0.101 -0.086 -0.085 -0.074 0.017 0.002 0.001 0.001 0.000 0.000 0.000 SBRY LN Equity SAINSBURY (J) PLC Consumer Staples 378.10 4.60% 20.11.2013 20.11 20.18 20.26 20.38 20.32 20.32 0.009 0.023 0.021 -0.009 0.013 0.013 0.009 0.005 0.003 0.002 0.001 0.001 IHG LN Equity INTERCONTINENTAL HOTELS GROU Consumer Discretionary 1954.00 2.35% 21.08.2013 20.05 20.29 20.61 21.71 0.025 -0.007 -0.051 -0.097 0.010 0.008 0.006 0.001 BNR GY Equity BRENNTAG AG Industrials 120.70 1.99% 20.06.2014 19.57 20.11 20.51 20.86 20.28 20.31 19.51 -0.126 -0.106 -0.102 -0.098 -0.077 -0.067 -0.051 0.033 0.004 0.001 0.000 0.001 0.001 0.002 YAR NO Equity YARA INTERNATIONAL ASA Materials 258.00 16.05.2014 22.52 21.23 23.82 23.50 0.099 -0.005 -0.079 -0.139 0.051 0.010 0.000 0.003 UU/ LN Equity UNITED UTILITIES GROUP PLC Utilities 762.50 4.58% 19.06.2013 25.89 25.21 24.28 22.29 -0.122 -0.091 -0.049 -0.001 -0.002 -0.001 -0.001 0.000 DSY FP Equity DASSAULT SYSTEMES SA Information Technology 93.58 0.85% 16.06.2014 15.96 16.42 17.05 18.44 19.60 19.60 -0.084 -0.102 -0.126 -0.133 -0.099 -0.099 0.016 0.013 0.008 0.003 0.002 0.002 SMIN LN Equity SMITHS GROUP PLC Industrials 1315.00 3.09% 23.10.2013 DE NA Equity DE MASTER BLENDERS1753 NV Consumer Staples 12.12 13.63 12.58 14.28 15.95 14.64 14.64 14.64 -0.374 -0.329 -0.374 -0.416 -0.214 -0.214 -0.214 0.064 0.032 0.024 0.011 0.005 0.005 0.005 WEIR LN Equity WEIR GROUP PLC/THE Industrials 2419.00 1.66% 02.10.2013 EDP PL Equity EDP-ENERGIAS DE PORTUGAL SA Utilities 2.60 14.21% 12.05.2014 WRT1V FH Equity WARTSILA OYJ ABP Industrials 38.83 2.83% 10.03.2014 NZYMB DC Equity NOVOZYMES A/S-B SHARES Materials 204.10 1.15% 27.02.2014 19.93 20.70 22.15 22.00 0.121 -0.018 -0.029 -0.011 0.034 0.003 0.000 0.000 SVT LN Equity SEVERN TRENT PLC Utilities 2085.00 3.72% 19.06.2013 19.50 20.24 21.26 19.70 0.349 0.255 0.128 -0.035 0.051 0.039 0.022 0.001 SWMA SS Equity SWEDISH MATCH AB Consumer Staples 242.70 3.30% 05.05.2014 22.93 23.86 23.36 22.48 -0.419 -0.101 -0.044 -0.015 0.044 0.010 0.003 0.003 GKN LN Equity GKN PLC Consumer Discretionary 292.30 2.84% 07.08.2013 SDF GY Equity K+S AG-REG Materials 33.18 15.05.2014 21.43 20.86 20.83 21.18 21.54 23.10 22.52 0.129 -0.008 -0.008 -0.009 -0.009 0.005 0.020 0.041 0.006 0.004 0.003 0.001 0.001 0.001 WTB LN Equity WHITBREAD PLC Consumer Discretionary 2705.00 2.29% 06.11.2013 17.26 17.07 16.81 17.04 0.084 0.075 0.064 0.047 0.007 0.007 0.008 0.008 ADEN VX Equity ADECCO SA-REG Industrials 55.15 3.26% 28.04.2014 22.45 22.33 23.00 24.43 25.19 24.84 25.23 -0.249 -0.167 -0.162 -0.139 -0.099 -0.090 -0.101 0.035 0.006 0.004 0.003 0.001 0.001 0.001 TKA GY Equity THYSSENKRUPP AG Materials 14.79 1.69% 20.01.2014 53.87 40.04 38.10 35.64 33.68 33.65 33.65 -0.189 -0.080 -0.065 -0.051 -0.003 0.019 0.056 0.014 0.003 0.002 0.001 0.001 0.000 -0.001 HEXAB SS Equity HEXAGON AB-B SHS Information Technology 202.50 1.23% 12.05.2014 26.01 28.20 29.36 29.36 0.000 -0.070 -0.107 -0.107 0.000 -0.001 -0.001 -0.001 SPM IM Equity SAIPEM SPA Energy 22.22 3.06% 19.05.2014 23.99 23.97 24.48 25.59 26.32 26.32 -0.114 -0.049 -0.062 -0.044 0.040 0.040 0.027 0.005 0.004 0.002 0.000 0.000 AGK LN Equity AGGREKO PLC Industrials 1749.00 1.50% 04.09.2013 OMV AV Equity OMV AG Energy 38.51 3.11% 19.05.2014 22.92 21.51 21.99 21.79 29.50 30.48 -0.697 -0.137 -0.077 -0.157 0.616 0.773 0.044 0.008 0.005 0.003 -0.003 -0.005 ITV LN Equity ITV PLC Consumer Discretionary 129.00 2.40% 30.10.2013 20.55 20.69 20.88 20.56 0.252 0.197 0.123 0.025 0.022 0.017 0.010 0.002 ORK NO Equity ORKLA ASA Consumer Staples 51.45 4.86% 18.04.2014 26.92 23.53 21.77 19.51 -0.436 -0.105 -0.072 -0.220 0.099 0.030 0.015 0.008 EN FP Equity BOUYGUES SA Industrials 21.37 7.49% 30.04.2014 43.59 33.86 32.90 32.16 32.78 31.16 31.18 -0.162 -0.100 -0.094 -0.089 -0.033 0.017 0.056 0.024 0.005 0.003 0.002 0.000 0.000 -0.001 ATLN VX Equity ACTELION LTD-REG Health Care 59.55 1.68% 22.04.2014 23.81 22.51 22.56 23.05 23.82 23.85 -0.628 -0.219 -0.157 -0.137 -0.106 -0.095 0.036 0.006 0.004 0.003 0.002 0.002 ALFA SS Equity ALFA LAVAL AB Industrials 150.00 2.50% 24.04.2014 20.64 22.33 22.82 22.65 23.99 23.99 -0.319 -0.170 -0.120 -0.118 -0.094 -0.094 0.059 0.014 0.005 0.003 0.000 0.000 FER SQ Equity FERROVIAL SA Industrials 13.24 3.40% 12.12.2013 25.31 25.11 25.20 25.41 24.83 24.48 24.41 -0.040 -0.057 -0.076 -0.131 -0.099 -0.095 -0.075 0.000 0.001 0.000 0.000 -0.001 0.000 0.000 COLOB DC Equity COLOPLAST-B Health Care 331.50 1.51% 12.12.2013 SKAB SS Equity SKANSKA AB-B SHS Industrials 119.70 5.22% 14.04.2014 16.57 17.83 19.00 18.82 19.61 19.61 -0.324 -0.344 -0.208 -0.173 -0.153 -0.153 0.102 0.024 0.025 0.009 0.002 0.002 SCHP VX Equity SCHINDLER HOLDING-PART CERT Industrials 139.60 1.72% 28.03.2014 17.65 18.26 18.62 19.31 17.60 17.64 -0.127 -0.112 -0.101 -0.082 -0.055 -0.026 0.026 0.005 0.002 0.002 0.002 0.002 KPN NA Equity KONINKLIJKE KPN NV Telecommunication Services 1.69 26.07.2013 52.64 48.33 45.19 41.31 39.80 40.35 39.98 -0.306 -0.054 -0.003 -0.037 -0.014 -0.050 -0.062 0.051 0.007 0.008 0.006 0.003 0.000 0.000 RRS LN Equity RANDGOLD RESOURCES LTD Materials 4804.00 0.75% 07.05.2014 35.28 33.72 31.59 30.22 -0.244 -0.178 -0.089 -0.087 -0.006 -0.004 -0.002 0.001 BNZL LN Equity BUNZL PLC Industrials 1332.00 2.27% 06.11.2013 GAS SQ Equity GAS NATURAL SDG SA Utilities 16.55 5.52% 08.01.2014 29.07 27.91 27.10 26.02 24.70 23.00 23.29 -0.113 -0.067 -0.052 -0.054 -0.020 0.143 0.083 0.003 0.001 0.000 0.000 -0.001 -0.001 -0.002 CCL LN Equity CARNIVAL PLC Consumer Discretionary 2396.00 2.74% 21.08.2013 19.93 20.33 20.87 22.27 0.029 -0.005 -0.050 -0.088 0.010 0.008 0.005 0.001 ABE SQ Equity ABERTIS INFRAESTRUCTURAS SA Industrials 14.83 4.45% 31.10.2013 21.09 21.60 21.72 21.86 20.92 20.37 20.24 -0.118 -0.131 -0.145 -0.182 -0.151 -0.147 -0.121 0.001 0.001 0.001 0.002 0.002 0.002 0.002 WKL NA Equity WOLTERS KLUWER Consumer Discretionary 17.05 4.28% 28.04.2014 18.35 18.22 18.45 19.18 20.29 20.93 21.24 -0.324 -0.198 -0.180 -0.153 -0.109 -0.073 -0.069 0.053 0.015 0.009 0.005 0.003 0.002 0.001 EDF FP Equity EDF Utilities 18.13 6.89% 12.12.2013 23.36 22.06 22.26 22.30 22.34 21.58 21.21 -0.175 -0.067 -0.088 -0.087 -0.038 0.007 0.071 0.042 0.009 0.006 0.003 0.002 0.003 0.004 SGE LN Equity SAGE GROUP PLC/THE Information Technology 352.50 3.08% 12.02.2014 14.76 17.08 20.24 24.82 0.227 0.252 0.286 0.303 0.026 0.019 0.010 -0.003 IMI LN Equity IMI PLC Industrials 1329.00 2.71% 04.09.2013 REX LN Equity REXAM PLC Materials 537.50 3.16% 07.08.2013 GBLB BB Equity GROUPE BRUXELLES LAMBERT SA Financials 61.97 4.41% 28.04.2014 12.99 12.24 12.53 13.48 13.88 13.88 -0.081 -0.117 -0.135 -0.172 -0.139 -0.139 0.039 0.012 0.008 0.004 0.003 0.003 DELB BB Equity DELHAIZE GROUP Consumer Staples 48.60 2.88% 28.05.2014 26.68 25.89 25.93 25.94 25.11 25.11 -0.441 -0.154 -0.129 -0.093 -0.076 -0.076 0.024 0.008 0.006 0.004 0.003 0.003 ELUXB SS Equity ELECTROLUX AB-SER B Consumer Discretionary 179.50 3.90% 26.03.2014 21.92 22.57 23.96 24.60 24.98 24.98 -0.295 -0.176 -0.186 -0.143 -0.142 -0.142 0.061 0.012 0.005 0.001 0.002 0.002 BVI FP Equity BUREAU VERITAS SA Industrials 92.95 1.97% 11.06.2014 25.49 25.80 25.74 25.61 25.32 25.73 -0.157 0.002 0.005 0.006 0.004 0.018 0.020 0.000 0.000 0.000 0.000 0.000 G1A GY Equity GEA GROUP AG Industrials 27.80 2.16% 22.04.2014 21.67 20.79 21.49 23.21 24.73 24.54 24.40 -0.361 -0.197 -0.163 -0.109 -0.115 -0.119 -0.125 0.036 0.010 0.007 0.002 0.001 0.001 0.002 BAB LN Equity BABCOCK INTL GROUP PLC Industrials 1152.00 2.38% 11.12.2013 HEIO NA Equity HEINEKEN HOLDING NV Consumer Staples 49.49 2.06% 26.08.2013 RSA LN Equity RSA INSURANCE GROUP PLC Financials 113.60 7.41% 25.09.2013 17.18 14.95 15.42 16.83 17.43 17.43 0.041 -0.087 -0.075 -0.021 -0.026 -0.026 0.002 0.003 0.004 0.004 0.002 0.002 MGGT LN Equity MEGGITT PLC Industrials 520.00 2.40% 14.08.2013 VK FP Equity VALLOUREC Industrials 41.10 1.68% 05.06.2014 31.22 30.16 30.65 31.94 31.29 31.24 30.06 -0.331 -0.226 -0.182 -0.129 -0.079 -0.051 -0.043 0.034 0.006 0.004 0.002 0.001 0.001 0.003 At The Money Implied Volatilities by Terms Stoxx600Index Option Implied Volatility Skew Parameters by Terms: IVt = atx + btx2 + ct Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 15.05.2013 Ticker Name GICS_SECTOR_NAME ATM2 Ref Dividend Yield Next Ex- Dividend Date ATM2 Vol - 30D ATM2 Vol - 60D ATM2 Vol - 90D ATM2 Vol - 6M ATM2 Vol - 12M ATM2 Vol - 18M ATM2 Vol - 24M Skew (a) - 30D Skew (a) - 60D Skew (a) - 90D Skew (a) - 6M Skew (a) - 12M Skew (a) - 18M Skew (a) - 24M Skew (b) - 30D Skew (b) - 60D Skew (b) - 90D Skew (b) - 6M Skew (b) - 12M Skew (b) - 18M Skew (b) - 24M BAB LN Equity BABCOCK INTL GROUP PLC Industrials 1152.00 2.38% 11.12.2013 LUPE SS Equity LUNDIN PETROLEUM AB Energy 144.90 26.58 25.66 27.54 27.95 28.95 28.95 -0.558 -0.080 -0.025 -0.036 -0.008 -0.008 0.074 0.014 0.005 0.002 -0.002 -0.002 AC FP Equity ACCOR SA Consumer Discretionary 26.10 11.06.2014 26.44 26.11 26.48 27.42 26.91 27.22 -0.098 -0.166 -0.166 -0.153 -0.107 -0.124 0.026 0.002 0.002 0.001 0.001 0.001 TEL2B SS Equity TELE2 AB-B SHS Telecommunication Services107.80 30.61% 13.05.2014 27.67 67.91 72.25 34.19 39.48 39.48 2.588 0.067 -0.391 1.254 1.194 1.194 0.045 -0.008 -0.012 -0.021 -0.028 -0.028 FER SQ Equity FERROVIAL SA Industrials 13.24 3.40% 12.12.2013 25.31 25.11 25.20 25.41 24.83 24.48 24.41 -0.040 -0.057 -0.076 -0.131 -0.099 -0.095 -0.075 0.000 0.001 0.000 0.000 -0.001 0.000 0.000 SCVB SS Equity SCANIA AB-B SHS Industrials 143.70 3.41% 06.05.2014 21.83 22.49 22.90 22.57 22.85 22.85 -0.312 -0.257 -0.232 -0.223 -0.159 -0.159 0.065 0.019 0.007 0.004 0.002 0.002 G1A GY Equity GEA GROUP AG Industrials 27.80 2.16% 22.04.2014 21.67 20.79 21.49 23.21 24.73 24.54 24.40 -0.361 -0.197 -0.163 -0.109 -0.115 -0.119 -0.125 0.036 0.010 0.007 0.002 0.001 0.001 0.002 GKN LN Equity GKN PLC Consumer Discretionary 292.30 2.84% 07.08.2013 HMSO LN Equity HAMMERSON PLC Financials 554.50 3.23% 14.08.2013 ELN ID Equity ELAN CORP PLC Health Care 8.73 35.55 35.75 35.96 36.22 36.01 35.75 -0.153 -0.039 -0.030 -0.009 0.008 0.011 0.035 0.001 0.000 0.000 0.000 0.000 ITV LN Equity ITV PLC Consumer Discretionary 129.00 2.40% 30.10.2013 20.55 20.69 20.88 20.56 0.252 0.197 0.123 0.025 0.022 0.017 0.010 0.002 REE SQ Equity RED ELECTRICA CORPORACION SA Utilities 41.48 5.86% 02.01.2014 25.16 23.84 22.76 21.55 19.73 19.19 18.89 -0.111 -0.126 -0.111 -0.135 -0.080 -0.112 -0.069 0.002 0.002 0.001 0.002 0.001 0.002 0.001 OMV AV Equity OMV AG Energy 38.51 3.11% 19.05.2014 22.92 21.51 21.99 21.79 29.50 30.48 -0.697 -0.137 -0.077 -0.157 0.616 0.773 0.044 0.008 0.005 0.003 -0.003 -0.005 EDEN FP Equity EDENRED Industrials 26.21 3.13% 26.05.2014 25.34 25.17 24.48 23.46 22.67 22.86 0.051 0.037 0.004 -0.056 -0.040 -0.019 0.016 0.000 0.002 0.001 0.000 0.001 TATE LN Equity TATE & LYLE PLC Consumer Staples 874.50 3.02% 26.06.2013 16.10 16.13 15.70 14.96 0.045 0.022 -0.010 -0.051 0.006 0.006 0.005 0.002 HEXAB SS Equity HEXAGON AB-B SHS Information Technology 202.50 1.23% 12.05.2014 26.01 28.20 29.36 29.36 0.000 -0.070 -0.107 -0.107 0.000 -0.001 -0.001 -0.001 SOON VX Equity SONOVA HOLDING AG-REG Health Care 103.10 1.36% 21.06.2013 24.97 24.65 24.52 24.33 24.29 24.40 -0.215 -0.101 -0.090 -0.095 -0.084 -0.080 0.032 0.003 0.002 0.002 0.002 0.002 CRDA LN Equity CRODA INTERNATIONAL PLC Materials 2576.00 2.49% 28.08.2013 EKTAB SS Equity ELEKTA AB-B SHS Health Care 103.80 1.35% 05.09.2013 20.18 20.18 20.99 23.05 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000 ATL IM Equity ATLANTIA SPA Industrials 13.89 5.51% 18.11.2013 19.99 20.31 20.82 21.17 22.60 22.60 -0.231 -0.208 -0.186 -0.140 -0.141 -0.141 0.034 0.009 0.005 0.003 0.002 0.002 HEIO NA Equity HEINEKEN HOLDING NV Consumer Staples 49.49 2.06% 26.08.2013 GA FP Equity CIE GENERALE DE GEOPHYSIQUE Energy #N/A N/A NRE1V FH Equity NOKIAN RENKAAT OYJ Consumer Discretionary 33.23 4.81% 14.04.2014 28.34 27.68 28.11 -0.126 -0.075 -0.042 0.013 0.001 0.000 FRES LN Equity FRESNILLO PLC Materials 1120.00 3.58% 14.08.2013 38.32 37.33 35.97 34.29 -0.175 -0.164 -0.150 -0.118 0.000 0.000 0.000 0.000 GRF SQ Equity GRIFOLS SA Health Care 29.14 0.75% 01.07.2013 29.19 27.18 26.30 24.45 22.25 22.28 22.35 -0.086 -0.099 -0.102 -0.112 -0.110 -0.090 -0.082 0.001 0.001 0.001 0.001 0.000 0.000 -0.001 MGGT LN Equity MEGGITT PLC Industrials 520.00 2.40% 14.08.2013 TRN IM Equity TERNA SPA Utilities 3.51 5.69% 25.11.2013 15.52 13.86 13.64 14.43 14.65 14.65 -0.198 -0.193 -0.136 -0.076 -0.070 -0.070 0.034 0.010 0.006 0.002 0.001 0.001 COLOB DC Equity COLOPLAST-B Health Care 331.50 1.51% 12.12.2013 CO FP Equity CASINO GUICHARD PERRACHON Consumer Staples 83.70 3.94% 24.04.2014 21.37 20.20 20.64 21.52 21.91 21.24 21.42 -0.361 -0.223 -0.197 -0.150 -0.100 -0.071 -0.047 0.032 0.008 0.006 0.003 0.002 0.002 0.002 SCR FP Equity SCOR SE Financials 22.78 5.49% 07.05.2014 21.42 21.36 21.28 21.62 22.29 22.29 -0.171 -0.170 -0.169 -0.157 -0.126 -0.126 0.014 0.012 0.008 0.003 0.002 0.002 FUR NA Equity FUGRO NV-CVA Energy 43.47 3.68% 12.05.2014 23.28 22.77 23.65 25.25 25.76 25.76 25.76 -0.353 -0.159 -0.154 -0.146 -0.129 -0.129 -0.129 0.036 0.007 0.005 0.004 0.002 0.002 0.002 MRO LN Equity MELROSE INDUSTRIES PLC Industrials 253.30 3.40% 18.09.2013 GAS SQ Equity GAS NATURAL SDG SA Utilities 16.55 5.52% 08.01.2014 29.07 27.91 27.10 26.02 24.70 23.00 23.29 -0.113 -0.067 -0.052 -0.054 -0.020 0.143 0.083 0.003 0.001 0.000 0.000 -0.001 -0.001 -0.002 MEO1V FH Equity METSO OYJ Industrials 31.91 5.80% 02.04.2014 25.98 25.39 26.51 -0.204 -0.119 -0.086 0.012 0.001 0.000 F IM Equity FIAT SPA Consumer Discretionary 5.36 21.04.2014 42.15 41.54 41.20 40.70 39.53 38.60 37.17 -0.084 -0.143 -0.162 -0.158 -0.185 -0.221 -0.218 0.029 0.004 0.002 0.001 0.001 0.001 0.002 WG/ LN Equity WOOD GROUP (JOHN) PLC Energy 805.50 1.63% 28.08.2013 VK FP Equity VALLOUREC Industrials 41.10 1.68% 05.06.2014 31.22 30.16 30.65 31.94 31.29 31.24 30.06 -0.331 -0.226 -0.182 -0.129 -0.079 -0.051 -0.043 0.034 0.006 0.004 0.002 0.001 0.001 0.003 KINVB SS Equity INVESTMENT AB KINNEVIK-B SHS Financials 169.40 16.05.2014 23.08 23.03 22.97 21.35 -0.383 -0.287 -0.162 0.000 0.007 0.005 0.003 0.000 BOL SS Equity BOLIDEN AB Materials 96.35 4.46% 05.05.2014 29.03 27.05 27.05 27.48 27.83 27.83 -0.464 -0.253 -0.225 -0.136 -0.137 -0.137 0.065 0.013 0.009 0.002 0.003 0.003 IMI LN Equity IMI PLC Industrials 1329.00 2.71% 04.09.2013 SRP LN Equity SERCO GROUP PLC Industrials 632.50 1.57% 05.09.2013 ARYN SE Equity ARYZTA AG Consumer Staples 59.70 1.17% 29.01.2014 17.38 17.79 18.13 18.88 18.52 18.90 -0.266 -0.052 -0.015 -0.013 0.002 -0.019 0.028 0.002 0.000 0.000 0.001 0.000 SPSN VX Equity SWISS PRIME SITE-REG Financials 78.35 4.59% 21.04.2014 13.85 13.11 13.29 13.53 14.09 14.00 -0.319 -0.140 -0.063 -0.013 -0.014 -0.009 0.022 0.005 0.003 0.003 0.002 0.002 VIE FP Equity VEOLIA ENVIRONNEMENT Utilities 10.67 6.56% 22.05.2014 27.65 27.66 28.63 29.79 30.19 29.02 28.40 -0.054 -0.034 -0.078 -0.075 -0.017 -0.002 0.039 0.048 0.007 0.004 0.001 0.000 0.003 0.004 EEEK GA Equity COCA-COLA HELLENIC BOTTLING Consumer Staples 20.27 25.06.2014 SIK VX Equity SIKA AG-BR Materials 2384.00 2.35% 17.04.2014 20.66 20.08 19.56 18.55 17.97 17.91 -0.621 -0.156 -0.074 -0.084 -0.070 -0.077 0.026 0.006 0.002 0.002 0.001 0.001 ANDR AV Equity ANDRITZ AG Industrials 43.83 3.31% 26.03.2014 28.50 25.62 25.83 26.37 20.05 17.04 -0.357 0.005 -0.004 0.023 0.389 0.558 0.043 0.010 0.006 0.005 0.002 0.003 MTX GY Equity MTU AERO ENGINES HOLDING AG Industrials 78.34 2.11% 09.05.2014 24.60 23.03 23.05 23.44 23.66 23.16 22.82 -0.276 -0.044 -0.052 -0.051 -0.022 -0.007 -0.001 0.021 0.004 0.003 0.002 0.002 0.002 0.002 TPK LN Equity TRAVIS PERKINS PLC Industrials 1487.00 1.95% 09.10.2013 HNR1 GY Equity HANNOVER RUECKVERSICHERU-REG Financials 61.44 4.39% 08.05.2014 21.92 21.06 21.50 22.25 22.75 22.26 21.46 -0.160 -0.126 -0.124 -0.111 -0.073 -0.053 -0.061 0.033 0.007 0.004 0.002 0.001 0.001 0.002 QIA GY Equity QIAGEN N.V. Health Care 14.70 23.58 23.25 23.41 23.89 24.28 24.19 24.20 -0.208 -0.037 -0.028 -0.084 -0.074 -0.073 -0.072 0.045 0.005 0.002 0.001 0.001 0.001 0.001 NHY NO Equity NORSK HYDRO ASA Materials 26.06 2.88% 09.05.2014 39.70 31.07 32.84 28.41 -0.719 -0.218 -0.218 -0.072 0.105 0.031 0.018 0.002 ETL FP Equity EUTELSAT COMMUNICATIONS Consumer Discretionary 25.22 4.36% 14.11.2013 18.52 18.19 18.12 18.33 19.30 19.23 0.038 0.052 0.021 -0.002 0.000 -0.027 0.038 0.002 0.000 0.000 0.000 0.000 VPK NA Equity VOPAK Industrials 45.67 2.15% 28.04.2014 23.42 21.48 21.15 20.90 20.59 20.59 -0.029 -0.070 -0.082 -0.080 -0.086 -0.086 0.037 0.006 0.004 0.003 0.002 0.002 BALN VX Equity BALOISE HOLDING AG - REG Financials 94.40 4.77% 06.05.2014 18.11 17.22 17.27 17.45 17.53 16.66 15.61 -0.195 -0.194 -0.191 -0.168 -0.102 -0.068 -0.064 0.043 0.011 0.007 0.004 0.003 0.003 0.003 PNN LN Equity PENNON GROUP PLC Utilities 696.50 4.18% 07.08.2013 ISAT LN Equity INMARSAT PLC Telecommunication Services672.00 4.78% 02.10.2013 DSV DC Equity DSV A/S Industrials 141.50 1.10% 24.03.2014 24.09 21.94 23.62 23.44 -0.368 -0.169 -0.122 -0.065 0.031 0.004 0.002 0.002 TNTE NA Equity TNT EXPRESS NV Industrials 5.86 1.71% 11.04.2014 24.81 23.81 25.27 29.42 31.11 31.11 31.11 -0.295 -0.083 -0.060 -0.027 -0.024 -0.024 -0.024 0.053 0.012 0.008 0.002 0.001 0.001 0.001 STM IM Equity STMICROELECTRONICS NV Information Technology 7.19 4.33% 09.12.2013 34.47 33.89 33.46 33.29 34.73 34.06 34.20 -0.176 -0.043 -0.018 -0.023 -0.059 0.086 0.051 0.019 0.004 0.004 0.001 0.001 0.000 0.000 BELG BB Equity BELGACOM SA Telecommunication Services 17.34 12.58% 10.12.2013 22.07 20.02 19.91 19.41 20.29 20.29 -0.053 -0.117 -0.116 -0.099 -0.052 -0.052 0.039 0.007 0.004 0.003 0.001 0.001 LISN SE Equity LINDT & SPRUENGLI AG-REG Consumer Staples 41295.00 1.57% 22.04.2014 14.44 14.39 14.39 14.40 14.77 14.91 -0.232 -0.013 -0.016 -0.035 -0.009 -0.011 0.010 0.001 0.001 0.002 0.001 0.002 INF LN Equity INFORMA PLC Consumer Discretionary 504.50 3.96% 14.08.2013 MNDI LN Equity MONDI PLC Materials 913.50 2.83% 21.08.2013 JMT PL Equity JERONIMO MARTINS Consumer Staples 16.85 2.14% 05.05.2014 SY1 GY Equity SYMRISE AG Materials 32.16 16.05.2014 22.67 22.35 22.63 23.40 23.36 23.80 23.61 -0.080 -0.130 -0.112 -0.098 -0.092 -0.093 -0.098 0.031 0.004 0.002 0.001 0.001 0.001 0.001 PRY IM Equity PRYSMIAN SPA Industrials 15.75 2.86% 21.04.2014 26.07 26.03 26.25 26.69 26.80 26.80 -0.133 -0.242 -0.204 -0.126 -0.087 -0.087 0.029 0.008 0.005 0.002 0.001 0.001 WMH LN Equity WILLIAM HILL PLC Consumer Discretionary 436.40 2.50% 23.10.2013 21.59 22.01 22.58 23.75 -0.072 -0.081 -0.093 -0.090 0.005 0.004 0.004 0.002 ZC FP Equity ZODIAC AEROSPACE Industrials 98.14 1.78% 13.01.2014 18.33 18.64 18.95 19.77 20.24 20.32 -0.102 -0.108 -0.107 -0.126 -0.059 -0.055 0.021 0.003 0.002 0.001 -0.001 -0.001 ADM LN Equity ADMIRAL GROUP PLC Financials 1285.00 7.09% 11.09.2013 GBF GY Equity BILFINGER SE Industrials 77.07 3.89% 22.04.2014 21.24 19.60 20.14 21.27 21.78 21.47 21.69 -0.313 -0.178 -0.179 -0.149 -0.107 -0.096 -0.095 0.028 0.006 0.004 0.003 0.003 0.003 0.003 PSN LN Equity PERSIMMON PLC Consumer Discretionary 1147.00 8.28% 30.10.2013 COB LN Equity COBHAM PLC Industrials 280.80 3.45% 09.10.2013 DELB BB Equity DELHAIZE GROUP Consumer Staples 48.60 2.88% 28.05.2014 26.68 25.89 25.93 25.94 25.11 25.11 -0.441 -0.154 -0.129 -0.093 -0.076 -0.076 0.024 0.008 0.006 0.004 0.003 0.003 CABK SQ Equity CAIXABANK S.A Financials 2.83 8.13% 28.05.2013 32.53 30.74 30.84 29.01 26.51 23.59 22.02 0.237 0.220 0.079 -0.110 0.007 0.255 0.090 0.000 -0.006 -0.005 0.000 -0.002 -0.003 0.003 PGS NO Equity PETROLEUM GEO-SERVICES Energy 86.95 2.82% 14.05.2014 27.17 28.04 29.17 31.36 -0.041 -0.050 -0.063 -0.077 0.017 0.013 0.008 0.001 DIA SQ Equity DISTRIBUIDORA INTERNACIONAL Consumer Staples 6.23 2.09% 16.07.2013 32.42 30.18 29.57 27.14 24.40 23.90 23.81 -0.230 -0.253 -0.246 -0.192 -0.149 -0.156 -0.156 0.004 0.003 0.002 0.001 0.000 0.000 0.000 UBI IM Equity UBI BANCA SCPA Financials 3.46 1.44% 19.05.2014 33.70 33.83 33.86 33.97 33.24 33.24 -0.183 -0.183 -0.183 -0.196 -0.176 -0.176 0.024 0.001 0.002 0.004 0.001 0.001 IIA AV Equity IMMOFINANZ AG Financials 3.32 4.52% 08.10.2013 33.20 20.32 20.41 22.65 30.13 29.91 -1.156 -0.491 -0.275 0.072 0.603 0.844 0.066 0.028 0.020 0.005 -0.006 -0.007 TGS NO Equity TGS NOPEC GEOPHYSICAL CO ASA Energy 217.90 3.67% 04.06.2014 30.40 30.10 29.71 29.04 -0.059 -0.105 -0.166 -0.237 0.018 0.015 0.010 0.004 LI FP Equity KLEPIERRE Financials 33.70 4.60% 21.04.2014 19.22 19.65 19.72 19.67 21.87 22.76 -0.274 -0.183 -0.170 -0.152 -0.089 -0.051 0.027 0.005 0.004 0.004 0.003 0.003 ATO FP Equity ATOS Information Technology 55.75 1.08% 06.06.2014 23.59 23.88 24.27 25.00 24.36 24.36 -0.128 -0.132 -0.137 -0.138 -0.134 -0.134 0.008 0.006 0.004 0.001 0.002 0.002 ENG SQ Equity ENAGAS SA Utilities 20.05 5.83% 04.07.2013 22.16 21.12 20.77 22.35 19.89 17.19 18.85 -0.072 -0.044 -0.040 -0.167 -0.020 -0.002 0.010 0.001 0.001 0.000 0.001 0.000 0.002 -0.001 KBC BB Equity KBC GROEP NV Financials 31.43 13.05.2015 41.74 35.89 35.27 34.33 33.10 33.10 -0.243 -0.190 -0.177 -0.142 -0.110 -0.110 0.024 0.003 0.003 0.003 0.002 0.002 PSPN SE Equity PSP SWISS PROPERTY AG-REG Financials 91.10 3.40% 07.04.2014 10.34 10.43 10.47 11.59 12.72 12.51 -0.249 -0.169 -0.148 -0.123 -0.124 -0.113 0.017 0.005 0.005 0.005 0.002 0.002 SLHN VX Equity SWISS LIFE HOLDING AG-REG Financials 153.80 2.93% 25.04.2014 26.04 24.25 24.06 24.06 24.40 23.76 23.48 -0.210 -0.150 -0.141 -0.124 -0.081 -0.060 -0.065 0.031 0.006 0.004 0.003 0.001 0.001 0.002 STERV FH Equity STORA ENSO OYJ-R SHS Materials 5.76 5.21% 23.04.2014 24.58 26.56 27.04 27.50 -0.393 -0.168 -0.120 -0.067 0.045 0.003 0.000 0.000 HO FP Equity THALES SA Industrials 36.23 2.57% 11.12.2013 26.24 24.23 23.90 23.72 22.94 22.52 22.55 -0.164 -0.056 -0.066 -0.084 -0.068 -0.074 -0.075 0.032 0.005 0.004 0.002 0.001 0.001 0.000 MAN GY Equity MAN SE Industrials 86.00 1.16% 10.06.2014 8.22 7.75 7.52 7.20 7.44 7.64 7.42 -0.200 0.004 -0.005 -0.017 -0.002 -0.004 -0.004 0.026 0.006 0.008 0.009 0.001 0.000 0.000 PWL ID Equity PADDY POWER PLC Consumer Discretionary 66.37 2.11% 04.09.2013 COLR BB Equity COLRUYT SA Consumer Staples 40.45 2.42% 27.09.2013 17.58 18.40 18.45 18.83 18.16 18.16 -0.346 -0.111 -0.091 -0.086 -0.069 -0.069 0.037 0.006 0.002 0.003 0.003 0.003 GALP PL Equity GALP ENERGIA SGPS SA Energy 12.50 2.30% 09.09.2013 III LN Equity 3I GROUP PLC Financials 362.70 2.26% 19.06.2013 20.58 20.39 20.13 20.08 0.076 0.031 -0.031 -0.071 0.002 0.000 -0.002 -0.001 GET FP Equity GROUPE EUROTUNNEL SA - REGR Industrials 6.42 1.87% 03.06.2014 17.76 18.11 18.32 19.52 19.81 20.07 -0.183 -0.135 -0.149 -0.128 -0.144 -0.131 0.038 0.010 0.007 0.002 0.001 0.001 ACS SQ Equity ACS ACTIVIDADES CONS Y SERV Industrials 22.51 5.11% 05.07.2013 27.86 26.72 25.83 25.76 25.68 23.63 24.56 -0.633 0.072 0.108 0.053 -0.235 -0.136 -0.213 0.016 0.001 0.001 0.001 0.002 0.001 0.002 SUN VX Equity SULZER AG-REG Industrials 166.40 1.98% 11.04.2014 20.11 20.33 20.71 21.51 23.17 23.04 -0.393 -0.234 -0.196 -0.133 -0.101 -0.097 0.025 0.007 0.006 0.002 0.001 0.001 PTC PL Equity PORTUGAL TELECOM SGPS SA-REG Telecommunication Services 3.57 20.05.2014 MEO GY Equity METRO AG Consumer Staples 24.66 4.06% 14.02.2014 26.14 25.92 25.91 26.32 23.79 23.98 23.41 -0.162 -0.051 -0.040 -0.034 0.109 0.092 0.127 0.038 0.005 0.004 0.002 0.005 0.006 0.007 AKSO NO Equity AKER SOLUTIONS ASA Energy 85.65 4.67% 18.04.2014 36.18 35.70 35.07 34.28 -0.585 -0.501 -0.391 -0.258 0.004 0.003 0.002 0.002 BBY LN Equity BALFOUR BEATTY PLC Industrials 227.50 6.20% 09.10.2013 ILD FP Equity ILIAD SA Telecommunication Services175.75 0.21% 04.06.2013 28.05 27.23 26.92 26.81 26.49 26.56 -0.263 -0.092 -0.094 -0.103 -0.090 -0.091 0.020 0.003 0.003 0.002 0.001 0.001 DLN LN Equity DERWENT LONDON PLC Financials 2497.00 1.40% 25.09.2013 BB FP Equity SOCIETE BIC SA Industrials 84.60 3.03% 21.05.2014 24.78 23.60 23.95 24.24 23.86 24.44 -0.124 -0.076 -0.092 -0.098 -0.089 -0.075 0.029 0.004 0.004 0.004 0.003 0.003 CLN VX Equity CLARIANT AG-REG Materials 14.44 2.29% 27.03.2014 23.75 23.47 24.06 25.21 26.01 25.55 25.69 -0.156 -0.093 -0.115 -0.093 -0.050 -0.051 -0.053 0.043 0.010 0.005 0.002 0.002 0.001 0.002 CSCG LN Equity CAPITAL SHOPPING CENTRES GRO Financials #N/A N/A AGS LN Equity AEGIS GROUP PLC #N/A N/A #N/A N/A LHA GY Equity DEUTSCHE LUFTHANSA-REG Industrials 15.76 3.17% 08.05.2014 31.43 29.82 29.61 29.41 30.05 29.94 28.66 -0.288 -0.166 -0.131 -0.088 -0.005 0.045 0.089 0.038 0.006 0.004 0.001 0.000 -0.002 -0.003 RAND NA Equity RANDSTAD HOLDING NV Industrials 33.53 2.98% 03.04.2014 23.46 22.89 23.40 24.73 25.49 25.49 25.59 -0.342 -0.204 -0.189 -0.144 -0.108 -0.108 -0.108 0.038 0.009 0.006 0.003 0.001 0.001 0.001 ROR LN Equity ROTORK PLC Industrials 2889.00 1.71% 28.08.2013 AML LN Equity AMLIN PLC Financials 434.10 5.81% 04.09.2013 VOE AV Equity VOESTALPINE AG Materials 25.48 3.34% 08.07.2013 33.34 25.62 25.48 26.43 35.21 35.77 -0.457 -0.009 0.018 -0.030 0.556 0.758 0.093 0.031 0.016 0.004 -0.007 -0.008 SDR LN Equity SCHRODERS PLC Financials 2555.00 1.72% 15.08.2013 ELI1V FH Equity ELISA OYJ Telecommunication Services 14.41 9.02% 26.03.2014 19.44 20.64 20.81 21.09 -0.026 -0.123 -0.155 -0.115 0.030 0.006 0.003 0.002 FR FP Equity VALEO SA Consumer Discretionary 48.55 3.09% 27.06.2014 27.68 28.83 29.16 30.06 30.86 30.86 -0.097 -0.096 -0.090 -0.083 -0.063 -0.063 0.008 0.006 0.004 0.001 0.000 0.000 BKG LN Equity BERKELEY GROUP HOLDINGS Consumer Discretionary 2171.00 SCH NO Equity SCHIBSTED ASA Consumer Discretionary 243.00 16.05.2014 DRX LN Equity DRAX GROUP PLC Utilities 580.00 2.22% 25.09.2013 TDC DC Equity TDC A/S Telecommunication Services 48.05 7.70% 09.08.2013 33.89 22.63 22.01 22.01 -2.284 -0.160 -0.166 -0.166 0.056 0.038 0.040 0.040 PMO LN Equity PREMIER OIL PLC Energy 381.60 PFG LN Equity PROVIDENT FINANCIAL PLC Financials 1566.00 8.26% 30.10.2013 CHR DC Equity CHR HANSEN HOLDING A/S Materials 209.60 1.60% 27.11.2013 TCY LN Equity TELECITY GROUP PLC Information Technology 950.00 0.95% 14.08.2013 FLS DC Equity FLSMIDTH & CO A/S Industrials 333.30 3.15% 07.04.2014 36.35 25.62 25.88 26.57 -0.185 -0.095 -0.064 -0.052 0.018 0.002 0.000 0.000 SMDS LN Equity DS SMITH PLC Materials 254.00 2.91% 02.10.2013 Option Implied Volatility Skew Parameters by Terms: IVt = atx + btx 2 + ct At The Money Implied Volatilities by Terms Stoxx600Index Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |