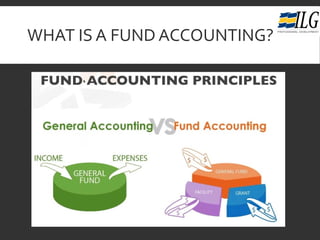

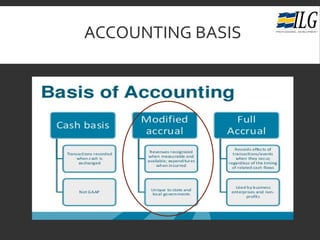

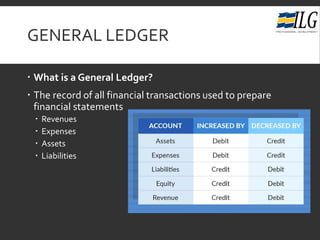

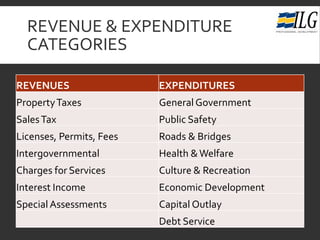

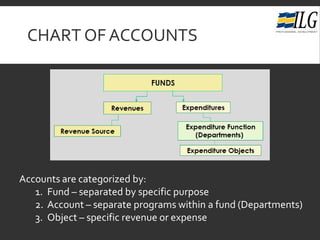

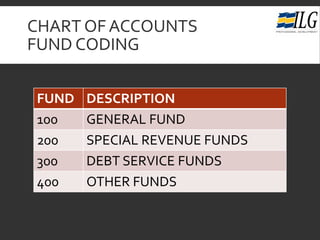

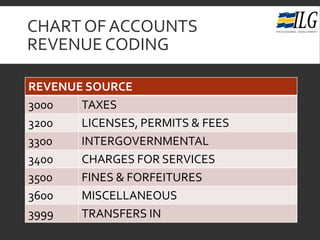

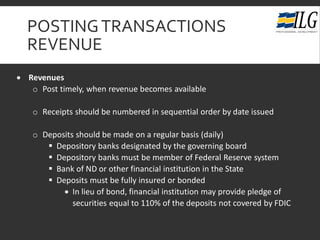

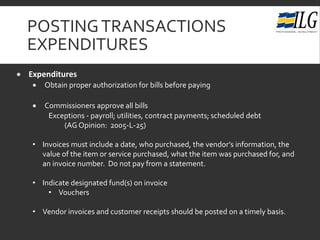

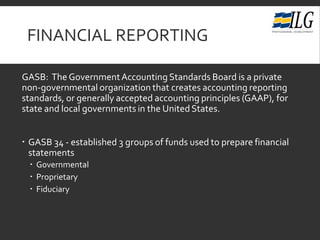

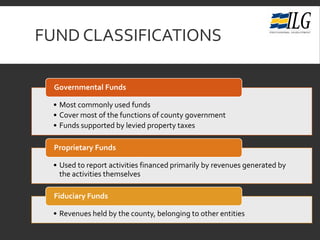

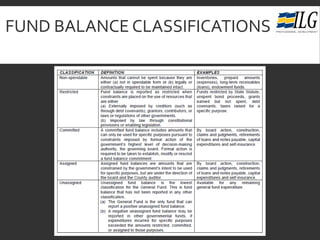

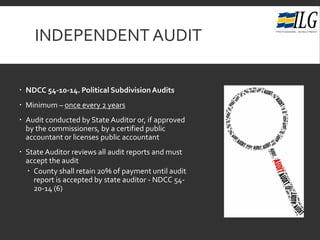

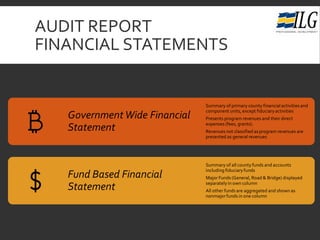

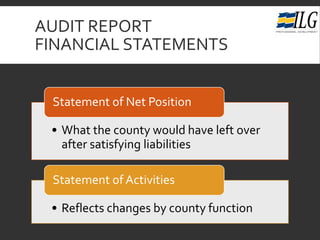

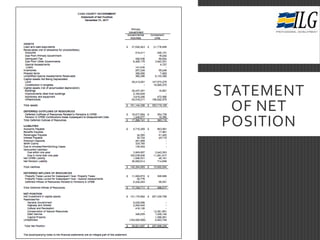

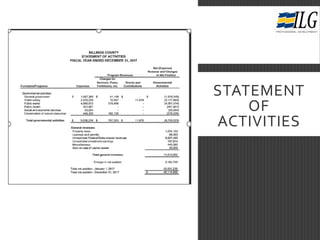

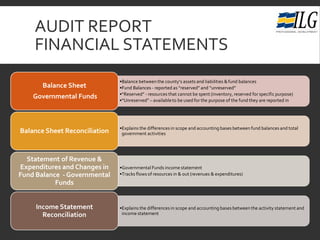

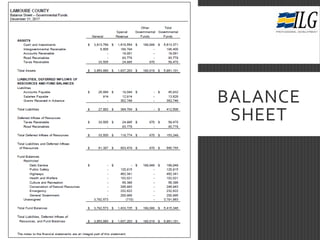

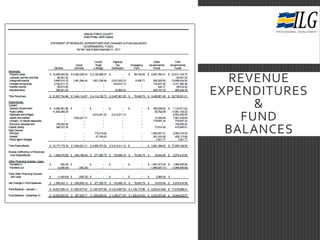

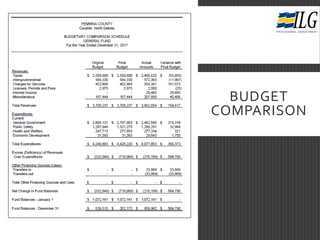

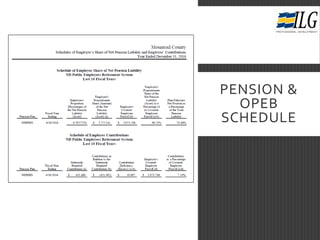

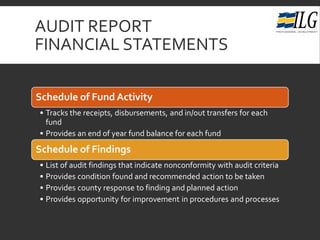

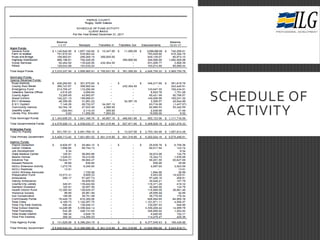

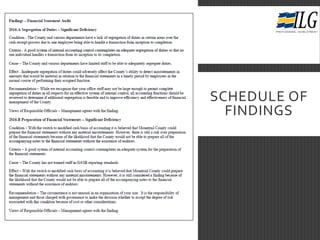

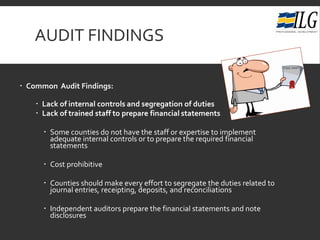

This document provides an overview of fund accounting basics for governmental entities. It defines key terms like funds, revenues, expenditures, assets, liabilities, and the chart of accounts. It explains how to code revenues and expenditures, post transactions, prepare required financial reports, and manage audits. The main points covered are the types of funds used, the financial statements prepared, and common audit findings around internal controls and segregation of duties.