Embed presentation

Download to read offline

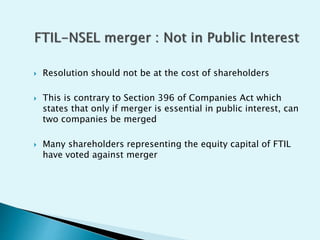

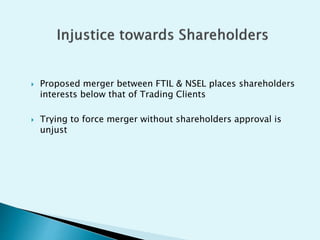

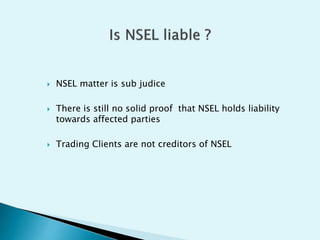

The document discusses a proposed merger between FTIL and NSEL, arguing that it is unjust towards FTIL shareholders and not in the public interest. It claims the merger tries to force approval without shareholder consent, that NSEL's liability is still uncertain under ongoing legal proceedings, and that the merger resolution should not come at the cost of shareholders' interests contrary to Companies Act regulations.