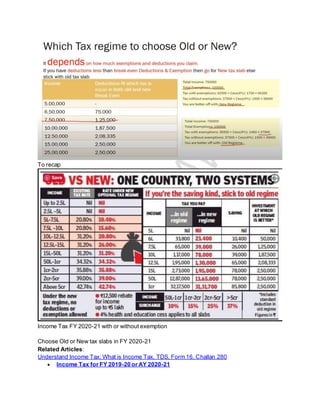

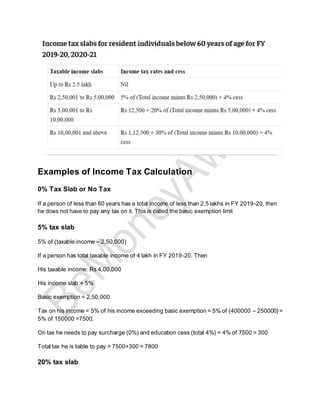

Here are the steps to calculate income tax for the given total incomes:

1. Total income of Rs. 2,88,000:

- Income up to Rs. 2,50,000 is tax exempt

- Taxable income = Rs. 2,88,000 - Rs. 2,50,000 = Rs. 38,000

- Tax on Rs. 38,000 at 5% slab = Rs. 1,900

- Add education cess @ 4% of Rs. 1,900 = Rs. 76

- Total tax payable = Rs. 1,900 + Rs. 76 = Rs. 1,976

2. Total income of Rs. 7,00,000

- Income up

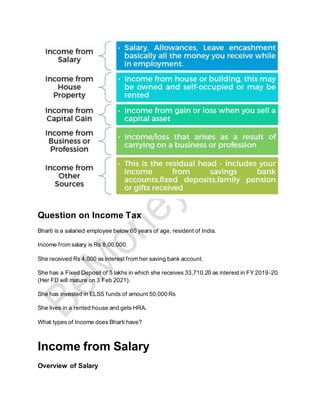

![Types of Income

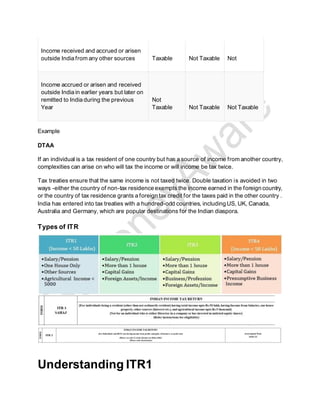

Income is classified into the following categories known as Heads of Income.

· Income from Salary:

o Salary is what is received by an employee from an employer in cash, kind or

as a facility [perquisite].

o Pension is also considered as salary. The Pension is normally paid a

periodical payment on a monthly basis which is fully taxable, under the head

Income from Salary, in the hand of the employee, whether Government

employee or non-government employee.

o Our article Senior Citizen : Income and Tax discusses it in detail

· Income from House Property:

o Income earned from rent of residential or commercial property.

o If one has taken home loan to buy a property, then interest payment is also

considered as negative Income from House Property

o Our article Income from House Property and Income Tax Return discusses it in

detail.

· Income from Profits and Gains of Profession or Business: Income earned from

freelancing, contracting, for doctors, CA,lawyers, by bloggers, YouTubers etc.

· Income from Capital Gains: Income earned from the sale of capital assets, like mutual

funds, shares, land, house.

· Income from Other Sources: Interest earned from savings accounts, fixed deposits,

winning lottery etc. Any income which does not fall in any category comes under this

· Exempt Income: Exempt Income, is the income that is not taxable. Even though these are

tax-free, all exempt incomes must be mentioned in the tax return. Our article Exempt Income

and Income Tax Return discusses it in detail.](https://image.slidesharecdn.com/free-income-tax-guide-220511092811-58352845/85/Free-Income-Tax-Guide-pdf-20-320.jpg)