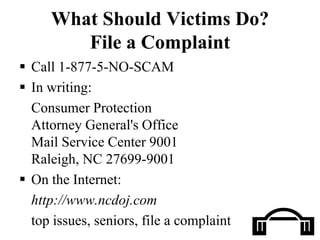

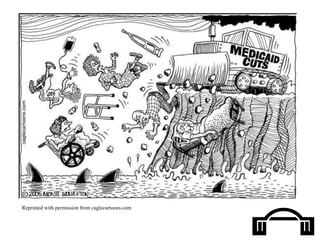

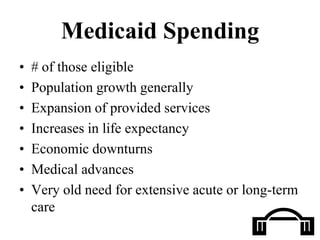

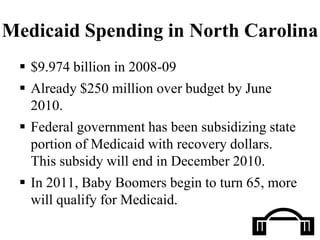

The document discusses aging trends and issues in North Carolina. It notes that the population aged 65 and older will double by 2030 and in 26 counties over a quarter of residents will be 65+. It outlines concerns around financial well-being, rural/urban differences, workforce, and financial implications for the state. It also discusses fraud against the elderly, including by loved ones, and provides recommendations to address the issue. Finally, it discusses Medicaid spending trends and challenges in serving the aging population.