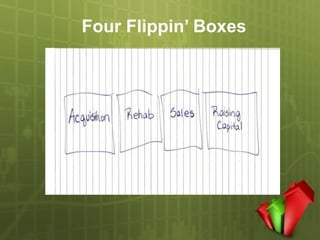

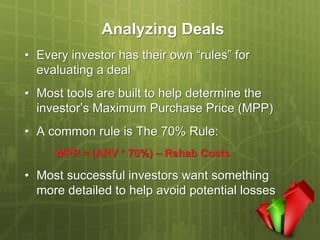

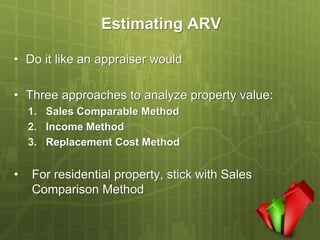

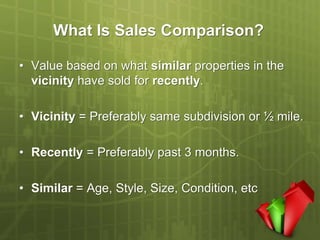

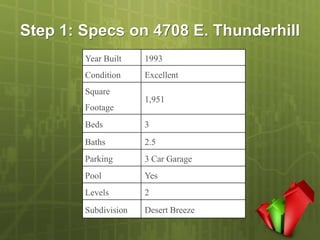

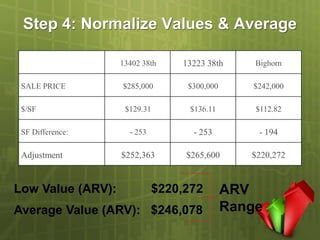

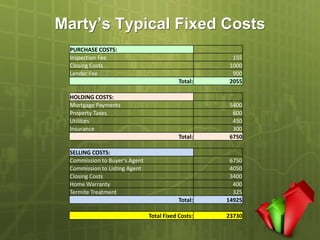

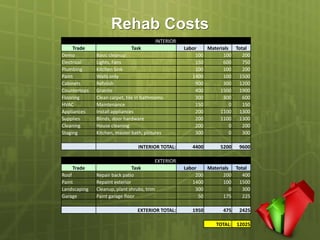

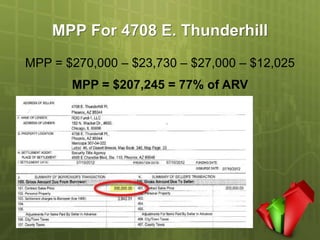

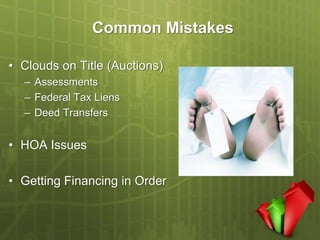

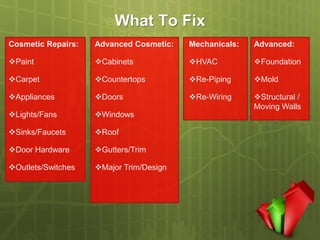

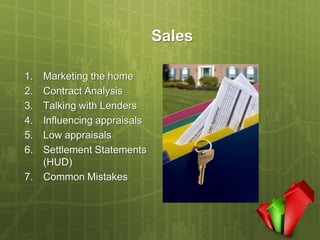

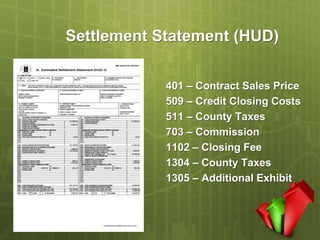

The document outlines a real estate investment strategy by Marty Boardman, an experienced realtor and investor, emphasizing the development of a personalized plan for property acquisition, rehabilitation, and sales. Key topics include assessing property value, estimating costs, and navigating the acquisition process while avoiding common mistakes. Boardman also highlights the importance of building a reliable team and the fundamentals of marketing and financing in real estate flipping.