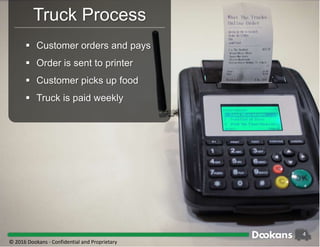

Dookans provides an online food ordering service for mobile food vendors, addressing consumer issues like finding trucks, cash-only transactions, and long lines. The platform allows customers to locate trucks, make mobile payments, and avoid queues, while offering truck owners visibility through schedules and marketing services. Seeking $500,000 for expansion in Portland, Dookans aims to enhance its software and improve marketing efforts.