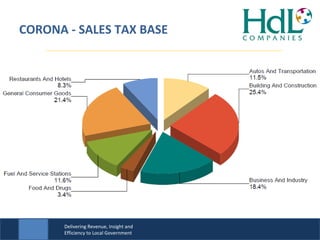

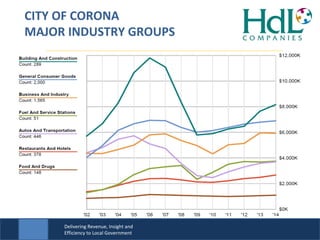

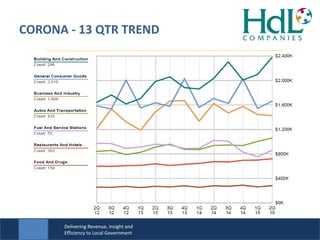

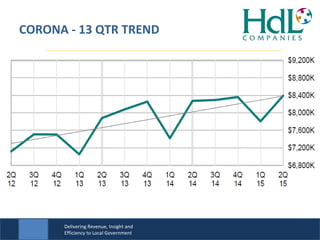

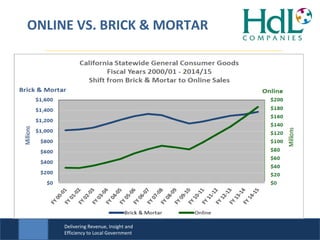

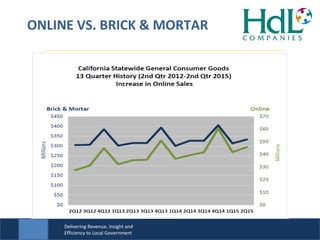

This document provides a sales tax update for the City of Corona from October 7, 2015. It includes information on Corona's sales tax base by major industry groups, sales tax trends over the past 13 quarters, and a comparison of online versus brick-and-mortar sales tax revenues. The data presented gives insights into Corona's economy and revenue sources.