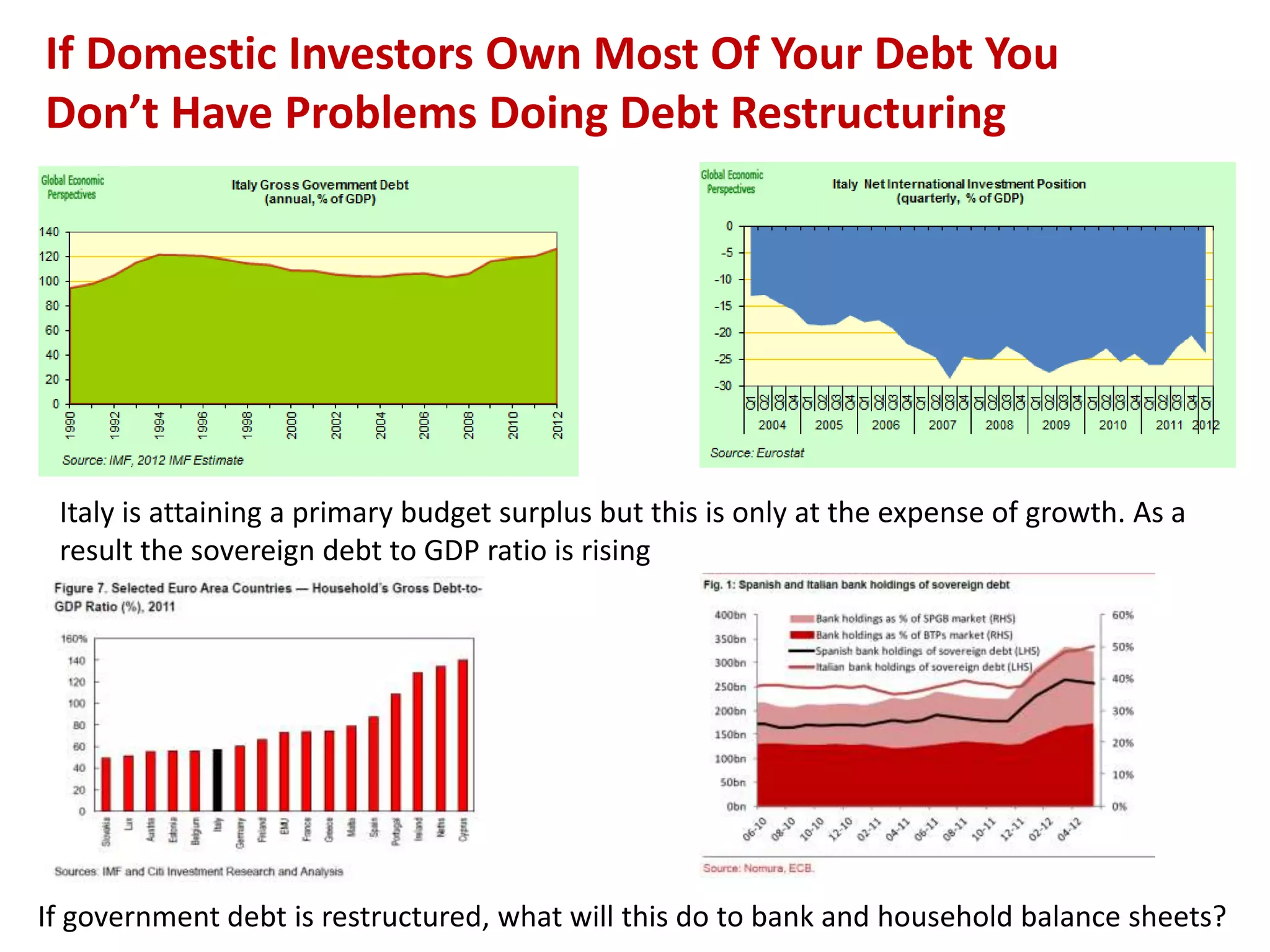

This document discusses five common misconceptions about investment decisions and macroeconomic policies:

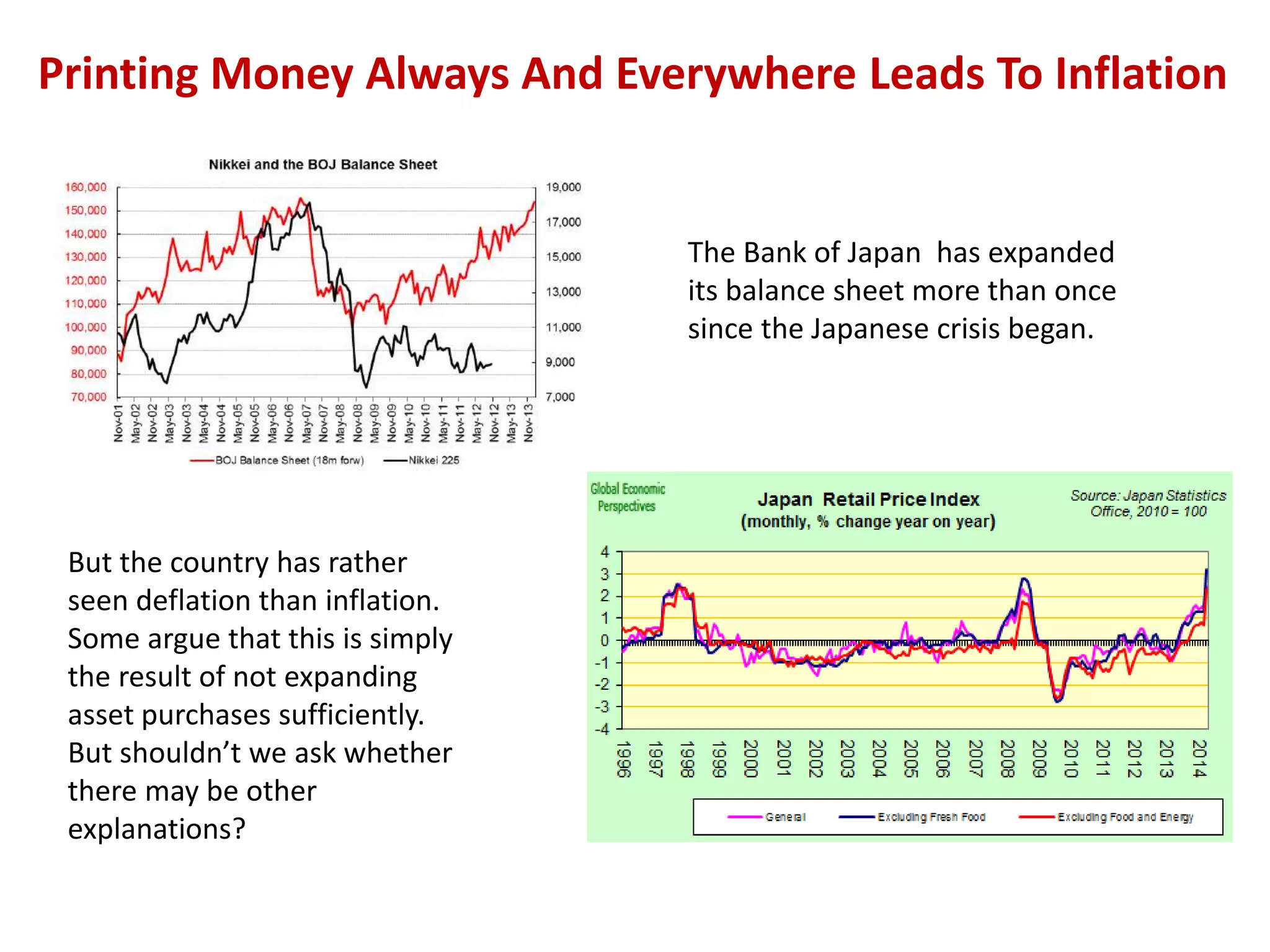

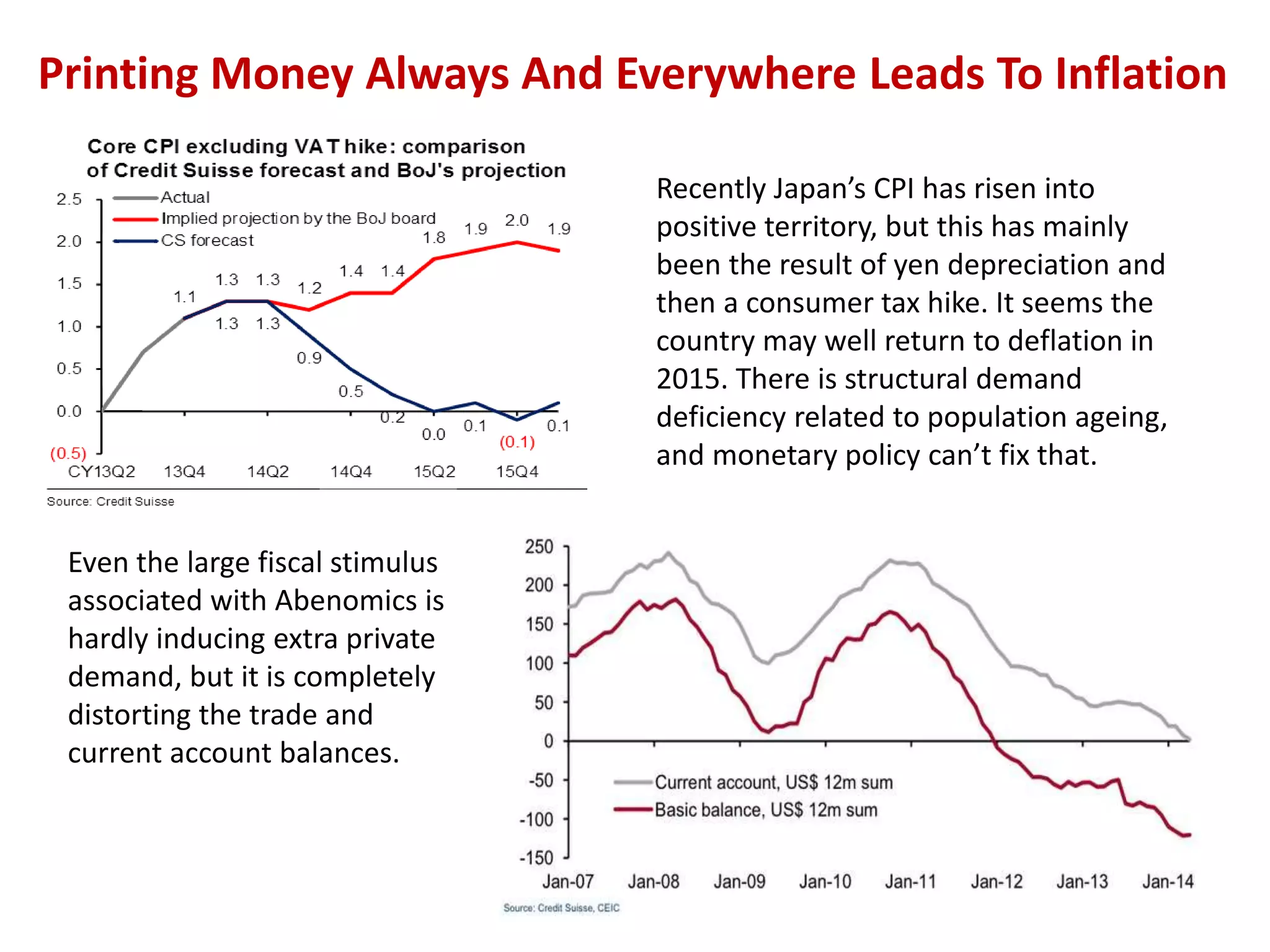

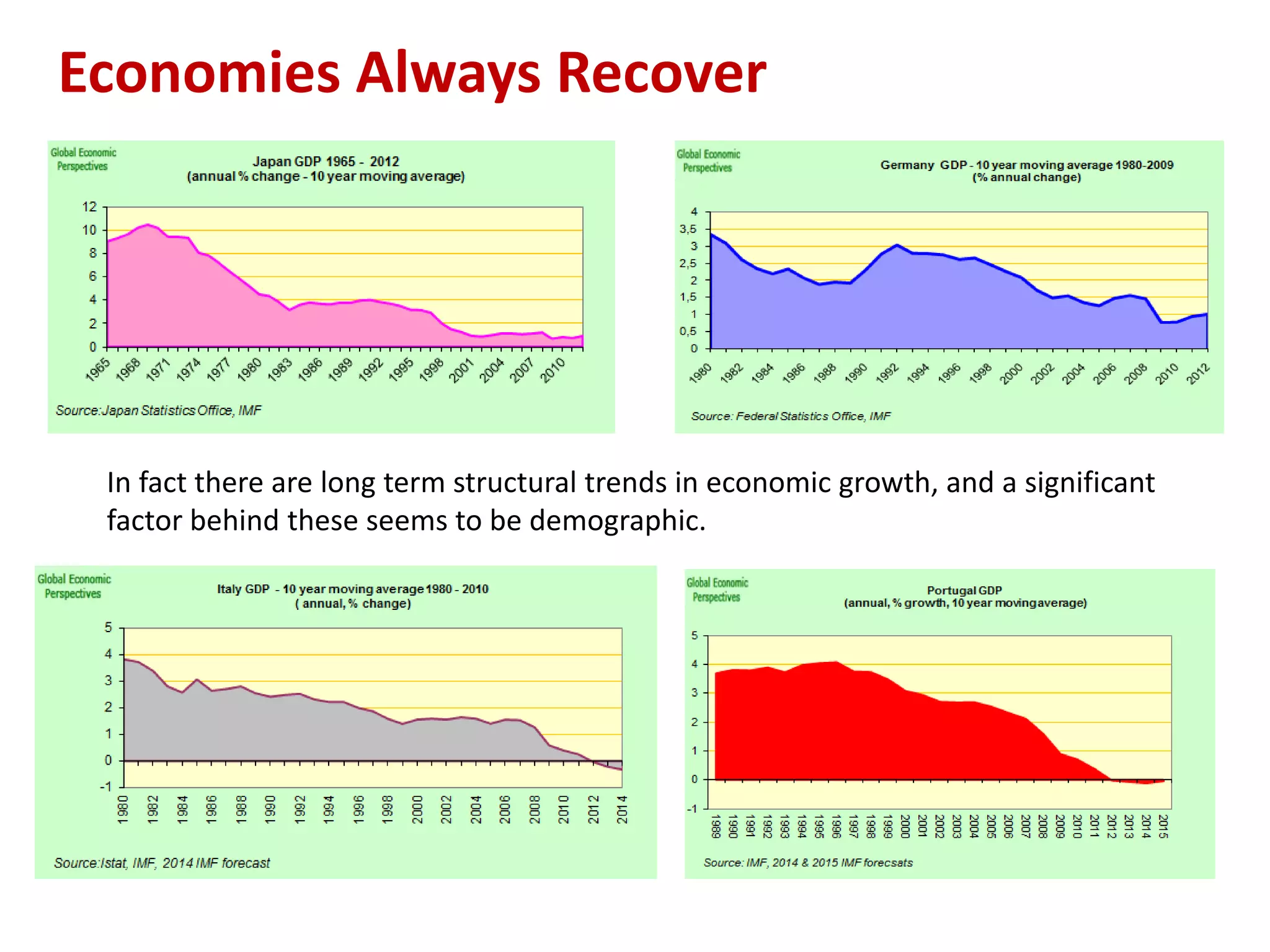

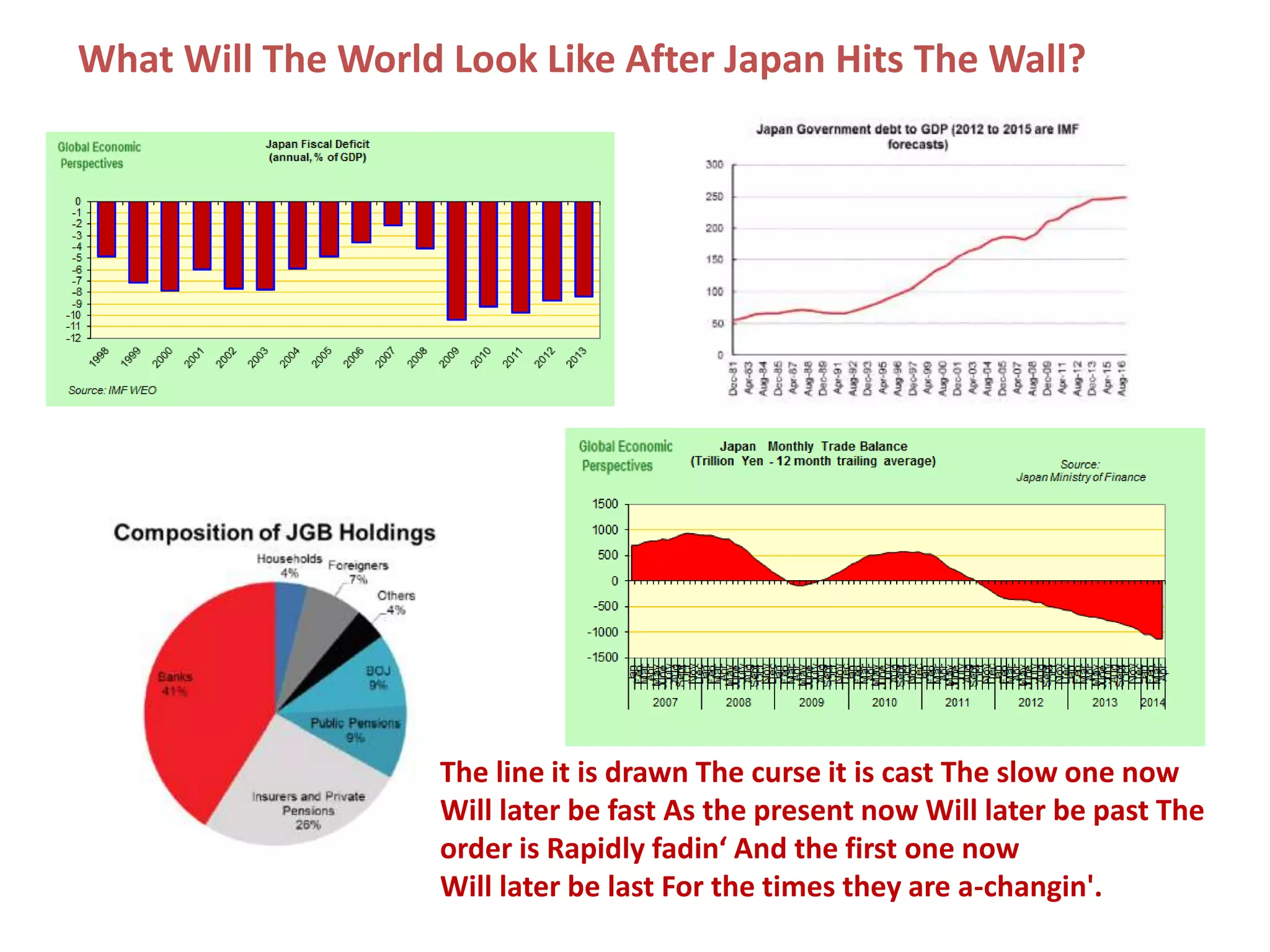

1. Printing money does not always lead to inflation, as demonstrated by Japan's experience with deflation despite monetary expansion. Other factors like demographics can impact inflation.

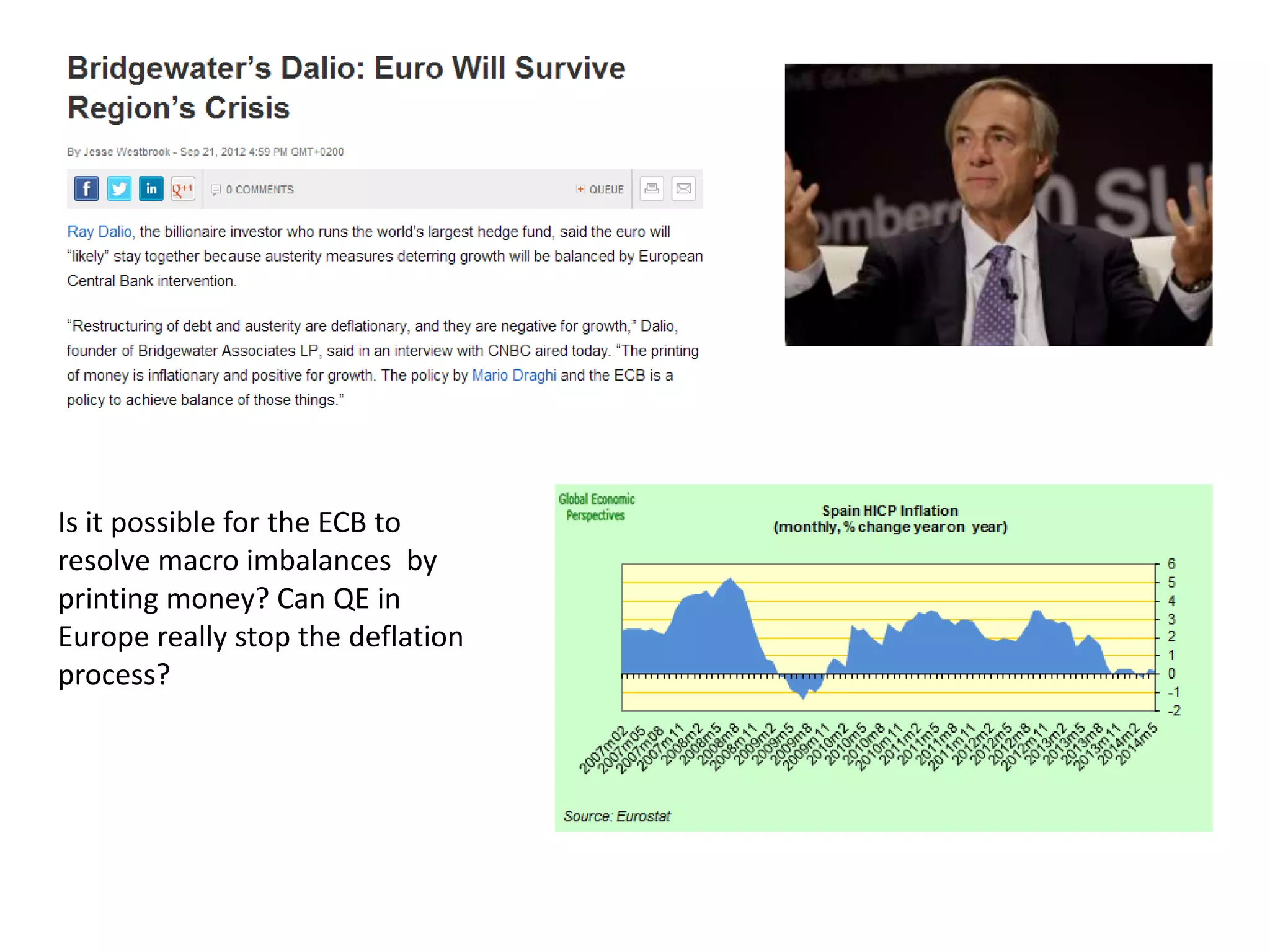

2. Money printing through quantitative easing may not be able to stop deflation in Europe due to structural issues like population aging reducing demand.

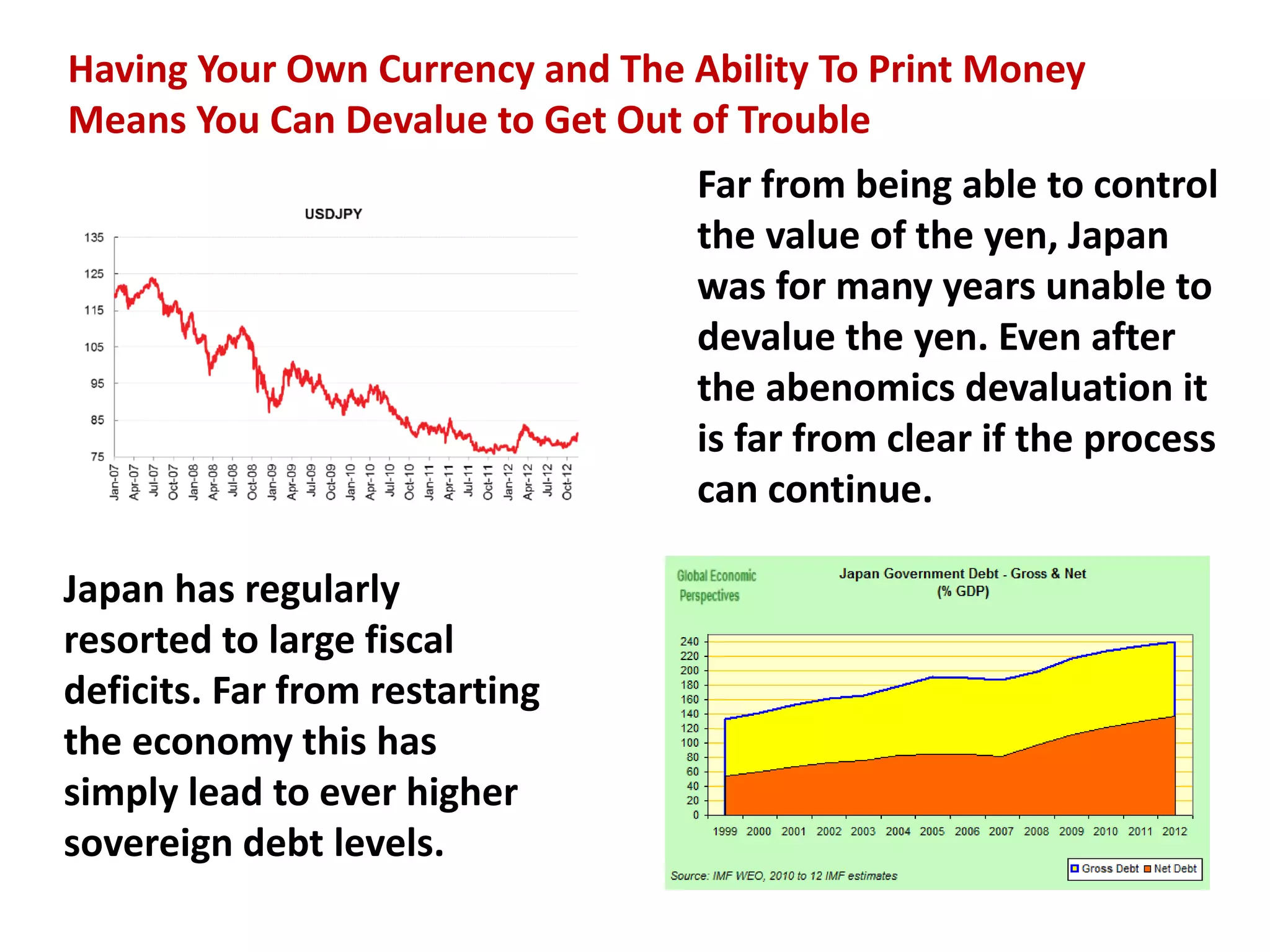

3. Devaluing currency does not guarantee getting out of economic trouble, as Japan struggled to control the yen's value for years despite intervention.

4. The euro is a political project, so its challenges may require political not just technical solutions. Money printing alone can't address issues like demographic changes.