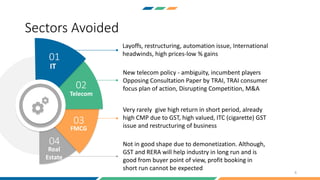

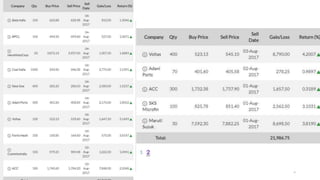

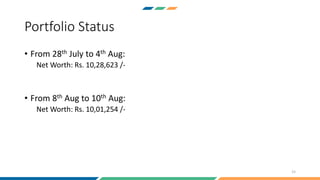

The document outlines a market analysis conducted by the 'wanna be vc' team, highlighting positive market sentiment and significant trends in the BSE Sensex and Nifty 50 as of late July 2017. It includes a granular selection of stocks with both successful investments, like Voltas and Maruti Suzuki, and underperforming ones such as SBI, and discusses the future outlook as potentially bearish if key support levels are breached. The analysis also mentions industry preferences and aversions, addressing factors impacting various sectors including telecom, FMCG, and real estate.