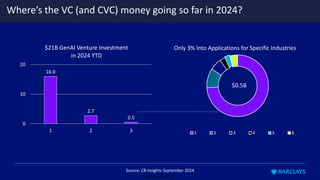

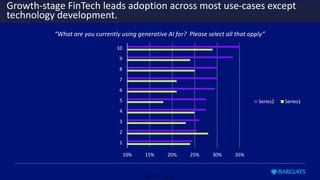

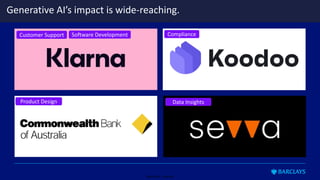

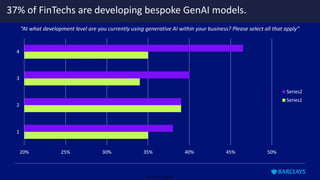

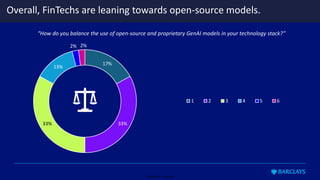

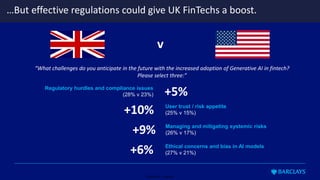

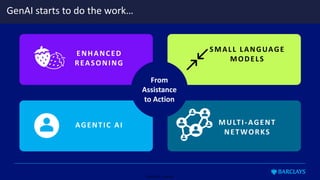

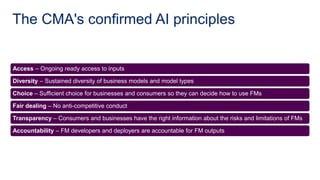

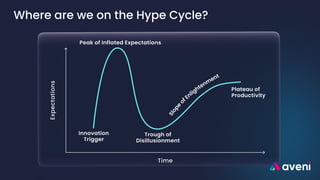

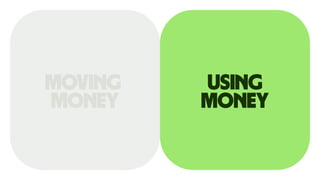

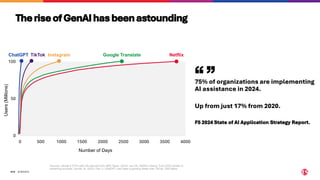

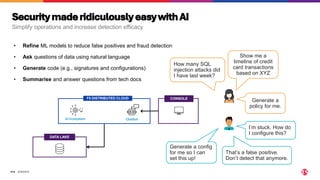

The document explores current trends, challenges, and opportunities within the fintech sector, highlighting significant growth expected, particularly in areas such as generative AI and partnerships. It discusses the evolving landscape where fintech revenues are projected to increase substantially, alongside potential hurdles including economic factors and regulatory challenges. Additionally, it emphasizes the importance of collaboration between academia, industry, and regulatory bodies to foster innovation and address industry pain points.