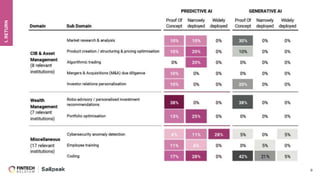

The document outlines the contributions of 17 institutions in using AI for retail banking, insurance, and wealth management, with a focus on predictive and generative AI applications. It discusses the governance and resource allocation for AI initiatives, the differing levels of AI application across business units, and anticipated regulations from the AI Act, which aims to enforce compliance by mid-2026. Additionally, it highlights the potential limitations and ethical considerations associated with AI usage.