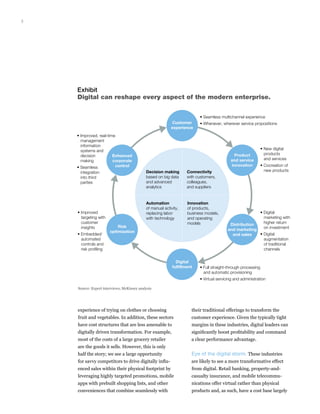

While digital transformation is often focused on enhancing customer interactions, the document finds that the greatest impact may come from cost savings and operational changes beyond customer interfaces. An analysis of multiple industries found that the average potential bottom-line impact from cost reductions through digital transformation is 36% over five years, compared to an average of 20% from increased digital sales. To fully capture potential value, companies need to take a holistic view and apply digital tools across their entire business model and value chain, not just in customer-facing areas.