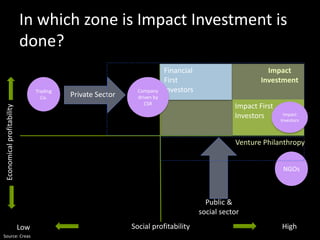

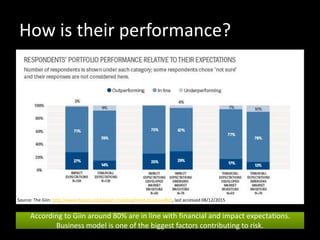

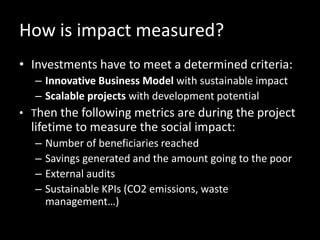

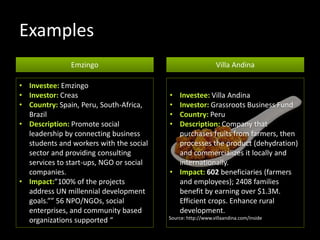

Impact investing aims to generate both social/environmental impact and financial returns. It includes investments in projects/organizations that provide solutions to challenges in areas like education, health, and renewable energy. Impact is measured using metrics like beneficiaries reached, emissions reductions, and audits. Examples include Emzingo, which supports social enterprises, and Villa Andina, a Peruvian fruit processor that benefits small farmers. While impact investing has potential, measuring impact and scaling projects remain challenges in maximizing development impact.