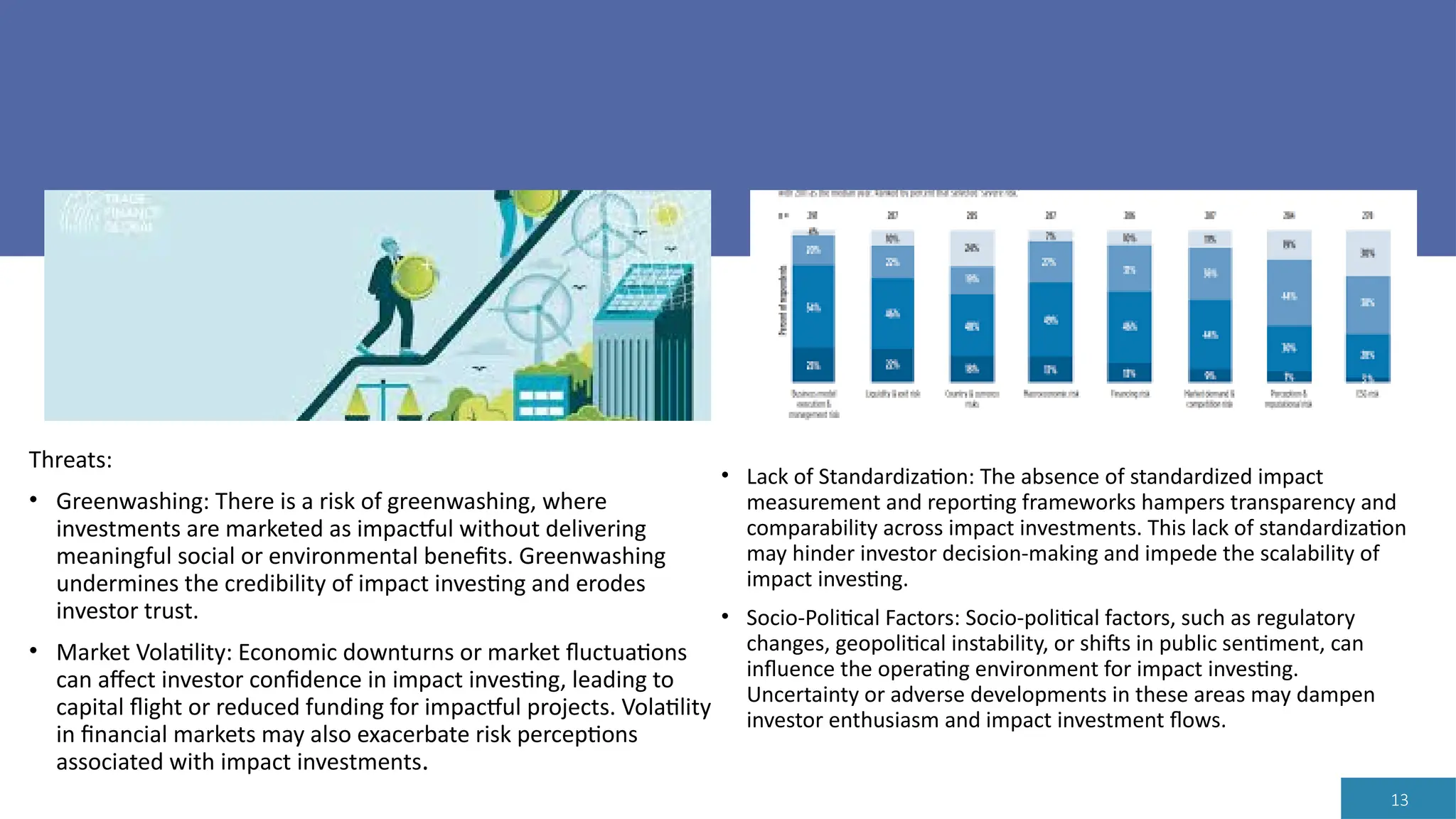

Impact investing focuses on directing capital to projects that generate social or environmental benefits alongside financial returns, with over 1,300 organizations managing $502 billion in assets globally. This investment approach is distinctly proactive, differing from socially responsible investments by prioritizing positive impacts rather than merely avoiding negative ones. The sector shows considerable growth potential, especially in India, driven by private capital flowing into industries like microfinance, healthcare, and education, while also facing challenges such as greenwashing and market volatility.