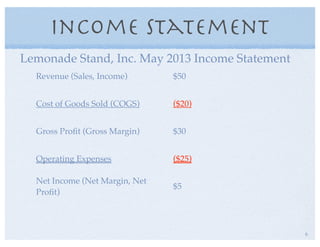

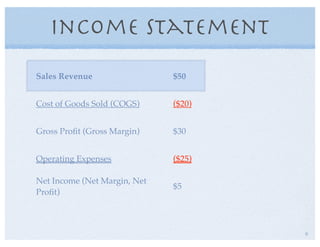

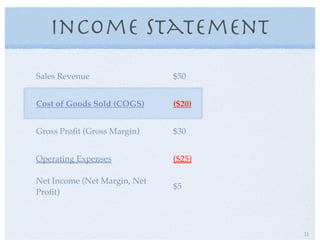

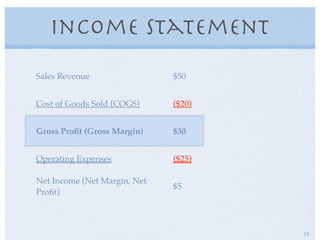

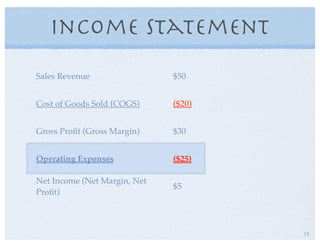

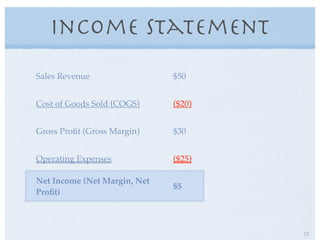

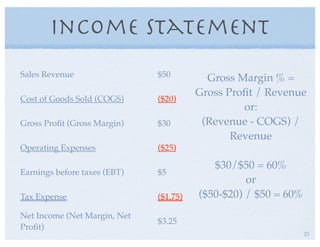

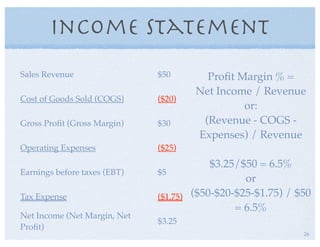

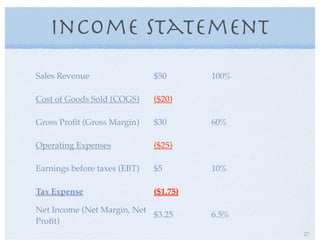

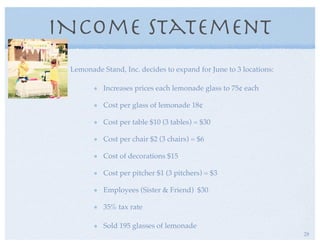

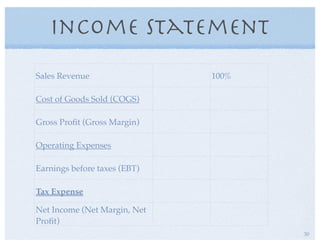

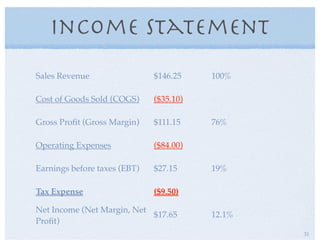

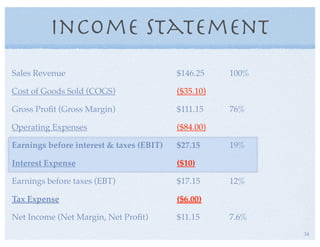

This document discusses an overview of income statements and key income statement terms like revenue, cost of goods sold, gross profit, operating expenses, earnings before taxes, taxes, and net income. It provides an example income statement for a lemonade stand business and calculates key financial metrics like gross margin and net margin percentages. It then expands the example to include additional locations and expenses like interest from a loan to demonstrate how different line items are affected.