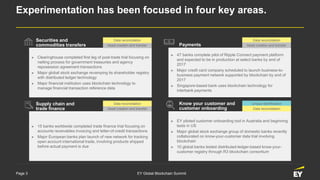

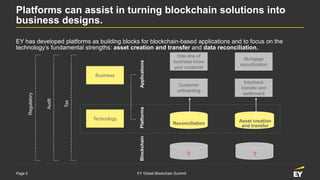

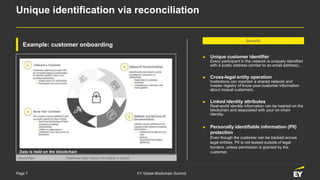

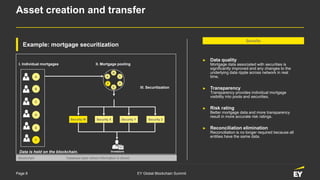

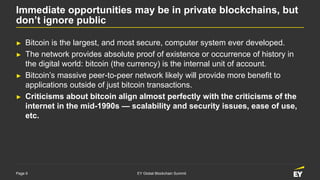

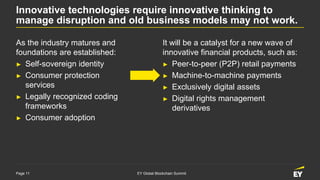

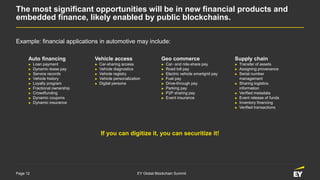

The EY Global Blockchain Summit discusses the use of blockchain technology in financial services, highlighting its applications in areas like asset creation, transaction reconciliation, and customer onboarding. Key developments include trials and implementations by major financial institutions to enhance transaction processes and data management. The document emphasizes the need for value-driven applications and innovative thinking to leverage blockchain's capabilities in transforming financial products and services.