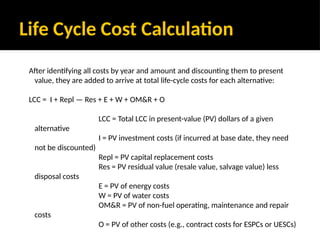

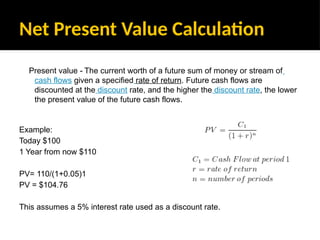

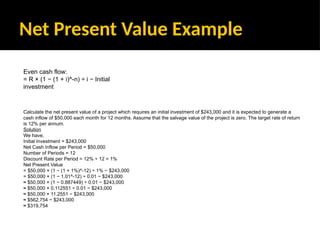

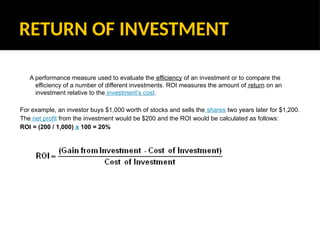

The document outlines financial principles, focusing on cost-benefit analysis, life-cycle cost analysis, and net present value calculations to evaluate project viability. It explains how to identify, value, and compare costs and benefits, and introduces discounting as a method to assess future cash flows in present terms. Various formulae and examples illustrate the methodologies for determining the total cost of ownership and the returns on investment.