Finance(mba) 151

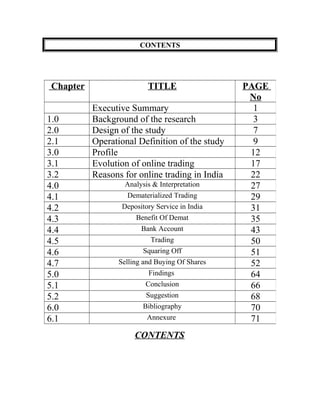

- 1. CONTENTS CONTENTS Chapter TITLE PAGE No Executive Summary 1 1.0 Background of the research 3 2.0 Design of the study 7 2.1 Operational Definition of the study 9 3.0 Profile 12 3.1 Evolution of online trading 17 3.2 Reasons for online trading in India 22 4.0 Analysis & Interpretation 27 4.1 Dematerialized Trading 29 4.2 Depository Service in India 31 4.3 Benefit Of Demat 35 4.4 Bank Account 43 4.5 Trading 50 4.6 Squaring Off 51 4.7 Selling and Buying Of Shares 52 5.0 Findings 64 5.1 Conclusion 66 5.2 Suggestion 68 6.0 Bibliography 70 6.1 Annexure 71

- 2. List of tables Serial No. TITLE PAGE No. 1) Table 1 Showing usage of Online trading system continent wise. 24 2) Table 2 Showing ranking of major benefits of online trading system. 25 3) Table 3 Showing products traded online. 26 4) Table 4 Showing statistics of NSDL as on Aug’2004. 33 5) Table 5 Showing savings for a person who buys shares for long term investment. 37 6) Table 6 Showing savings for an investor who sells dematerialised shares. 39 7) Table 7 Showing savings for a trader who buys and sell very often. 41

- 3. List of Graphs Serial No. TITLE PAGE No. 1) Graph showing usage of Online trading system continent wise. 24 2) Graph showing ranking of major benefits of online trading system. 25 3) Graph Showing products traded online. 26 4) Graph Showing statistics of NSDL as on Aug’2004. 33 5) Graph Showing savings for a person who buys shares for long term investment. 38 6) Graph Showing savings for an investor who sells dematerialised shares. 39 7) Graph Showing savings for a trader who buys and sell very often. 41 List of charts Serial No. TITLE PAGE No. 1) Chart 1: Showing NSDL and its Interface 32 2) Chart 2: Showing procedure of opening a demat account 47

- 4. Executive Summary The term "market" can have many different meanings. It consists of production to ultimate consumption. One usage of the term denotes the primary market and the secondary market. These two markets distinguish between the market where securities are created and the market where they are traded among investors. Their function is key in understanding how securities are traded. The primary market is where securities are created. It's in this market that firms sell (float) new stocks and bonds to the public for the first time. Secondary market is where most trading occurs, the secondary market is the one in which securities are traded after having been initially offered in the primary market. It is basically a market in which an investor purchases an asset from another investor, rather than an issuing to corporation. This includes the NYSE, NASDAQ and all major exchanges around the world. The defining characteristic of the secondary market is that investors trade among themselves. For example, if you go to buy Microsoft stock, you are dealing only with another investor who owns shares in Microsoft. Microsoft (the company) is in no way involved with the transaction. However there was an improvement in the mechanism of trading whereby it was seen that there was a shift from the traditional method of physical

- 5. trading to the updated version of online trading. This gave birth to the system of DEMATERIALISATION (Demat). With the age of computers and the Depository Trust Company, securities no longer need to be in certificate form. They can be registered and transferred electronically. Dematerialisation is nothing but the process by which physical certificates of an investor are converted to an equivalent number of securities in electronic form and credited in the investor's account with his (DP) Depository Party. Only those certificates that are already registered in your name and are in the list of securities are admitted for Dematerialisation at NSDL/ CDSL. Investors readily accepted and are still continuing with this system as trading in Demat segment completely eliminates the risk of bad deliveries. In case of transfer of electronic shares, one saves around 0.5% in stamp duty. Demat shares are supposed to remove all the problems of physical trading. The biggest attraction of trading in Demat shares is that the shares an investor buys comes with a clean title and immediately after the settlement on the relevant stock exchange. Buying shares in the Demat form always guarantees the investor a good title as soon as the settlement is over and hence it is a preferred mode of trading today and will be so in the future also.

- 6. Background of the research Online brokering global scenario: Online brokerage has grown substantially since the introduction of Internet and now account for 40%-50% of retail trade. This change has come in because individual investors want to increase control over their finances and do not want someone else to manage the money. Online trading has become very popular in last couple of years because of convenience of ease and use. Numerous companies have gone on-line to meet their customer’s demands enabling them to trade when they want and how they want to. Online trade, which now accounts for 50%-60% of all retail trade, is forecasted to increase to 70% by 2007. At present online brokers hold $574billion in assets but this figure is expected to grow to $4 trillion by end of 2007. The market has become saturated and very competitive. As the number of players increase, it becomes very difficult to differentiate. The volatility in US equity, market in 1999 and September 11 World Trade Center attack in 2001 has hurt the online brokerage trading volumes. Established E-brokerage firms have created bearer to entry that makes it difficult for new player to enter into the market.

- 7. Indian e-broking scenario The Indian stock broking business has gone through a sea of changes. From that of a business dominated by few individual players to institutional members, as did trading open outcry and hidden deeds to screen best and transparency. India enters the cyber-trading era to equal the current market trends taking into consideration the need to facilitate inflow of funds in the capital market. The trading system will enable all categories of investors, resident and non-resident Indian, to trade online. Online brokerage in India is still in its early days. Though the trade through online broking is very miniscule compare to total trading, the signs are that it will grow to 30%-35% in next few years. Effect on off-line Business With the emergence of e-broking, which offers many benefits like, level playing filled to all investors, comfort of the house, simplicity, low brokerage and value added services it could be possible for some of the offline trade to shift to online trade.

- 8. The proportion of online broking business compare to off line broking is miniscule about less than 1%. The offline player would not be affected unless the figure reaches a minimum of 8-10%. Online trade has not started to eat the volumes of, off line business till now. But at he same time it has created new set of clients for e.g., NRI’s who were not very active in the market due to lack of transparency and information, have moved to use this facility. Housewives are another new category. Net savvy student’s and retired persons are the next expected category. But a question is still there, those who get value added services from broker will continue to stay offline and those that are like any other normal retail investors, will have no hesitation to shift to online trading. The fact is that over a few years we would see more non-professionals getting to access to the market. E-broking has eaten the share of offline broking business especially into the sub-broking where the same investors went to get whatever services was provided. Depository services-beginning of the era of stocks at click Today it is a practical reality that one can arrange delivery of securities (shares) sold anytime, anywhere to anyone by a ‘click’ of the mouse and it is possible to trade in securities and settlement of the accounts from the convenience of a sitting room or via a laptop. The depository is responsible to deliver and receive securities trade at the stock exchange, which are the

- 9. business partners of the depository. It dose not deal with financial aspect of the settlement of the trade. Dematerialisation of securities (shares) was the commencement of the era of stocks. The beginning was made in 1996, with legislation of the depository act 1996 and SEBI regulations 1996. Concept of depositories A depository means a place where anything is deposited. It can be anything and can include securities, physical goods, cash and or money or valuables. We have safe deposit vaults where we deposit our valuables for safe custody but under our control. This is also a form of depository. Internationally, there are two systems to hold securities. • The first is to hold securities in a physical form. The ownership can be transferred by any means, including the electronic media. This is also known as ‘immobilization of securities’. This system is followed where the physical volume of securities is low, for example bullion. • The second system is to retain the details of the security holding in an account in an electronic format, which is similar to maintaining a bank account. This is known as ‘Dematerialisation of securities’. This system is followed where the volume of securities is substantial. With the growth of the Indian capital market in the decade and the increasing trading activity in the stock market, the volume of paper being exchanged has increased exponentially and will continue to increase. This

- 10. was one of the primary reasons for India opting for the ‘Dematerialisation’ depository route.

- 11. Statement of problem: Online trading and Demat are the two emerging concepts in stock market. It involves personal factors, technical factors, business factors and economic factors. The interplay of these factors on stock market requires a deep study about the pattern process and procedures and performance. This study is intended to identify the various concepts about Demat and the online trading and its way of functioning. Scope of the Study The study encompasses only the major Secondary market that have a substantial share in the share market. The scope of the study is limited to the performance of the secondary market for the limited period. Need for the study • Physical trading has been given up by many stock exchange around the world and till India is catching up. • Transparency has become an important issue with the regular series of scams over the years • At this junction, Indian investors are able to avail the facilities of Depository participants, Depositories, along with brokerage. • So how far this system is working in India and the investors experience with these new system of trading.

- 12. Objectives of the Study The awareness level of various concepts of Demat & online trading. • Most preferred Demat & online trading. • To study various plans of any company. • To study the cost of online trading. • To know the market leaders in the segment. • To offer suggestions based on findings Research Design Throughout the study an attempt has been made to arrive at the conclusions with help of economic reasoning, experience derived from secondary markets from the lessons of the economic history. The assets, which the corporation has inherited, have deep roots and justify full discussion in its historical perspective. Sources of data Database can be classified into two categories, which are: Primary data: The procedure followed in the collection of primary data is from the interview method i.e., personal interview with the managers. Secondary data: The secondary data collected from different websites, journals, company reports and the available literature on the subject.

- 13. OPERATIONAL DEFINITION OF THE STUDY SECONDARY MARKET: Secondary market is the one in which securities are traded after having been initially offered in the primary market. It is basically a market in which an investor purchases an asset from another investor, rather than an issuing corporation. STOCK EXCHANGE: It is an association, organization or body of individuals whether incorporated or not, established for the purpose of assisting, regulating and controlling business in buying, selling and dealing in securities. CLEARING HOUSE (CH): Clearing House is entities setup by Stock exchanges to ensure that process of settlement takes place smoothly. Generally Stock Exchange will set aside some capital to start the CH. ROLLING SETTLEMENT CYCLE: Rolling settlement cycle starts and ends on the same day and the settlement takes place on T+2, which is 2 business days from the date of the same day from the date of the transaction. INITIAL PUBLIC OFFERING – (IPO): The first sale of stock by a private company to the public. IPOs are often smaller, younger companies seeking capital to expand their business. IPOs can be a risky investment, for the individual investor it is tough to predict what the stock will do on its initial day of trading. It is also known as going public.

- 14. FLOAT: It indicates that portion of a new issue which has not yet been procured by the public. The term also depicts the amount of funds that are in the process of collection and represented by cheques possessed by one bank drawn on other local or out of town banks. It also signifies the value of cheques covered by the Federal Reserve but which are not collected by the Federal Reserve from the bank on which the cheques were drawn. MARGINAL TRADING: It suggests buying of security or commodity by a person from the funds borrowed for part of the purchase price rather than the entire price. Such a person does not pay for the entire transaction from his own funds but borrows money for part of the purchase price. DEMATERIALISATION: Dematerialisation is the process by which physical certificates of an investor are converted to an equivalent number of securities in electronic form and credited to the investor’s depository account with his Depository Party (DP). DEPOSITORY: A depository account is similar to a bank account. It gives a summary of an investor’s holding of securities in the companies in the Indian stock exchange and records transaction details of securities bought and sold during the period. The information of securities holding is maintained in the electronic form. SCRIP: It denotes any temporary document entitling its holder or bearer to receive stock or a fractional share of stock in a corporation, cash, or some other article of value upon demand, or at some specified future date.

- 15. DEPOSITORY PARTICIPANT: A Depository Participant (DP) is an agent appointed by the Depository and is authorized to offer depository services to all investors. An investor cannot directly open a demat account with the depository. An investor has to open his account through a DP only. The DP in turn opens the account with the Depository. The DP in turn takes up the responsibility of maintaining the account and updating them as per the instructions given by the investor from time to time. The DP generates and provides the holdings statement from time to time as required by the investor. Thus, the DP is basically the interface between the investor and the Depository. LIMITATIONS OF THE STUDY The information provided by the managers may not be the actual figures; it may be a virtual data in the sense conclusions based on the real data vary from the virtual data. The study is conducted in the short period of time, and due to time constraints. The study covers only to a particular geographical region, and hence the conclusions cannot be considered as a whole outcome of the industry.

- 16. Indian Stock Market Overview The two primary exchanges in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange of India Ltd (NSE). In addition, there are 25 Regional Stock Exchanges. However, the BSE and NSE have emerged as the two leading exchanges and account for about 80 percent of the equity volume traded in India. The NSE and BSE are almost equal in size in terms of daily traded volume. The average daily turnover at the exchange has increased from Rs 851 crore in 1997-98 to Rs 17,351 crores in 2005- 2006(march) and further to 20000 crores (source; nseindia.com). NSE has around 1900 shares listed with a total market capitalization of around Rs 31,40,392.32 crore. The BSE has over 7000 stocks listed and has a market capitalization of around Rs 22,54,378 crore (march06) source; bseindia.com. Most of the key stocks are traded on both the exchanges and hence an investor can buy these stocks from either of the two exchanges. Both the exchange has same settlement cycle, which does not allow investors to shift their positions. The primary index of BSE is BSE Sensex comprising 30 stocks. The BSE Sensex is the older and more widely followed index. Both these indices are calculated on the basis of market capitalization and contain the heavily traded shares from key sectors. The timing of trading hours starts from 9.55 am to 3.30 pm. The markets are closed on Saturdays and Sundays.

- 17. The key regulator governing Stock Exchanges, Brokers, Depositories participants, Mutual Funds, FIIs and other participants in Indian secondary and primary market is the Securities and Exchange Board Of India (SEBI) Ltd. India ranked top 08 countries in term of the market capitalization of its stock market. If you decide to operate through an exchange, you have to avail the services of a SECURITIES AND EXCHANGE BOARD OF INDIA registered broker/sub-broker. You have to enter into a broker-client agreement and file a client registration form. Since the contract note is a legally enforceable document, you should insist on receiving it. You have the obligation to deliver the shares in case of sale or pay the money in case of purchase within the time prescribed. If you have opted for transaction in physical mode, in case of bad delivery of securities by you, you have the responsibility to rectify them or replace them with good ones. To affect a transfer in the physical mode the securities should be sent to the company along with a valid, duly executed and stamped transfer deed duly signed by or on behalf of the transferor (seller) and transferee (buyer). It is essential to send by registered post with acknowledgement due and watch out for the receipt of the acknowledgement card. If the confirmation of receipt is not received within a reasonable period, the postal authorities should be immediately approached for confirmation. Sometimes, for our own convenience, we may choose not to transfer the securities immediately. This may facilitate easy and quick selling of the

- 18. securities. In that case care should be taken to see that the transfer deed remains valid. However, in order to avail the corporate benefits like the dividends, bonus or rights from the company, it is essential to get the securities transferred in our name. On receipt of our request for transfer, the company proceeds to transfer the securities as per provisions of the law. In case they cannot affect the transfer, the company returns back the securities giving details of the grounds under which the transfer could not be affected. This is known as Company Objection. In case we are unable to get the errors rectified or get them replaced, we may have to recourse to the seller and his broker through the stock exchange to get back our money. Sometimes securities in physical form may be lost or misplaced then we must immediately request the company to record a stop transfer of the securities and simultaneously apply for issue of duplicate securities. For transactions in Demat mode we are requested to refer to the trading/settlement in depositories section. Whom to approach for Grievance Redressal? There will be occasions when there are grievances against the company in which we are stake-holders. Given below are types of grievances for which we could approach SEBI: Issue related i.e. non-receipt of refund order/allotment advice, cancelled stock invests. Non-receipt of dividend. Shares related i.e. non-receipt of share certificates.

- 19. Debenture related i.e. non-receipt of deb. certificates, non-receipt of interest warrant. Non-receipt of letter of offer for rights and interest on delayed payment of refund orders. Complaints related to collective investment schemes. Complaints related to Mutual Funds Mutual Funds Dept., SEBI Complaints related to Dematerialisation or DPs, Depositories and Custodian Cell. Apart from taking up grievances against companies of the types mentioned above through SEBI the following types of grievances could be taken up with other authorities/agencies as given below: With the Stock Exchange: At the investor Information Centre of all the recognised Stock Exchanges: Complaints related to securities traded/listed with the exchanges. Regarding the trades effected in the exchange against the companies. Complaints regarding the trades affected in the exchange against the members of the exchange. With the Department Of Company Affairs/ concerned Registrar of Companies (ROC) Complaints against unlisted companies. Complaints regarding non-receipt of annual report, AGM Notice. Fixed deposit in manufacturing companies.

- 20. With the Reserve Bank of India: Fixed deposits in banks and NBFCs. With the concerned company/ROC: Forfeiture of shares. Moreover two other avenues always available to the investors to seek redressal of their complaints. They areas follows: Complaints with Consumers’ Disputes Redressal Suit in the court of Law.

- 21. EVOLUTION OF ON-LINE TRADING The history of e-trading began in 1983, when a doctor in Michigan placed the first online trade using E TRADE technology. What began with a single click over 16 years ago has now taken the world by storm. The concept was visualized by one Bill Porter, a physicist and inventor with more than a dozen patents to his credit, who provided online quotes and trading services to Fidelity, Charles Schwab, and Quick & Reilly. This led Bill to wonder why, as an individual investor, he had to pay a broker hundreds of dollars for stock transactions. With incredible foresight, he saw the solution at hand: Someday, everyone would own computers and invest through them with unprecedented efficiency and control. And today his dream has become a reality. e-trading has become a way of investing in the developed world and is soon catching on in developing countries too. There are three basic things needed for e-trading, a bank account, a Demat account and a brokerage account. The steps in e-trading replicate the real life situation and are fairly simple to follow. Once these three accounts are opened, the money and shares are transferred to your bank and Demat account automatically, electronically and without any paper work.

- 22. The first step is of course to open an account. One can open multiple accounts with him or herself as the first name in the account. Then it is necessary to determine the type of account that you want and how you want to pay for the trades you make. Accounts can be Individual, Joint, Sole Proprietorship, Corporate, or Partnership etc. The form filling requires simple personal details like full legal name, Citizenship status, Residency status, employer's name and address, your passportPAN number, Date of birth, etc. One can download the forms or request for them by post or even request for a representative of the firm to come over to help you with the form. Post-submitting, you are allotted a USER ID and PASSWORD while giving details for registration. Then an Account Reference Number is generated and displayed to you. These three things are unique to an individual and ensure security of transactions. The acceptance of the application is communicated by email. The Online Trading is a discount trading service appropriate for individuals who require fast execution, lowest commissions and have the expertise to make their own trading decisions without the direction of a full service broker. It gives you an opportunity to leverage your independence to execute, receive automatic fills, monitor, and manage your account on your time. With online order-entry system the investor can transmit his/her orders via the Internet (electronically), directly to the Pit or to the Exchange floor in real time (in as little as 2.5 seconds).

- 23. In order to start trading online it is important that you deposit money in your bank account before placing a buy order. In order to place a sell order you must have shares in your DEMAT Account. In order to place a buy order you need to fund your account. You can do this by depositing money in your bank account or else you can sell some shares existing in your Demat account and use the proceeds of sale to fund your purchase transaction. The amount of money required before placing a buy order would depend on the value of order and the type of e-invest account you have enrolled for - whether cash or margin. In a Margin account one can use a line of credit to buy marginable securities or for overdraft protection. Such an account is opened after taking into consideration Annual income, Net worth, description of your investment objectives, as it involves lending a line of credit. In a cash account, the amount of securities bought has to be backed by the cash in the account. Then comes placing the order. For this you enter your Trading password and go to trade. From the Trading tab, select Enter Order under the Stocks heading. Select a transaction type: Buy, Sell. At 'Number of Shares', type the number of shares that you want to buy. At 'Stock Symbol or Name(s)', type the stock symbol. If you don't know the symbol, click 'Find Symbol', type the company name, click 'Search' and click the symbol that you want from the list. For a

- 24. market order, select 'Market'. Otherwise, select 'Limit', 'Stop' or 'Stop Limit' and enter the price. 'Market Order': you just ask the broker to buy or sell your stocks at the best price available. 'Limit Order': you tell the broker to trade only when the stock hits a certain price or better. 'Stop Order': you tell the broker to sell your shares if the stock drops below a certain price. Select either 'Good for Day' or 'Good Until Canceled'. If you want to place an 'All-or-None' order, click 'All or None'. Type your trading password and click 'Preview Order'. If you want to change your order, click 'Cancel' and make your changes. To see if your order has been executed and filled as you expect, check your account balance. The 'Account Balances' page shows your account equity (the value of your account) and your buying power. If an order to buy or sell stock hasn't been executed yet, you might be able to change or cancel the order. Orders that you have placed but for which you haven't yet received execution reports appear when you click 'View Open Orders' under the 'Stocks' heading of the 'Trading' tab. To change a stock order from the 'Trading' tab, select 'View Open Orders', make sure you're currently in the correct account, the click 'Change' beside the order you want to change.

- 25. Enter your change or changes - you can change the quantity, price, and term. For a new price, select the appropriate option button and then enter the price (unless you're changing it to a market order). You cannot change the stock symbol or the transaction type (Buy, Sell, Sell Short, or Buy to Cover). Enter your trading password and click 'Preview Change Order'. Or, if you want to cancel your changes, click 'Do Not Change'. The account opening charge, commission rates and the minimum limit of transaction vary from site to site. Other charges can include Annual Services Charges, Custody charges, D-Mat account charges etc. So sitting at home one can take an investment decision at ease after having researched and read up fully about the stock. With the advent of online trading, it would seem that the markets are just a click away. However, do remember that currently in India the handful of online trading offers are mere order routing systems. But it will not be long enough before the entire system goes online.

- 26. REASONS FOR ONLINE TRADING IN INDIA: Each investor has one or other reasons to go for online trading instead of offline trading. They are as follows: They are independent. They fell they have control over their account, can make their own decisions and don’t have to give reasons for their actions. They have a reason to participate in the stock market and learn about it. They find it interesting, cheap, easy, fast and convenience. A lot of information is online so they can keep up-to-date with what is happening in the trading world. They are sure and overconfident. They have access to numerous tools to invest and can create their own portfolio. They feel that trading through net can hide from others. REASONS FOR THE EMERGENCE OF ONLINE TRADING IN INDIA: The reasons for providing online trading facility to investors by the Indian companies are various. They are as follows: Online trading has a very good future in India, as it is not exploited properly so far. Consistent increase in the number of users of interest. Consistent increase in the number of personal computer users.

- 27. Part of diversification. Less investment in technology and other areas compared to the returns. More awareness in investors about the stock market. RECENT DEVELOPMENTS: The bumpy Bull Run in the stock markets has triggered a slowdown in the opening of new account by the depository participants (DPs). Faced with the sudden dip in the number of new account being opened the DPs are devising ways to attracts customers. On offer is Interactive Voice Response (IVR) for the latest update on Demat accounts and services through the Internet. Analysts said there was booms in Demat account opening as retail customers were riding high on the loans extended to pick up initial public offers. Most of these Demat accounts are now dormant. Several DPs are planning to launch Interactive Voice Response (IVR) units and Demat services on the Net, Through these IVR units, investor will be able to know the current value of their portfolio, current holdings, transaction list, etc. Some DPs are providing Demat services on the Net to enable customer to access their account and get the holding and transaction statement on a daily basis. For eg: HDFC Bank.

- 28. With Online trading an investor can: Enter orders through Internet. Review your account balances and transaction activity. Obtain stock quotes in real time. Access company profiles and research. Receive the most competitive and current commission schedule. Direct Floor Access-Submit trades directly to the pit in real time. Institutional Quality Order Entry. Market-to-Market Dynamic Account Updates. Reduced Commissions - Up to 80% discounted commission rates. Table 1: Showing usage of Online trading system continent wise. Continent Percentage N.America 25% Asia Pacific 21% W.Europe 44% Rest of the world 10% Usage of online trading system continent w ise N.America Asia Pacific W.Europe Rest of the w orld 25% 21%44% 10%

- 29. Source: Primary data Table 2: Showing ranking of major benefits of online trading system Benefit Single bank Multi-bank IIT 4 1 TS 1 2 CS 6 3 BS/A 2 4 STP 3 5 QR/A 5 6 0 2 4 6 8 10 12 Ranks IIT TS CS BS/A STP QR/A Benefits Ranking of major benefits multi-bank Single bank Source: Secondary data IIT: Improved Information Transparency. TS: Time Saving CS: Cost Saving BS/A: Better Security/Audit STP: Straight Through Processing

- 30. QR/A: Quality of Research /Analytics Table 3: Showing products traded online Product Percentage Swaps and options 8% Bonds 15% Commercial paper 12% Shares 65% Products traded online Sw aps and options Bonds Commercial paper Shares 65% 12% 15% 8% Source: Primary data

- 31. Physical Trading Indian investor community has undergone sea changes in the past few years. India now has a very large investor population and ever increasing volumes of trades. However, this continuous growth in activities has also increased problems associated with stock trading. Most of these problems arise due to the intrinsic nature of paper based trading and settlement, like theft or loss of share certificates. This system requires handling of huge volumes of paper leading to increased costs and inefficiencies. Risk exposure of the investor also increases due to this trading in paper. The risks involved in dealing of shares: • Delay in transfer of shares. • Possibility of forgery on various documents leading to bad deliveries, legal disputes etc. • Possibility of theft of share certificates. • Prevalence of fake certificates in the market. • Mutilation or loss of share certificates in transit. The physical form of holding and trading in securities also acts as a bottleneck for broking community in capital market operations. The introduction of NSE and BOLT has increased the reach of capital market manifolds. The increase in number of investors participating in the

- 32. capital market has increased the possibility of being hit by a bad delivery. The cost and time spent by the brokers for rectification of these bad deliveries tends to be higher with the geographical spread of the clients. The increase in trade volumes lead to exponential rise in the back office operations thus limiting the growth potential of the broking members. The inconvenience faced by investors (in areas that are far flung and away from the main metros) in settlement of trade also limits the opportunity for such investors, especially in participating in auction trading. This has made the investors as well as broker wary of Indian capital market. In this scenario Dematerialised trading is certainly a welcome move. Trading can be at minimum number in capital market. Split of shares made more investors to join the investment scenario.

- 33. Dematerialised Trading Dematerialisation or "Demat" is a process whereby the investors securities like shares, debentures etc, are converted into electronic data and stored in computers by a Depository. Securities registered in the investors name are surrendered to depository participant (DP) and these are sent to the respective companies who will cancel them after "Dematerialisation" and credit investors depository account with the DP. The securities on Dematerialisation appear as balances in investors depository account. These balances are transferable like physical shares. If at a later date, the investor wishes to have these “Demat" securities converted back into paper certificates, the Depository helps them to do this. Depository functions like a securities bank, where the Dematerialised physical securities are traded and held in custody. This facilitates faster, risk free and low cost settlement. Depository is much like a bank and performs many activities that are similar to a bank. Following table compares the two Bank Depository Holds funds in accounts Holds securities in account

- 34. Transfers funds between accounts Transfers securities between accounts Transfers without handling money Transfers without handling securities Safekeeping of money Safekeeping of securities Sample of physical securities being defaced and marked ‘surrendered for dematerialization’ ,

- 35. DEPOSITORY SERVICES IN INDIA India has two depository service providers. The National Securities Depository Limited (NSDL) was incorporated on 8th November 1996, and The Central Depository Services Limited (CSDL) was incorporated in 1996 as the second depository, to provide depository services to the investors. The depositories are required to operate within the legal framework of: • Depository Act 1996 • SEBI (Depository and Participants) Regulation, 1996 • SEBI’s guidelines issued from time to time • Bye-laws • Business Rules The bye-law and business rules are designed by the depository based on the above to govern its functioning and operational procedures, and also that of it business partners.

- 36. The procedures of NSDL and CSDL’s procedures are not significantly different from as it has to follow the same legal framework to operate. National Securities Depository Limited (NSDL) At present there are two depositories in India, National Securities Depository Limited (NSDL) and Central Depository Services (CDS). NSDL is the first Indian depository; it was inaugurated in November 1996. NSDL was set up with an initial capital of US$28mn, promoted by Industrial Development Bank of India (IDBI), Unit Trust of India (UTI) and National Stock Exchange of India Ltd. (NSEIL). Later, State Bank of India (SBI) also became a shareholder. NSDL has since its inception built a network of its business partners and 10 stock exchanges are now trading in securities in the Demat form. Chart 1: Showing NSDL and its Interface Investor Depository Participant R & T NSDL Clearing House

- 37. NSDL carries out its activities through various functionaries called business partners who include Depository Participants (DPs), Issuing corporates and their Registrars and Transfer Agents, Clearing corporations/ Clearing Houses etc. NSDL is electronically linked to each of these business partners via a satellite link through Very Small Aperture Terminals (VSATs). The investor interacts with the depository through a depository participant of NSDL. A DP can be a bank, financial institution, a custodian or a broker. Table 4: Showing statistics of NSDL as on Aug’2005 Companies available for demat 4,464 Companies signed for demat 4,510 Debt instruments admitted for demat 4,767 Commercial papers admitted for demat 619 Depository participants of NSDL 213 Depository participants' service centre locations 1,718 Active clients accounts (in thousands) 3,798 Demat custody (Qty. in crores) 6170 Demat custody (Value in Rs crores) 478,845

- 38. Statistics of NSDL as on Aug'05 1 2 3 4 5 6 7 8 9 Source: Primary data Central Depository Services (CDS) The other depository is Central Depository Services (CDS). It is still in the process of linking with the stock exchanges. It has registered around 20 DPs and has signed up with 40 companies. It had received a certificate of commencement of business from SEBI on February 8, 1999. These depositories have appointed different Depository Participants (DP) for them. An investor can open an account with any of the Depositories’ Participant (DP). But transfers arising out of trades on the stock exchanges can take place only amongst account-holders with NSDL's DPs. This is because only NSDL is linked to the stock exchanges (nine of them including the main ones-NSE and BSE). Once connected to both the depositories the stock exchanges have also to ensure that inter-depository transfers take place smoothly. It also involves

- 39. the two depositories connecting with each other. The NSDL and CDS have signed an agreement for inter-depository connectivity. Benefits Of Demat Transacting the depository way has several advantages over the traditional system of transacting using share certificates. Some of the benefits are: • Trading in Demat segment completely eliminates the risk of bad deliveries, which in turn eliminates all cost and wastage of time • Associated with follow up for rectification. This reduction in risk associated with bad delivery has lead to reduction in brokerage to the extent of 0.05% by quite a few brokerage firms. In case of transfer of electronic shares, you save 0.10% in stamp duty.

- 40. • The investor can also avoid the cost of courier/ notarization/ the need for further follow-up with your broker for shares returned for company objection • In case the certificates are lost in transit or when the share certificates become mutilated or misplaced, to obtain duplicate certificates, the investor may have to spend at least Rs 500 for indemnity bond, newspaper advertisement etc, which can be completely eliminated in the Demat form • The investor can also receive his/her bonuses and rights into their depository account as a direct credit, thus eliminating risk of loss in transit. • The investor can also expect a lower interest charge for loans taken against Demat shares as compared to the interest for loan against physical shares. This could result in a saving of about 0.25% to 1.5%. Some banks have already announced this. • The exclusive demat segments follow rolling settlement cycle of T+3 i.e. the settlement of trades will be on the 3rd working day from the trade day. This will enable faster turnover of stock and more liquidity with the investor. • Reduction in handling of huge volumes of paper • Periodic status reports to investors on their holdings and transactions, leading to better controls. • RBI has increased the limit of loans against Dematerialised securities as collateral to Rs 2mn per borrower as against Rs1mn per borrower in case of loans against physical securities.

- 41. • RBI has also reduced the minimum margin to 25% for loans against Dematerialised securities as against 50% for loans against physical securities. • Demat functions not only in capital market; it also does in money market. Savings Trading in dematerialised shares results in substantial savings for the investors. Following tables and graphs gives an idea about these savings. Table 5: Showing savings for a person who buys shares for long term investment. (On a purchase of Rs10000) Item Physical (Rs) Depository (demat) (RS) Savings (Rs) Brokerage 100 50 50 *Stamp Duty 50 1.5 48.5 Postal Charges 30 - 30

- 42. Company Objection (courier etc.) 35 - 35 Settlement charges 10 5 5 Custody (5 years) 50 30 20 Total 275 86.5 188.5 * Stamp duty of 0.015%. Long term investment 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Brokerage Stamp Duty Postal Charges Company Objection (courier etc.) Settlement charges Custody (5 years) Items Savings Savings (Rs) Demat (Rs) Physical (Rs) Analysis: In physical trading an investor incurs 50% charges more than he/she does in demat. Due to trading in demat an investor saves upto 10% in brokerage, 50% in stamp duty, postal charges and company objection

- 43. like courier etc. Investor can save upto 25% in settlement charges and 20% in custody of 5 years. Inference: As compared to physical trading, an investor saves a lot in demat on account of brokerage, settlement charges and custody and does not incur any cost in stamp duty, postal charges and courier. Table 6: Showing savings for an investor who sells dematerialised shares (For a sale of Rs10000). Item Physical (Rs) Depository (demat) (Rs) Savings (Rs) Brokerage 75 50 25 Company Objection (courier, etc.) 35 - 35 Settlement charges 10 5 5 Total 120 55 65

- 44. 0 10 20 30 40 50 60 70 80 Savings Physical (Rs) Demat (Rs) Savings (Rs) Form of shares Selling of dematerialised shares Brokerage Company Objection (courier, etc.) Settlement charges Analysis: Many brokers offer reduced brokerage for selling of dematerialised securities since they will not have the fear of bad delivery. Saves upto 35% in company objection, 20% in brokerage charges and 5% in settlement charges when trading is done through demat rather than doing physical trading. Inference: Selling of dematerialised shares is more profitable than physical selling of shares.

- 45. Table 7: Showing savings for a trader who buys and sells very often. (For a trader who turns over his portfolio of Rs10000 ten times in a year). Item Physical (Rs) Depository (demat) (Rs) Savings (Rs) Brokerage 1000 500 500 Settlement charges 100 50 50

- 46. Custody (5 years) 125 25 100 Total 1125 575 650 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Savings Brokerage Settlement charges Custody (5 years) Items Frequent buying & selling of shares Savings (Rs) Demat (Rs) Physical (Rs) Analysis: For those who sell and buy shares frequently, they save upto 20% in brokerage and settlement charges and upto 40% in custody for 5 years if trading is done through demat and not physically. Inference: For frequent traders in the stock market demat is a better option.

- 47. Bank Accounts How to open a bank account with a Depositary participants (DP)? Opening a depository account is as simple as opening a bank account. To open an account the investor has to: • Fill up the account opening form, which is available with the DP. • Sign the DP-client agreement, which defines the rights and duties of the DP and the person wishing to open the account.

- 48. • Receive your client account number (client ID). • This client ID along with investors DP ID gives them a unique identification in the depository system. There is no restriction on the number of depository accounts a person can open. However, if the existing physical shares are in joint names, investor has to open the account in the same order of names before they submit their share certificates for demat. A sole holder of the share certificates cannot add more names as joint holders at the time of dematerializing his/her share certificates. However, if the investor wants to transfer the ownership from his individual name to a joint name, he should first open an account as the sole holder (account A) and dematerialise the share certificates. He should then open another depository account (account B) in which he is the first holder and the other person is the second holder and make an off market transfer of the shares from the account A to account B. The investor will incur a charge on this transaction. A client can choose to open more than one account with same DP. In addition to this, he has a choice of opening accounts with more than one DP. There is no compulsion for the client to open his account with the same DP as that of his broker. Even if he has an account with another DP, he can carry out normal business with his broker. There is no loss in operational efficiency. How to choose a DP?

- 49. Following are the few aspects that you should consider before choosing a DP: Branch-level service: Most DPs offer depository services from their main branch as well as through other branches and franchisees. Higher the number of branches your DP has greater will be the geographical convenience you will have. Before opening an account with a DP you should also check whether the DP is offering all the services through its branches. DPs mandate a time limit for submission of debit instructions before settlement pay-in time. It should be checked whether the time limit applies equally to all the branches (or franchisees) of the DP or whether it varies. Backup facilities: Having an adequate backup system is extremely necessary for a DP. In case of a system failure all the data could be lost if backup facilities are not present. Although depositories too have the data with them but a strong system with the DP ensures no risks and hassles. So before opening an account get details from your DP about its computer system's technical specifications and backup facilities. Safe procedures: Your securities account can get debited only if you submit to your DP a duly filled and signed 'delivery instruction' form (separate for market trades and off-market transfers) that authorizes the DP to debit your account. This form will be executed only when the investor has sold shares. But the investor could have worries that some one else can forge your signature on such a form, which your DP will not be able to detect, and their account will get debited .To get rid of these worries

- 50. investor should check that delivery instruction form book that they get from their DP must be serial-numbered with numbers unique to their account and recorded in the DP's system. There is an additional safety feature available with the DPs. Investor can freeze their account on the debit side if they do not want to sell the shares from their account, this will ensure that no debit is done in their account. When they want to sell their shares they can execute the same form to unlock their account. Customer Service: DPs should have adequate customer service facilities. At some time or other the investor will need some information on their account. DP should be able to provide quick service, so it should be checked whether the DP has a dedicated customer service department. OPENING OF DEPOSITORY ACCOUNT An investor is required to open a depository account with a depository participant, if he / she wish to buy or sell securities listed in demat form in the Indian stock exchanges. At present, the following groups of investor are permitted to open a depository account:

- 51. • Individuals • Non- Resident India • Foreign nationals of Indians origin, except those from Pakistan, Nepal and Bangladesh. • Corporate • Clearing Members (CM) • Foreign Institutional Investors (FIIs) • Mutual Funds (MFs). SEBI, on 28 January 2000, also permitted foreign corporation and individuals to invest in the Indian market, albeit with some restrictions. It has, however, yet to issue the guidelines for opening depository accounts for this group of investors. PROCEDURE OF OPENING A DEPOSITORY ACCOUNT Chart 2: Showing procedure of opening a demat account Investor

- 52. • Select a Depository Participant • Complete Depository Account Opening Form • Prepare Required Documents, Detailed • Submit DAOF, with documents to DP • Sign Agreement with DP • Open Depository Account • Generate Client ID (account) number • Transmit details to depository • Acknowledge Client ID • Client ID Activated • Communicates to investor • Client ID number • Guidelines for availing depository services Investor Investor Depository Participant Depository Participant Depository Depository Participant

- 53. Dematerialisation and Rematerialisation How to Dematerialise Your Shares? To dematerialise the share certificates the investor has to: • Fill up a dematerialisation request form, which is available with the DP; • Submit their share certificates along with the form; (write "surrendered for demat" on the face of the certificate before submitting it for demat) • Receive credit for the dematerialised shares into their account in 15 days. Dematerialised shares do not have any distinctive or certificate numbers. These shares are fungible - which means that 100 shares of a security are the same as any other 100 shares of that security. Shares held in street name (market deliveries) cannot be dematerialised. Odd lot share certificates can also be dematerialised. No transfer deed is required for dematerializing certificates, the certificates have to be accompanied by a demat request form (DRF) which can be obtained from DPs. It is compulsory to mention the ISIN number of the company while filling up the Demat Request form. This, to a certain extent, ensures that the security mentioned in the Demat Request Form is the same as the one the investor intends to dematerialise. According to the Depositories Act, 1996, an investor has the option to hold shares either in physical or in dematerialised form. An

- 54. investor can hold part of his holdings in demat form and part of his holdings in the form of share certificates for the same security. An investor can dematerialise shares that are pledged with a bank, which is a DP as well. How to Rematerialise Your Shares? During a rematerialisation process, the request goes from the DP to the R&T agent via NSDL. The R&T Agent, after processing the request, will print and dispatch the share certificate directly to the investor. No transfer duty will be charged when they rematerialise their shares. They have the option of rematerializing their total holdings or part of it.

- 55. Trading Trading in dematerialised securities is quite similar to trading in physical securities. The major difference is that at the time of settlement, instead of delivery/ receipt of securities in the physical form, it is done through account transfer. An investor cannot trade in dematerialised securities through his DP. Trading at the stock exchanges can be done only through a registered trading member (broker) of the stock exchange irrespective of whether the securities are held in physical or dematerialised form. DPs role will only be to facilitate settlement of trade in the dematerialised form, by transferring securities from and to the account of the investor, for selling and buying respectively. Trading in dematerialised securities is presently available at NSE, BSE, CSE, DSE, BgSE, LSE, MSE, ISE and OTCEI. Any investor, who buys securities from any of the stock exchanges where dematerialised securities are available, may receive his delivery in the dematerialised form as dematerialised shares can be delivered in the physical segment at the option of the seller. Therefore those investors who buy securities from these exchanges should necessarily open a depository account to take delivery of these shares.

- 56. Squaring off In the exclusive demat segment, the trades can be squared off within the same day as this segment follows a rolling settlement cycle. In the physical segment the trades can be squared off within the trading period specified for that stock exchange. This is presently five working days, between Wednesday to Tuesday at NSE, Monday to Friday at BSE and Thursday to Wednesday at CSE If an investor squares off his position within the trading period, he does not need to open a depository account. Depository account is required for taking delivery or giving delivery of dematerialised securities in case an investor buys or sells respectively. In case the investor squares off his trade and does not have to take or give delivery of dematerialised securities, the depository account is not used. As in the physical segment, an investor can go long or short in the demat segment also. How to access a scrip? At NSE, the AE and BE segments can be accessed by selecting the scrip the investor wants to trade in and typing AE or BE in place of EQ. At the BSE, all scrips have a scrip code. For going to the Demat segment, add 500000 to the scrip code. For eg If the scrip code of RIL is 325 in the physical segment, the scrip code to be typed for going to Demat segment is 500325.

- 57. Selling and Buying Of Shares How To Sell Dematerialized Shares Selling dematerialized shares in stock exchanges is similar to the procedure for selling physical shares. Instead of delivering physical shares to the broker, you instruct your DP to debit your account with the number of shares sold by you and credit your broker's clearing account. For this, a delivery instruction has to be given to your DP in a standardized format, which will be available with your DP. In short, for selling demat shares; • You can sell shares in any of the stock exchanges linked to a depository through a broker of your choice. • Give an instruction to your DP to debit your account and credit your broker's clearing member pool account. (this is a depository account used exclusively for settling transactions by a broker) • On the pay-in day, your broker gives instruction to his DP for delivery of the shares to clearing corporation of the relevant stock exchange. • The broker receives payment from the clearing corporation • You receive payment from your broker for the sale in the same manner you would receive payment for a sale in the physical mode.

- 58. How To Buy Dematerialized Shares. The procedure for buying dematerialized shares in stock exchanges is similar to the procedure for buying physical shares. When you want to purchase shares in electronic form, you have to instruct your broker to purchase the dematerialized shares from the stock exchanges linked to a depository. Once the order is executed, you have to instruct your DP (vide a simple format which is available with the DP) to receive securities from your broker's clearing account. Alternatively, you may give a standing instruction to receive credits into your account and do away with giving a separate receipt instruction each time you expect a credit. You have to ensure that your broker too gives a matching instruction to his DP to transfer the shares purchased on your behalf into your depository account. You should also ensure that your broker transfers the shares purchased from his clearing account to your depository account, before the book closure. This is really important because shares that remain in the clearing account of the broker on the book closure/ record date will not be eligible for corporate benefits.

- 59. In brief, the transactions relating to purchase of shares are: • You can purchase shares in any of the stock exchanges connected to a depository through a broker of your choice and make a payment to your broker; • Your broker receives credit in his clearing account with his DP on the pay-out day; • Broker gives instructions to his DP to debit his clearing account and credit your account; • You instruct your DP for receiving credit into your depository account either through a specific receipt instruction or using the "standing instruction" facility.

- 60. Charges NSDL does not charge the investor directly but charges its DPs, who are free to charge their clients. NSDL charges its DPs under the following heads: Transaction Fees: Market Trade - sale - nil; purchase - 5 basis points (i.e. 0.05% of the value of net receipts to a clearing members account) Off Market Trade: sale - nil; purchase - 10 basis points (i.e. 0.1% of value of securities) Custody Fees: 3.5 basis points p.a. (i.e. 0.035% p.a. of average value of securities) Rematerialisation: Rs. 10/- per certificate One time payment scheme: NSDL has announced a new scheme under which, if a company makes a one-time payment of 5 basis points (0.05%) of the average market capitalization during the preceding 26 weeks, then NSDL will not charge any custody fees to the DPs for shares of that company. Future issues by such companies would require a payment of 5 basis points on the new share capital created. The valuation for new shares will be done at the issue price. Companies would not be required to pay any additional amount, if they make a bonus issue.

- 61. Receipt of Cash/ Non-Cash and Corporate benefits When any corporate event such as rights or bonus or dividend is announced for a particular security, depository will give the details of all the clients having electronic holdings in that security as of the record date to the registrar. The disbursement of cash benefits such as dividend/ interest will be done directly by the registrar. In case of non-cash benefits, depository will directly credit the securities entitlements in the depository accounts of all those clients who have opted for electronic allotment based on the information provided by the registrar. If an investor has holdings in physical form, he can receive the bonus/ rights issue against this in the dematerialised form. In case of fractional part, as in the physical segment, it would be paid in cash and the remaining whole part would be credited to the investors account. NSDL provides details of the beneficial owner as on (the record date) to the Issuer Company / register so as to enable the company the benefits arising out of these holdings. Shareholders are given the option by the issuer, of receiving their securities entitlements (like bonus or rights) in the form of physical certificates or in the form of dematerialised holdings. If the investor chooses to receive securities in the dematerialised form, he gets a direct credit to his account through NSDL, thereby avoiding the risk of loss of certificates in transit..

- 62. Lending, borrowing and transmission of securities How to Lend Securities? The investor has to instruct their DP through a standard format (which is available with your DP) to deposit their securities with the intermediary. If the intermediary accepts the deposit of securities, the securities will be moved from their account into the intermediary's account. If they wish to recall the securities lent, then they can make a request through a standard format available with their DP. How to Borrow Securities? The investor has to instruct their DP through a standard format (which is available with your DP) to borrow securities from the intermediary. If the intermediary accepts the request, the securities will be moved from the intermediary's account to their account. If they wish to return the securities borrowed, then they can make a request through a standard format available with the DP. Transmission of Securities: Transmission of securities due to death, lunacy, bankruptcy, and insolvency or by any other lawful means other than transfer is also possible in the depository system. In the case of transmission, the claimant will have to fill in a transmission request form. The DP, after ensuring that the application is genuine, will transfer securities to the account of the claimant. For this, the claimant must have a depository account.

- 63. The major advantage in transmission of dematerialised holdings is that the transmission formalities for all securities held with a DP can be completed in one go, unlike in the case of share certificates, where the claimant will have to interact with each issuing company or its R&T Agent. In case where the deceased was one of the joint holders in the Client account, the surviving client(s) shall be the person(s) recognized by depository as having title to the securities held in that joint Client account. In case where the deceased was a sole holder of the Client account, his legal heir(s) or the legal representative(s) will be the person(s) recognized by depository as having title to the securities held in that sole Client account.

- 64. Security National Security and Depository Limited claims to have undertaken sufficient security measures. These measures are: • A DP can be operational only after registration by SEBI, which is based on the recommendation from NSDL and SEBI’s own independent evaluation. • Every day, there is a system driven mandatory reconciliation between the DP and NSDL. • There are periodic inspections into the activities of both DP and R&T agent by NSDL. This also includes records based on which the debit/ credit are affected. • The data interchange between NSDL and its business partners is protected by standard protection measures such as encryption. This is a SEBI requirement. • There are no direct communication links between two business partners and all communications between two business partners are routed through NSDL • All investors have a right to receive their statement of accounts periodically from the DP. • Every month NSDL forwards statement of accounts to a random sample of investors as a counter check.

- 65. • In the depository, the depository holds the investor holdings on trust. Therefore, if the DP goes bankrupt the creditors of the DP will have no access to the holdings in the name of the clients of the DP. These investors can then either dematerialise their holdings or transfer them to a different account held with another DP. • Investor grievance: All grievances of the investors are to be resolved by the concerned DP. If they fail to do so the investor has the right to approach NSDL. • Insurance Cover: NSDL has taken a comprehensive insurance policy to protect the interest of the investors in cases of failure of the DP to resolve a genuine loss. The details of the policy is as under: • Upper limit per claim: Rs200mn • Number of claims allowed: unlimited • Minimum value of the claim: Rs150, 000 • To cover claims valued less than Rs150, 000 NSDL has an investor protection fund in place. Besides all these safety measures efforts have been done to make this electronic system foolproof.

- 66. Demat Shares: Are They 100% Safe When an investor buys physical shares from the stock market, they can never be certain of the validity of the title of shares. There were many reasons- the sellers' signature did not match, or the certificates were fake, forged or stolen, and so on. Demat shares are supposed to obviate these problems. Buying shares in the demat form always guarantees the investor a good title as soon as the settlement is over. The biggest attraction of trading in demat shares is that the shares an investor buys comes with a clean title and immediately after the settlement on the relevant stock exchange. Rule 100 of market regulator SEBI determines whether the shares delivered in a settlement, are good or not. Under rule 100, the shares that have been transferred any number of times can still be withdrawn by the company, if a transfer is found to be invalid for any reason. Suppose an investor <A> sells physical shares to investor <B> and investor <B> gets them dematerialised. Later <B> sells the shares in the stock exchange and investor <C> buys them. Meanwhile <A> discovers that his share certificates were stolen and fraudulently sold by someone else. He gets a court order restraining the company from further transferring the shares and attaching them (currently in possession of C). This is known as 'stop transfer'. So <C> who has bought dematerialised shares is now struck with the shares. He cannot sell these shares since they would be frozen in his account

- 67. Safety of the system has given boost to secondary market operations. Volume increased and number of securities increased by reducing the face value. In demat shares, pre-demat problems about the validity of a share do not affect the interest of the buyers after dematerialisation. Shares go through a verification process at the registrars' before they are dematerialised. Therefore the responsibility lies with the registrar. The registrar must find a remedy if the original transfer of shares, before their dematerialisation comes under doubt. But there is a catch. The company and its registrars are not responsible if the reasons for original transfer being invalid were not available at the time of dematerialisation. Matters have to be dealt with, on a case-to-case basis. Which means that even demat buyer may find that his shares have been frozen in his demat account. This kind of case has to be contested in court by the parties involved. This issue is not directly addressed in ‘The Depositories Act, 1996’. SEBI’s regulations on depositories and depository participants also do not mention the issue. Matters get more complex if an investor has traded further in shares of the same company in his demat account. Demat shares are fungible and don’t have distinctive numbers. It is not easy to track the sale or trade of shares after they are dematerialised.

- 68. One of the major worries in case of dematerializing the physical holdings is the taxman. Through depositories or DPs Income Tax department can easily track down your holdings in capital market. This could be a reason for worry to the people as it is not possible at all as the settlement process is streamlined.

- 69. Findings • After the introduction of dematerialisation the stock market has become more transparent and it attracts more investors day by day. • If the volume increases continuously, DPs will be in a position to decrease the charges for opening and maintenance of demat a/c. • It is observed that banks normally levy a lower service charge compared to other depository participants. • There are some other banks which charges less services charges for demat services than other securities companies. • When the numbers of users are more on line, the speed of the transaction is affected. • Since the rolling settlement is one day, people who are speculating without having full amount of money or shares with their DP, tend to face higher degree of risk. • Some securities have not yet started with the Interactive Voice Response (IVR) units and demat on net.

- 70. • Even though online trading provides privacy to the clients, trends available from the trading room will not help most of the online traders. • Investors dealing online must possess good knowledge for analyzing the information passed on by the companies through net. • Online service depends highly on technology.