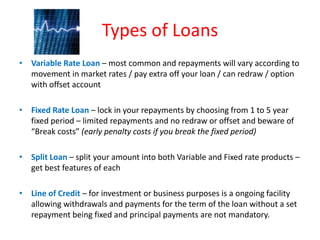

This document provides information about a boutique mortgage broking firm, including their experience and qualifications, the types of financing they can assist with such as home loans, investment loans, and business finance, and the process they follow which includes assessing a client's needs, making loan recommendations, and assisting them through the application and approval process.