The document is a guide for financing a home that provides information on:

1) The process and team members involved in financing a home including the mortgage broker, realtor, lawyers, and home inspectors.

2) The types of mortgages including closed and open mortgages.

3) What is considered in a mortgage application including income, credit history, and required documents.

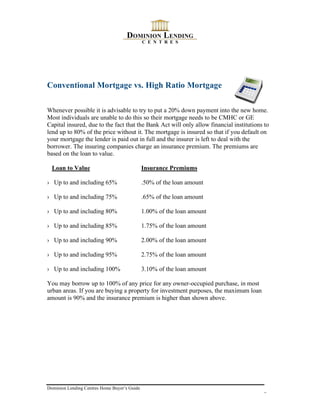

4) The differences between a conventional and high ratio mortgage.

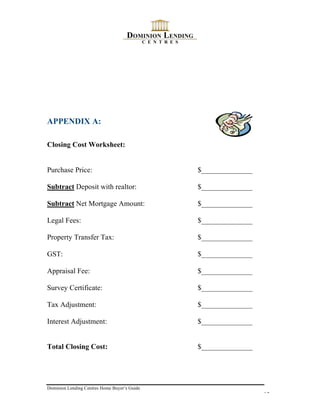

5) Estimated closing costs such as property transfer tax, legal fees, and more.

6) Special financing programs such as purchasing with improvements or 0% down payment programs.