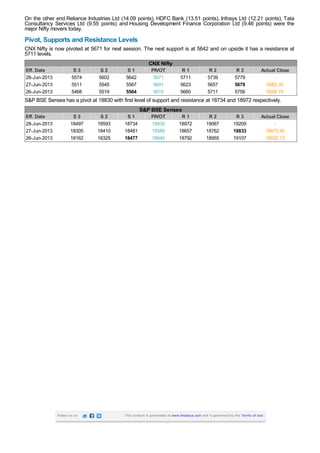

The Sensex gained over 300 points and closed 1.75% higher on the day of F&O expiry, amid news of a narrowed current account deficit in the March quarter. Key sectors like oil & gas, IT and healthcare gained as the CAD for January-March came in at 3.6% of GDP, lower than the previous quarter. Reliance, HDFC Bank, Infosys and TCS were among the top contributors to the gains in both the Sensex and Nifty.