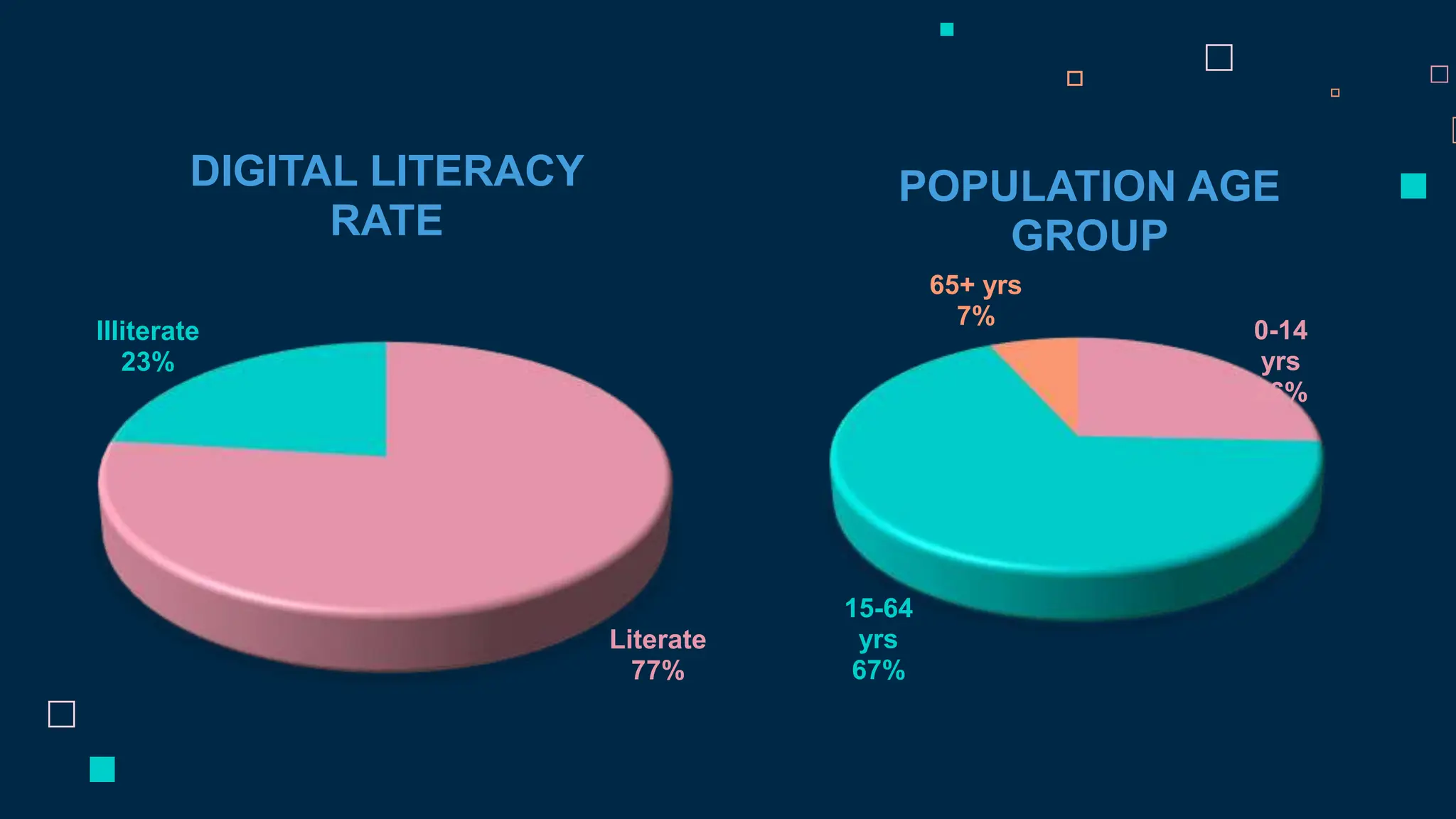

This document describes a project to develop an automated web-based form filling system using optical character recognition (OCR) technology. The system aims to reduce errors and improve efficiency for customers and the banking industry by simplifying the manual data entry process. Special attention is given to ensuring digitally excluded groups like the elderly can access banking services. The solution integrates OCR to automatically populate forms with text data extracted from uploaded identity documents. This represents an important step towards digital inclusion and banking industry advancement.