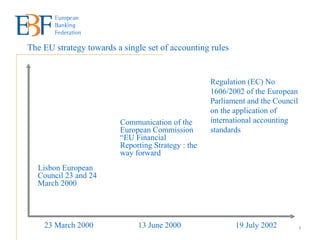

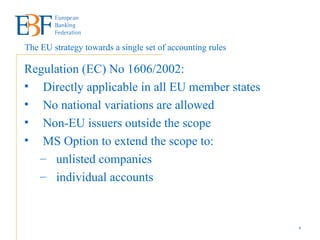

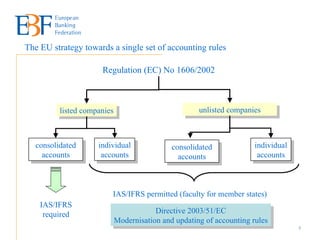

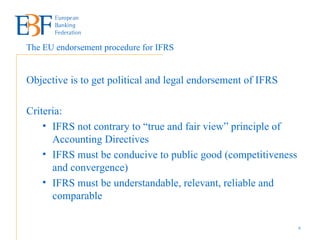

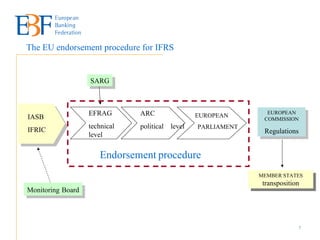

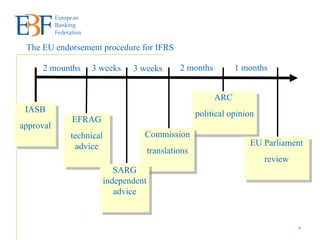

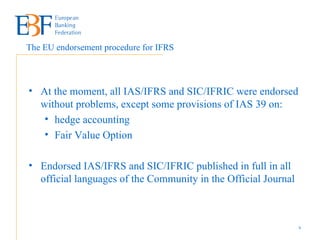

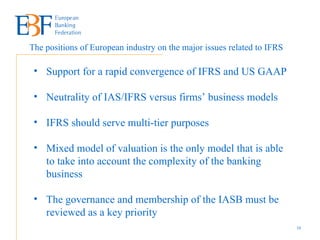

The document discusses the EU's strategy towards adopting a single set of international financial reporting standards (IFRS) for use across Europe. It outlines the EU endorsement process for new or revised IFRS, which involves review by several bodies before the standards are adopted. Finally, it summarizes some of the positions held by European industry on key IFRS issues such as convergence with US GAAP and the need for neutral standards that serve different business models.