This document discusses analyzing a firm's internal organization. It begins by explaining the importance of resources, capabilities, and core competencies in developing competitive advantages. Resources alone do not provide advantages; firms use resources to form capabilities, some of which become core competencies. The document then discusses four criteria for determining if capabilities are core competencies: value, rareness, imitability, and substitutability. Firms must effectively manage current core competencies while developing new ones to remain competitive. The relationship between analyzing opportunities in the external environment and a firm's internal strengths and weaknesses is also discussed.

![5/12/2020 Print Preview

https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentI

d=595324184110311321600972163&dockAppUid=101&eISBN=

9781337916776&id=7… 1/3

Chapter 2: The External Environment: Opportunities, Threats,

Industry Competition, and Competitor Analysis: 2-1 The

General,

Industry, and Competitor Environments

Book Title: Strategic Management: Competitiveness &

Globalization: Concepts and Cases

Printed By: Veronica Powell ([email protected])

© 2020 Cengage Learning, Inc.

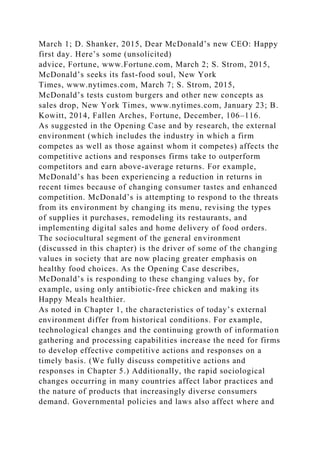

2-1 The General, Industry, and Competitor Environments

The general environment (composed of dimensions in the

broader society that influence

an industry and the firms within it.) is composed of dimensions

in the broader society that

influence an industry and the firms within it. We group these

dimensions into seven

environmental segments: demographic, economic,

political/legal, sociocultural,

technological, global, and sustainable physical. Examples of

elements analyzed in each of

these segments are shown in Table 2.1.

Table 2.1

The General Environment: Segments and Elements

Demographic segment Population size](https://image.slidesharecdn.com/figure2-230110072044-e6240dd7/85/Figure-2-2The-Five-Forces-of-Competition-ModelThe-five-forces-docx-104-320.jpg)

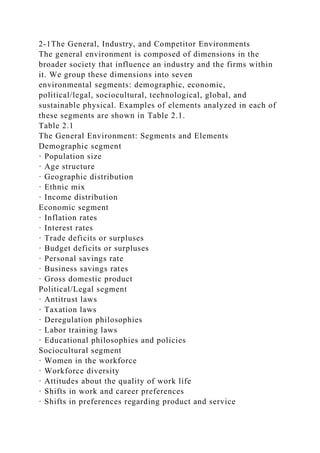

![understanding its general and

industry environments.

An analysis of the general environment focuses on

environmental trends and their

implications, an analysis of the industry environment focuses on

the factors and conditions

influencing an industry’s profitability potential, and an analysis

of competitors is focused on

predicting competitors’ actions, responses, and intentions. In

combination, the results of

these three analyses influence the firm’s vision, mission, choice

of strategies, and the

competitive actions and responses it will take to implement

those strategies. Although we

discuss each analysis separately, the firm can develop and

implement a more effective

strategy when it successfully integrates the insights provided by

analyses of the general

environment, the industry environment, and the competitor

environment.

Chapter 2: The External Environment: Opportunities, Threats,

Industry Competition, and Competitor Analysis: 2-1 The

General,

Industry, and Competitor Environments

Book Title: Strategic Management: Competitiveness &

Globalization: Concepts and Cases

Printed By: Veronica Powell ([email protected])

© 2020 Cengage Learning, Inc.

© 2020 Cengage Learning Inc. All rights reserved. No part of

this work may by reproduced or used in any form or by any

means -

graphic, electronic, or mechanical, or in any other manner -

without the written permission of the copyright holder.](https://image.slidesharecdn.com/figure2-230110072044-e6240dd7/85/Figure-2-2The-Five-Forces-of-Competition-ModelThe-five-forces-docx-110-320.jpg)