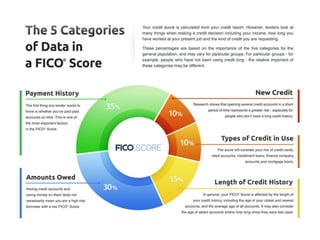

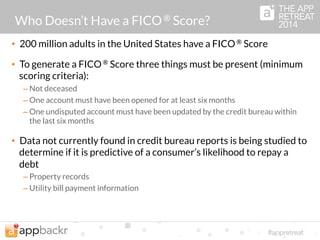

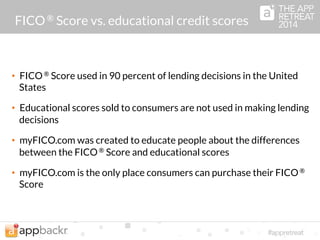

The FICO score is a 3-digit number between 300-850 that ranks consumers according to their credit risk, with higher scores indicating lower risk of default. Over 100 billion FICO scores have been sold and power over 10 billion lending decisions annually. To generate a FICO score, a consumer must have at least one open account that has been reported to credit bureaus within the last 6 months and not be deceased. FICO scores are used in 90% of US lending decisions and consider factors consumers can review and correct to determine creditworthiness in a fair and transparent manner.