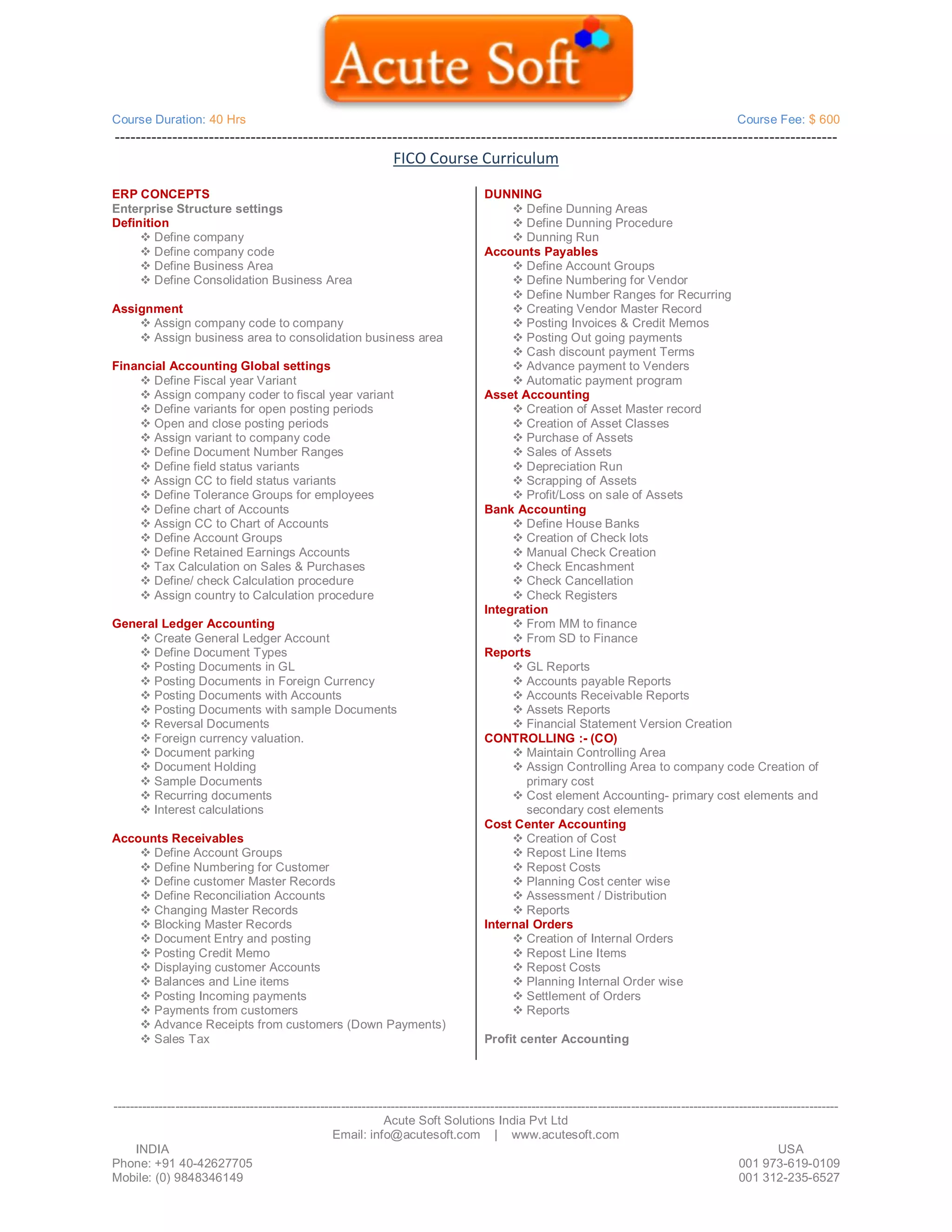

This document provides details about a 40-hour FICO training course costing $600. The course curriculum covers key ERP and accounting concepts including enterprise structure settings, financial accounting global settings, general ledger accounting, accounts receivable, accounts payable, asset accounting, bank accounting, integration with other modules, and controlling concepts like cost center accounting, internal orders, and profit center accounting. Reports related to the general ledger, accounts payable, accounts receivable, assets, and financial statements are also covered.