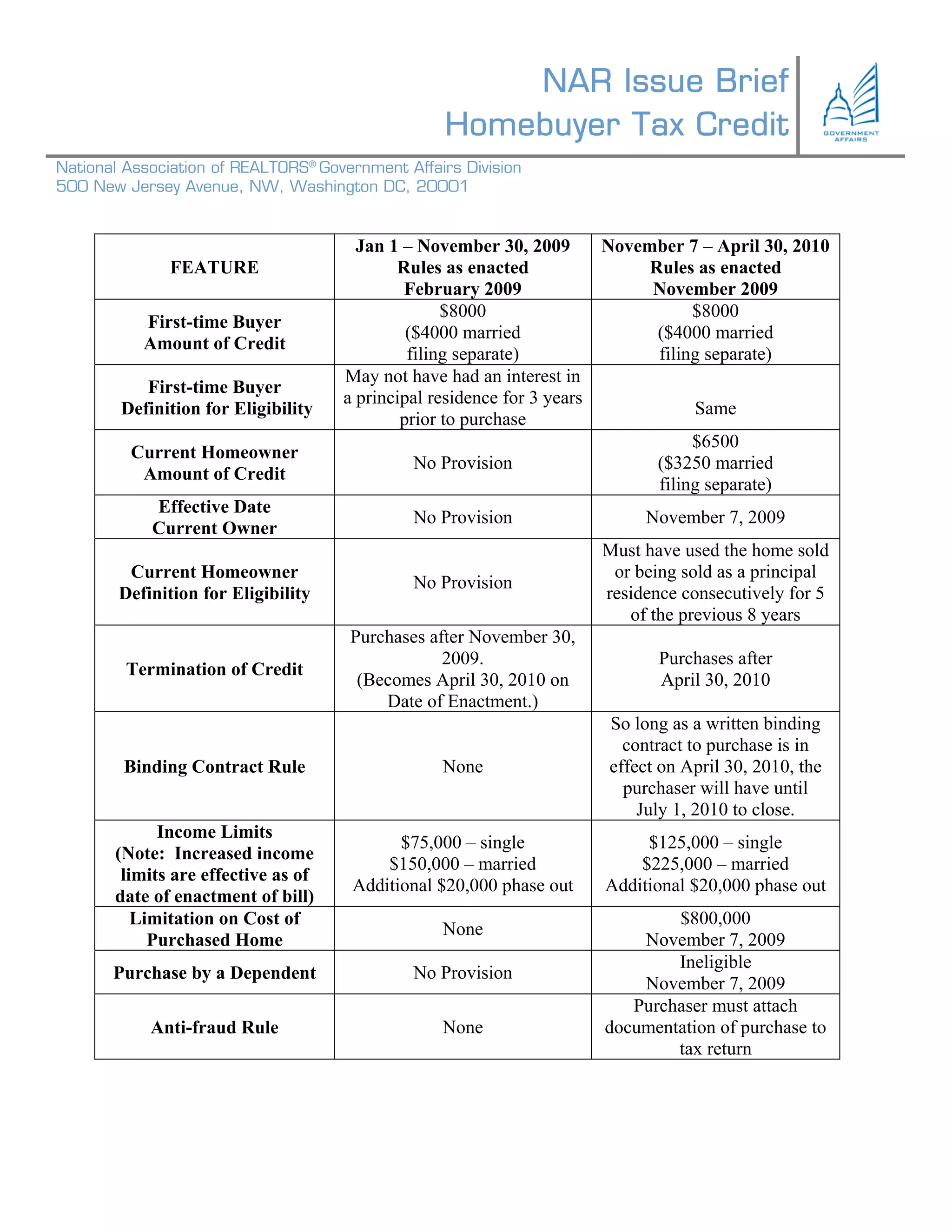

This document summarizes and compares the rules for the homebuyer tax credit for purchases between January 1 and November 30, 2009 and those for purchases between November 7, 2009 and April 30, 2010. It outlines the amounts of the credit for first-time buyers and current homeowners, eligibility requirements, income limits, purchase price limits, rules around binding contracts, and documentation requirements to combat fraud.