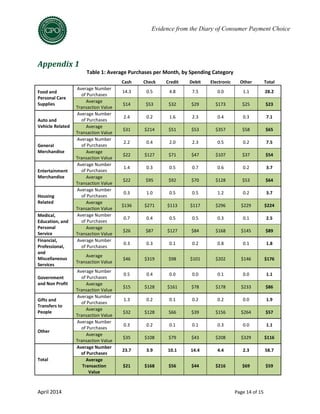

1) Cash continues to play a dominant role in consumer spending, accounting for 40% of all consumer transactions based on number, though only 14% based on value.

2) Cash is used most frequently for small-value transactions under $50, accounting for half of such transactions on average.

3) Cash remains widely used across various spending categories, including food, entertainment, and services, even where alternative payment options are typically available.

4) Consumer payment preferences strongly influence payment choice, with those preferring cash using it for about half their transactions on average, while preferences also correlate with factors like age, income level, and access to financial products.