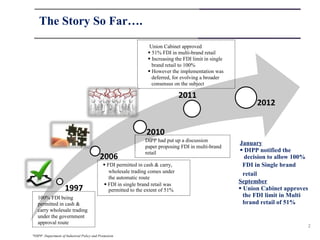

The document discusses India's policy journey regarding FDI in multi-brand retail. Key points include:

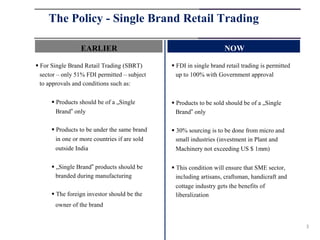

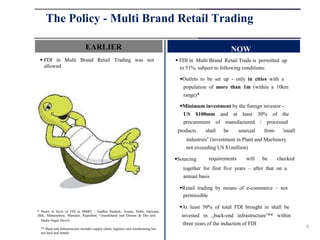

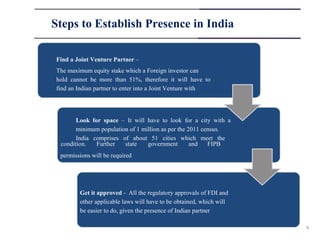

- In 2012, the Cabinet approved 51% FDI in multi-brand retail and increased FDI in single-brand retail to 100%.

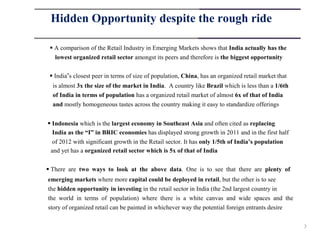

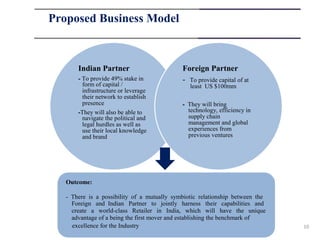

- FDI in multi-brand retail is now permitted at 51% in cities with a population over 1 million, requiring $100M investment and 30% sourcing from small industries.

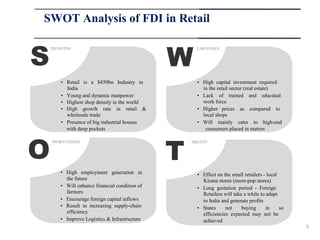

- FDI is seen as an opportunity to improve infrastructure, supply chains and employment, but may also negatively impact small retailers. Foreign investors face challenges adapting to India's diverse market but could find success with a long term view.