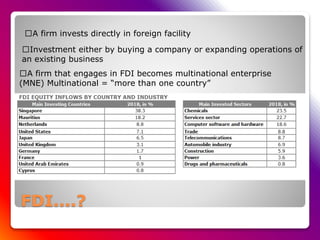

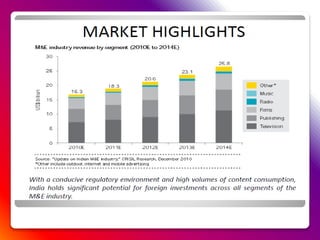

Foreign direct investment (FDI) in India's media and entertainment industry has increased in recent years. FDI up to 100% is allowed in many sectors, including broadcasting, print media, films, and advertising. The media and entertainment industry is growing rapidly in India and is projected to become a $20 billion industry by 2013. Opportunities for FDI exist in television, film entertainment, animation, print media, mobile entertainment, and more. The government has also taken steps like allowing more foreign investment in cable TV and allowing companies to raise foreign funds through non-news business arms.