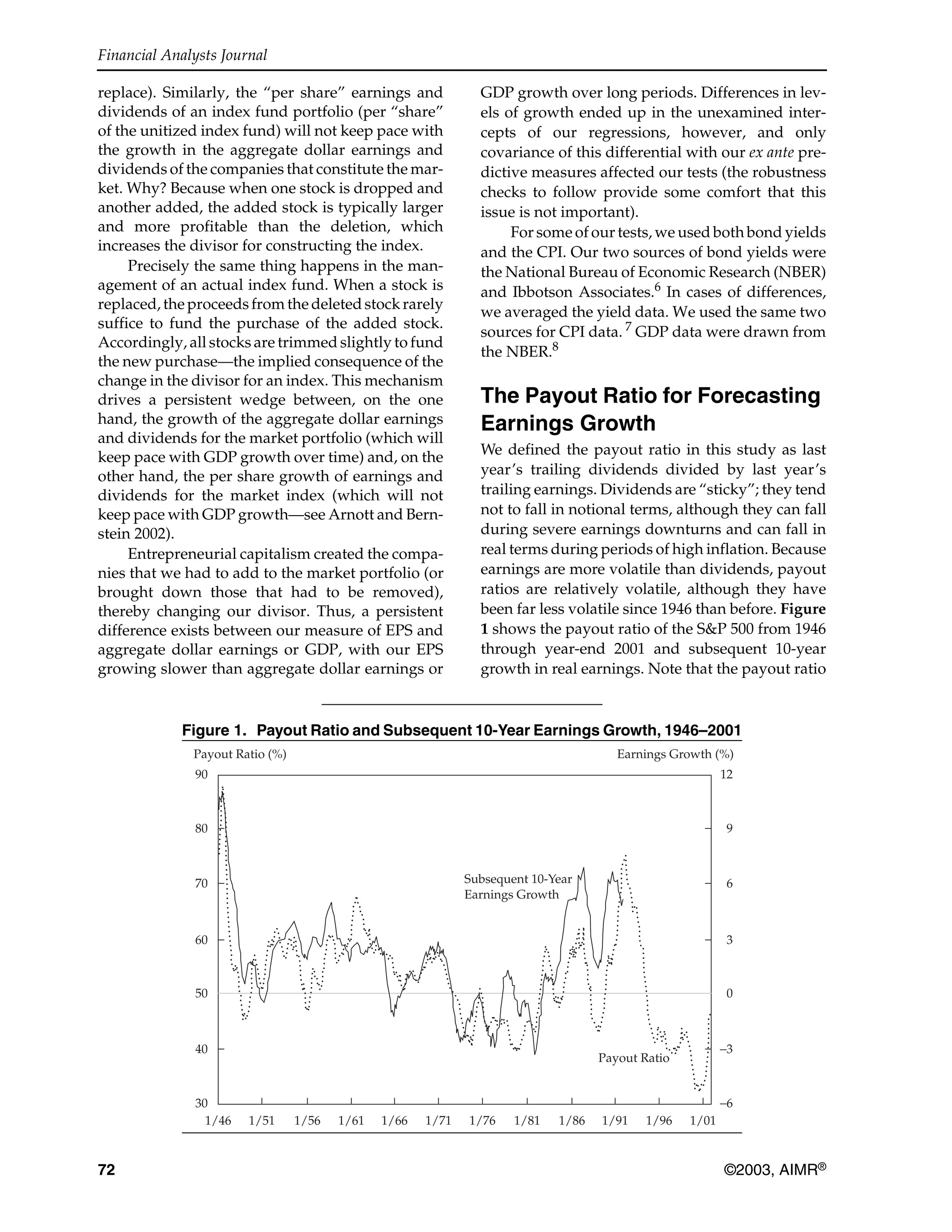

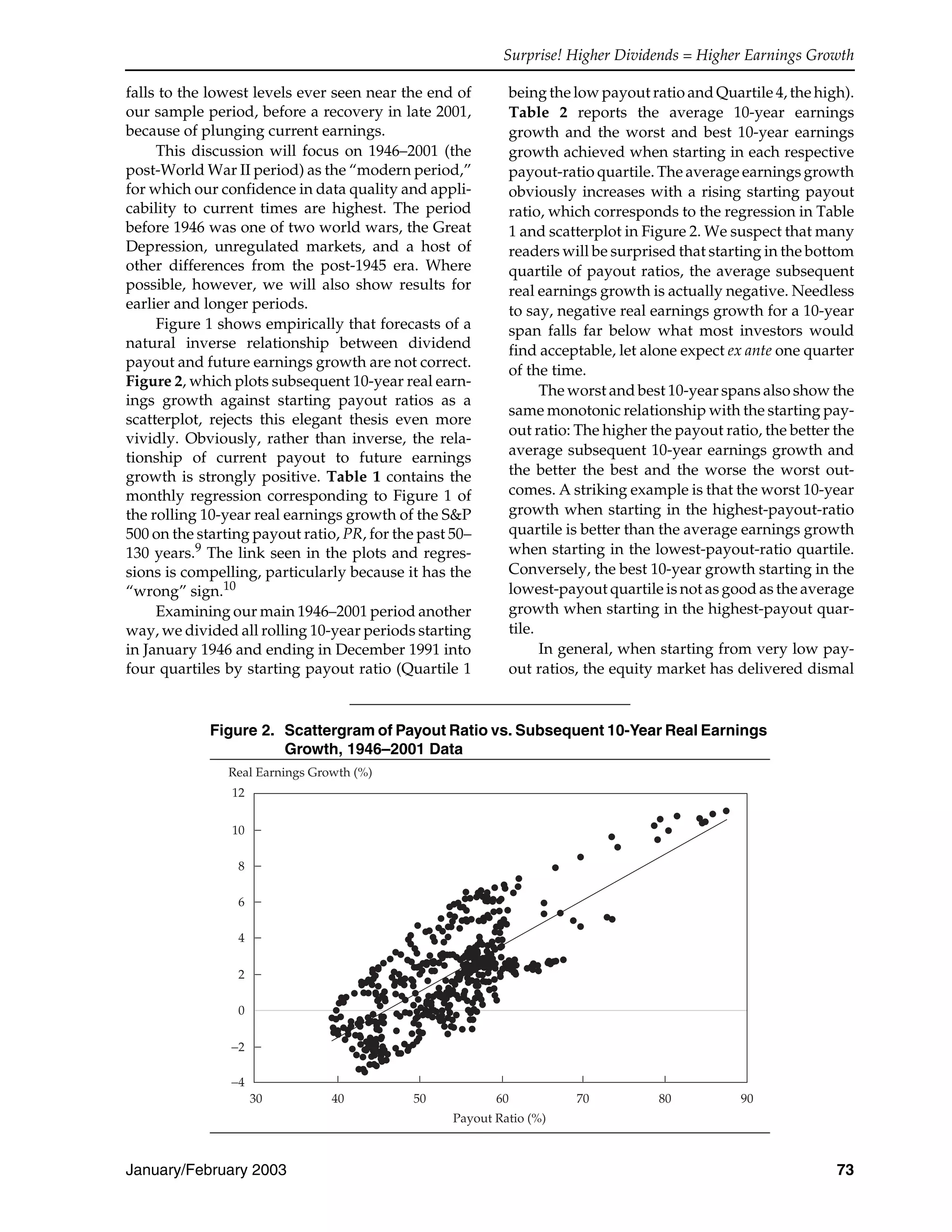

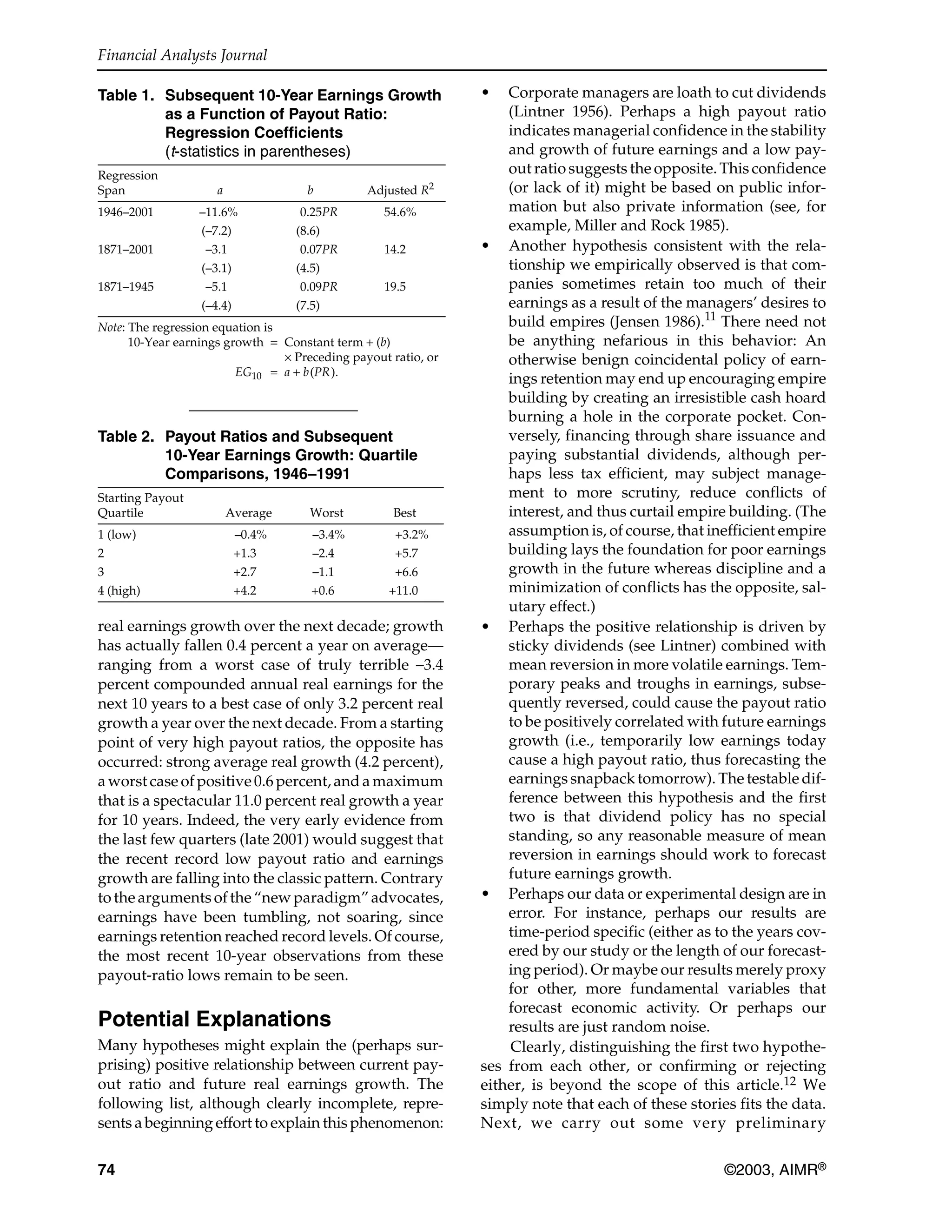

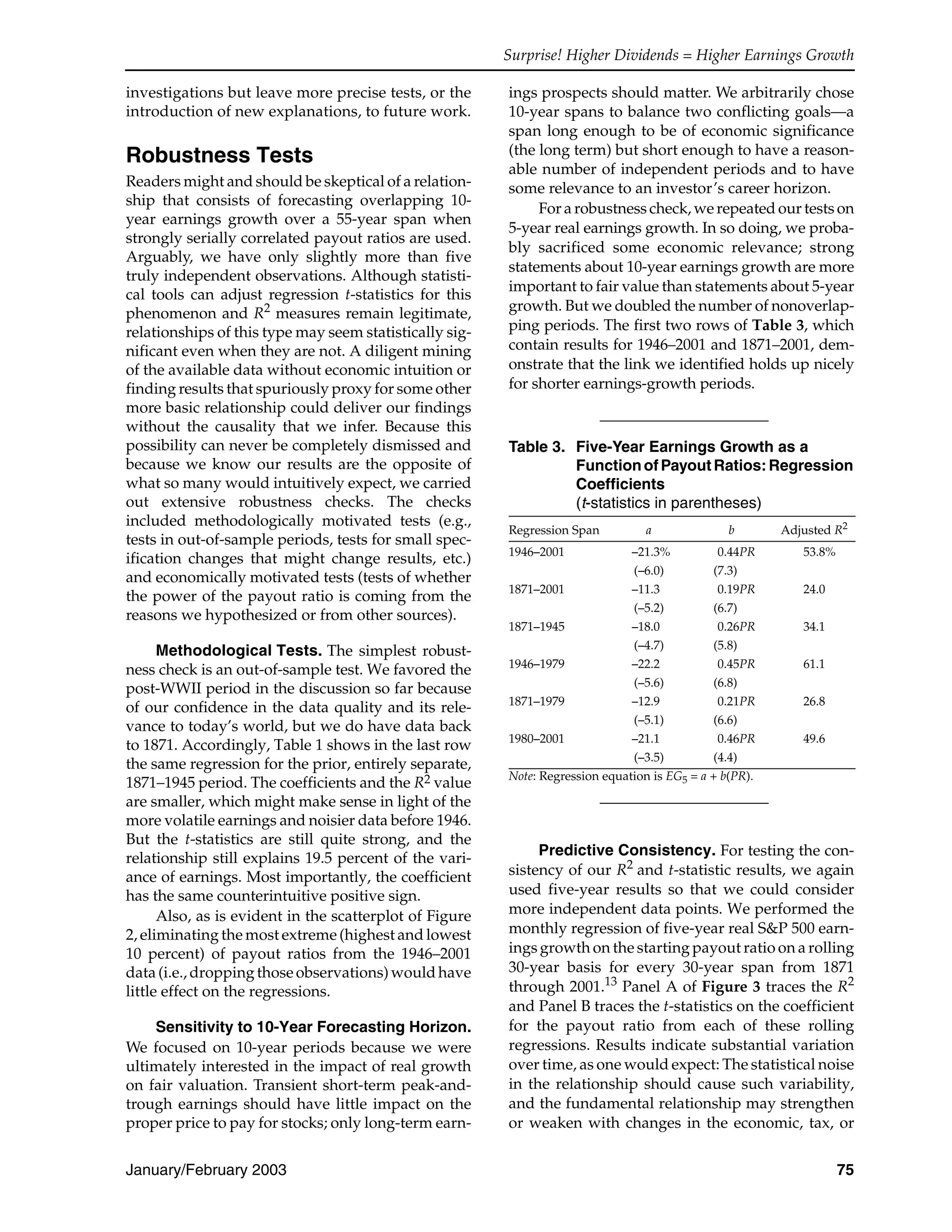

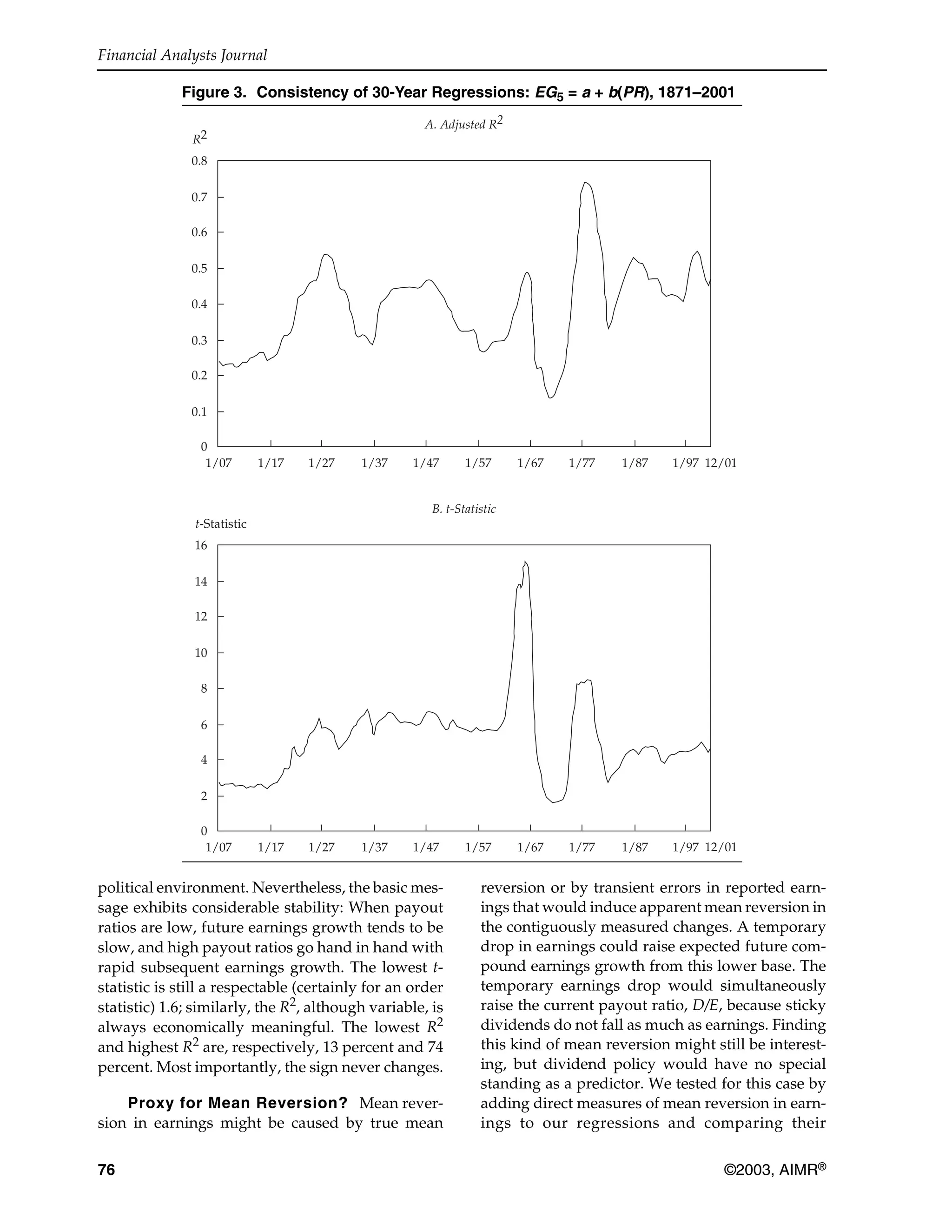

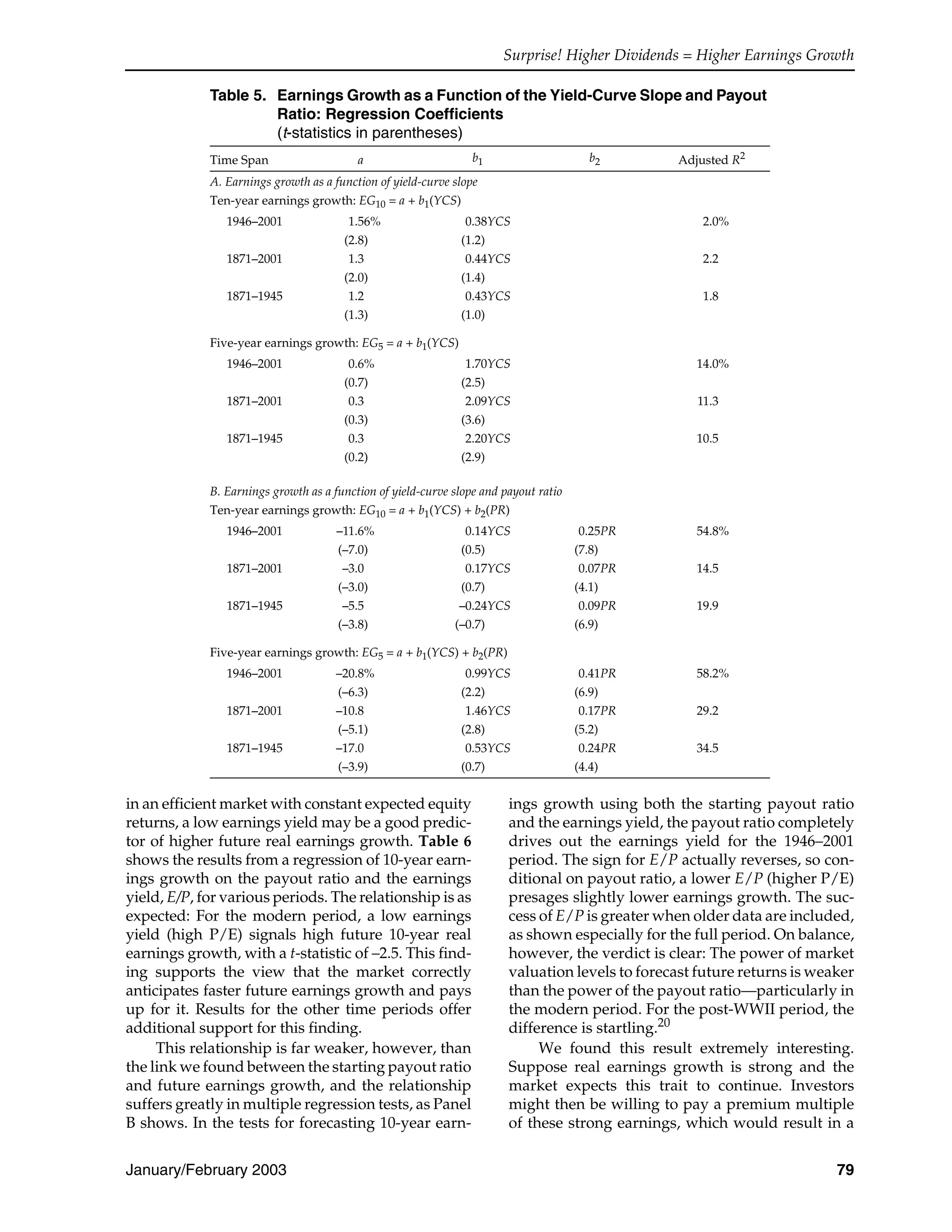

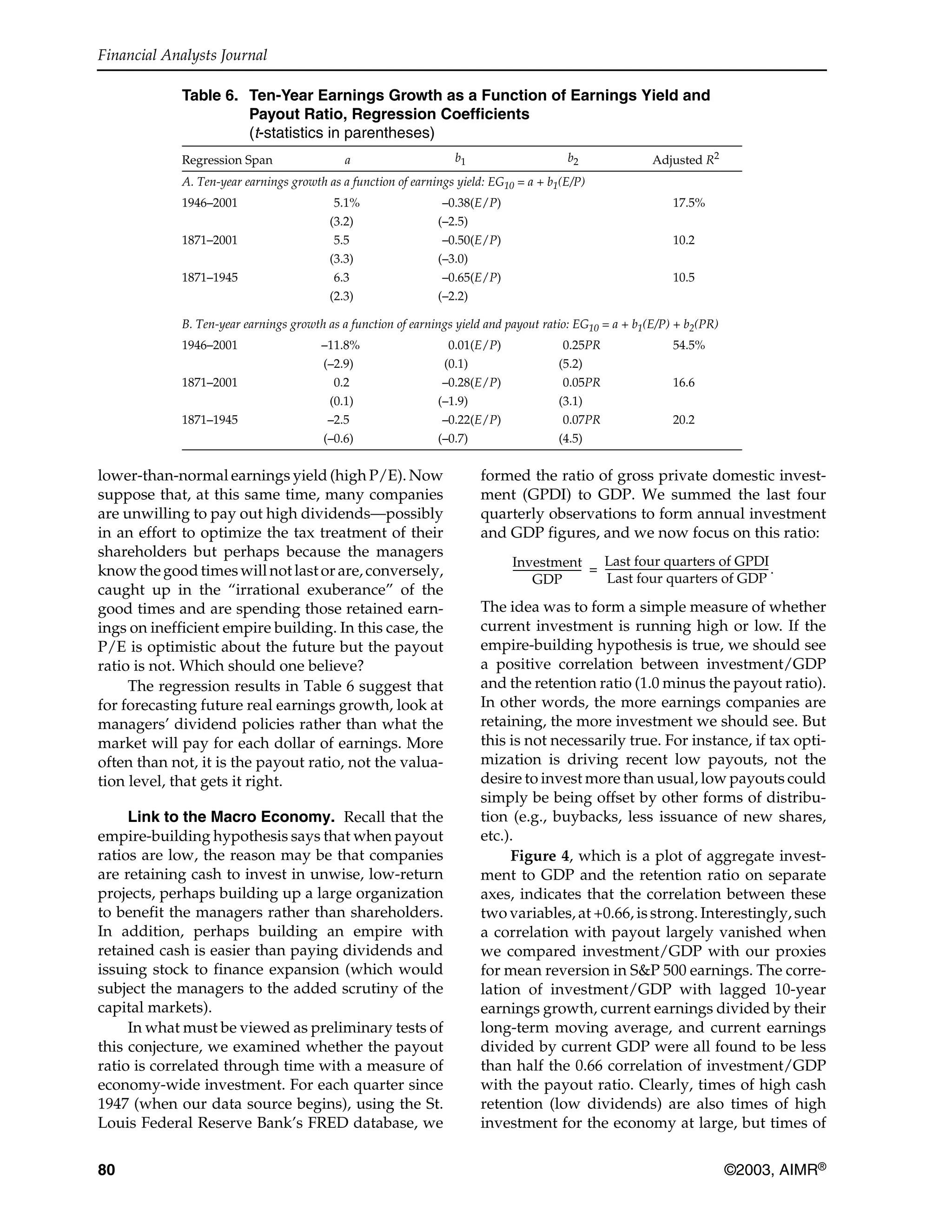

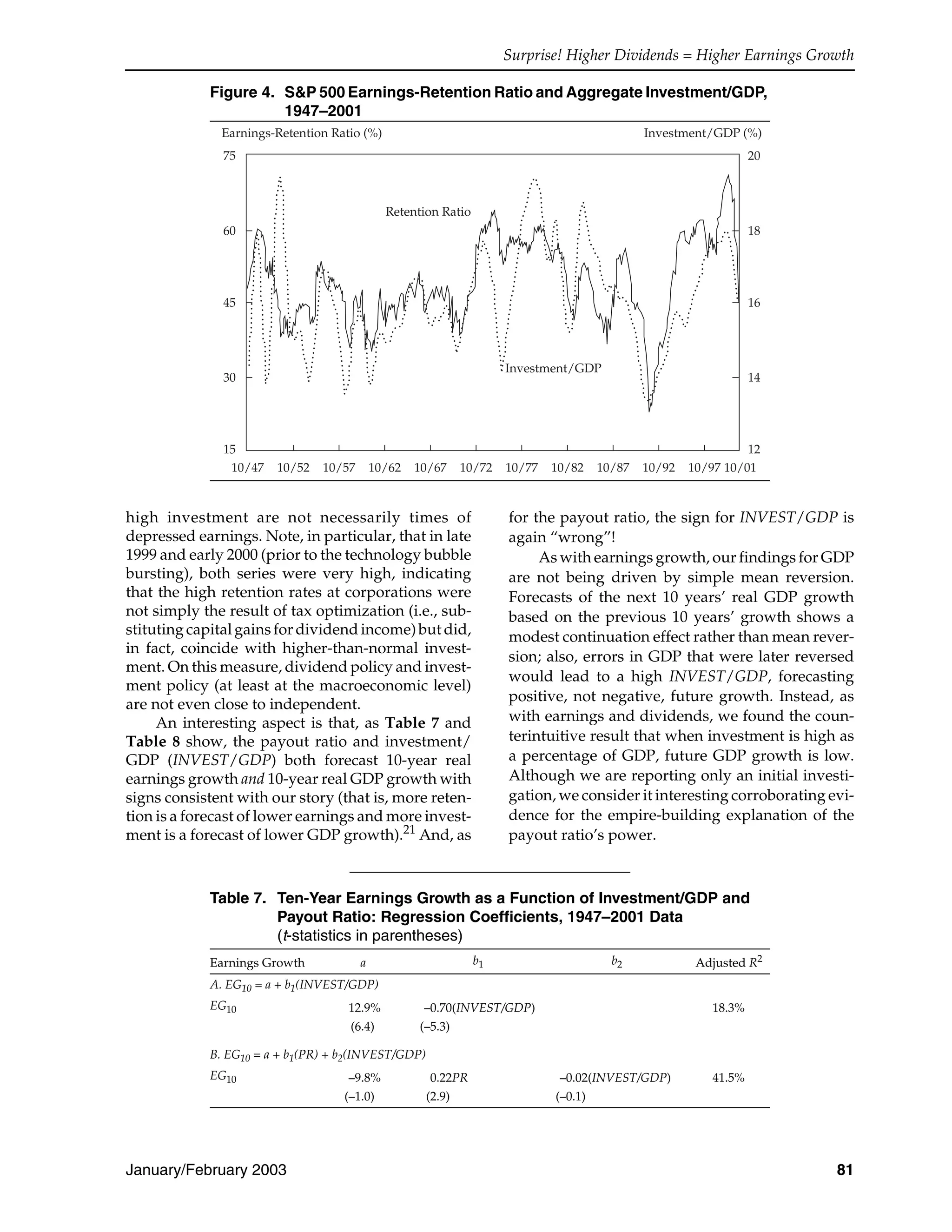

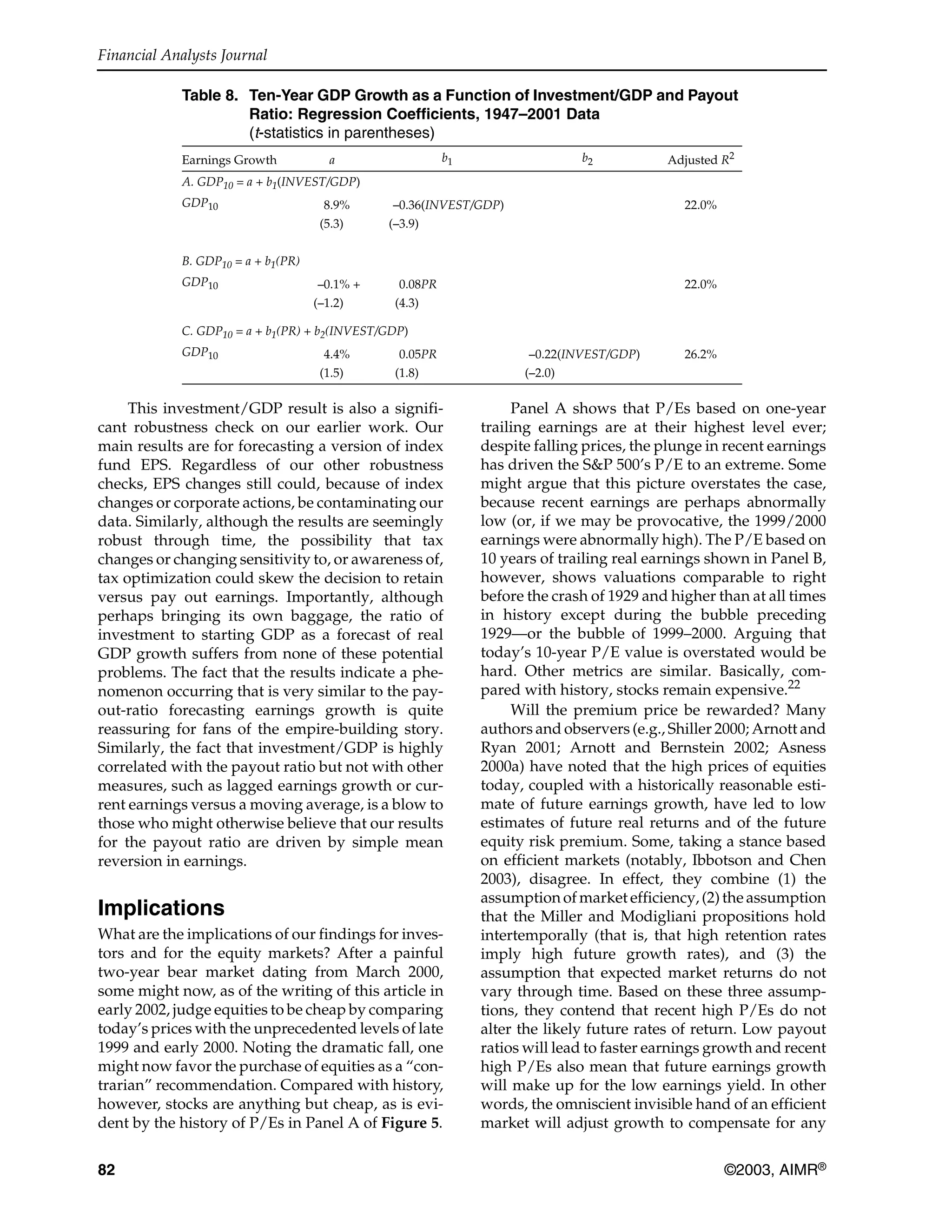

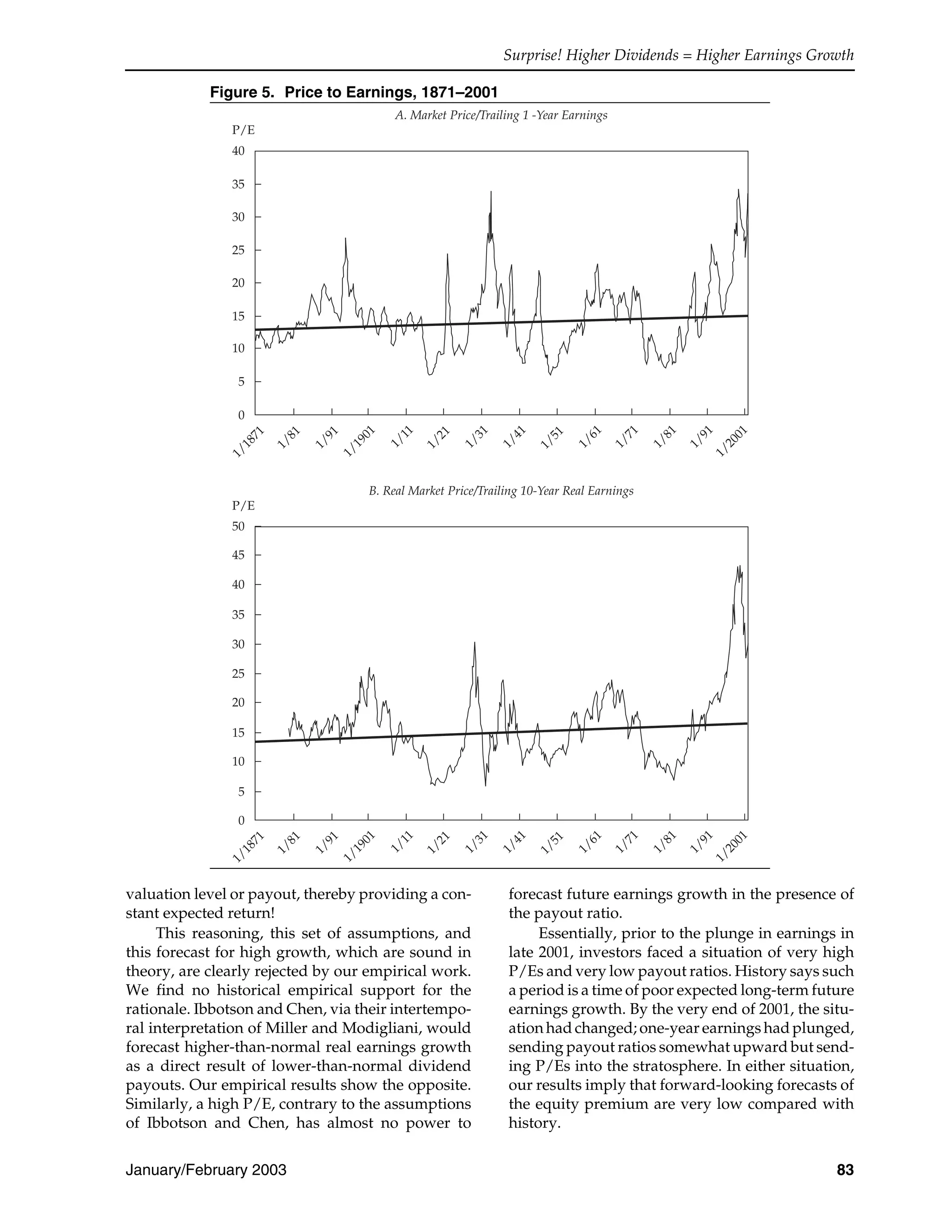

The document investigates whether a company or market's dividend payout ratio can predict future earnings growth. It finds that historically, the highest expected future earnings growth occurs when current payout ratios are high, and the slowest growth occurs when payout ratios are low. This relationship holds even after accounting for other factors like mean reversion in earnings. The findings contradict the view that reinvesting more earnings will fuel faster growth, and instead support the idea that managers sometimes signal expectations or engage in inefficient behavior through dividends. The low payout ratios seen recently may not be a sign of strong future earnings growth as some predict, according to the historical relationship identified in the document.