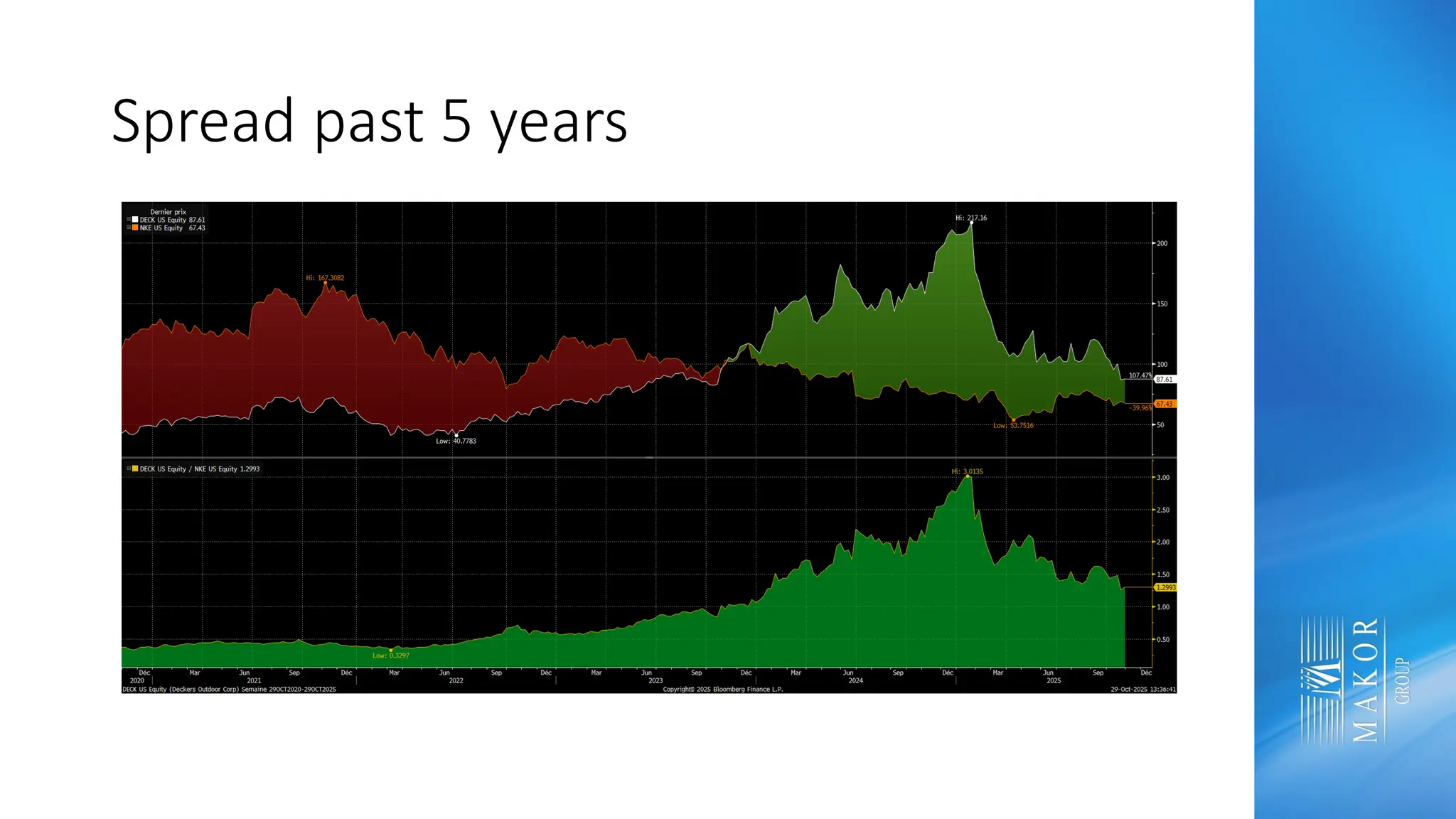

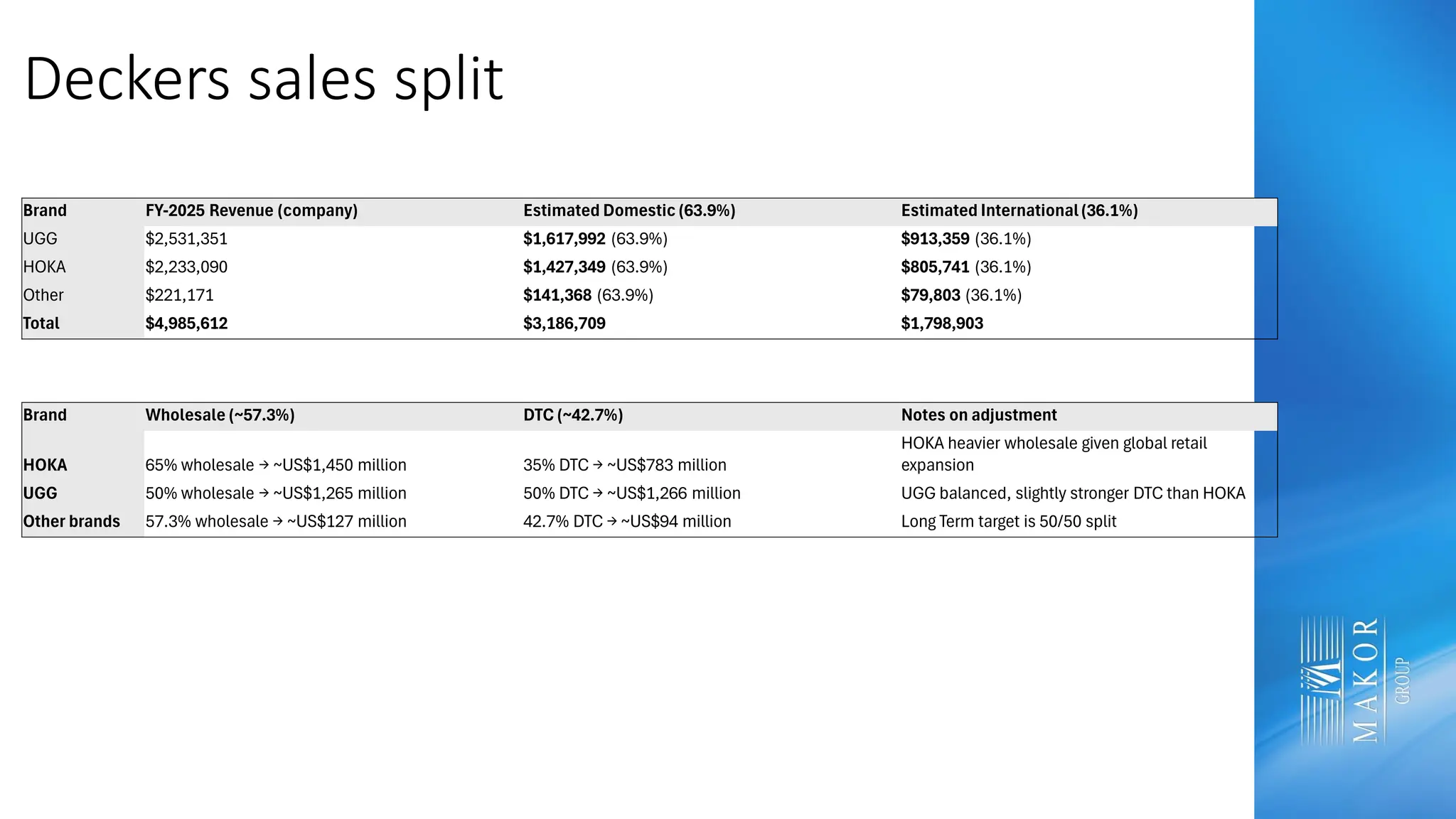

Deckers is a very interesting US based company owning 2 strong brands, UGG and Hoka.

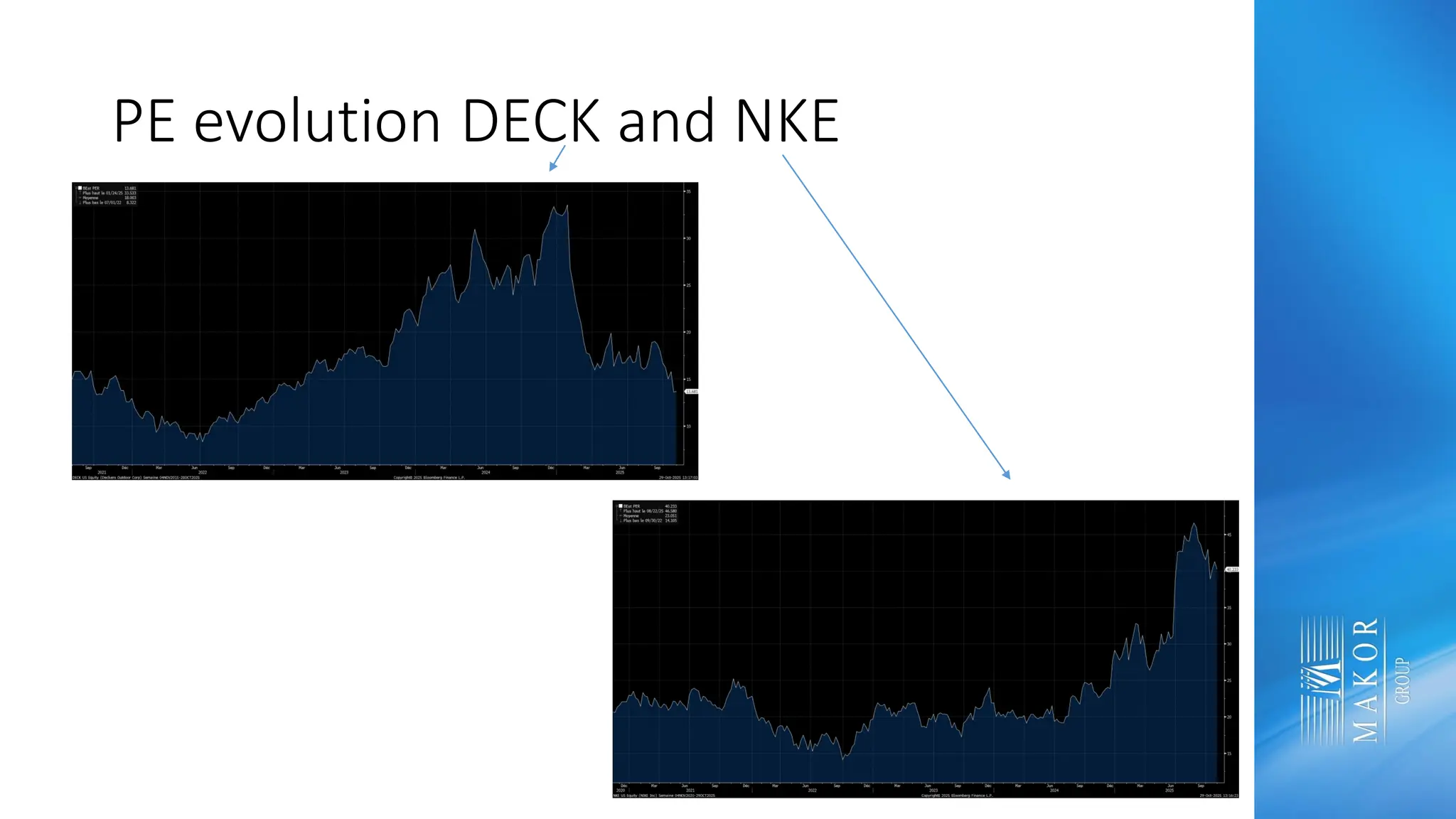

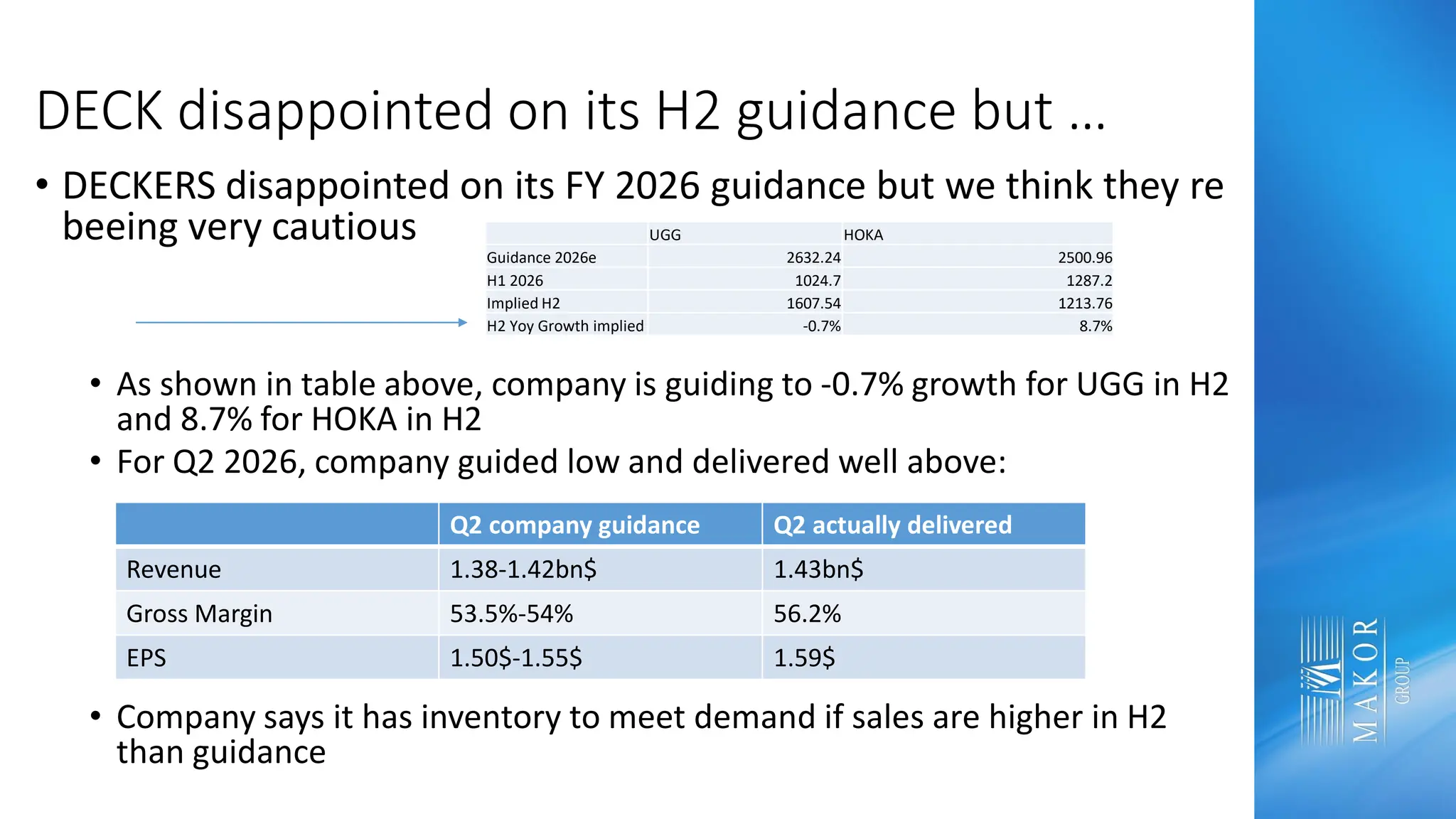

Stock has had a poor run recently, due to market s cautiousness on UGG top line growth.

At around 80$ when we pushed the trade, this risk seemed well taken into account in the share price.

Not surprisingly, stock is back to 100$+ (in 1 month).