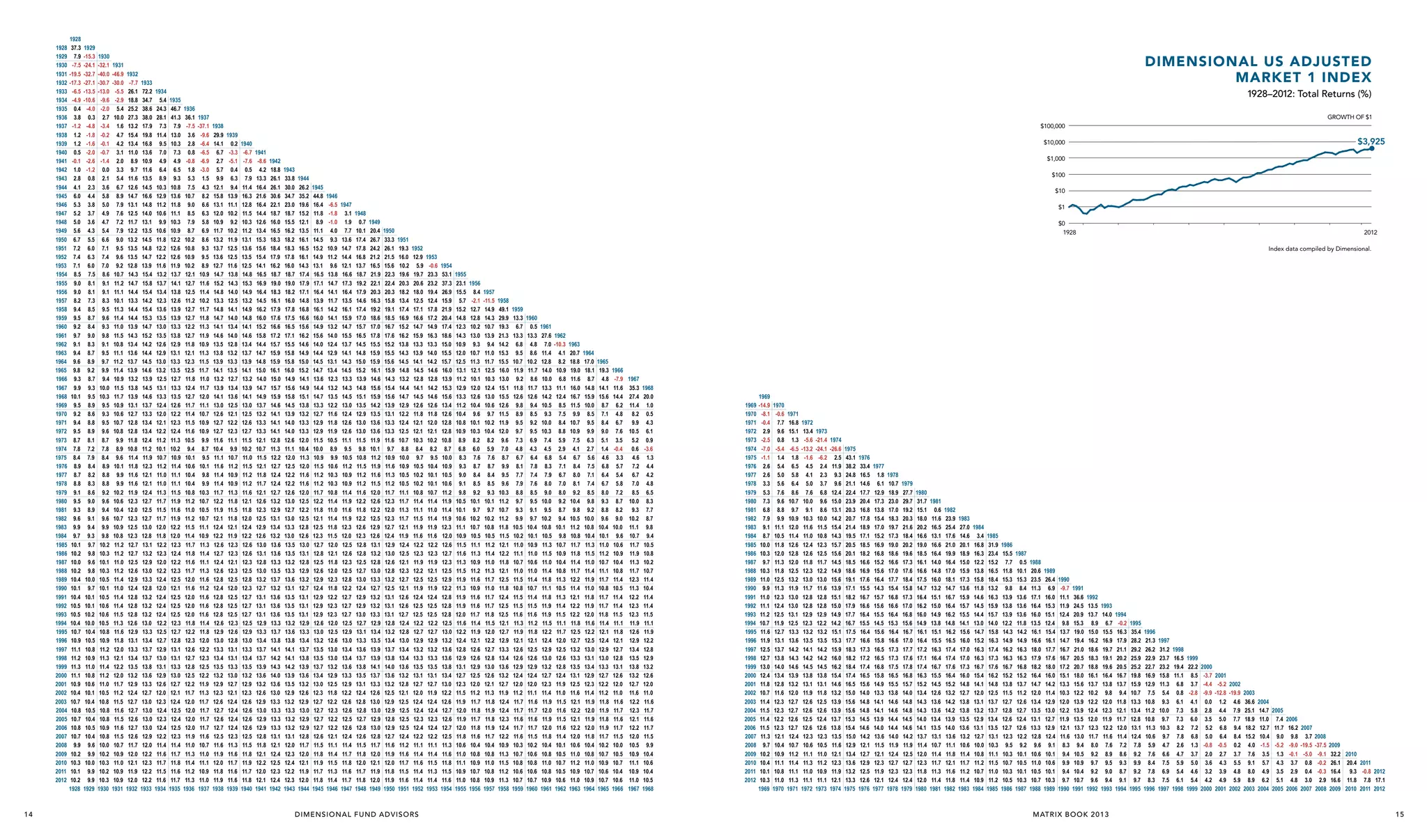

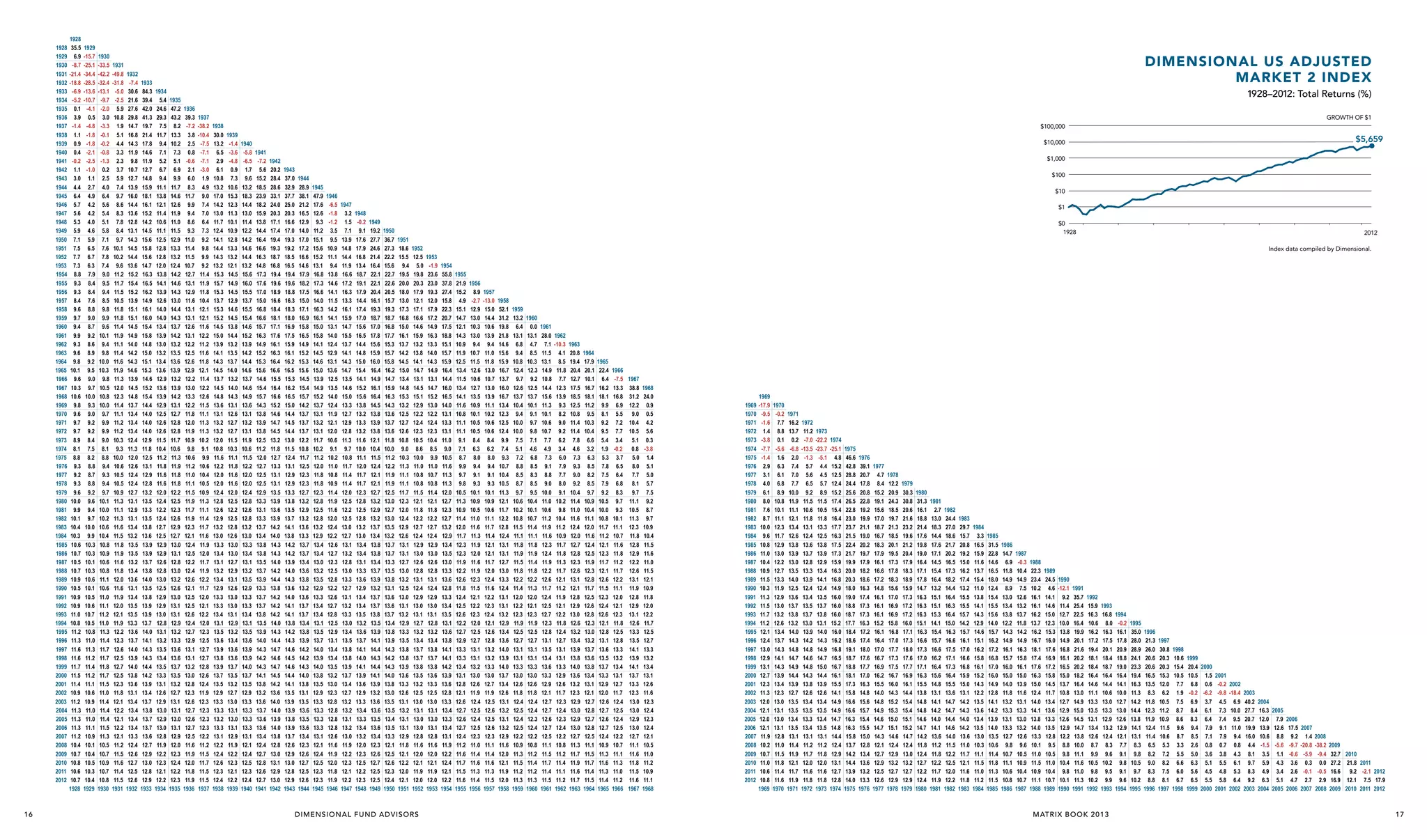

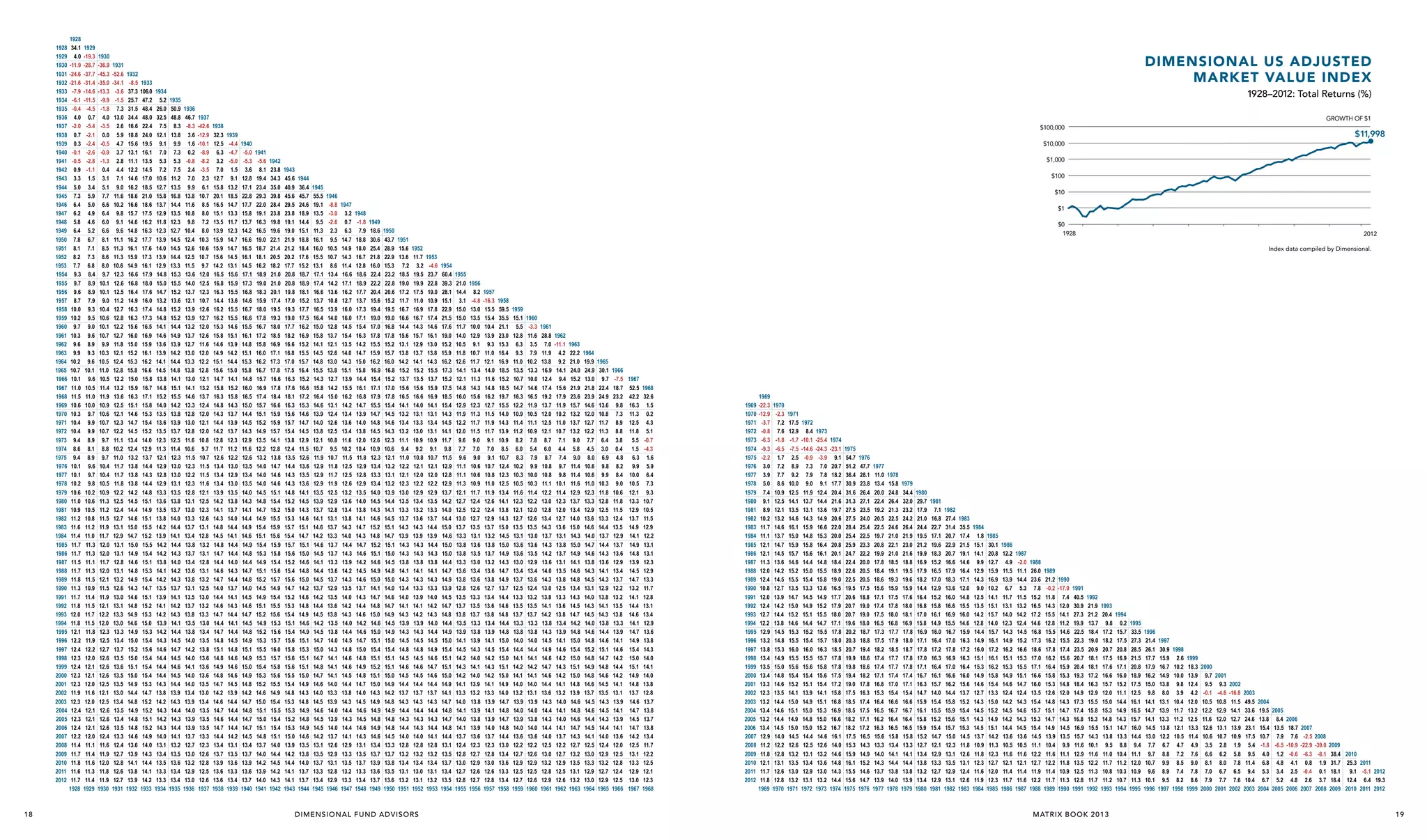

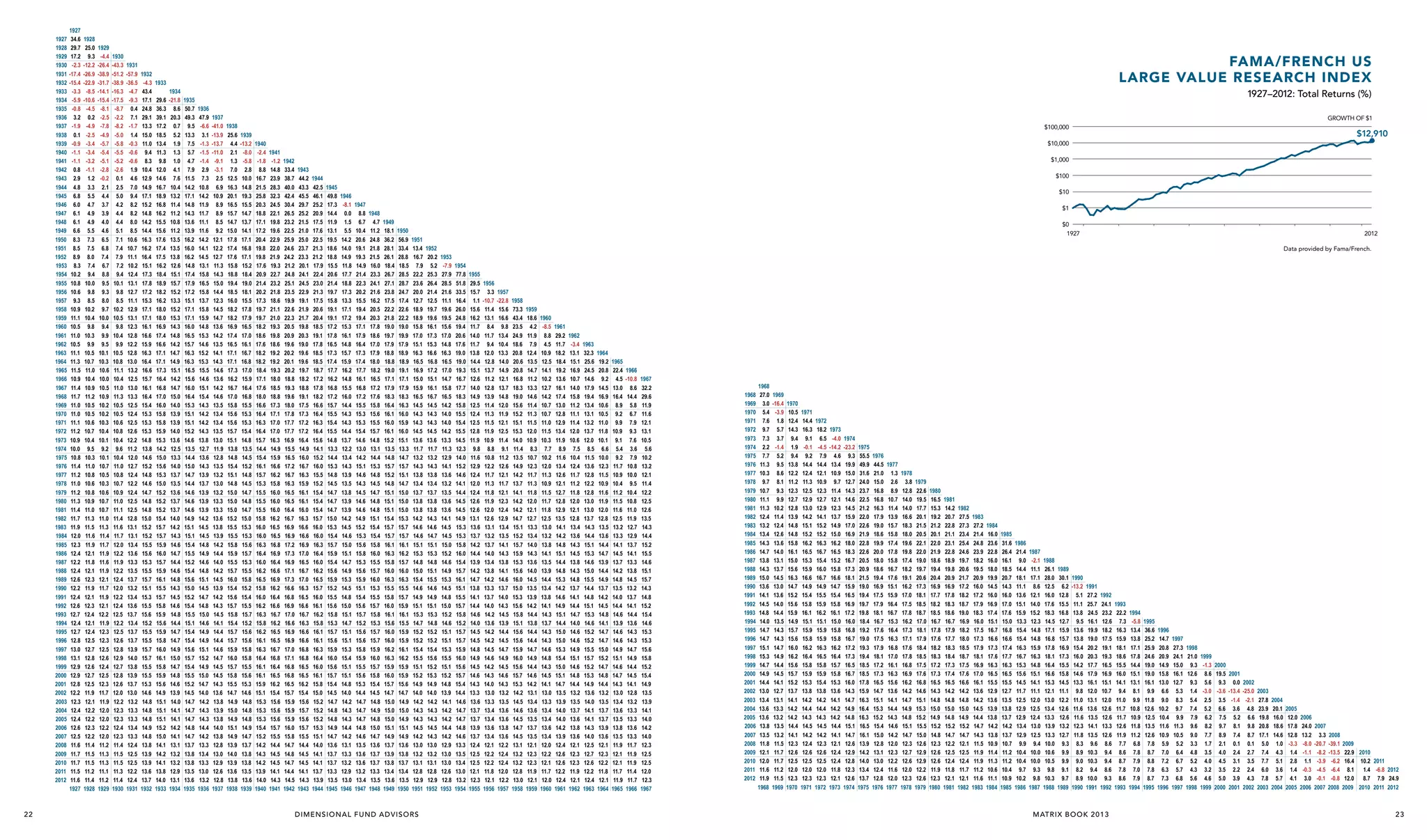

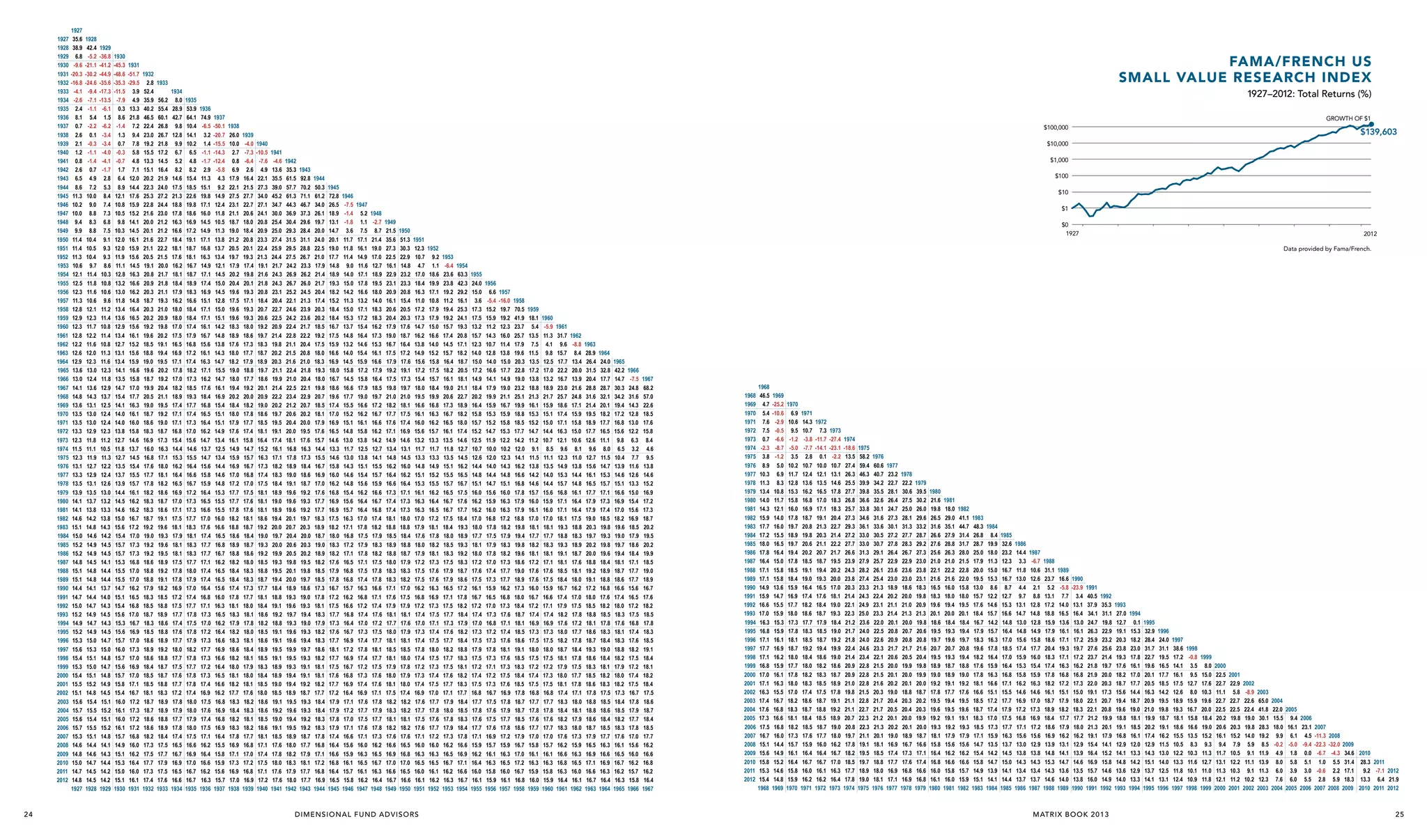

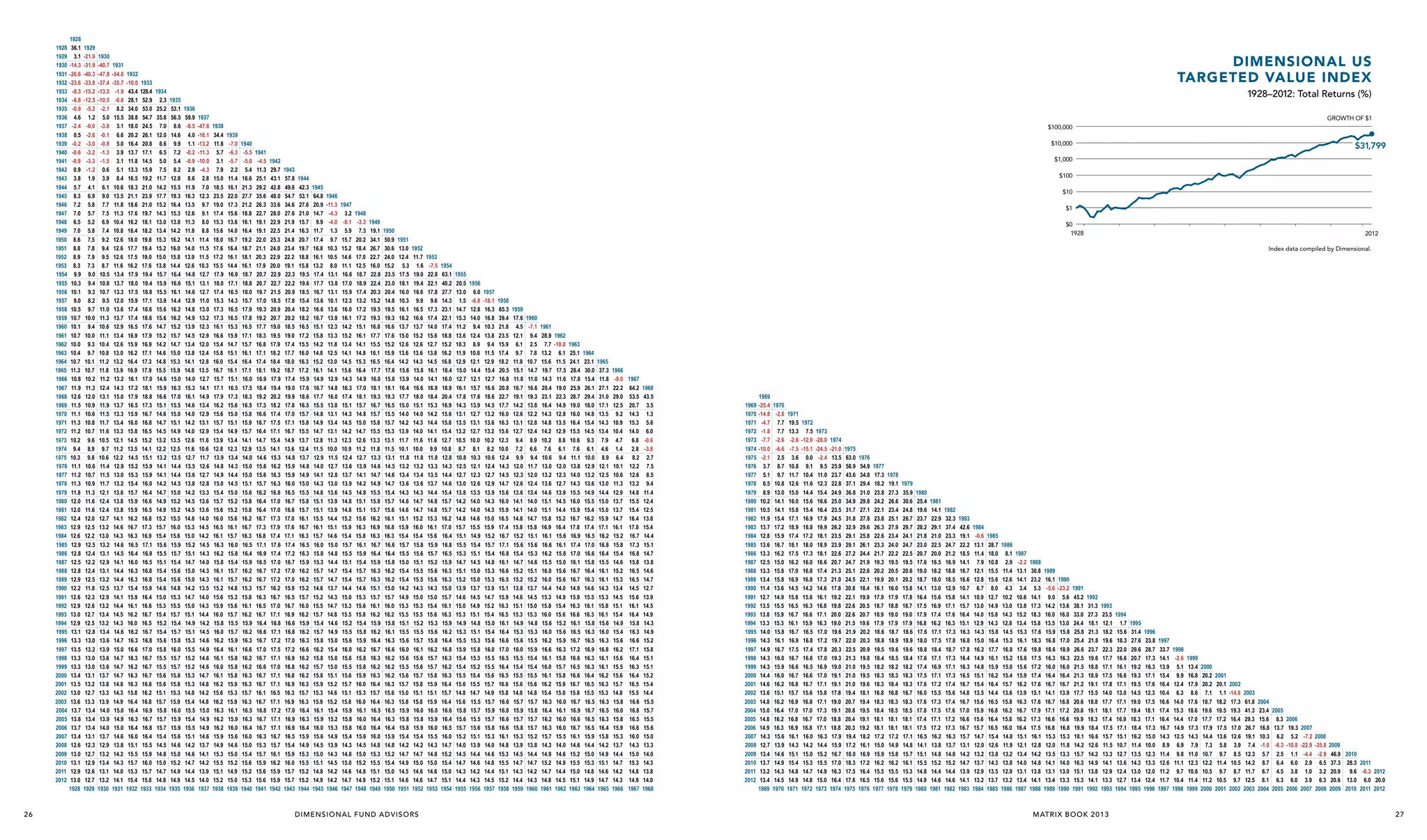

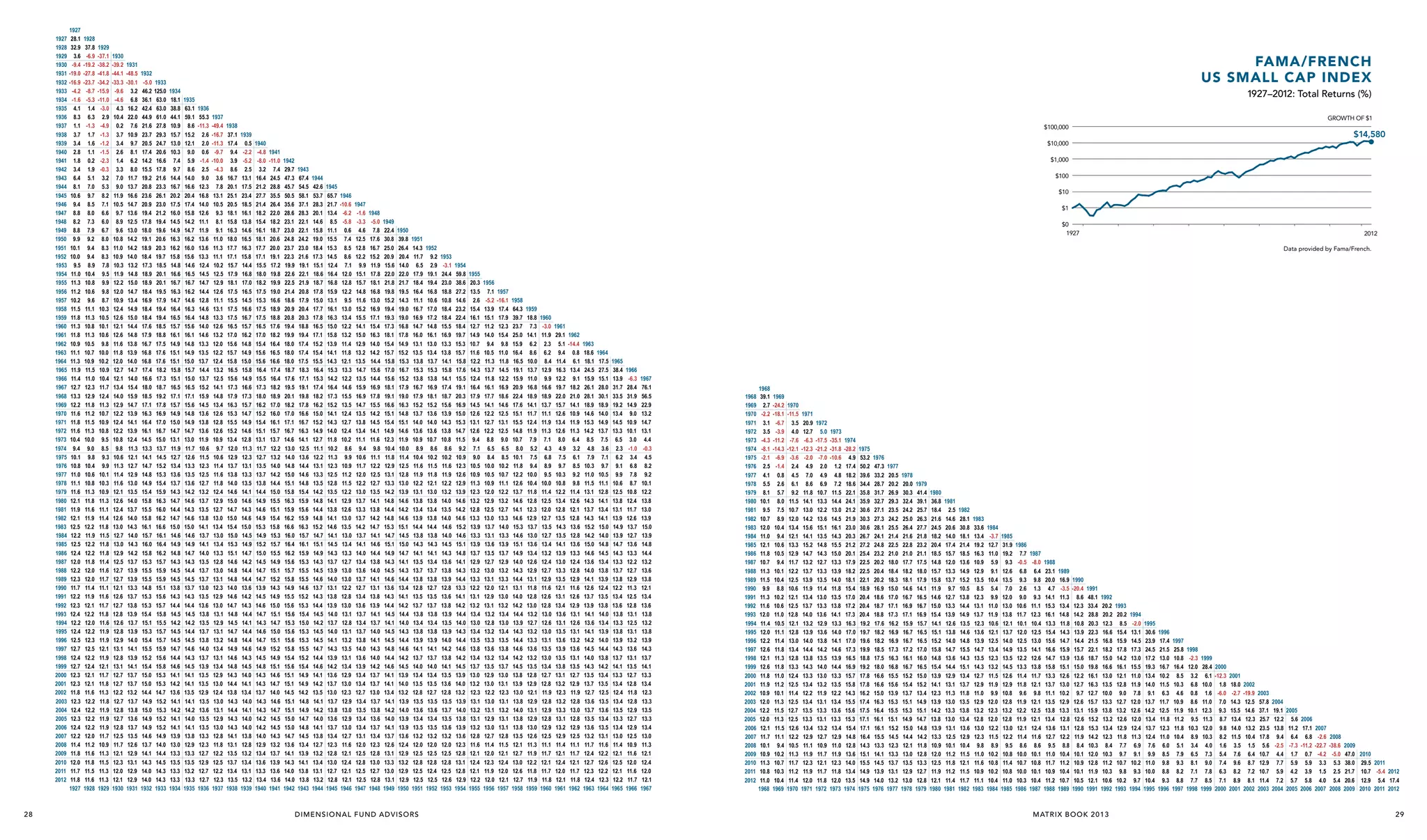

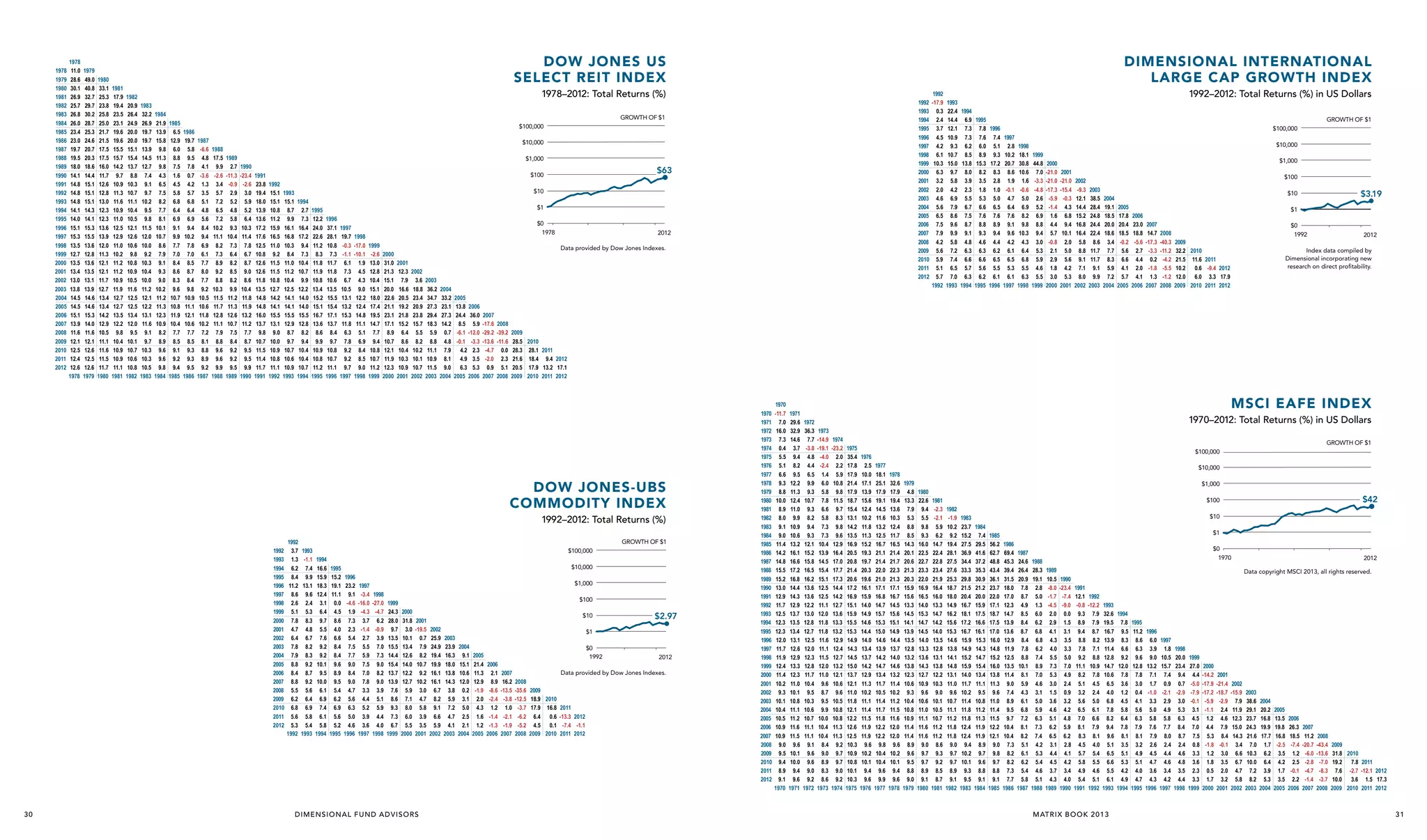

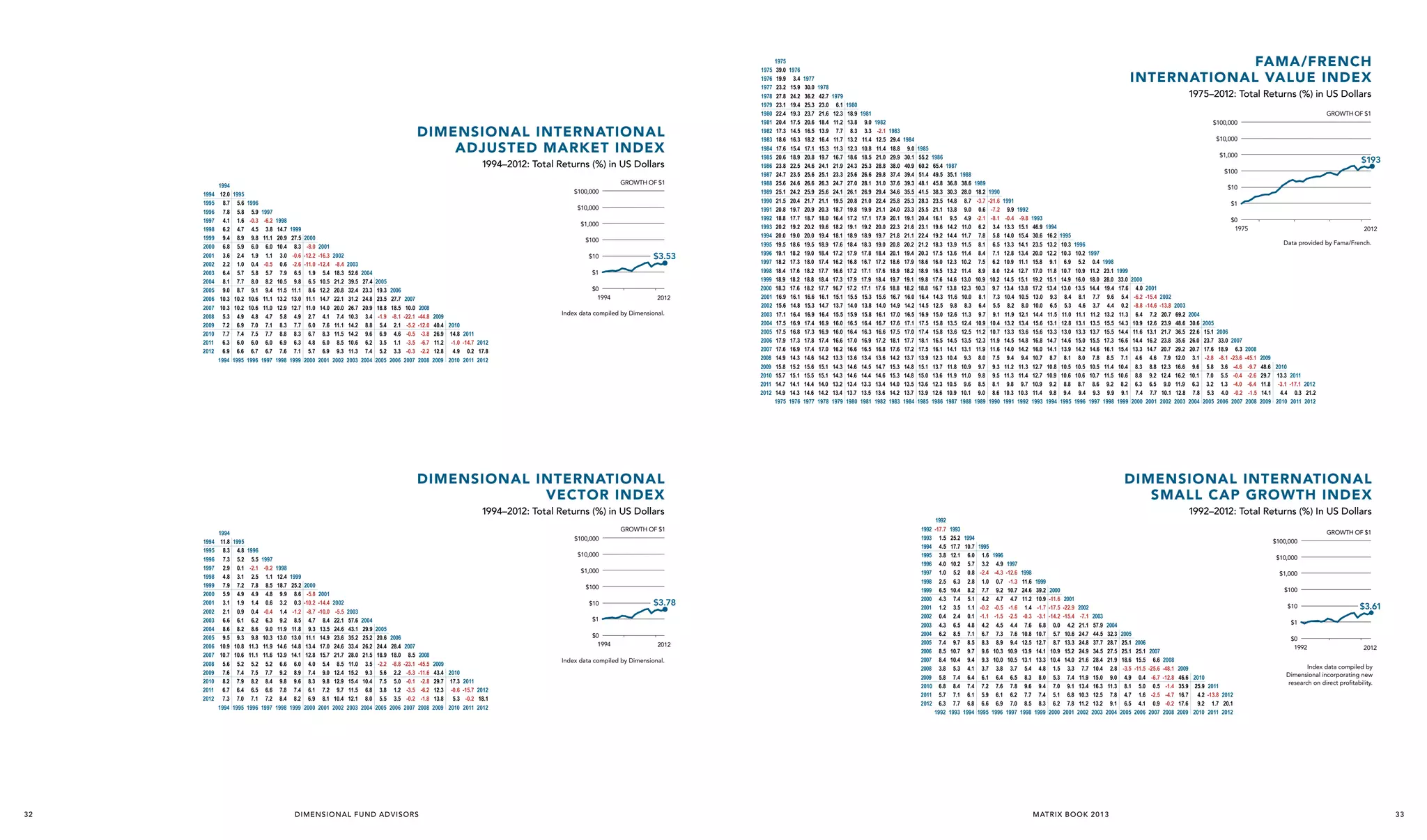

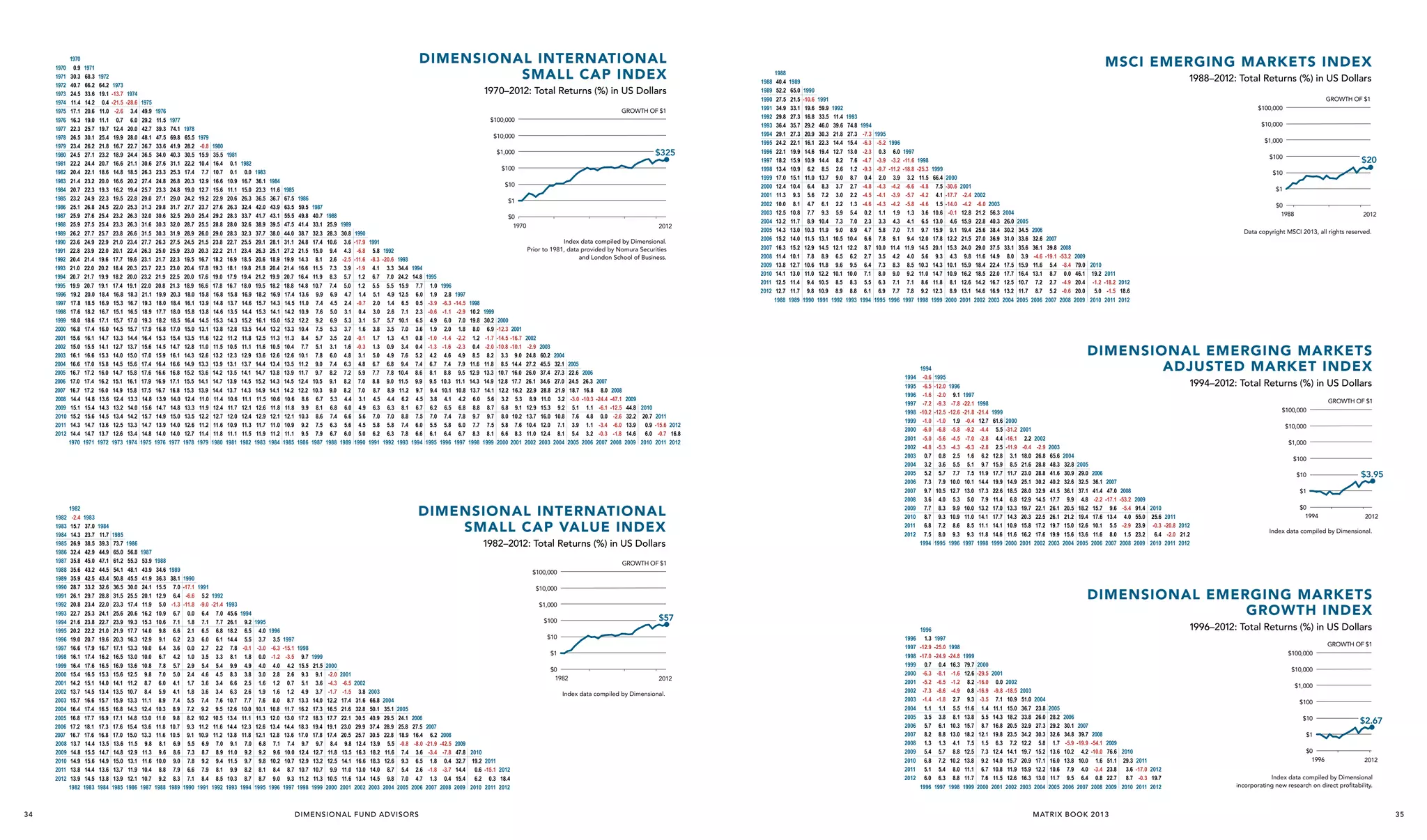

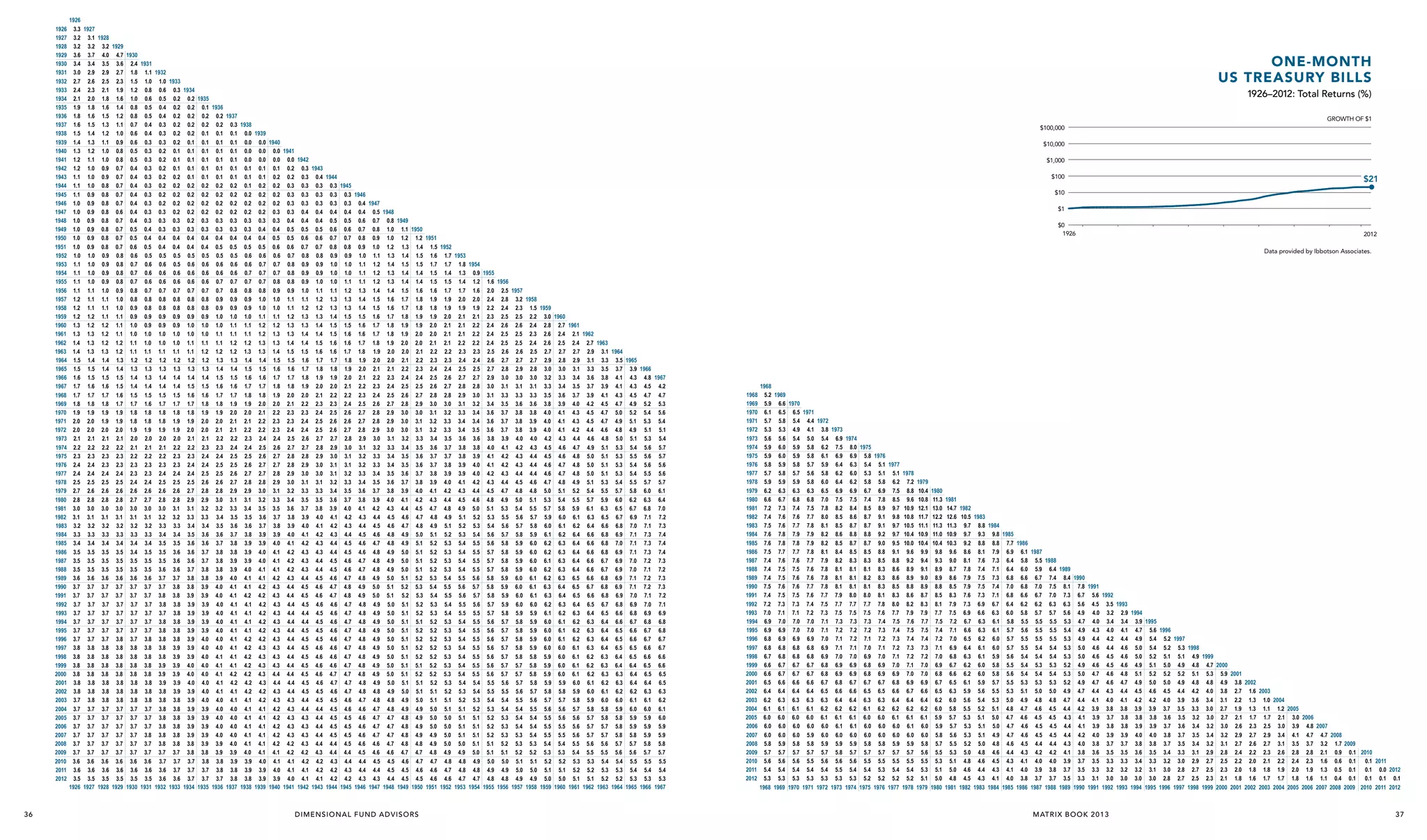

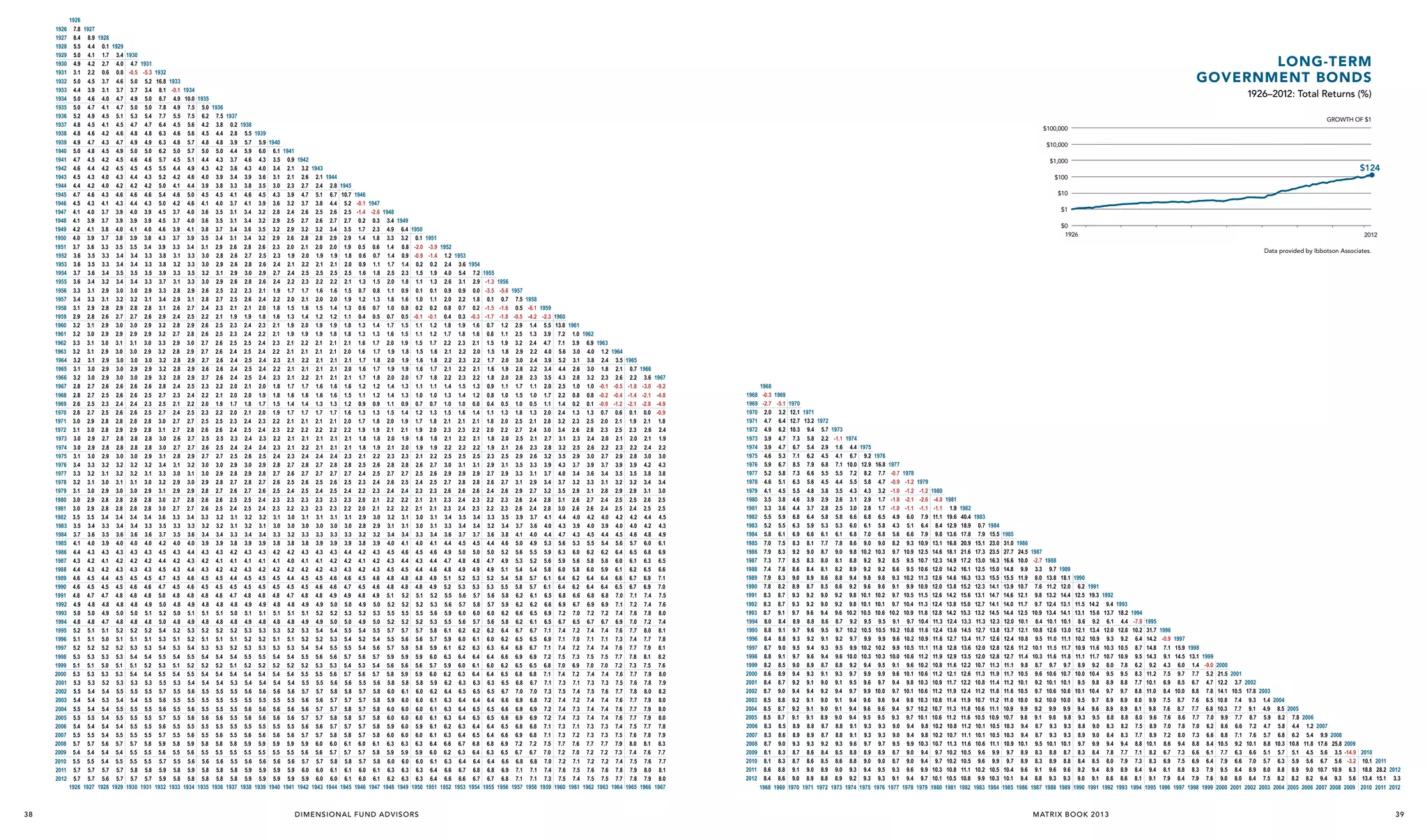

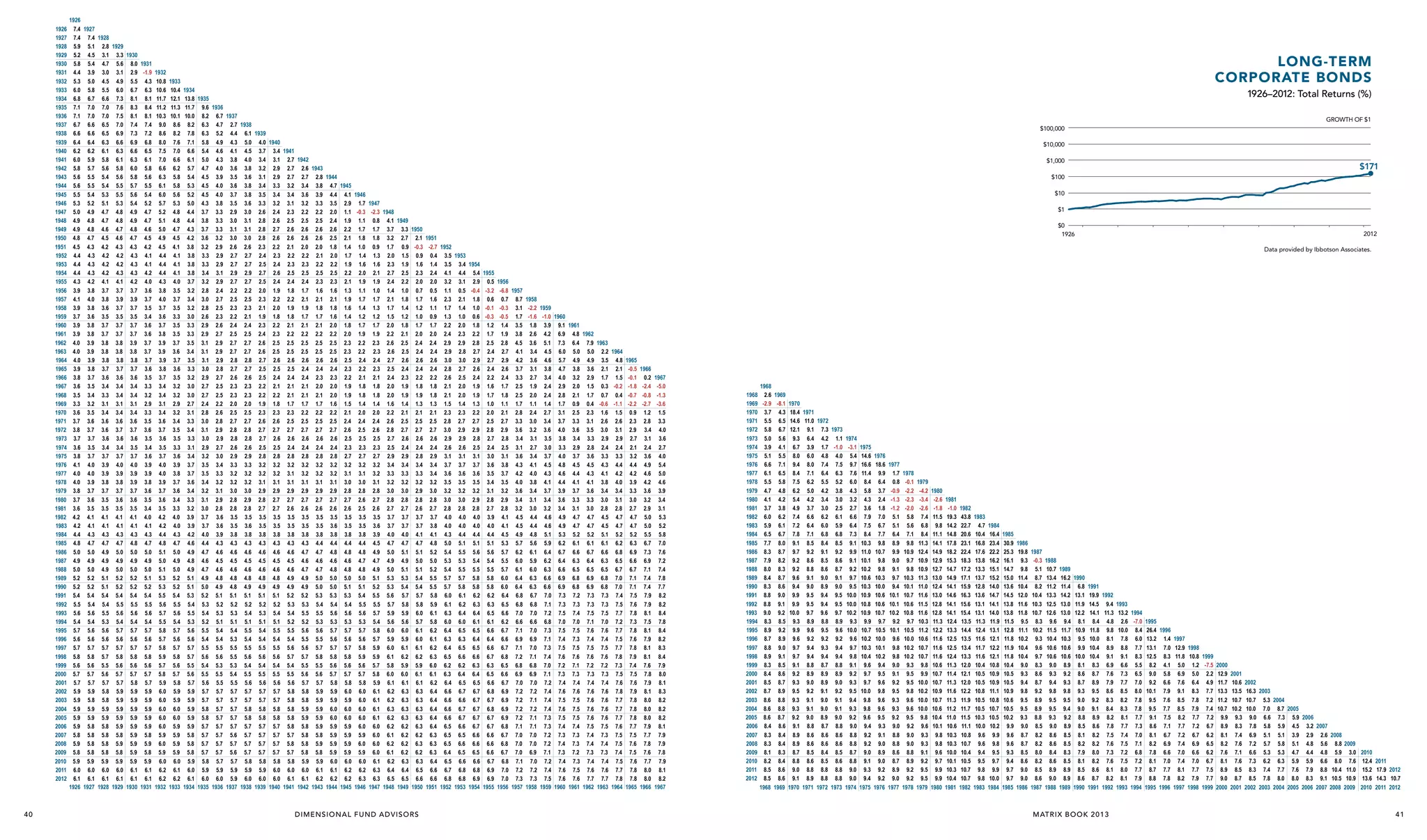

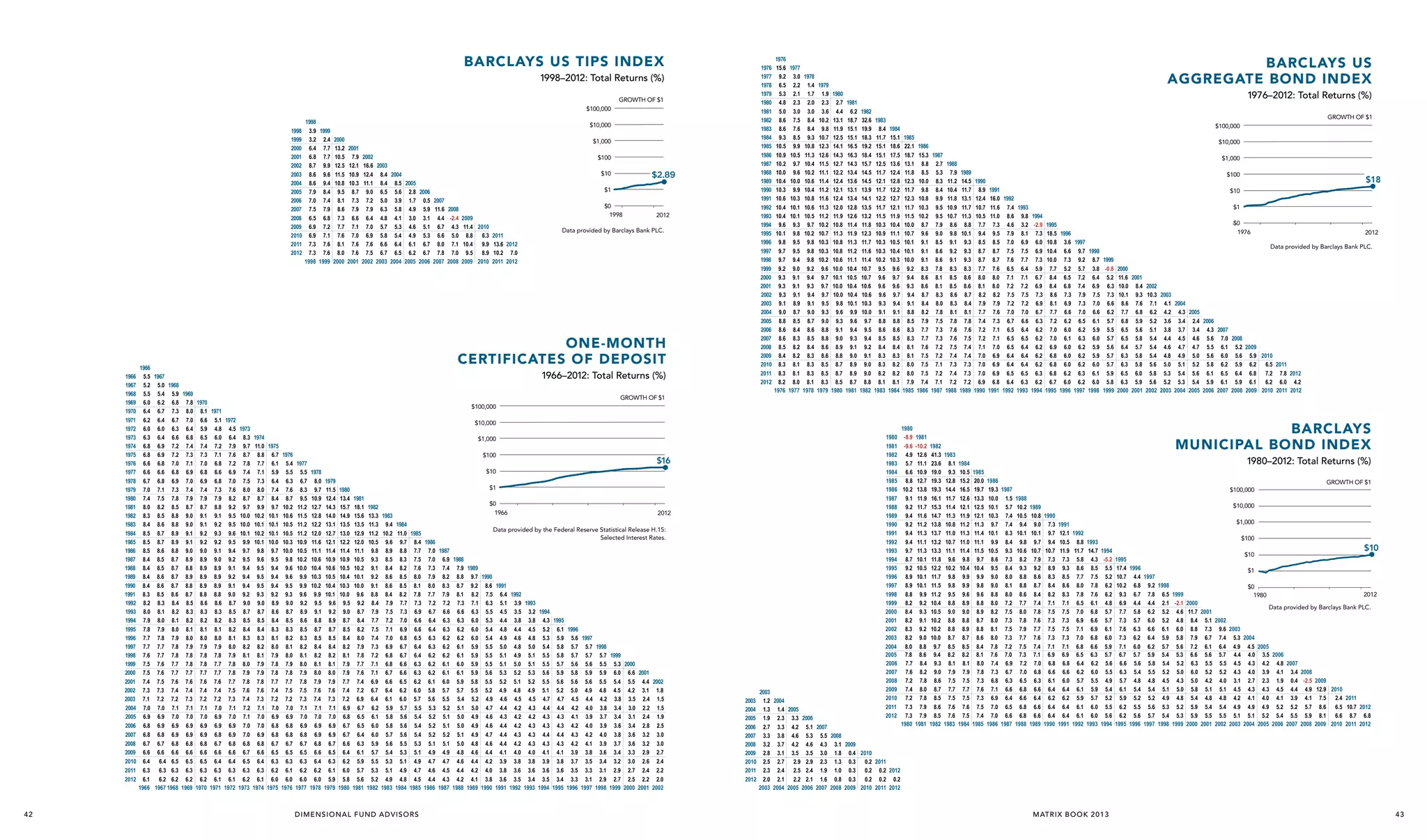

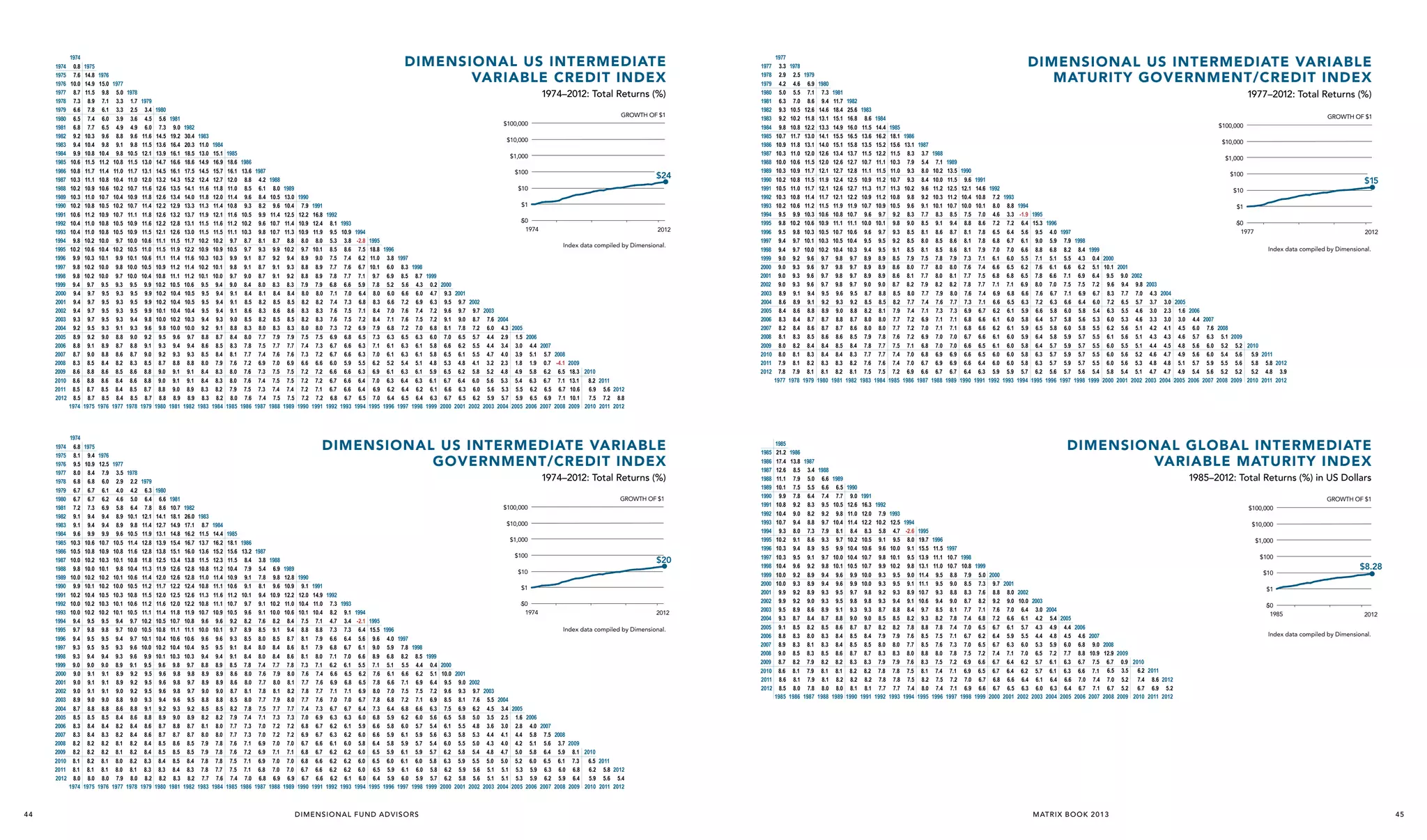

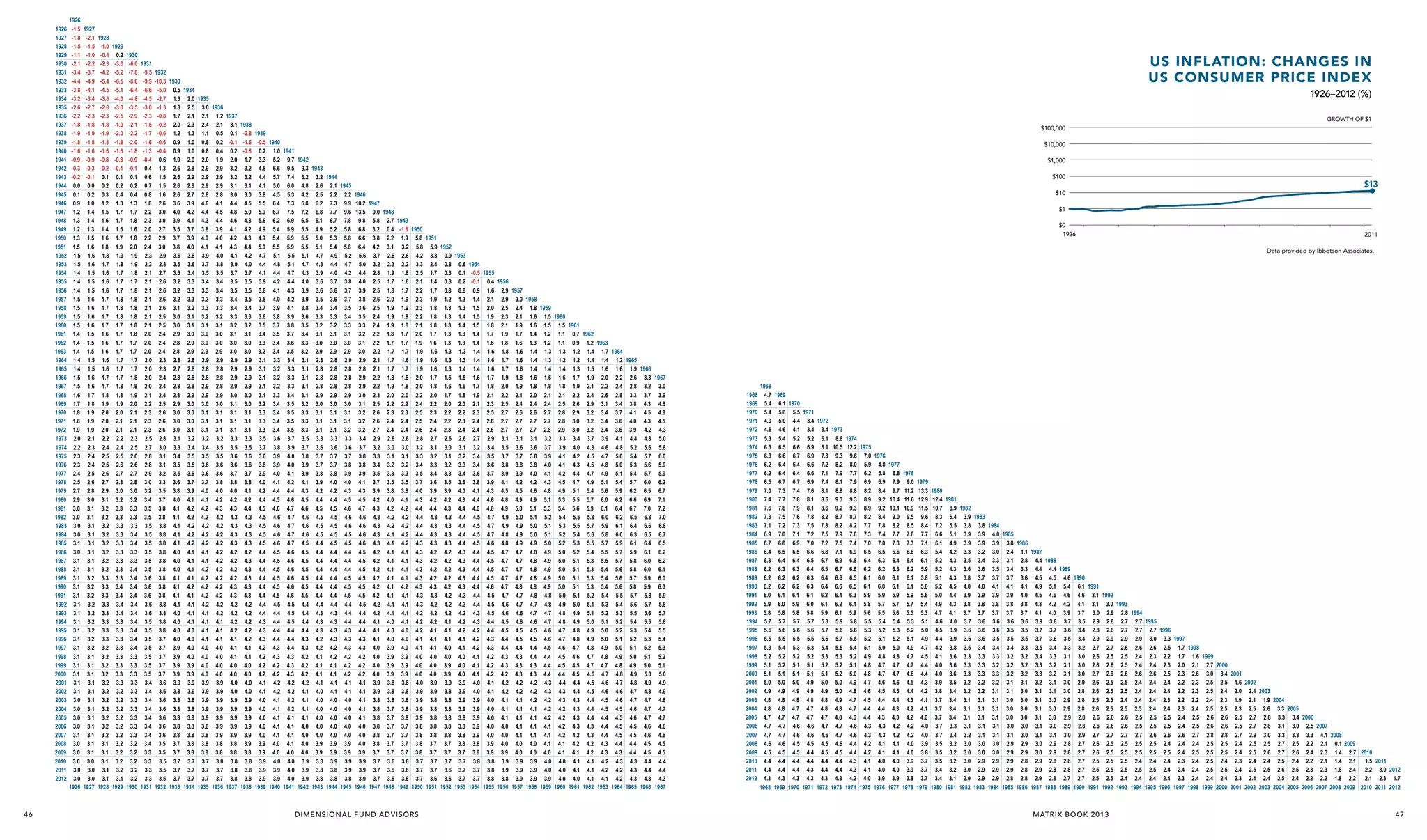

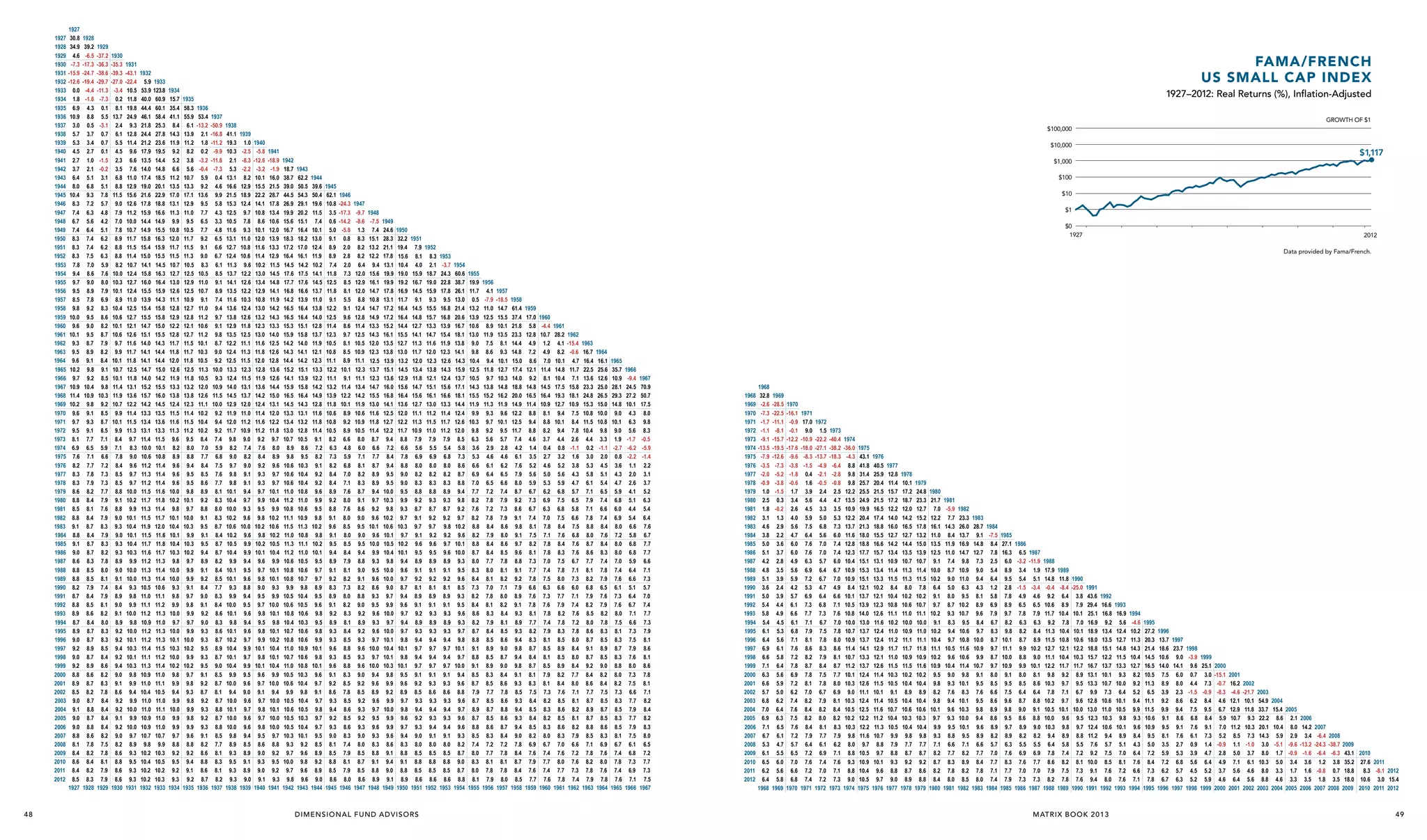

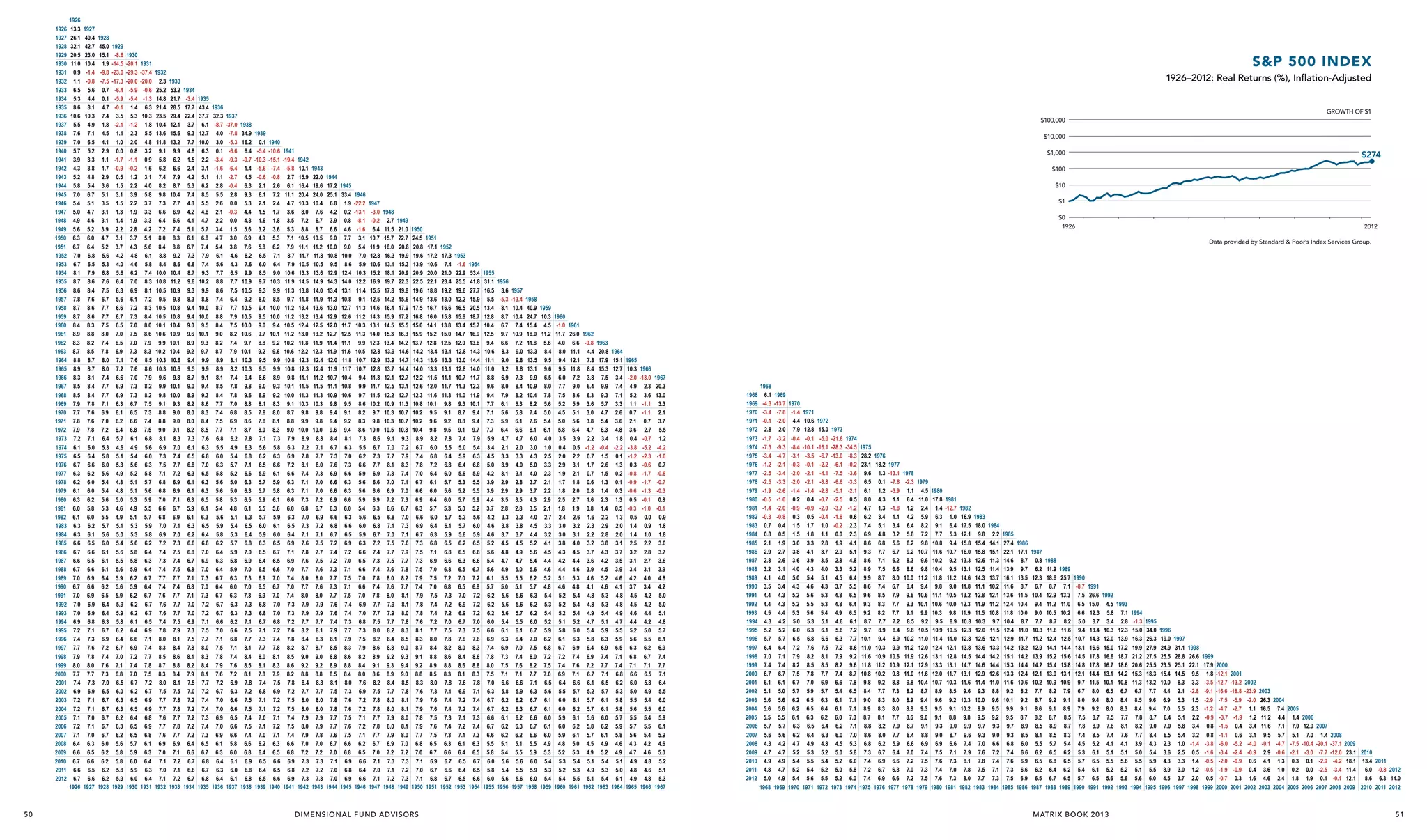

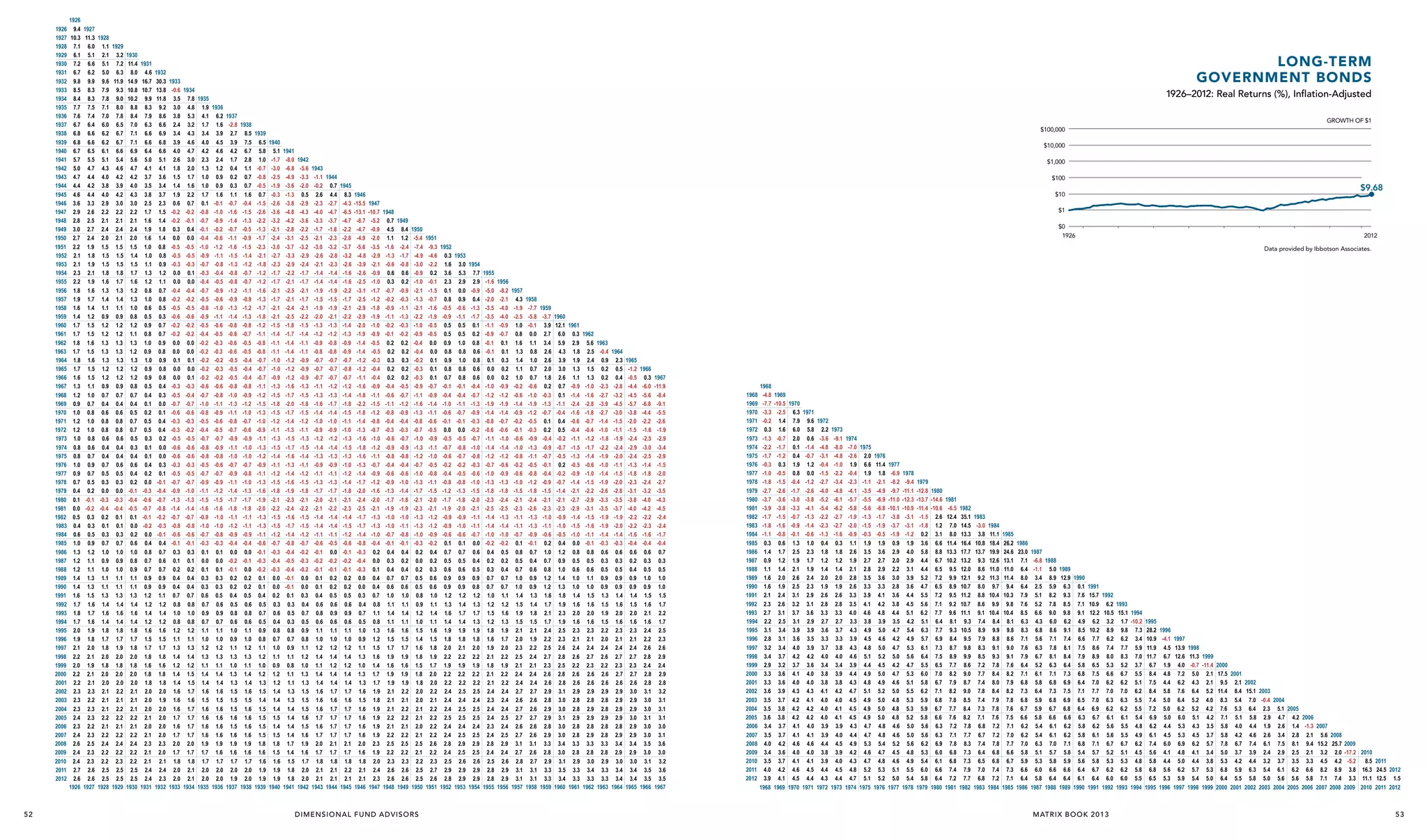

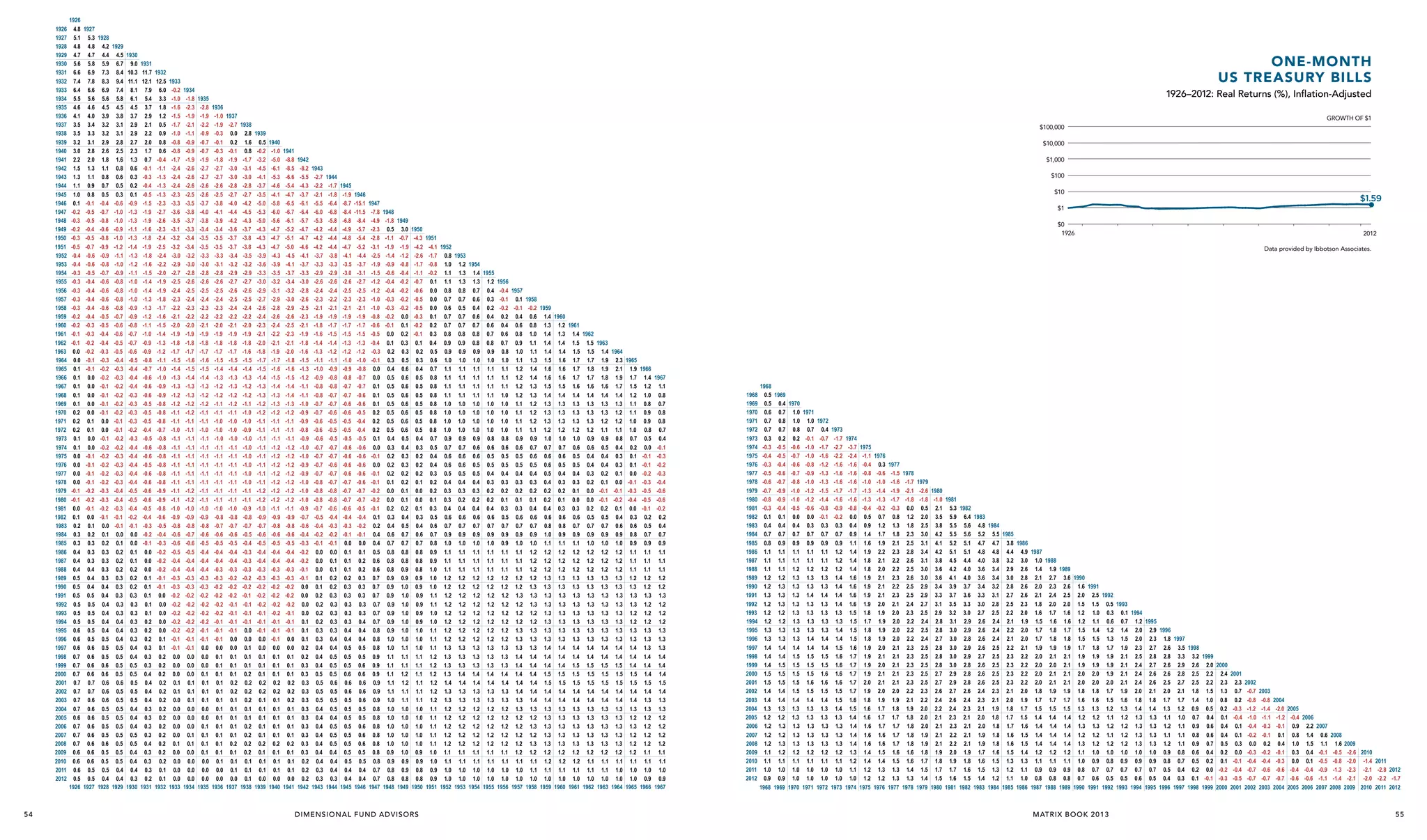

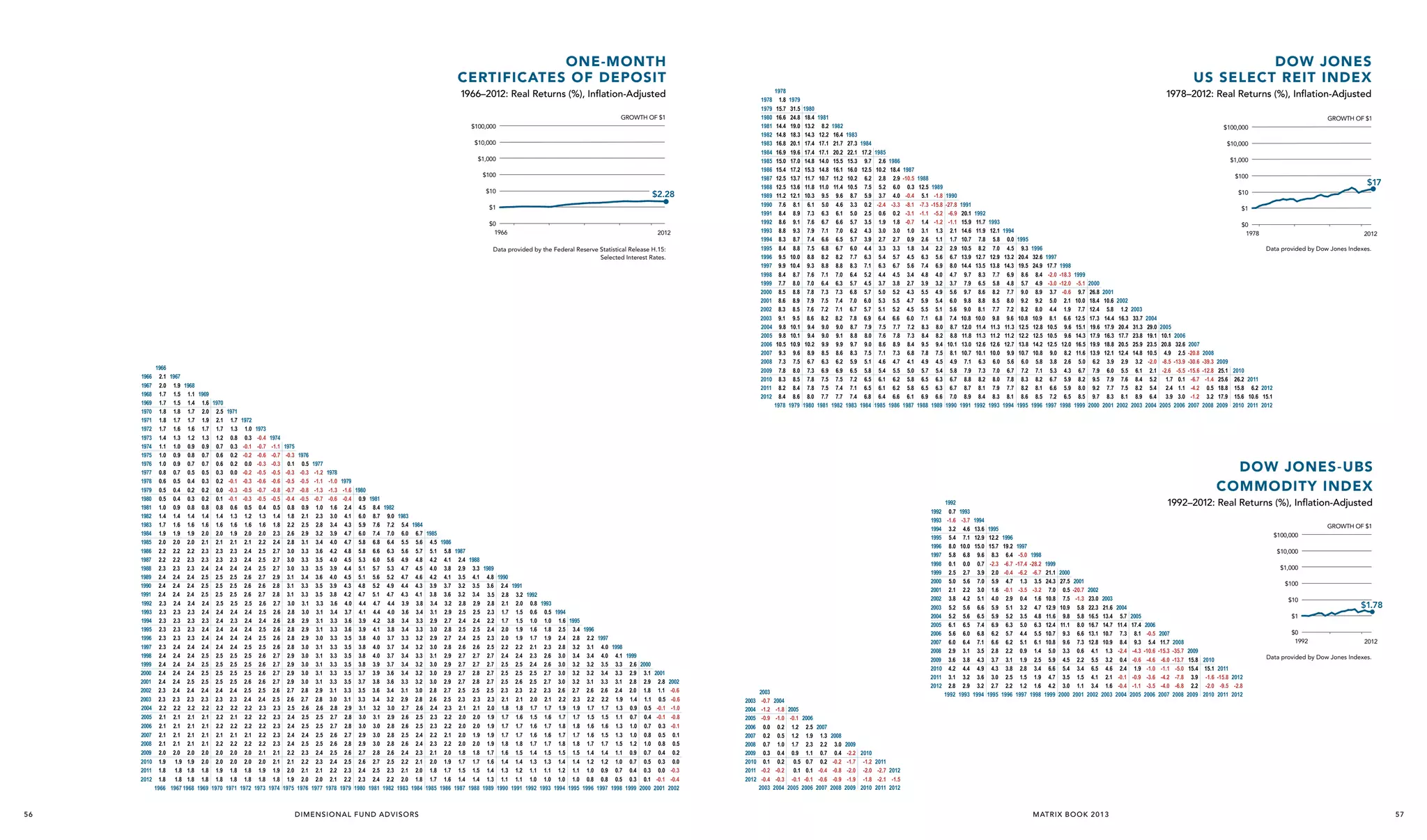

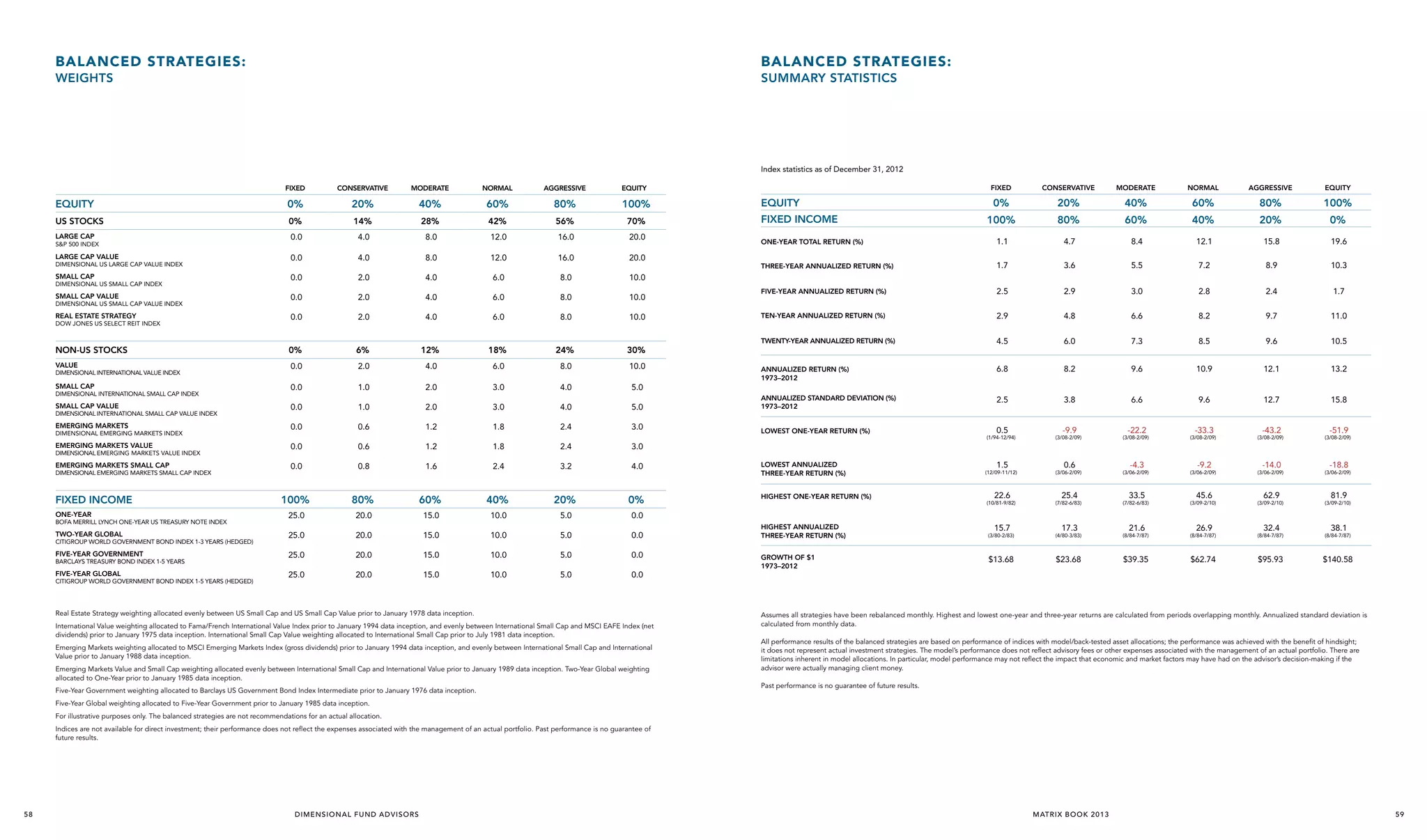

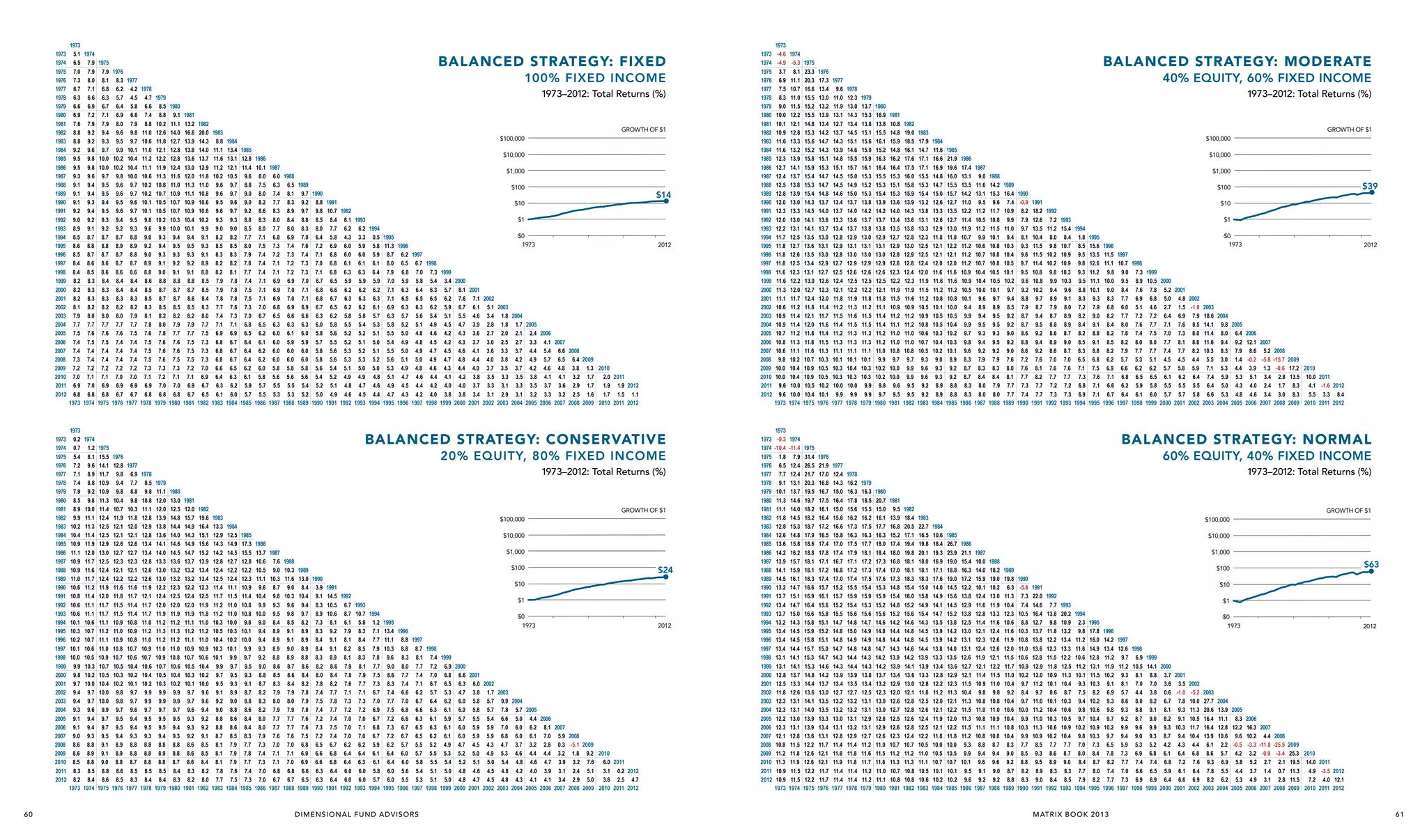

This document provides historical return data for various investment indexes from 1926 to 2012. It discusses Dimensional Fund Advisors' evolution in response to advances in financial research. Key points include:

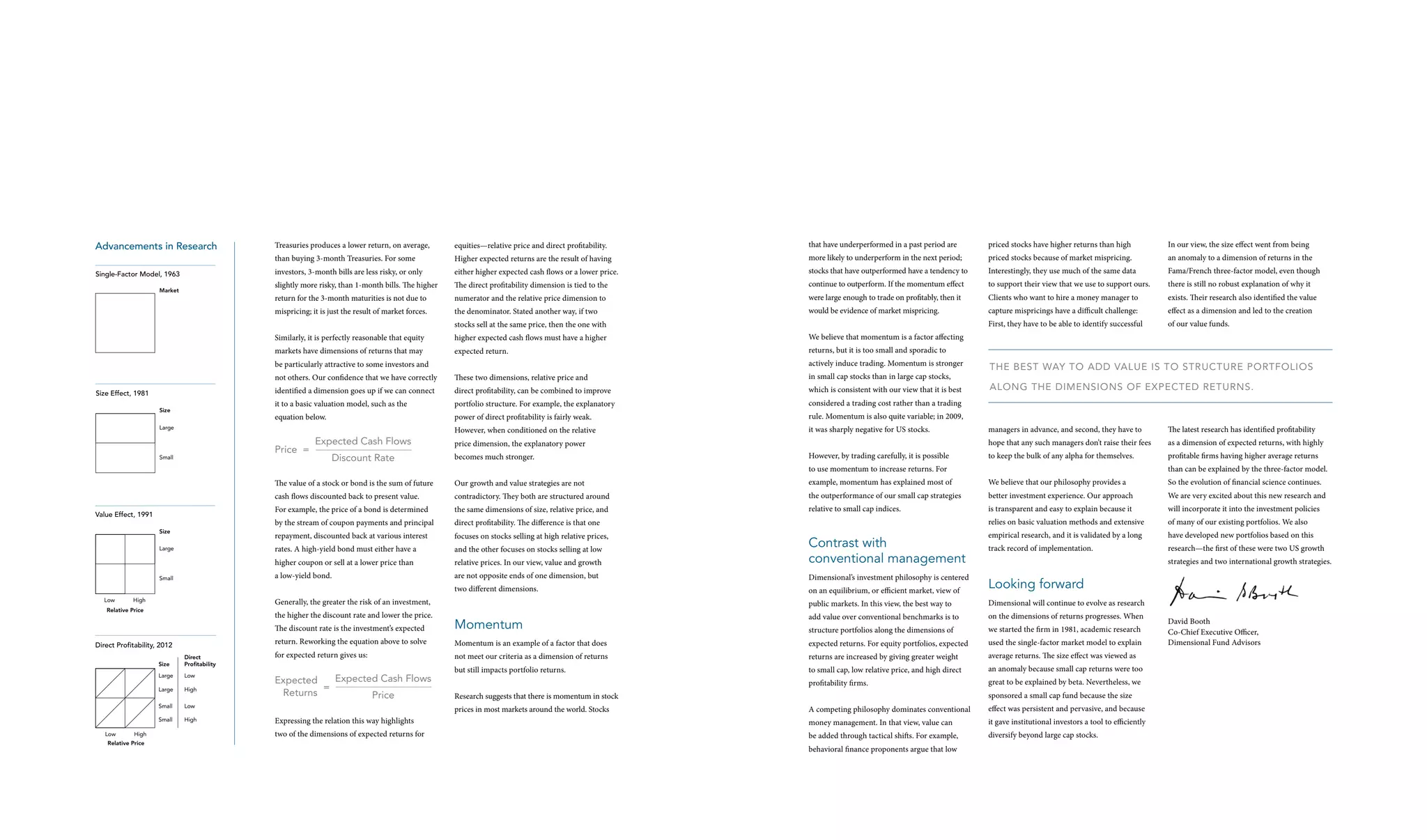

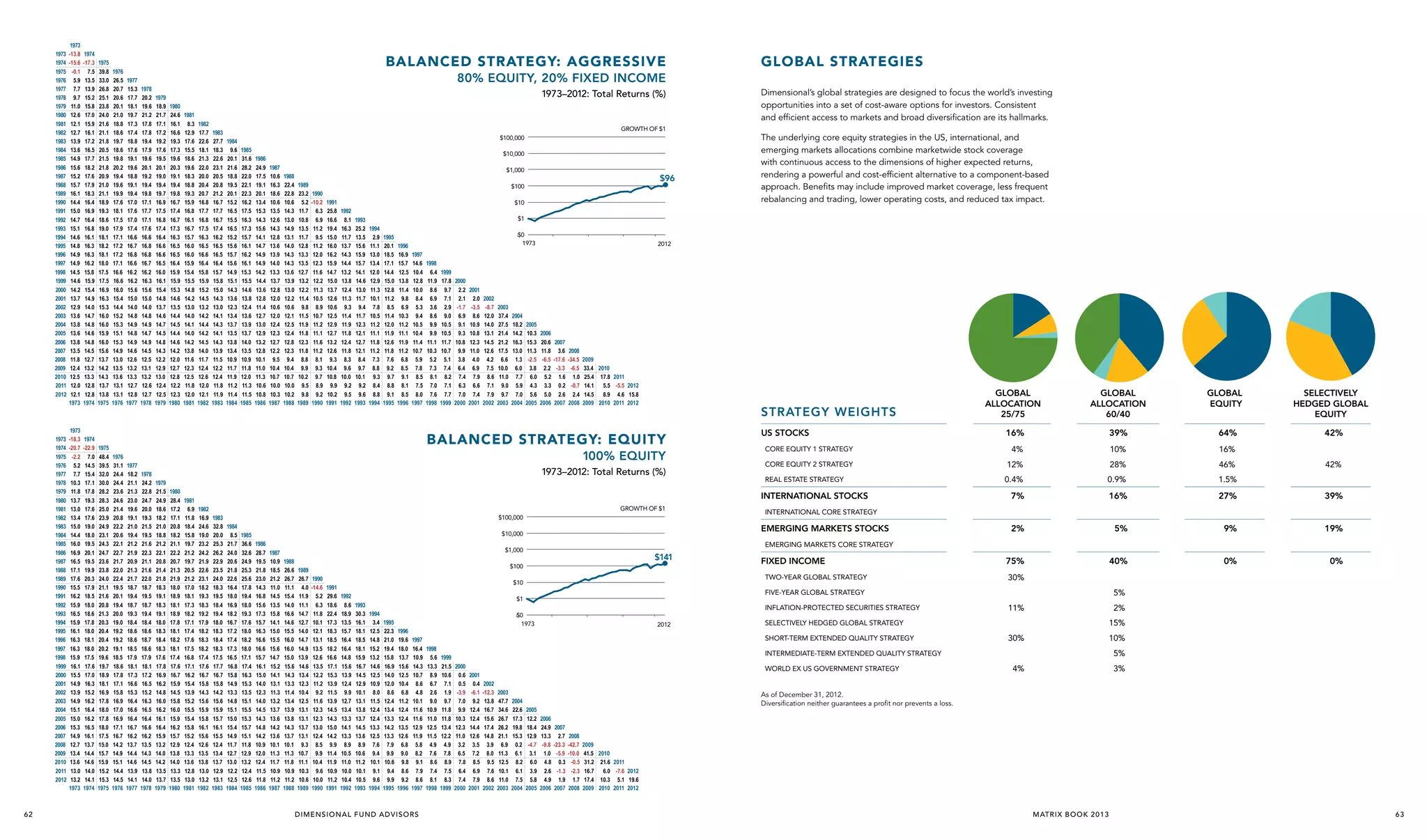

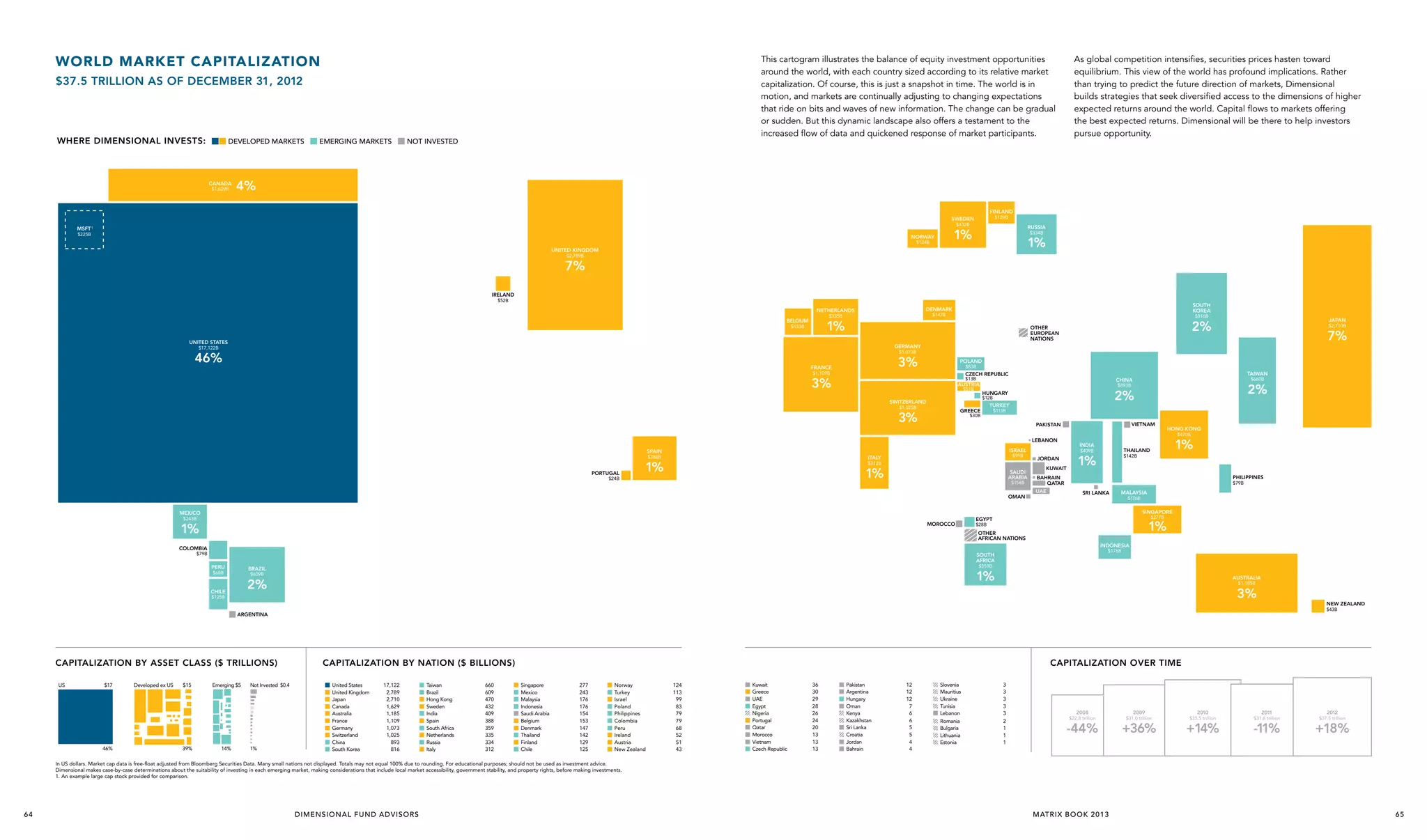

- Dimensional structures portfolios around dimensions of expected returns identified by research, such as market, size, value, and profitability factors.

- Recent research identified profitability as a new dimension with high profitability firms having higher average returns.

- Dimensional incorporates new research findings by evolving existing strategies and developing new ones.

- Dimensional's approach focuses on expected returns rather than attempting to time markets or capture short-term anomalies.

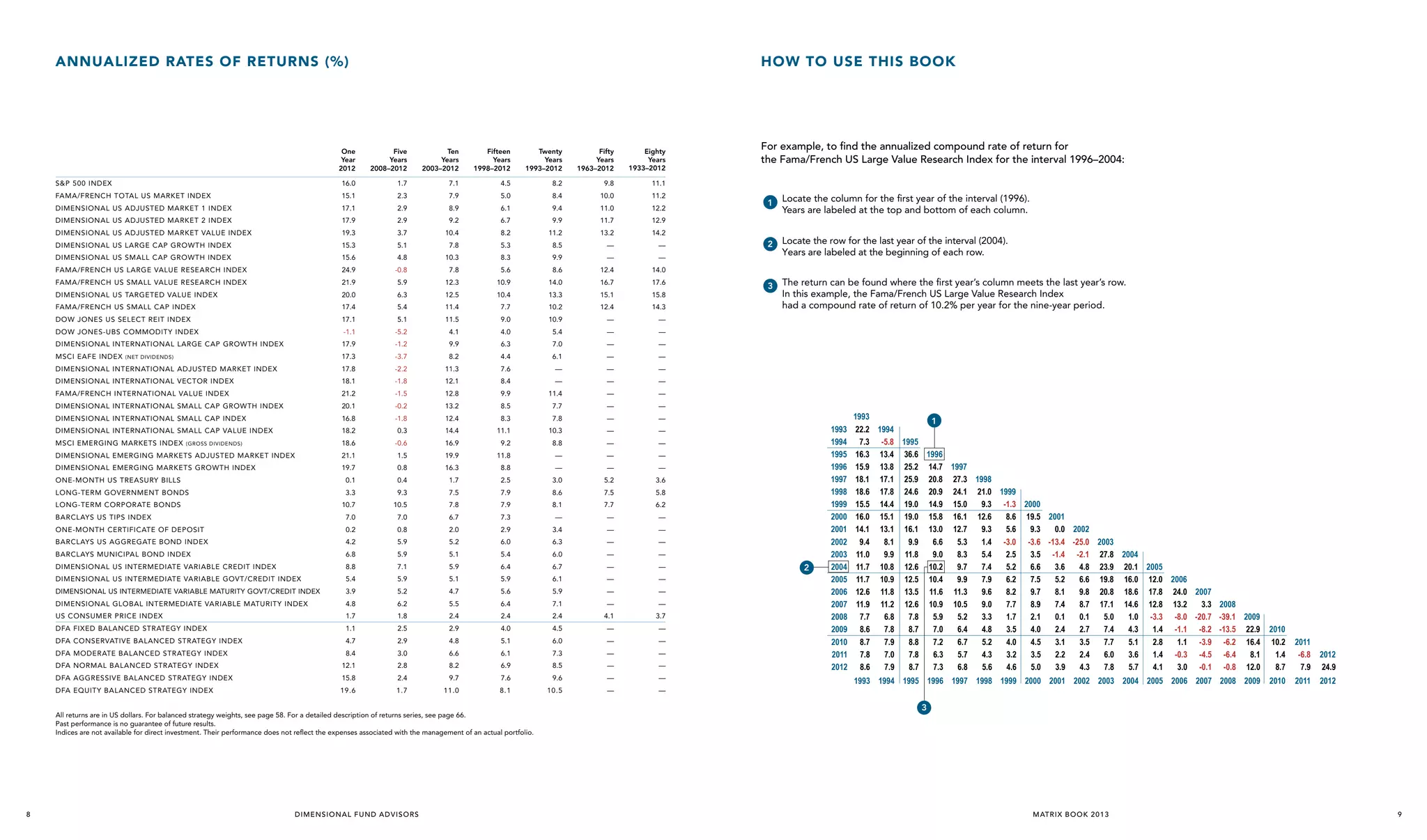

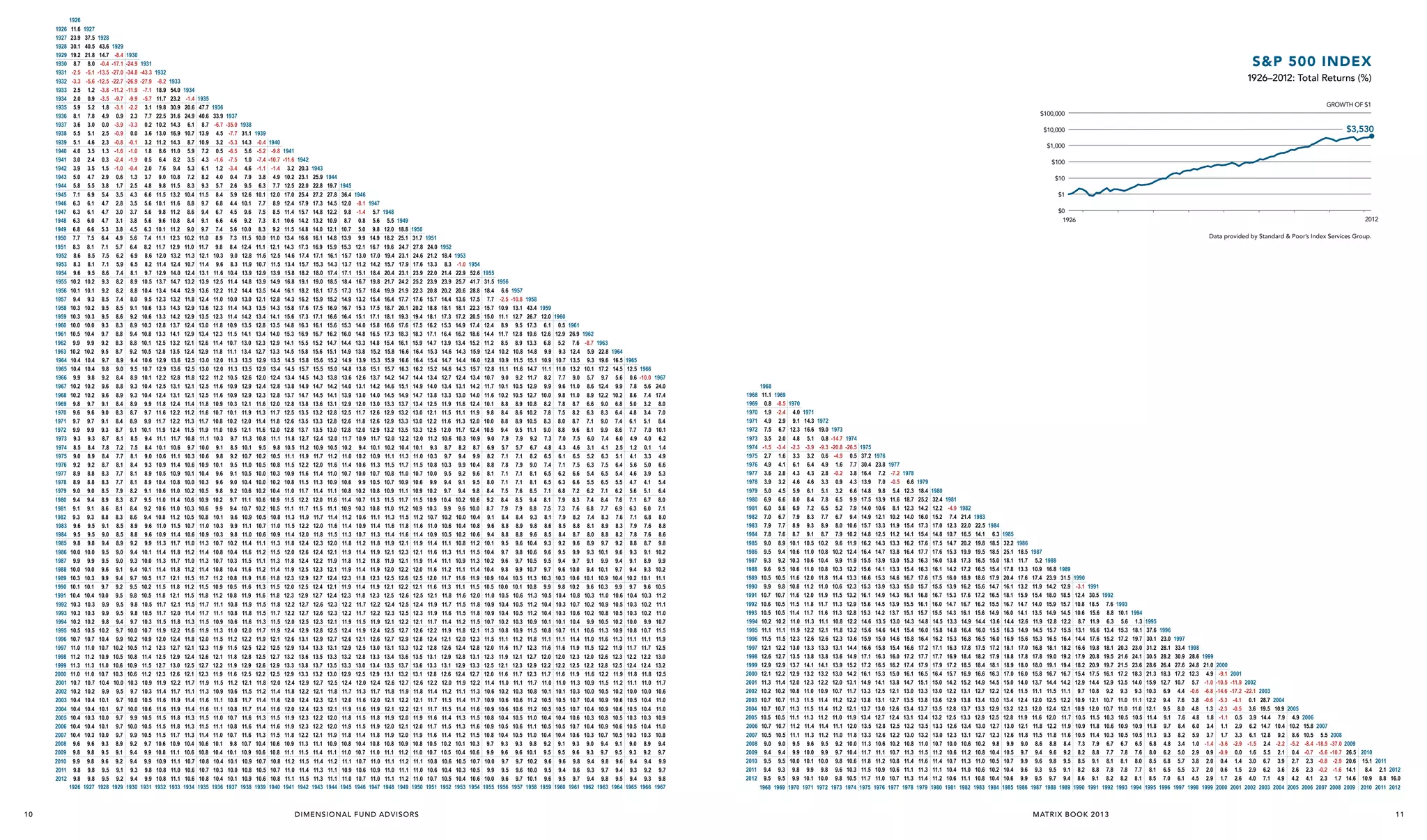

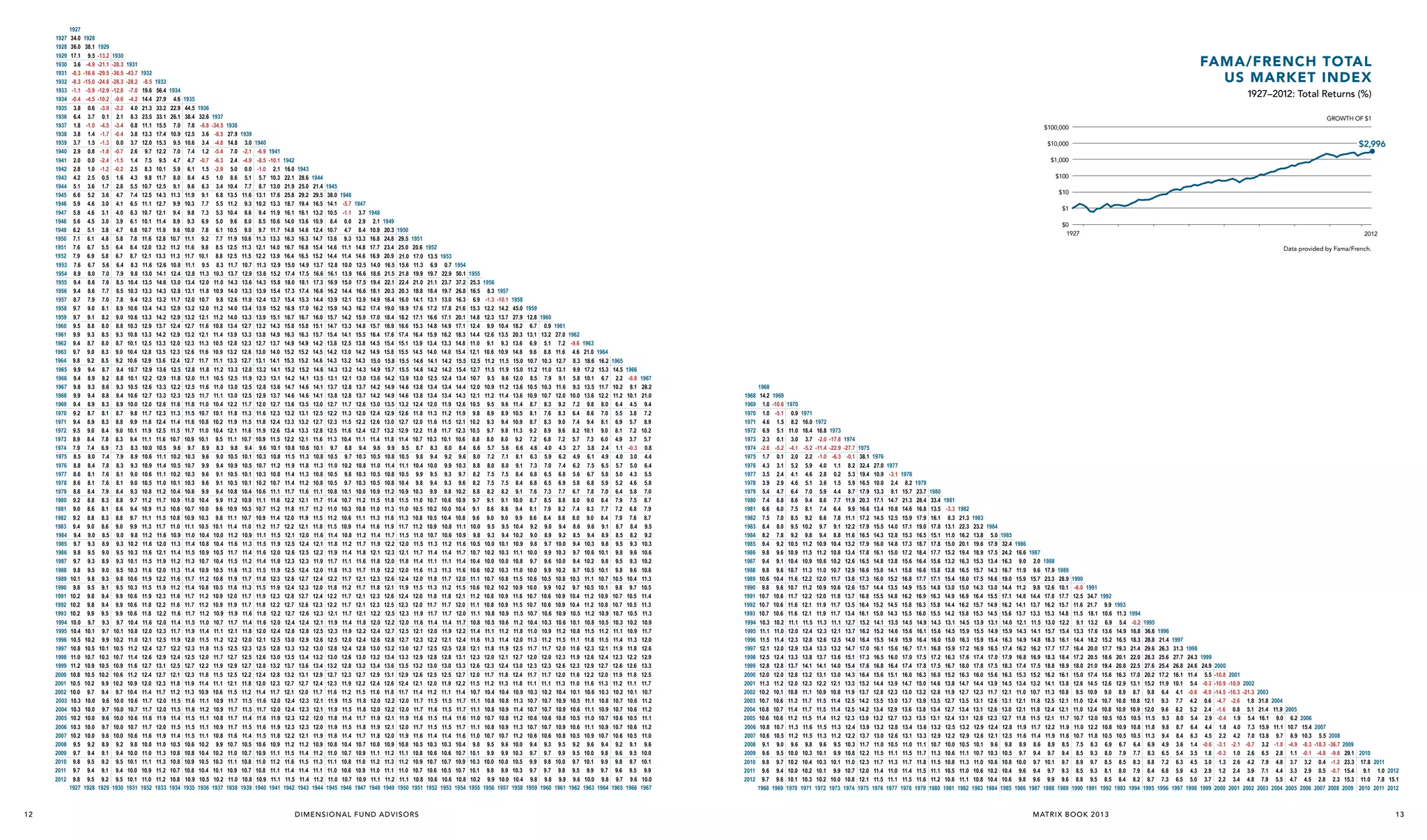

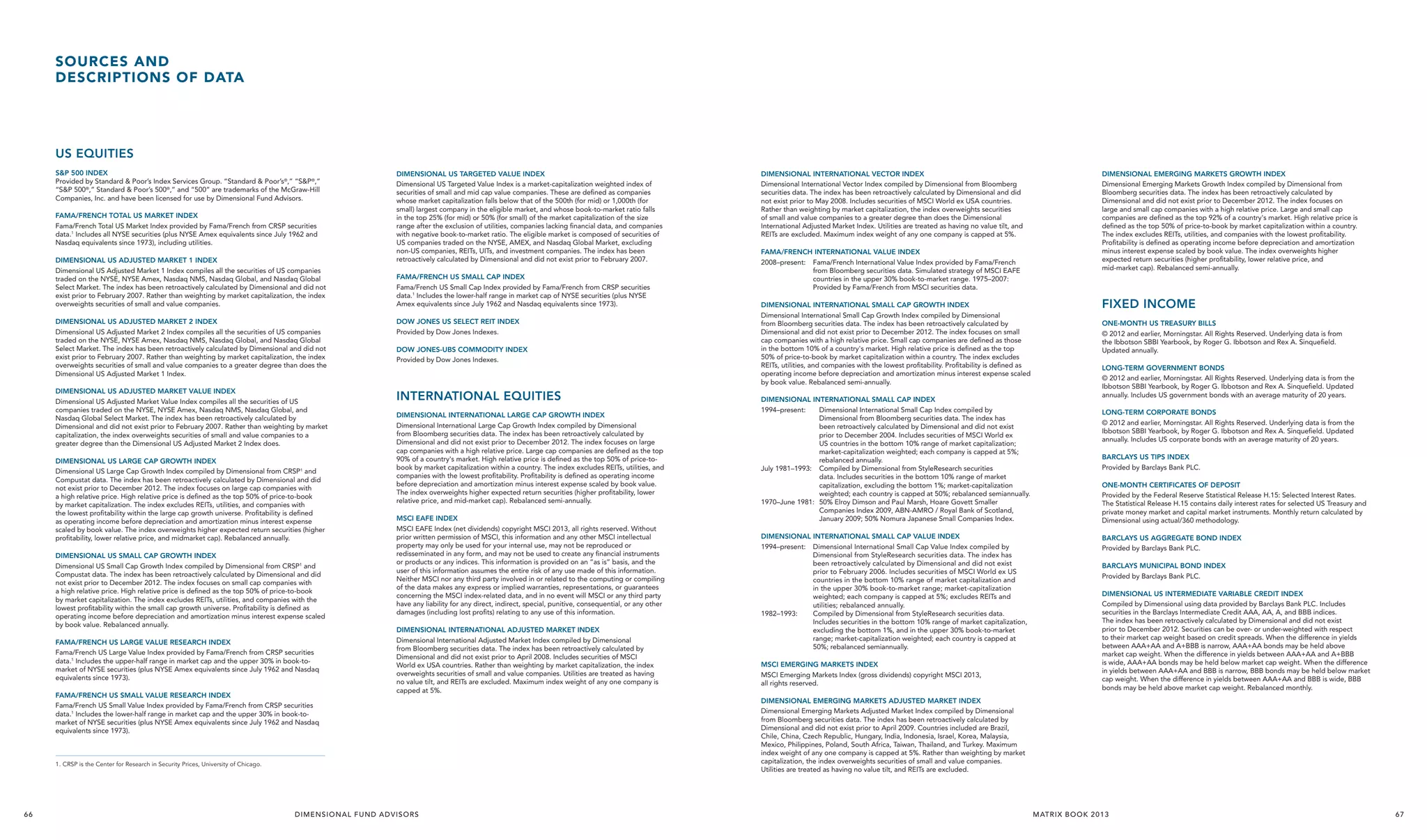

- Historical return data is provided for indexes spanning US and international equities