This document provides an overview and summary of Chapter 10 from an investments textbook. The chapter covers common stock valuation, including discounted cash flow models like the dividend discount model and relative valuation techniques like the P/E ratio approach. It emphasizes that students should understand how to value stocks by discounting expected future dividends or earnings. The chapter also discusses determining a stock's required rate of return and intrinsic value, as well as how valuation is affected by growth rates, payout ratios, and interest rates. Worked examples and practice problems are provided to help students apply these valuation concepts.

![MAJOR CHAPTER READINGS [Contents]

Discounted Cash Flow Techniques

[the discounted cash flow (present value) equation]

The Required Rate of Return

[brief description of what it is; more detail in Chapter

11]

The Expected Cash Flows

[brief description of what is involved]

The Dividend Discount Model

[the equation; the 3 growth rate cases]

Dividends, Dividends--What About Capital Gains?

[how dividends plus a terminal price are equivalent to the

estimated stream of all future dividends]

Intrinsic Value and Market Price

[what it is and what it means; rules for stock selection]

The Dividend Discount Model in Practice

[an example of real-world use of this model]

Other Discounted Cash Flow Approaches

[Streetsmart Guide to Valuing a Stock]

The P/E Ratio or Earnings Multiplier Approach to Valuation

[model; definition; importance]

The Valuation Model

[how this information is presented]

Determinants of the P/E Ratio

[factors that affect the P/E ratio; how affected; examples]

Understanding the P/E Ratio

[P/Es reflect investor expectations about growth prospects

and the risk involved]

P/E Ratios and Interest Rates](https://image.slidesharecdn.com/64920420-solution-ch10-charles-p-jones-190402173512/75/64920420-solution-ch10-charles-p-jones-3-2048.jpg)

![P/E ratios and interest rates are inversely related]

Relative Valuation Techniques

[based on making comparisons in order to determine value]

P/E Ratios

[is the P/E for a stock lower or higher than justified by

its prospects?; example]

Price/Book Value

[P/E ratios and interest rates are inversely related]

P/S Ratio (PRS)

Economic Value Added

Which Approach to Use?

[both approaches, discounted cash flow techniques and

relative valuation techniques, can be used and both involve

subjective judgments]

Bursting the Bubble on New Economy Stocks—A Lesson in Valuation

[the debacle in dot.com companies; valuation methods do

apply]

Some Final Thoughts on Valuation

[subjective nature of valuation]

Appendix 10-A The Constant Growth Version of the DDM

Appendix 10-B The Analysis and Valuation of Preferred Stock

POINTS TO NOTE ABOUT CHAPTER 10

Tables and Figures](https://image.slidesharecdn.com/64920420-solution-ch10-charles-p-jones-190402173512/75/64920420-solution-ch10-charles-p-jones-4-2048.jpg)

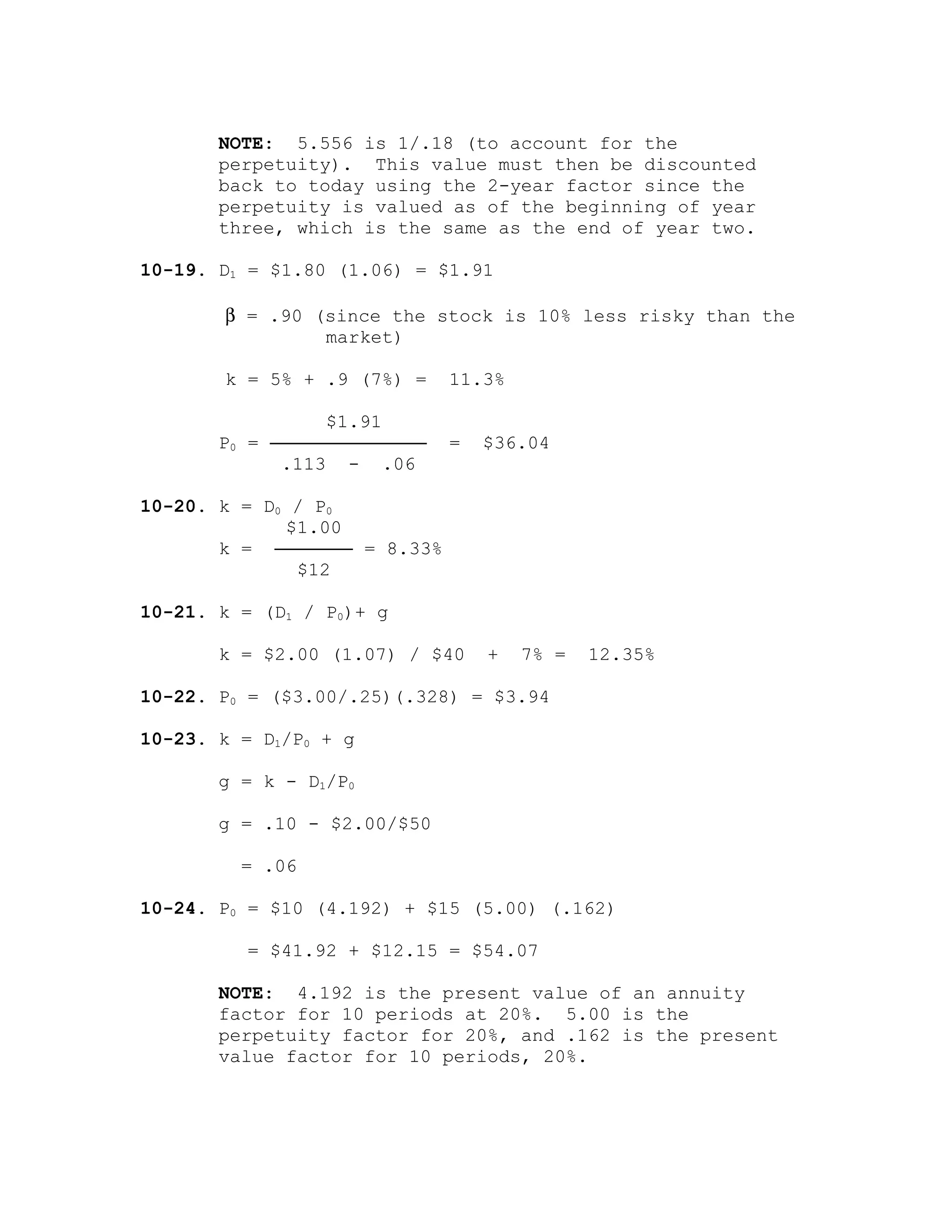

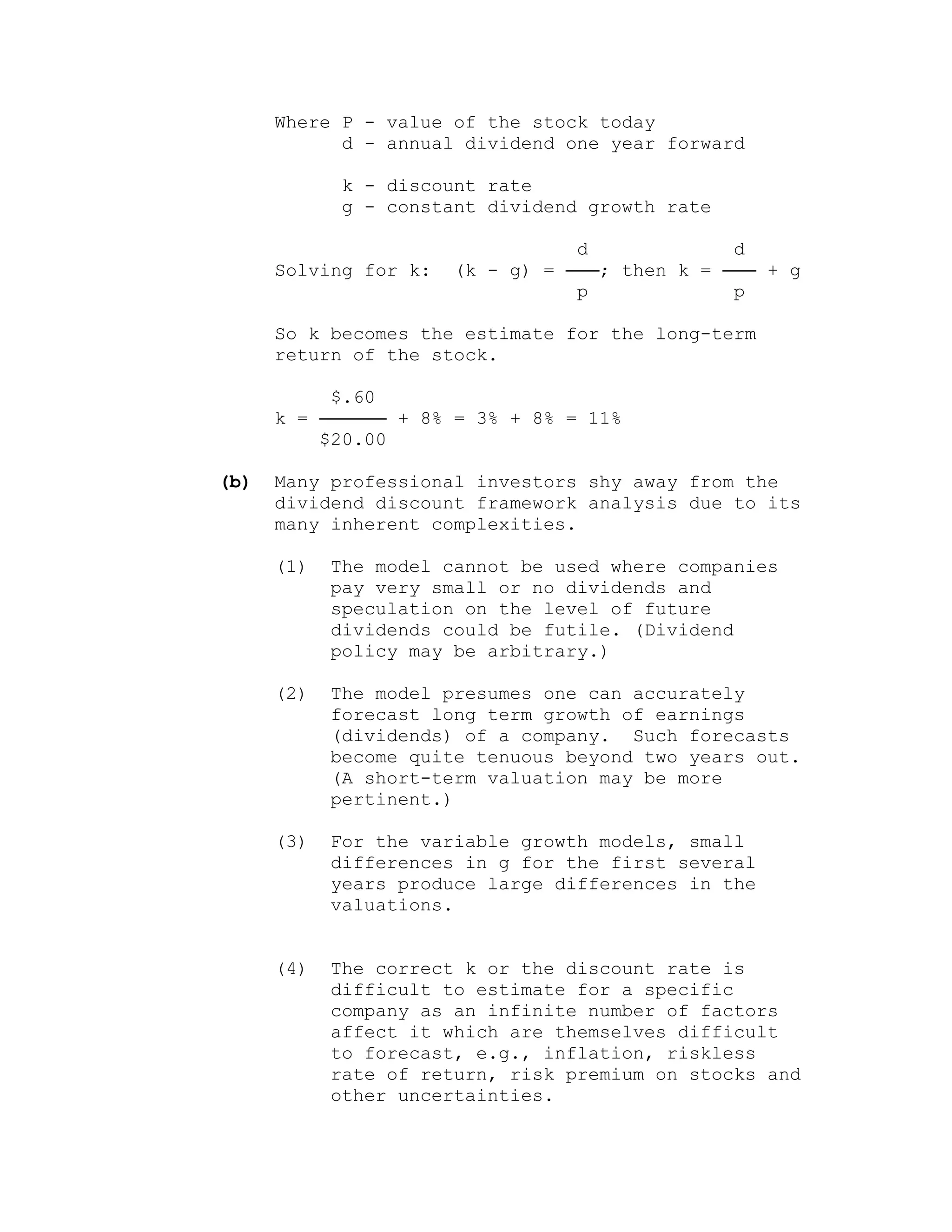

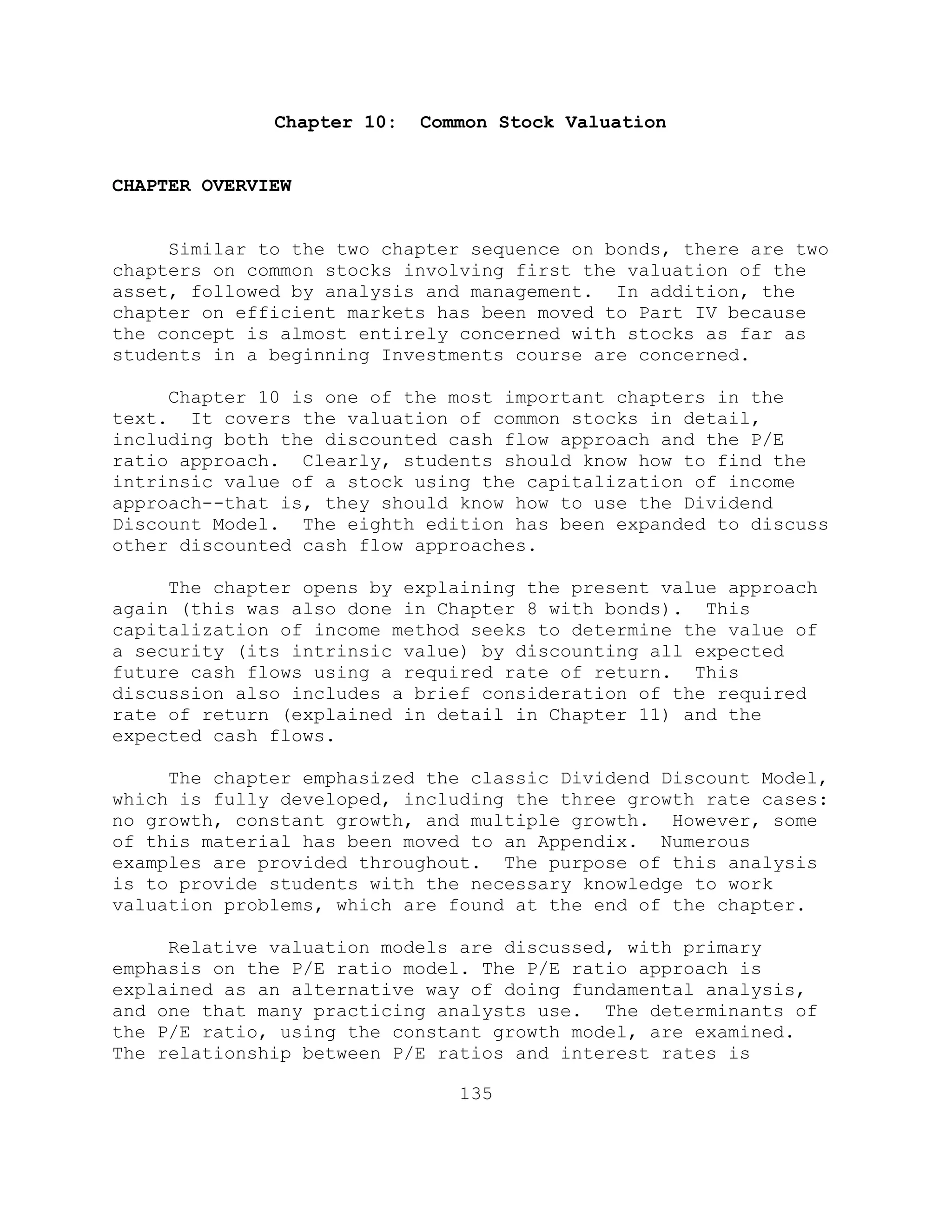

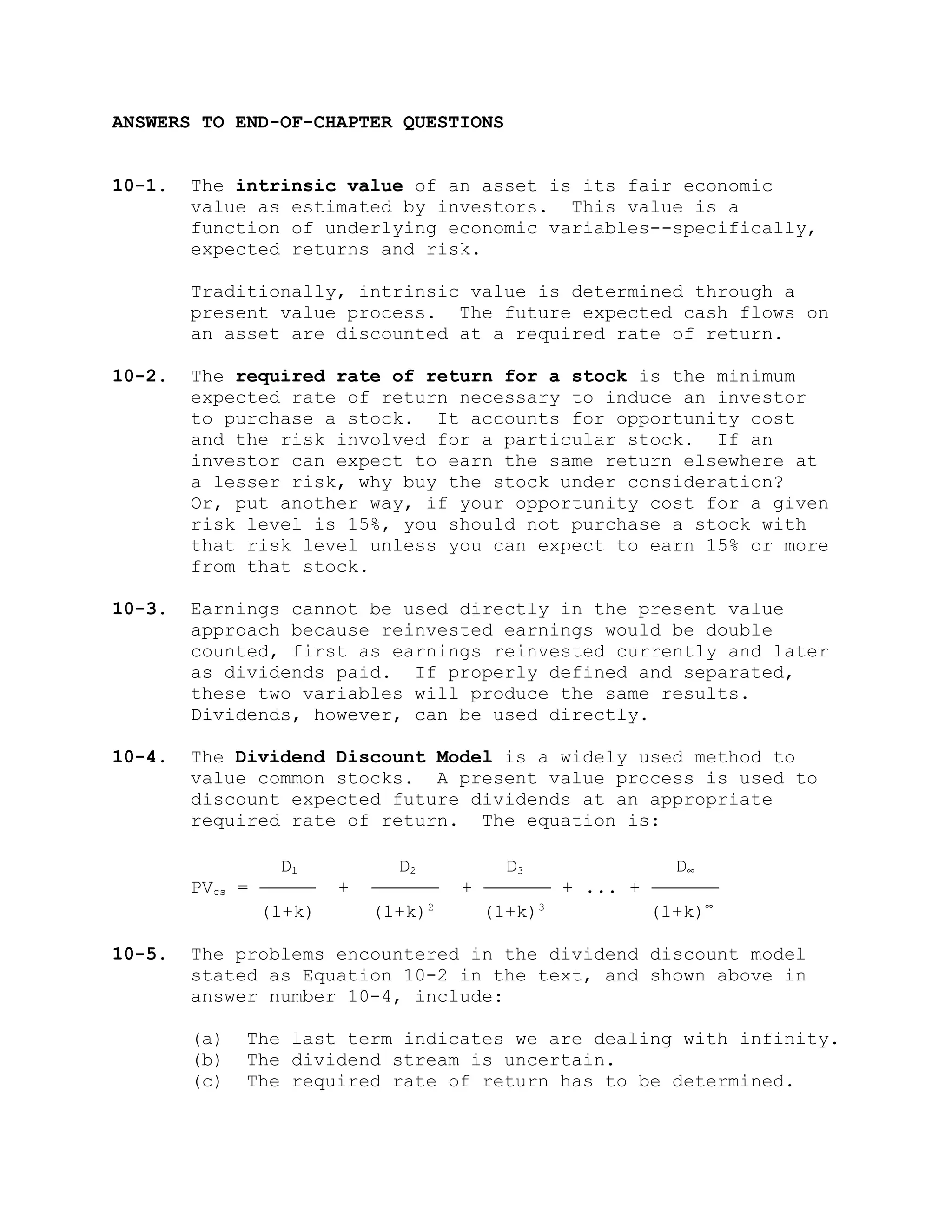

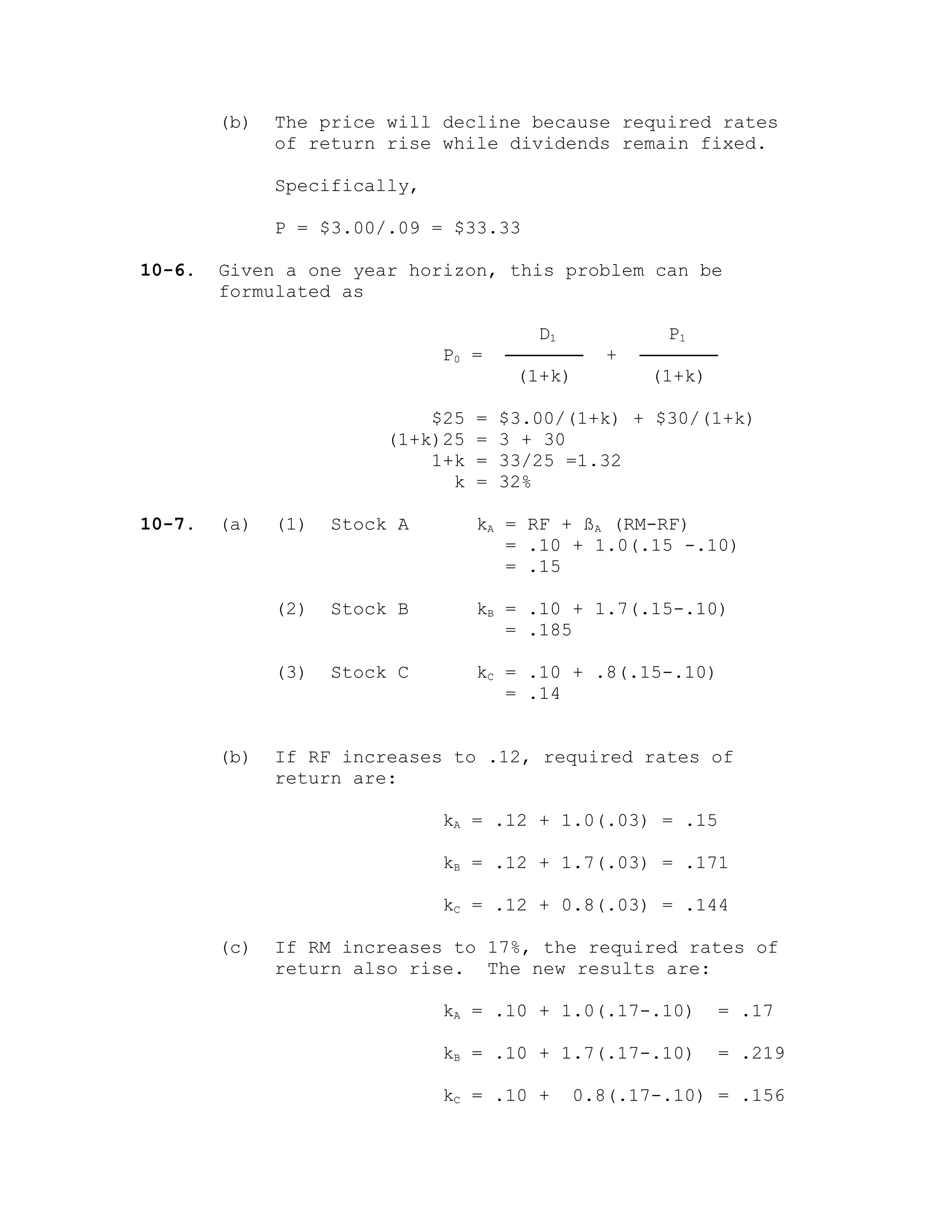

![ANSWERS TO END-OF-CHAPTER PROBLEMS

10-1. Using the constant growth version of the Dividend

Discount Model:

k = D1/P0 + g

= $2.00/$45 + .09

= .1344 or 13.44%

10-2. Reversing the formula used in answer 10-1 to solve

for price, and recognizing that we must compound the

stated dividend, D0, up one period to obtain D1,

P0 = D1/(k-g)

= D0(1+g)/(k-g)

= $2.25(1+.08) / (.13-.08)

= $2.43/.05

= $48.60

10-3. Again using the constant growth version of the

Dividend Discount Model, solve for g

k = D1/P0 + g

k-g = D1/P0

-g = D1/P0 - k

g = k - D1/P0

Or: g = k - [(D0(1+g))/P0]

Therefore:

g = .15 - [($3.00(1+g))/50]

50g = 7.50 - 3 - 3g

53g = 7.50 - 3

53g = 4.50

g = 08.49 or 8.49%

10-4. P = D0/k = 1.50/.15 = $10.00

10-5. (a) k = D0/P0 = $3.00/$40 = 7.5%](https://image.slidesharecdn.com/64920420-solution-ch10-charles-p-jones-190402173512/75/64920420-solution-ch10-charles-p-jones-11-2048.jpg)

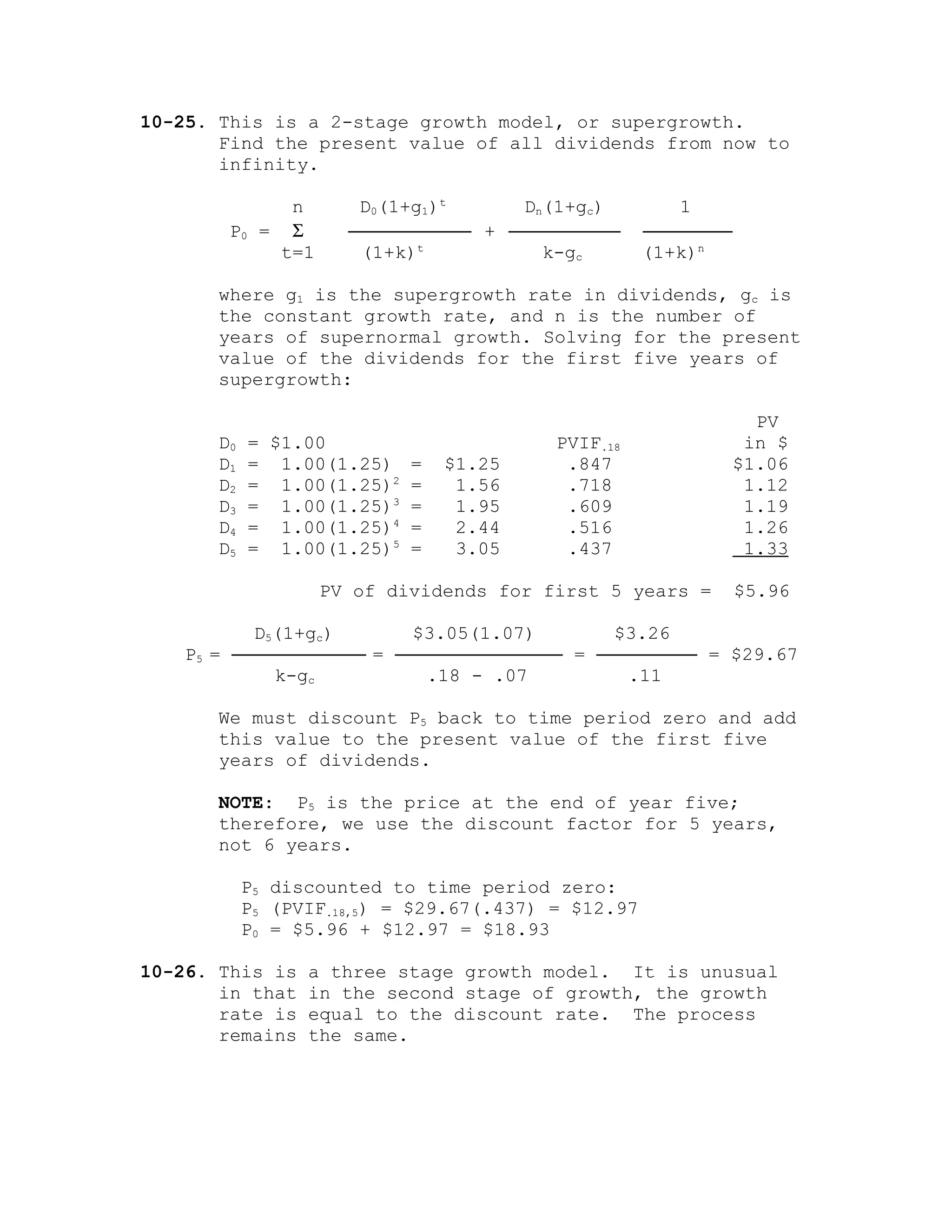

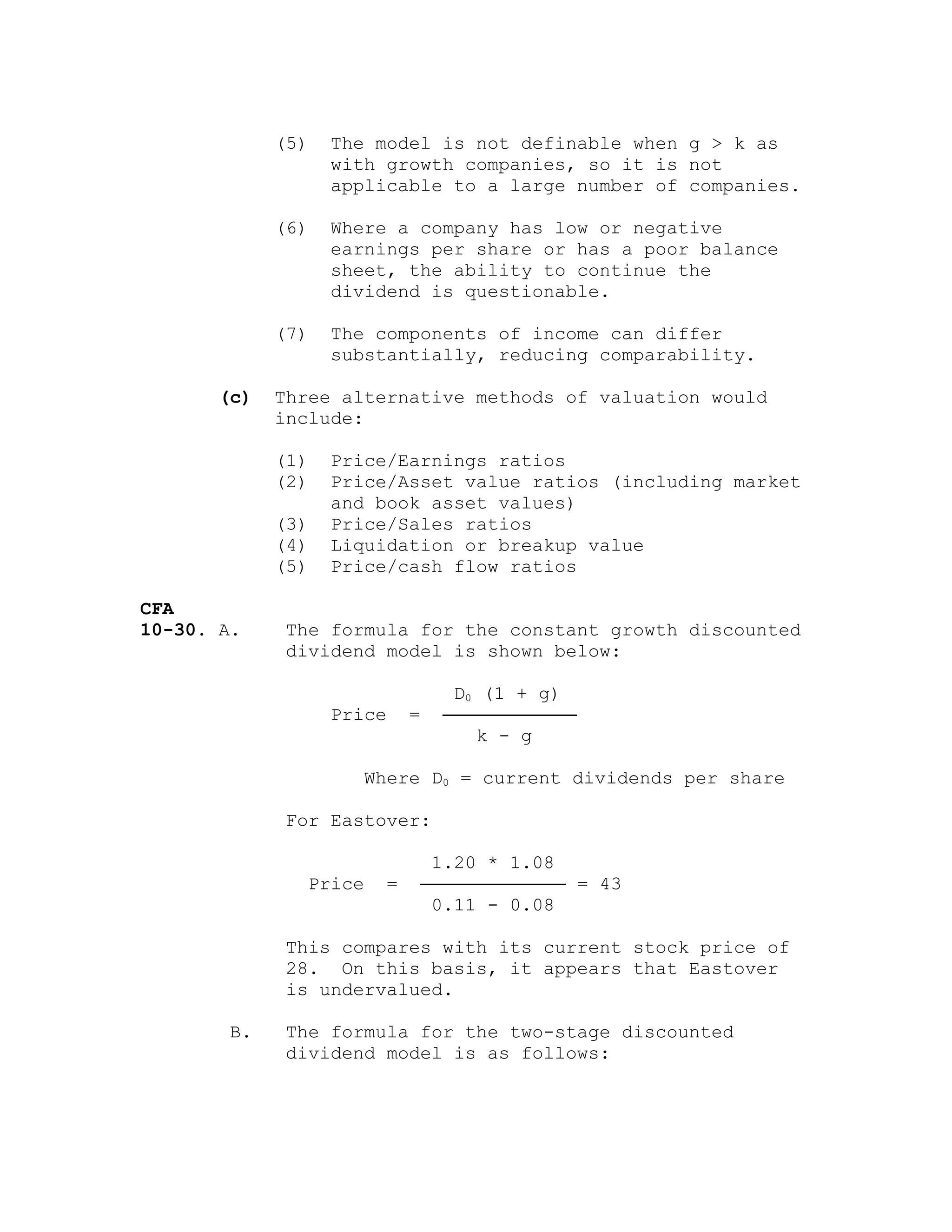

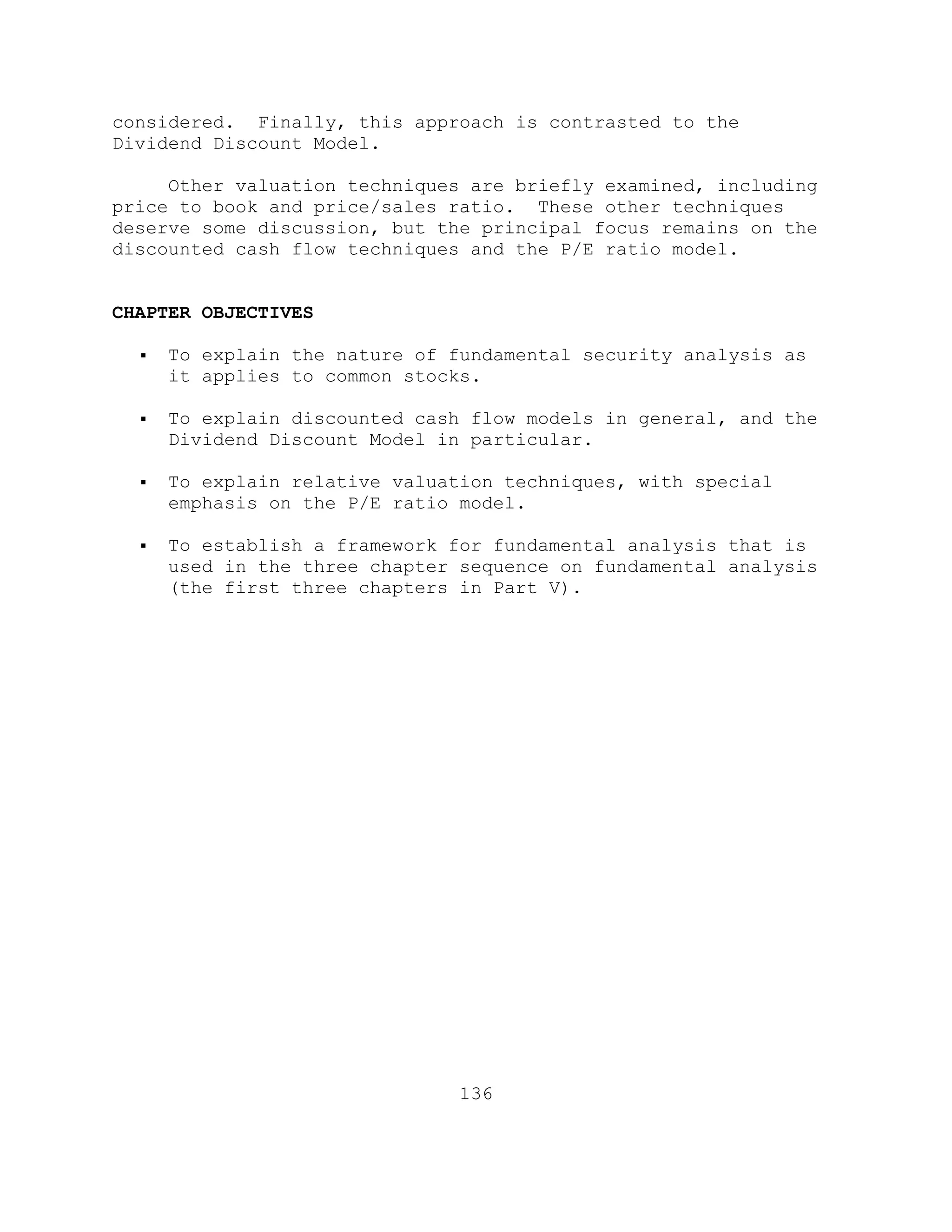

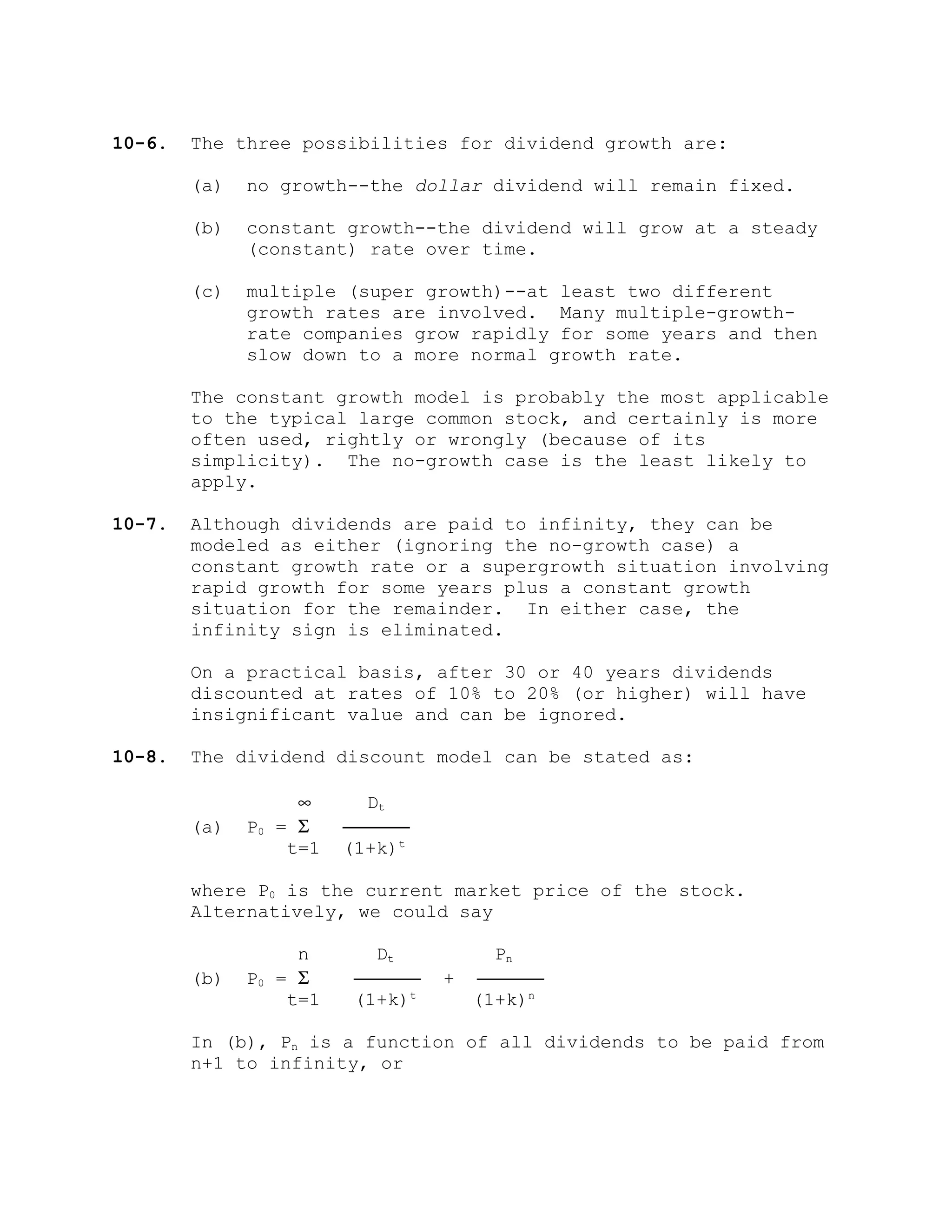

![10-8. (a) It is necessary to calculate the growth rate

since it is not given. Referring to the future

(compound) value table at the end of the text,

and reading across the 12 year row, we find a

factor of about 2.0 (actually, 2.0122) at the

intersection of the 6% column (or, using the

rule of 72, 72/12 = 6%). Therefore g = 6% and

k = [$3.00(1.06)]/$60 + .06

= 053 + .06

= .113 or 11.3%

(b) Using the same table to find a factor of 3.0 on

the 6 year row, we find g to be approximately

20% (the exact factor at 20% is 2.986).

Therefore, using g = 20%,

k = [$3.00(1.20)]/$60 + .20

= .06 + .20

= .26 or 26%

10-9. (a) Solving for k as the expected rate of return,

k = [$1.80(1.08)]/$36 + .08

= .054 + .08

= .134 or 13.4%

Since the expected return of 13.4% is less than

the required rate of return of 14%, this stock

is not a good buy.

(b) P0 = D1/(k-g)

= [$1.80(1.08)]/[.14-.08]

= $32.40

An investor should pay no more than $32.40 if

his or her required rate of return is 14%.

If the required rate of return is 15%, the

maximum an investor should pay is obviously

less than in the previous problem.

Specifically,

P0 = [$1.80(1.08)]/[.15-.08]

= $27.77](https://image.slidesharecdn.com/64920420-solution-ch10-charles-p-jones-190402173512/75/64920420-solution-ch10-charles-p-jones-13-2048.jpg)