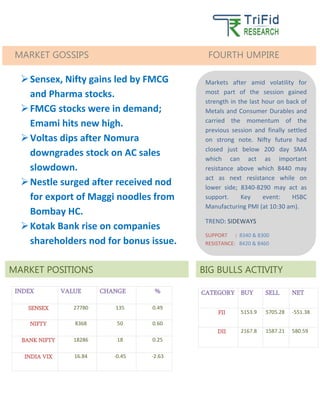

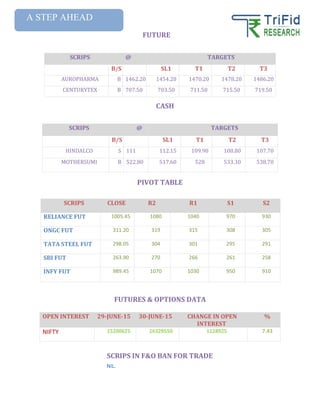

On July 1, 2015, Indian markets showed gains, notably in FMCG and pharma stocks, while major indices like Sensex and Nifty increased by 0.49% and 0.60% respectively. Key resistances for Nifty were identified at 8420 and 8460, with supports at 8340 and 8300. The document also highlights individual stock movements, including a rise in Nestle following a court nod for Maggi exports and a downgrade of Voltas by Nomura.