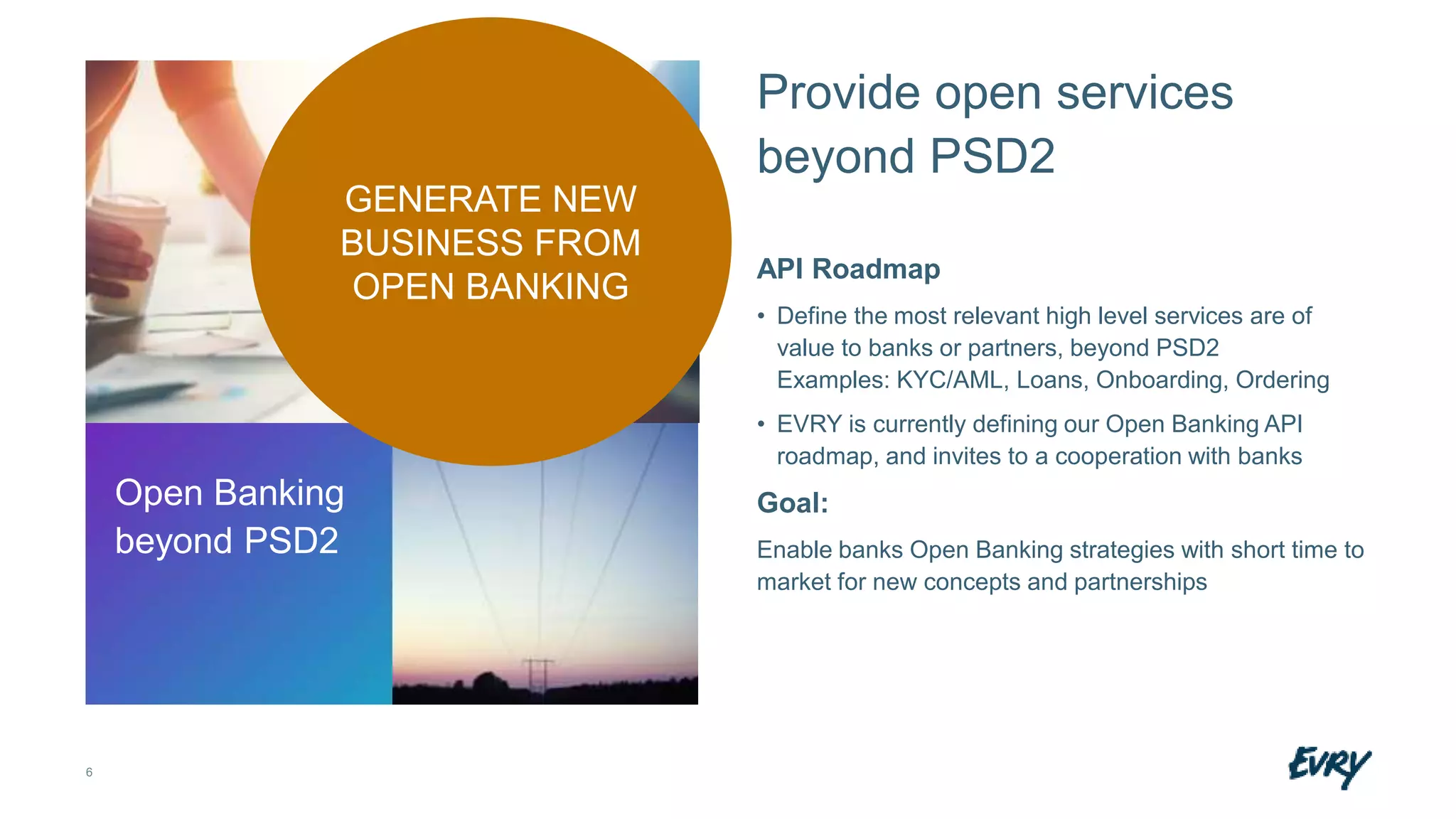

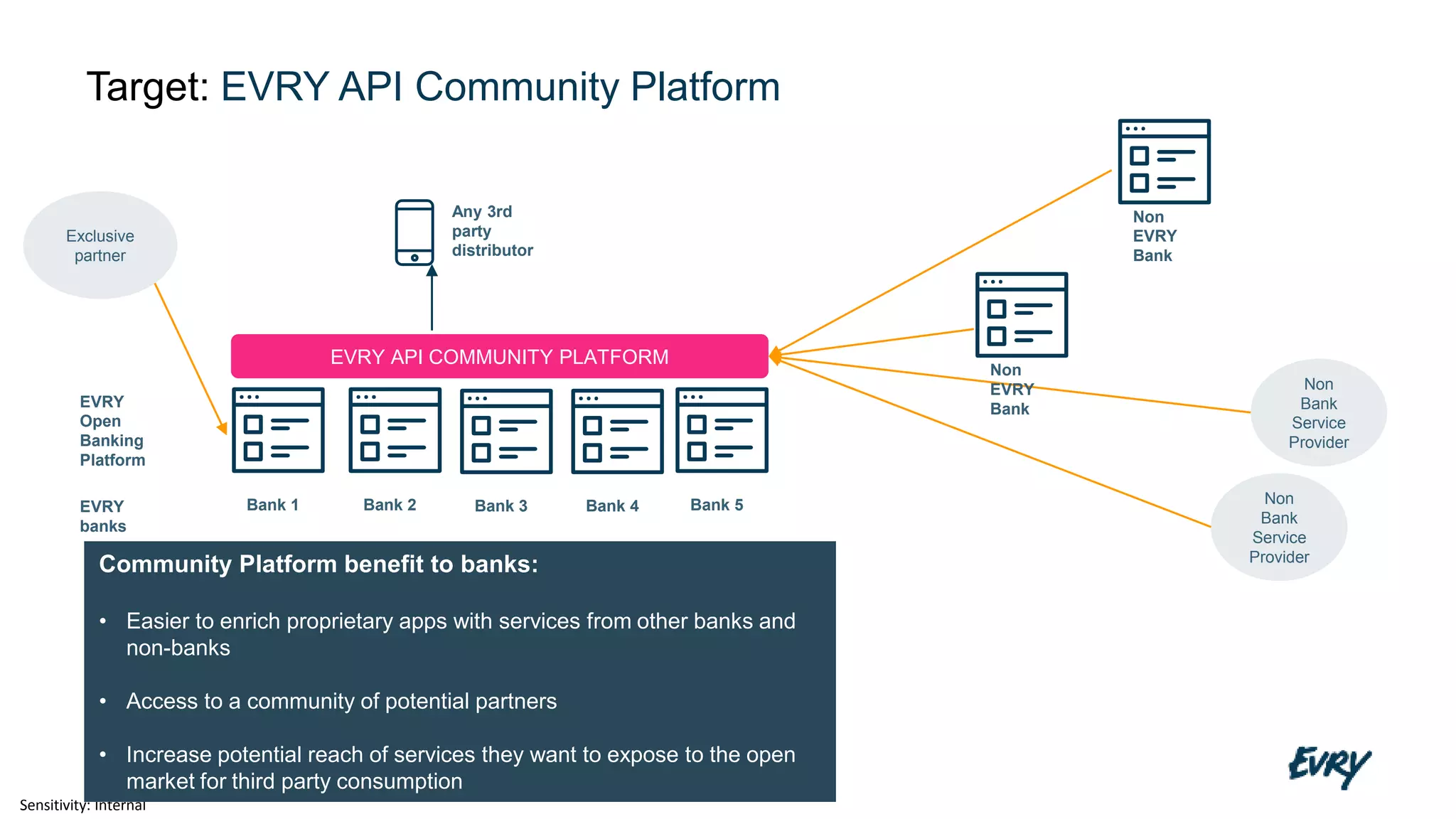

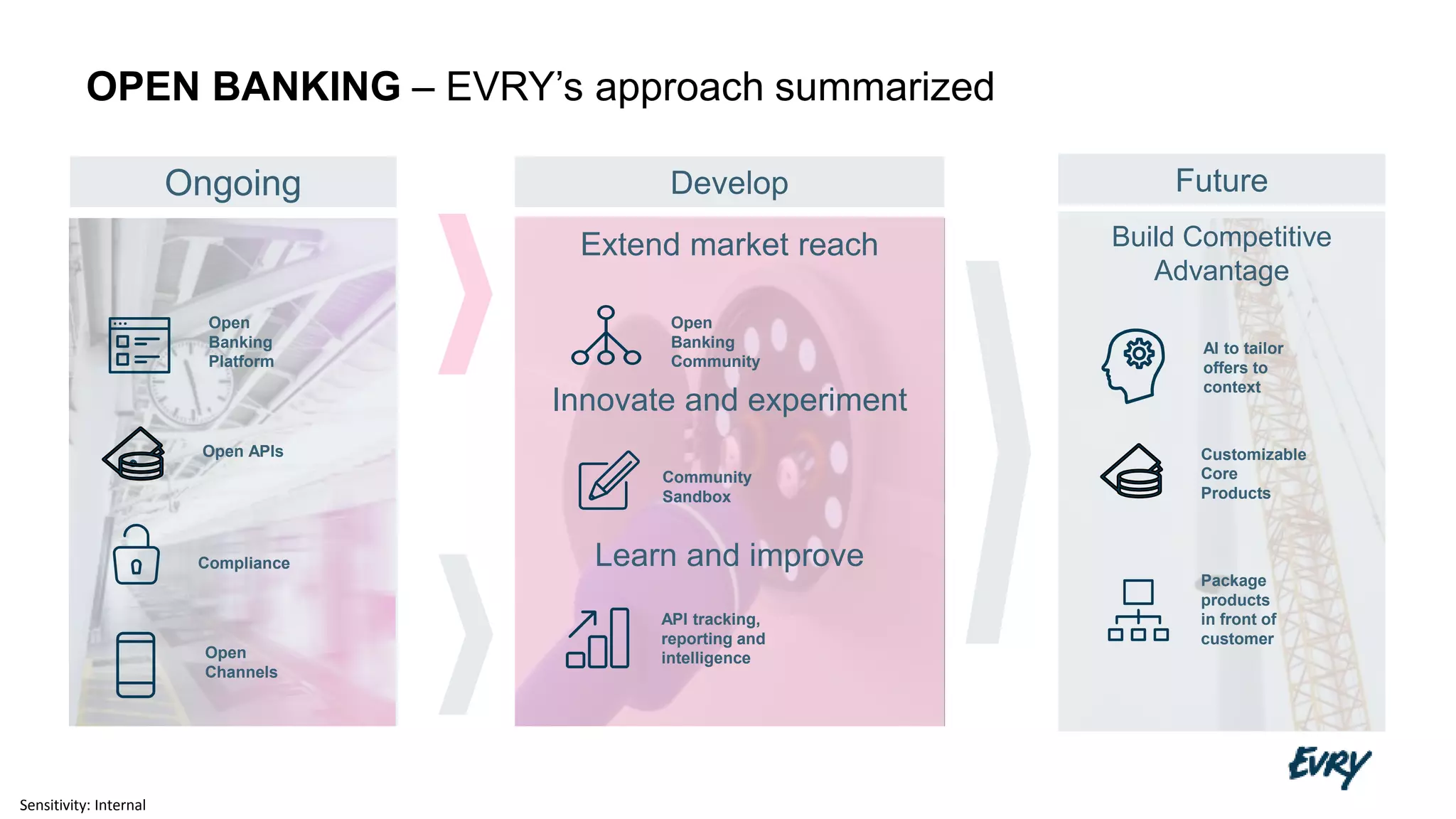

The document outlines Evry's open banking platform, focusing on its adaptability to various banking approaches influenced by bank size, segment, and strategy. It highlights the aim to provide high-level services beyond PSD2, such as KYC/AML and loans, while fostering partnerships and collaboration among banks and third-party service providers. Evry seeks to create a community platform that enhances integration and market reach through a shared open banking API framework.