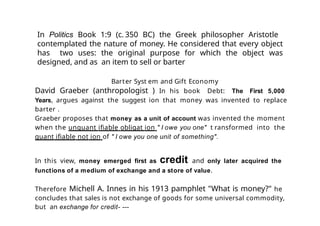

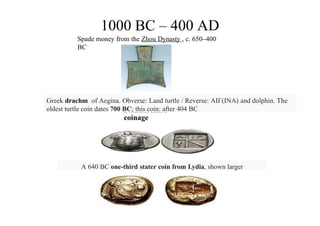

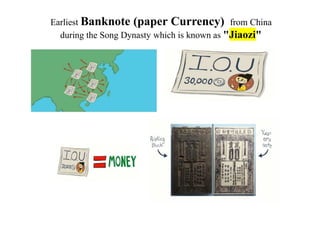

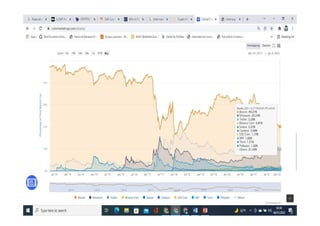

The document outlines the evolution of money and currency, exploring topics like barter systems, commodity money, and the development of banking and central banks. It highlights key historical events and figures, such as the introduction of paper money, the gold standard, and cryptocurrencies, while discussing the transition from money as a physical commodity to a digital medium of exchange. The text also critiques various monetary theories and practices, emphasizing the role of trust and the functions of money in society over time.