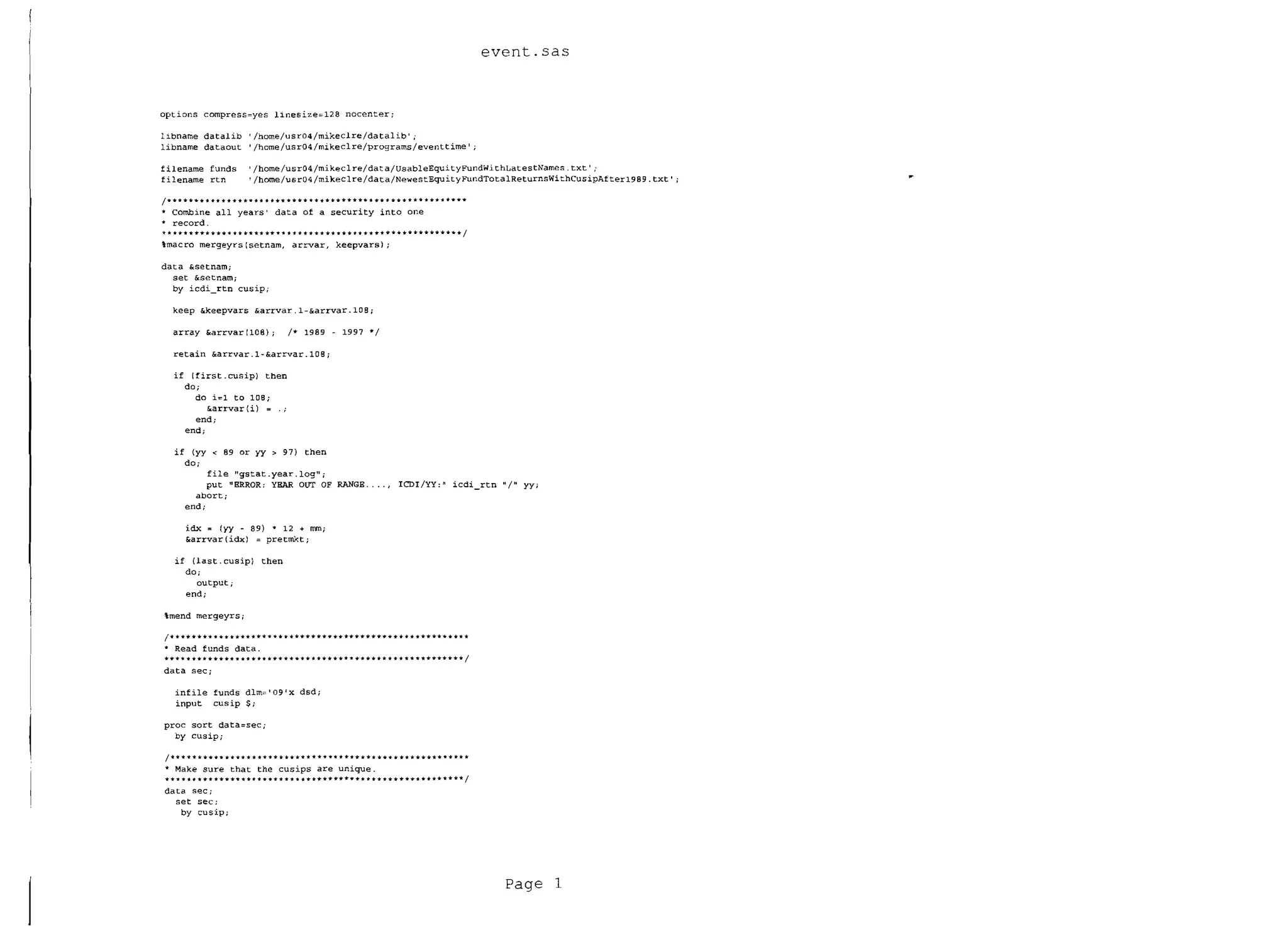

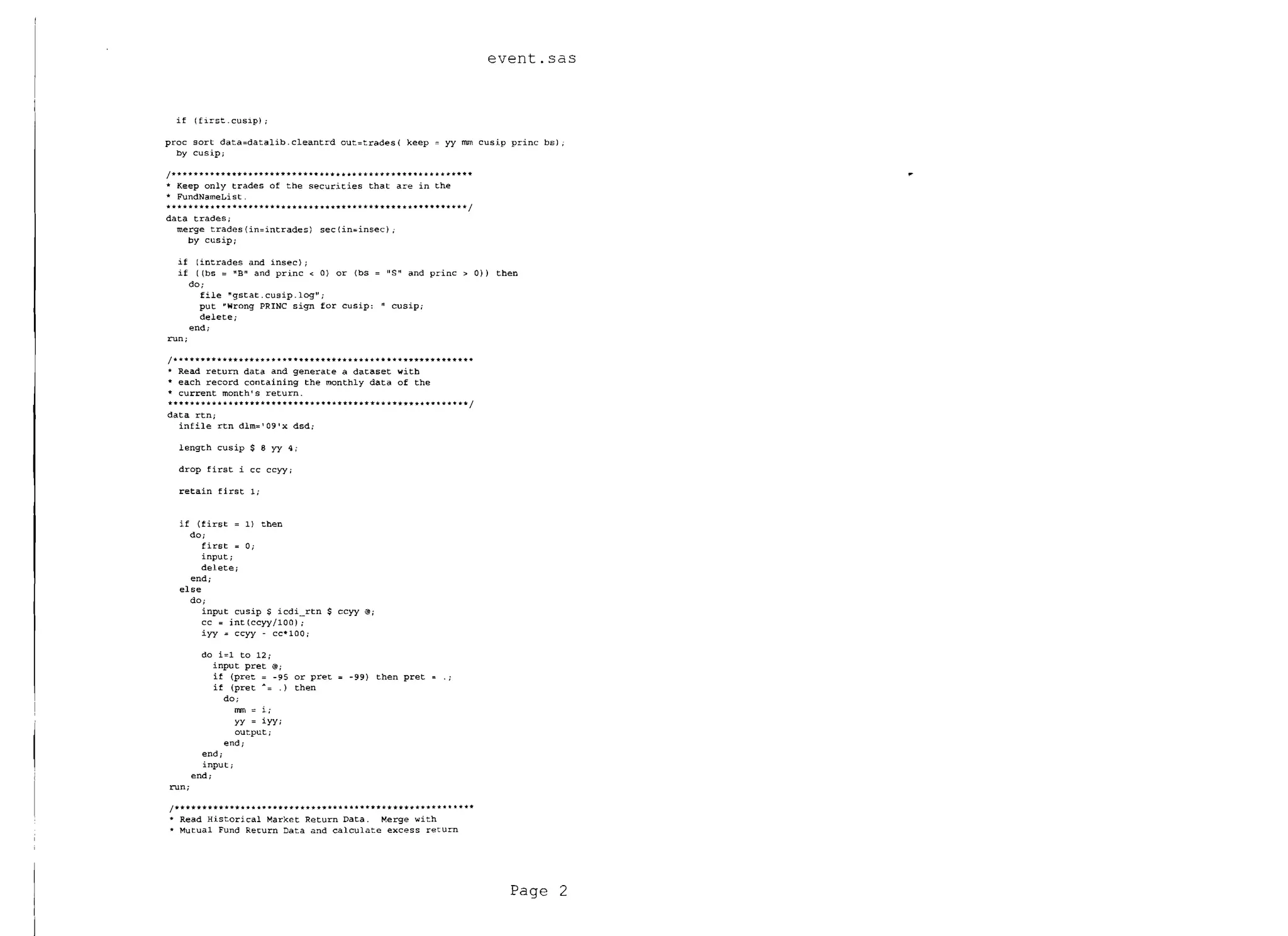

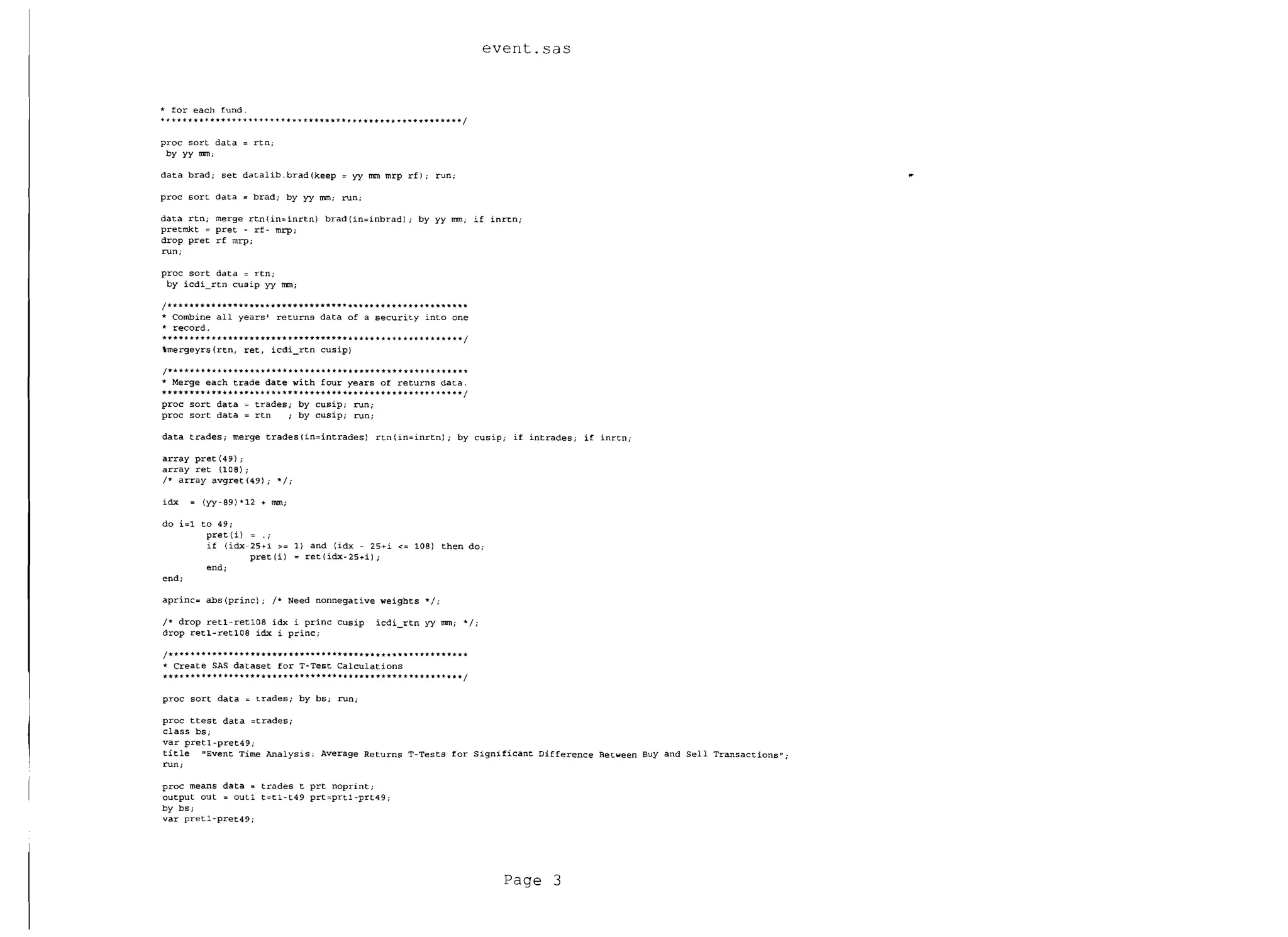

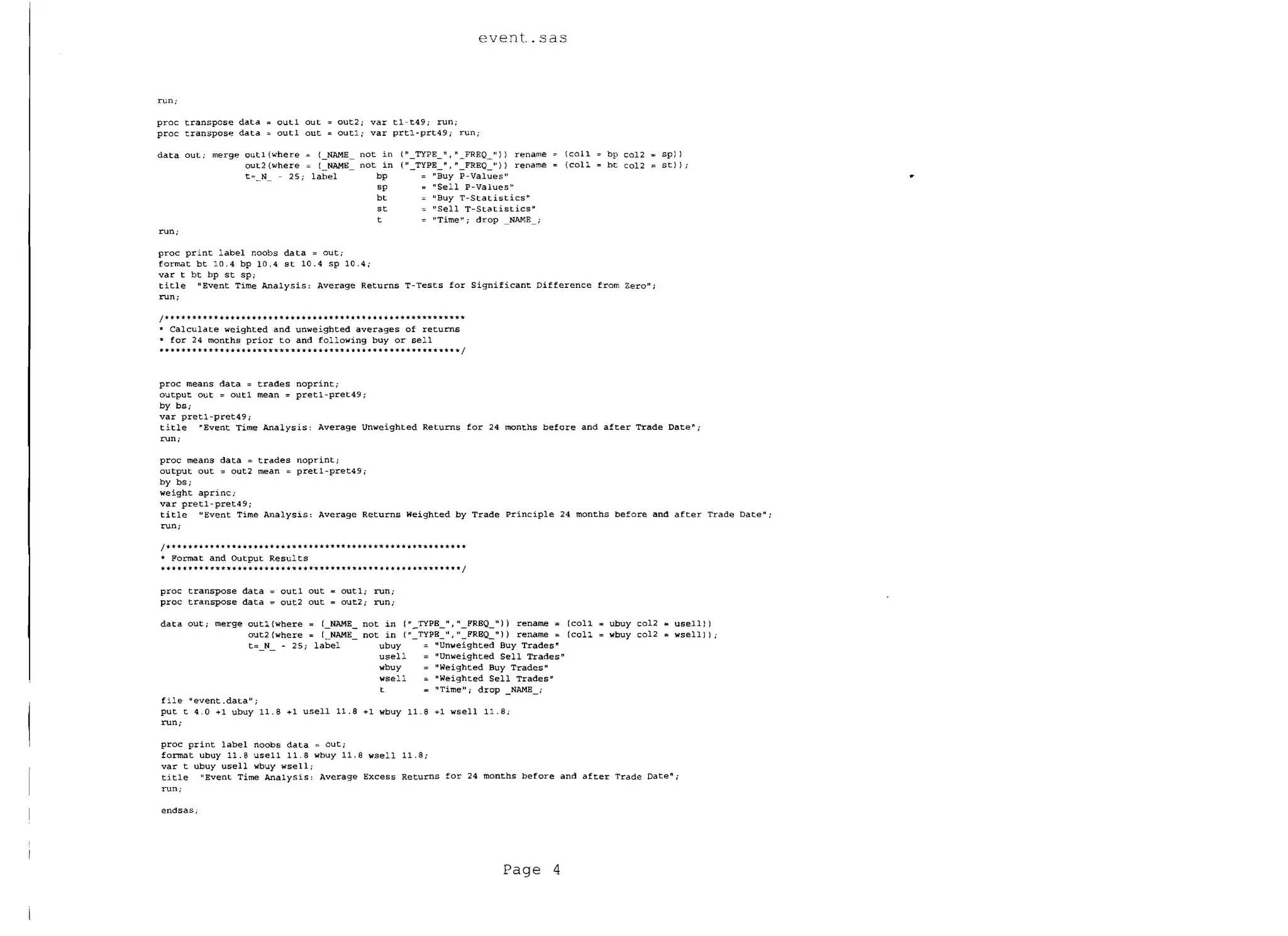

1. The document contains SAS code to analyze equity fund return data around buy and sell transactions.

2. The code reads fund holdings and return data, merges the data, and calculates excess returns relative to market indexes.

3. Statistical tests and averages are calculated to compare returns for periods before and after hypothesized buy and sell signals.