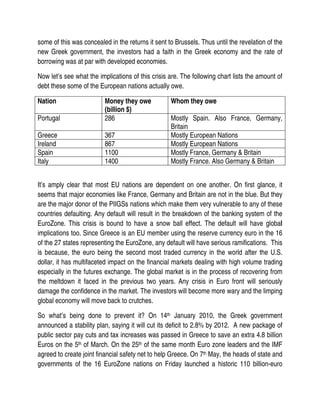

The debt crisis began in Greece in late 2009 when the new government revealed the budget deficit was much higher than previously reported. This undermined market confidence in Greece and caused borrowing rates to rise sharply. The crisis spread to other European nations like Portugal, Ireland, Spain and Italy who had taken on large debts. A bailout package was created by the IMF and Eurozone nations to help Greece, but long term solutions are still needed to restore confidence and prevent the crisis from worsening or spreading further. National austerity measures are being implemented but more fiscal coordination between European states may be required to contain the problem.