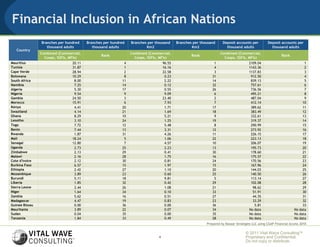

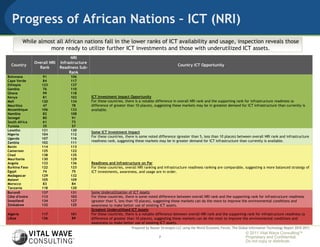

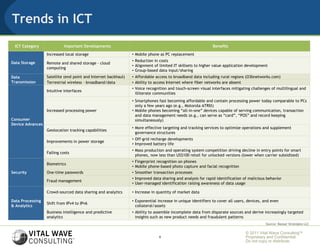

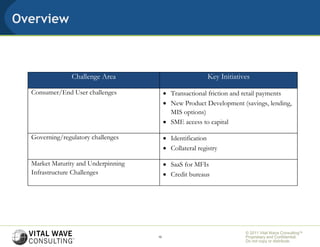

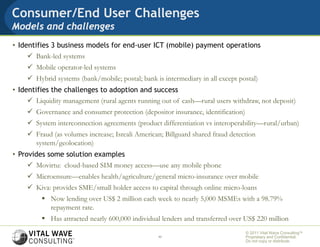

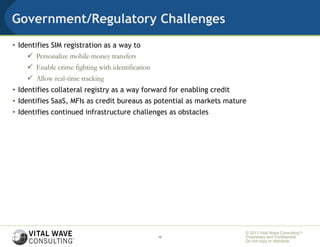

The document provides an analysis of challenges and opportunities for financial sector development in Africa, particularly focusing on the role of ICT to promote financial inclusion. It identifies various barriers such as consumer understanding, regulatory issues, and market maturity, while also highlighting significant trends in ICT that could support financial sector improvements. The report emphasizes the need for investments in infrastructure and innovative solutions to overcome existing challenges and enhance service delivery in the region.